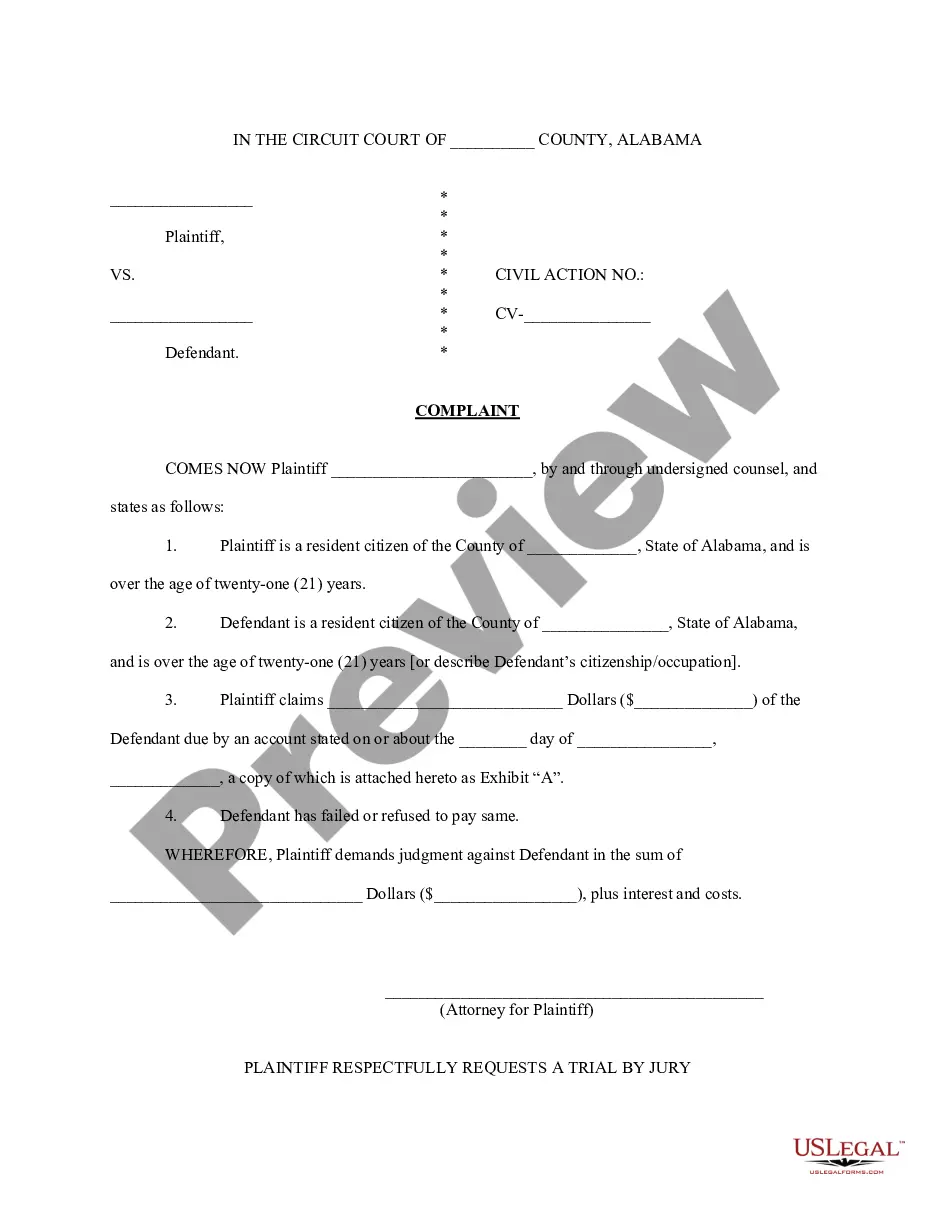

Alabama sample complaint filed in Circuit Court to collect a debt.

