With this Commercial Property Sales Package, you will find many of the forms that are part of closing a commercial real estate transaction.

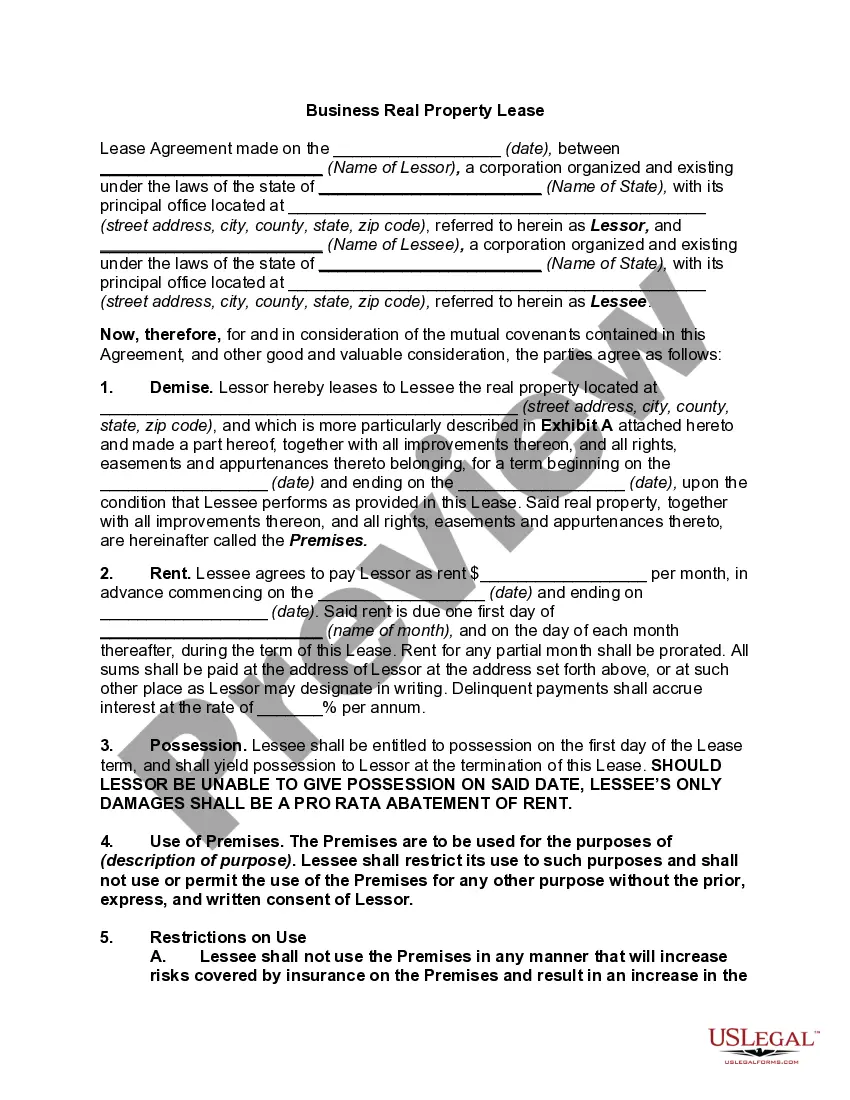

Included in your package are the following forms:

1. A Contract for the Sale and Purchase of a Commercial Lot or Land without a Broker;

2. A Option for the Sale and Purchase of a Commercial Building;

3. A Option for the Sale and Purchase of a Commercial Lot or Land;

4. An Addendum for Environmental Assessment of Threatened or Endangered Species or Wetlands;

5. An Addendum for Continued Marketing of Property by Seller due to Contingencies;

6. An Exchange Addendum to Contract for Tax Free Exchange under Section 1031;

7. A Tax Free Exchange Agreement pursuant to Section 1031; and

8. A Fixed Rate Promissory Note Secured by Commercial Real Estate.

Purchase this package and save up to 30% over purchasing the forms separately!