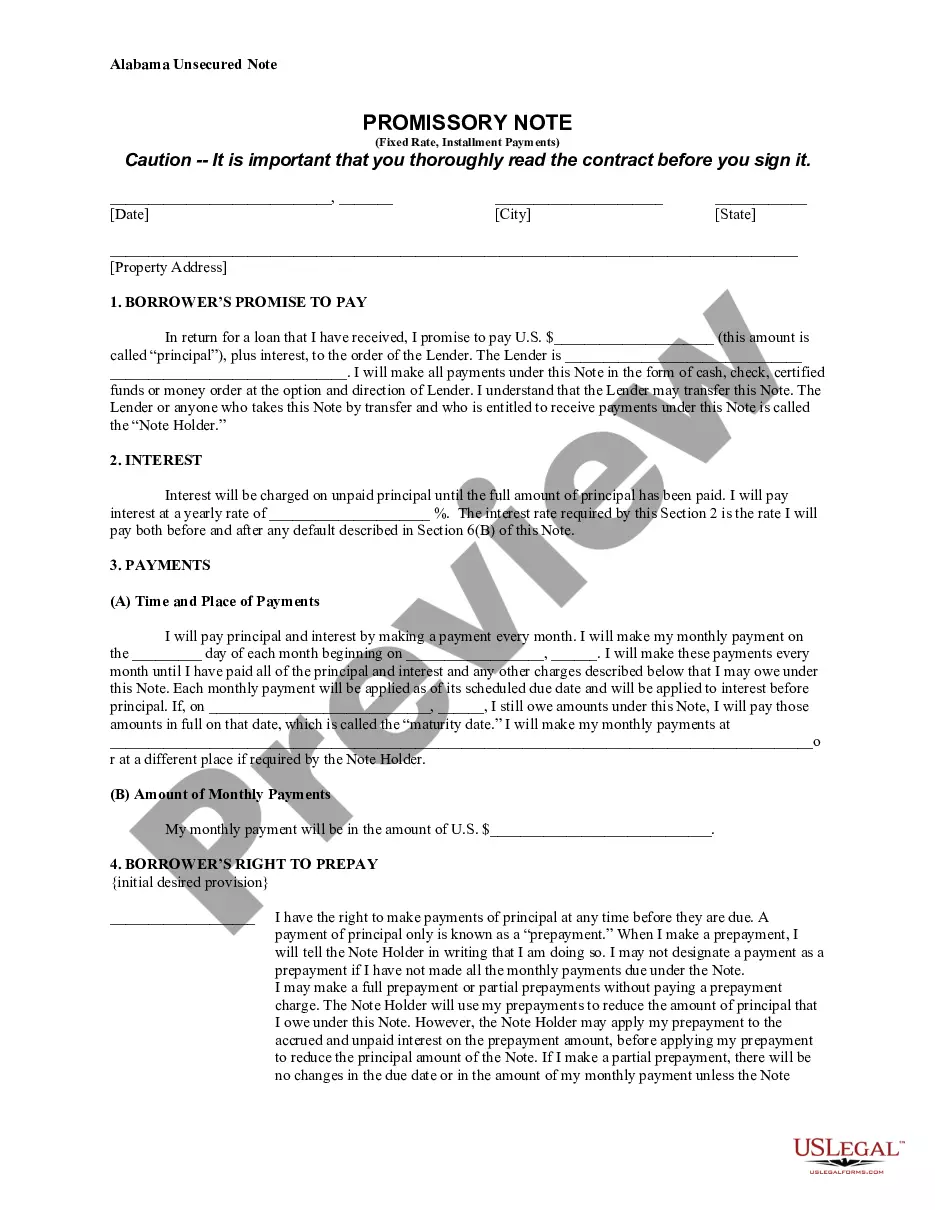

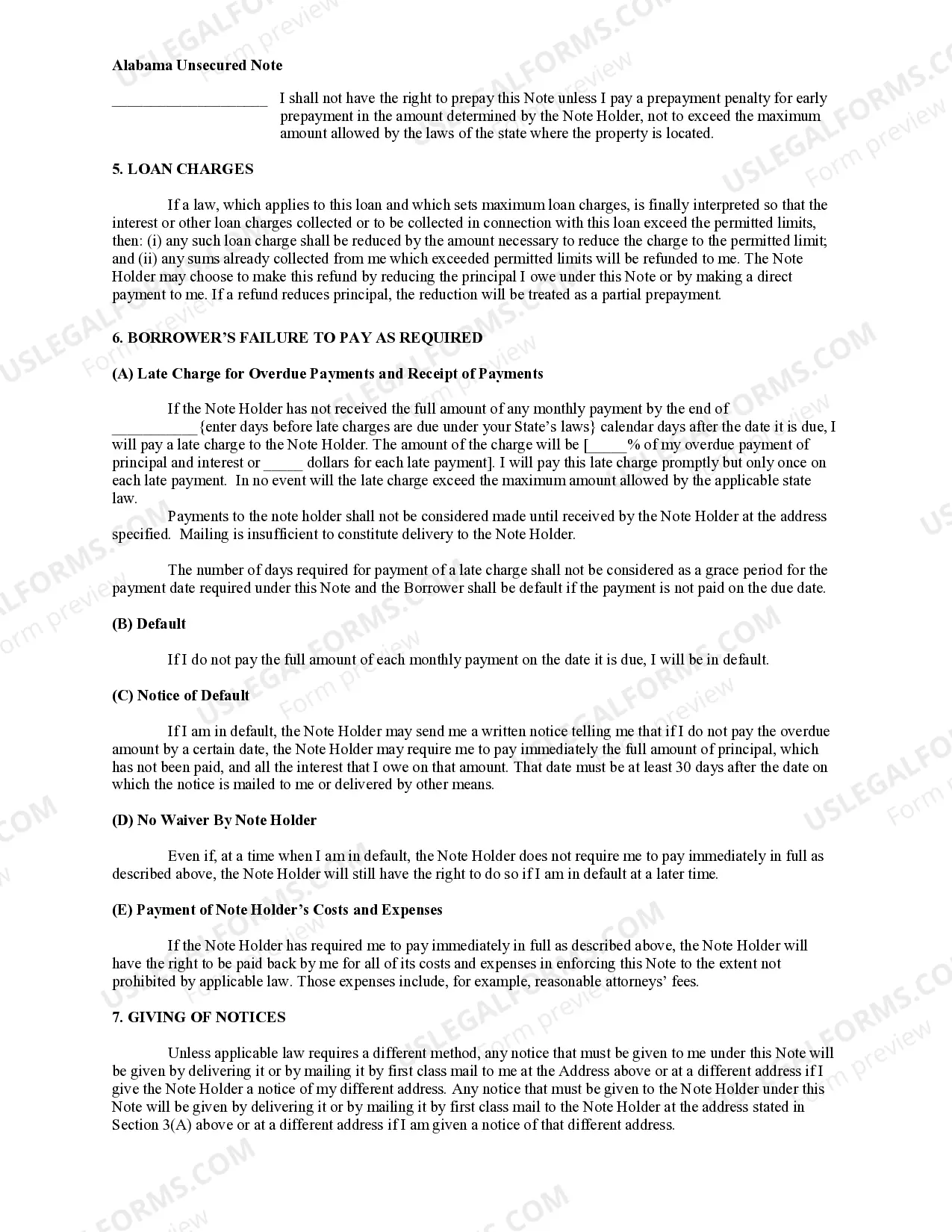

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Alabama Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Alabama Unsecured Installment Payment Promissory Note For Fixed Rate?

Utilizing Alabama Unsecured Installment Payment Promissory Note for Fixed Rate examples crafted by skilled lawyers enables you to evade frustrations when completing paperwork.

Simply obtain the template from our site, complete it, and request legal advice to review it.

Doing this can assist you in conserving significantly more time and energy than asking a lawyer to draft a document for you individually.

After following all of the aforementioned steps, you will be capable of filling out, printing, and signing the Alabama Unsecured Installment Payment Promissory Note for Fixed Rate template. Remember to verify all entered information for accuracy before submitting it or sending it out. Minimize the time spent on document creation with US Legal Forms!