Alabama Complaint for Account Stated

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

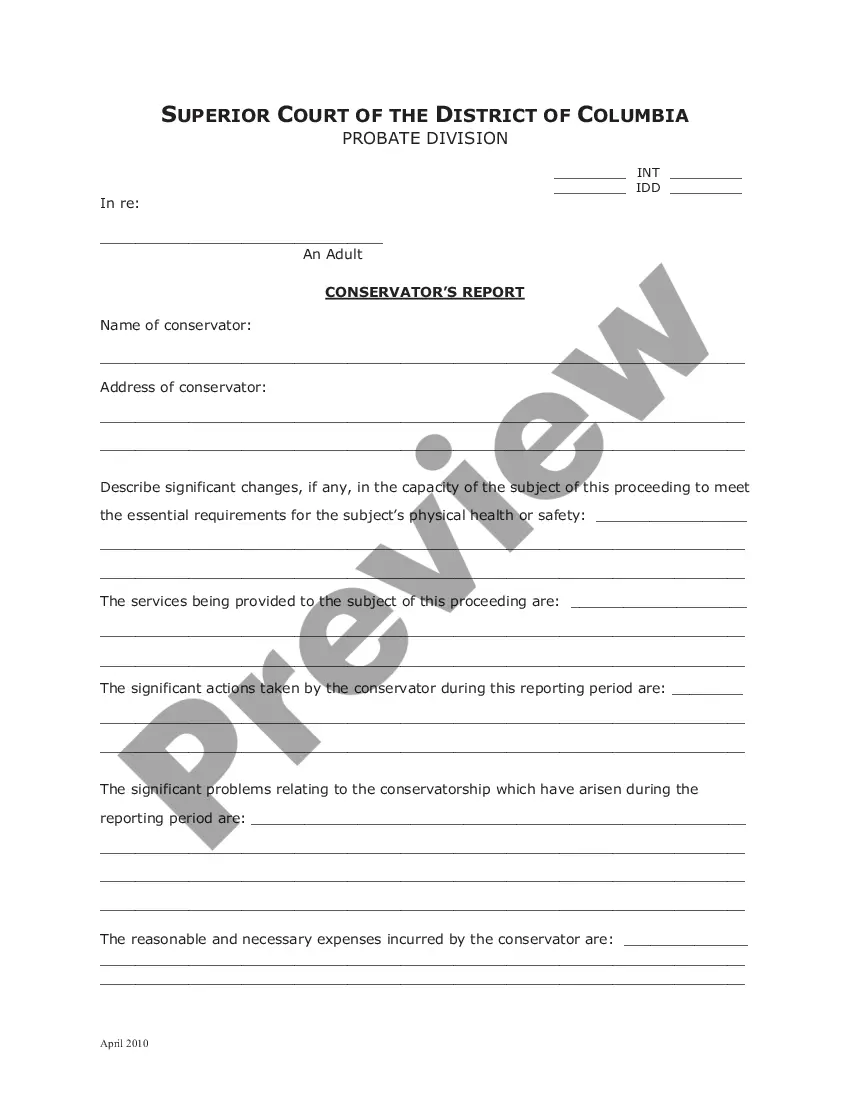

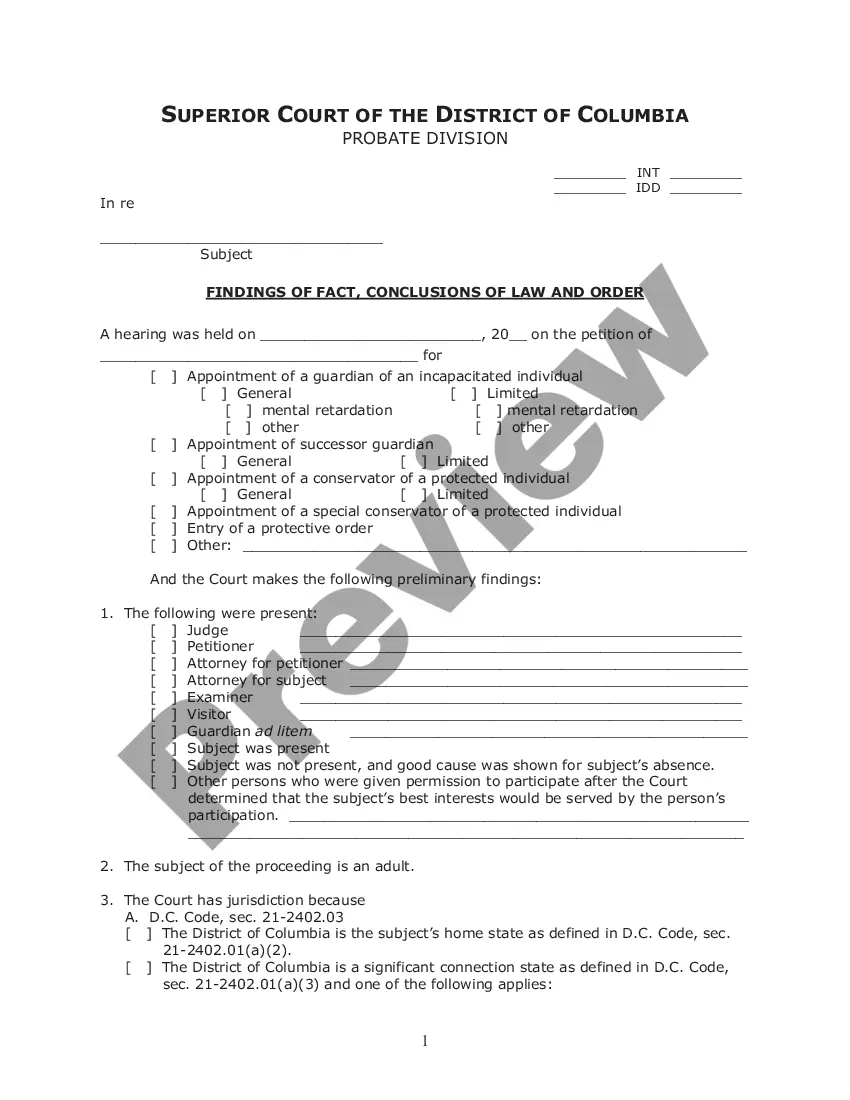

Looking for another form?

How to fill out Alabama Complaint For Account Stated?

Employing Alabama Complaint for Account Stated templates crafted by proficient attorneys helps you to circumvent frustrations when completing forms.

Simply obtain the template from our site, complete it, and have a lawyer review it.

This will conserve you significantly more time and energy than asking a legal expert to draft a document entirely from the beginning tailored to your requirements.

After completing all the steps above, you'll be able to fill out, print, and sign the Alabama Complaint for Account Stated template. Remember to verify all entered information for accuracy before submitting or dispatching it. Save time creating documents with US Legal Forms!

- If you have previously purchased a US Legal Forms subscription, just Log In to your account and return to the sample page.

- Locate the Download button close to the template you are reviewing.

- Once you download a document, you can find all of your saved samples in the My documents section.

- If you do not have a subscription, there is no need to worry. Just follow the guidelines below to register for your online account, obtain, and complete your Alabama Complaint for Account Stated template.

- Ensure you're downloading the appropriate state-specific form by rechecking.

- Utilize the Preview option and examine the description (if accessible) to determine if you need this particular sample and if so, click Buy Now.

Form popularity

FAQ

Rule 56 of the Alabama Rules of Civil Procedure governs summary judgments. This rule allows a party to request that the court rule in their favor when there is no genuine issue of material fact. Understanding this rule can be significant when handling an Alabama Complaint for Account Stated, as it may impact the outcome of your case. Our platform provides valuable resources to help you grasp these legal principles.

Failing to respond to a complaint in Alabama can lead to serious consequences, including a default judgment against you. This means the court may rule in favor of the plaintiff without hearing your side of the story. If you've received an Alabama Complaint for Account Stated, it's essential to address it promptly to avoid such outcomes. Seeking help from legal services can guide you through the process.

When you receive an Alabama Complaint for Account Stated, you have 30 days from the date of service to provide your answer. If you miss this deadline, the court may automatically rule in favor of the other party. Timely responses help maintain your position in the legal process and avoid unfavorable outcomes. If you're unsure how to draft your answer, our platform offers various resources to assist you.

In Alabama, you generally have 30 days to respond to a complaint after it is served. This timeframe is important because failing to respond can result in a default judgment against you. When dealing with an Alabama Complaint for Account Stated, it is crucial to meet this deadline to protect your rights. Consulting with a legal professional can help ensure you respond appropriately.

In legal terms, account stated refers to a mutual agreement between parties about the amount due for services rendered or goods provided. It confirms that both sides accept the established balance, making it easier to seek recovery in court. When navigating your legal journey, utilizing a comprehensive platform like uslegalforms can help you effectively prepare your Alabama Complaint for Account Stated.

An account state refers to the condition of an account, including whether it is open or closed, and the current balance owed. This status can influence how disputes are managed within the legal system. In the context of an Alabama Complaint for Account Stated, understanding account states can clarify your legal rights and obligations.

An action for account stated is a legal claim where one party seeks to enforce an agreement that has been accepted by both parties regarding the amounts owed. It simplifies the collection process by establishing that both parties acknowledge the account balance as accurate. When filing an Alabama Complaint for Account Stated, highlighting an action for account stated can significantly strengthen your position.

An open account is characterized by a balance that can fluctuate due to recurring transactions, such as purchases or payments made by both parties. It remains active until either party decides to terminate the agreement or it becomes a closed account. Understanding what qualifies as an open account is essential when drafting an Alabama Complaint for Account Stated.

An open account refers to an ongoing credit arrangement between parties, where transactions can occur continually over time. In contrast, a closed account is settled and typically involves a one-time transaction with no further dealings expected. Knowing these distinctions is crucial when preparing an Alabama Complaint for Account Stated, as they impact the nature of the claim.

The statute of limitations on a stated account in Alabama is also three years. This limit applies to specific instances where a debtor acknowledges the debt verbally or in writing. If you find yourself in a situation requiring legal attention, consider filing an Alabama Complaint for Account Stated. Performing this action can initiate a review of your rights and options regarding the debt in question.