- In case you already possess a US Legal Forms subscription, simply Log In to your account and return to the sample section.

- Locate the Download button next to the templates you are examining.

- After acquiring a document, your saved templates can be found in the My documents tab.

- If you don't have a subscription, it's not an issue. Just follow the steps below to register for an account online, obtain, and complete your Alabama Unsecured Installment Payment Promissory Note for Fixed Rate template.

- Double-check and ensure that you’re downloading the correct state-specific form.

- Utilize the Preview function and read the description (if available) to determine if you need this exact template and if so, click Buy Now.

Form popularity

FAQ

An example of a promissory note could be an Alabama Unsecured Installment Payment Promissory Note for Fixed Rate, where a lender agrees to provide a borrower with $10,000. The terms specify that the borrower will repay the amount in equal monthly installments over three years with a fixed interest rate. Utilizing professionally designed templates from US Legal Forms can help you see structured examples when drafting your own.

When you report a promissory note for tax purposes, you need to declare any interest earned as income. If you possess an Alabama Unsecured Installment Payment Promissory Note for Fixed Rate, the interest you receive must be included when filing your taxes. Keep accurate records of payments and unpaid interest, as this documentation will aid in accurate reporting.

Writing a promissory note for payment involves specifying the borrowed amount, the interest rate, and the repayment terms, including the due date. In creating an Alabama Unsecured Installment Payment Promissory Note for Fixed Rate, ensure to include any fees for late payments and other specific terms that protect both parties. By following a clear format, you can ensure the note is enforceable and easy to understand. Consider using US Legal Forms for reliable templates.

Yes, a handwritten promissory note can be legal as long as it meets the essential criteria. For an Alabama Unsecured Installment Payment Promissory Note for Fixed Rate, the key elements include clear terms regarding the amount borrowed, the interest rate, and the repayment schedule. However, for better protection and clarity, consider using a professionally drafted template, such as those available on the US Legal Forms platform.

An installment note and a promissory note share similarities, but they are not identical. An installment note specifically outlines a payment plan with scheduled payments, whereas a standard promissory note may not include these details. When you create an Alabama Unsecured Installment Payment Promissory Note for Fixed Rate, it often functions as an installment note, detailing clear terms for repayment. Our user-friendly platform can help you draft this note to ensure every necessary detail is included.

Yes, a promissory note can indeed be unsecured. An unsecured promissory note does not require collateral, making it a popular choice for personal loans or informal agreements. When using an Alabama Unsecured Installment Payment Promissory Note for Fixed Rate, the lender relies on the borrower's promise to repay. By using our platform, you can create a robust document that adheres to legal standards, even without collateral security.

In Alabama, a promissory note does not necessarily need to be notarized to be valid. However, notarization can help strengthen the document's authenticity and enforceability. It is particularly beneficial in legal disputes, as a notarized Alabama Unsecured Installment Payment Promissory Note for Fixed Rate provides clear evidence of the agreement. Using our platform, you can easily create a professional note that meets Alabama's legal standards.

An example of an on-demand promissory note would include language stating that the borrower will repay the principal amount upon the lender’s request. Such notes typically do not have a fixed repayment schedule, meaning the lender can demand repayment at any time. This flexibility is useful in various financial situations, including scenarios involving the Alabama Unsecured Installment Payment Promissory Note for Fixed Rate.

The main difference lies in their payment structures. An installment note outlines specific repayment amounts over time, while a general promissory note may have varying terms for repayment. Understanding how these instruments differ is crucial for creating an accurate Alabama Unsecured Installment Payment Promissory Note for Fixed Rate that meets your financial obligations.

To fill out a promissory demand note, you need to specify the names and addresses of the parties involved and the principal amount. Unlike installment notes, this type does not have a fixed repayment schedule; repayments are due upon demand. Therefore, clarity is essential in documenting what constitutes a demand for payment in an Alabama Unsecured Installment Payment Promissory Note for Fixed Rate.