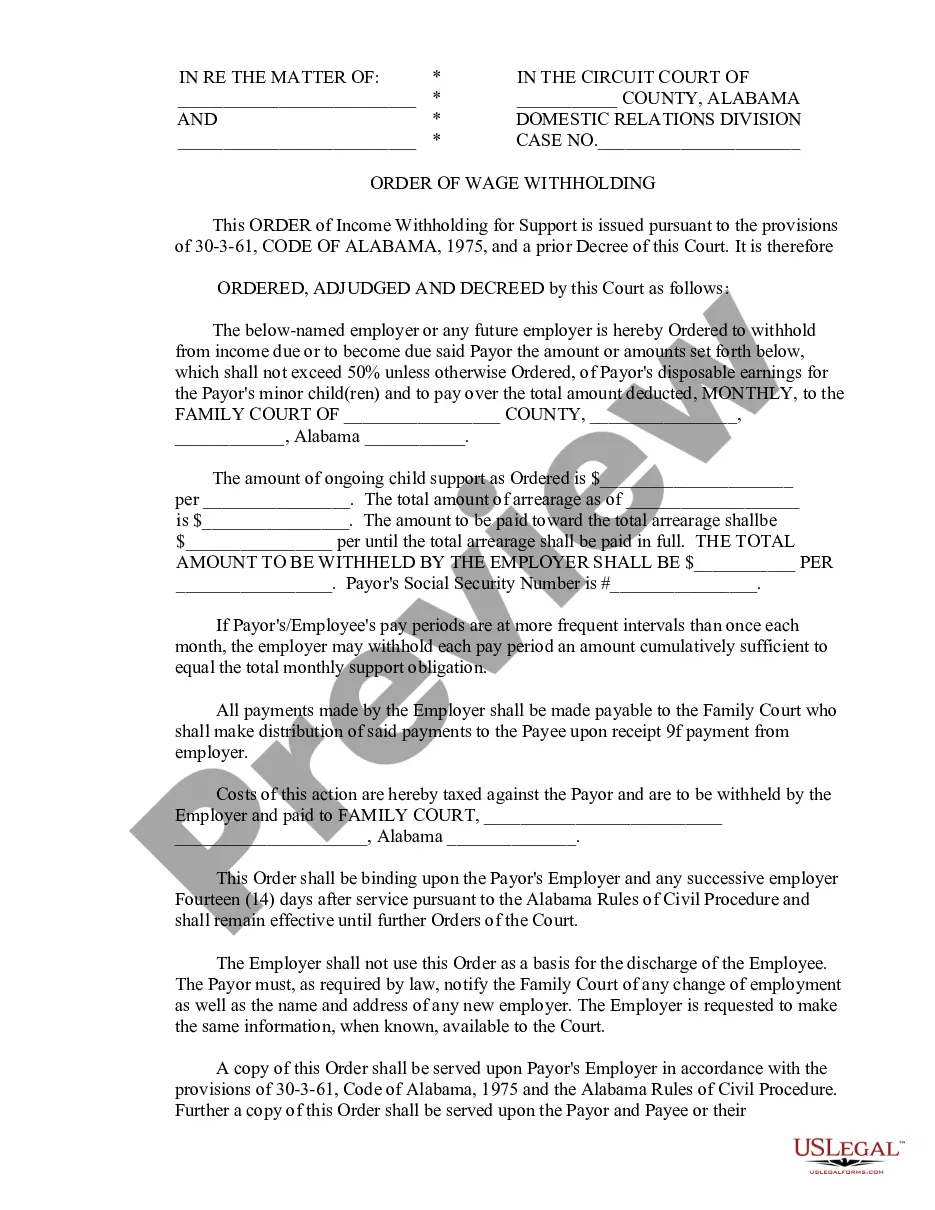

This Order for Wage Withholding is issued by the Circuit Court in order to pay support from the wages an employer pays to a person obligated to pay support.

Alabama Order for Wage Withholding

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Order For Wage Withholding?

Utilizing Alabama Order for Wage Withholding forms crafted by skilled attorneys allows you to sidestep complications when completing paperwork.

Simply download the template from our site, complete it, and seek legal advice for review.

This can save you significantly more time and effort than searching for an attorney to create a document tailored to your requirements.

- If you already possess a US Legal Forms subscription, just Log In to your account and return to the sample webpage.

- Locate the Download button near the template you are examining.

- After downloading a file, you can find your saved forms in the My documents section.

- If you do not have a subscription, it’s not a significant issue.

- Just adhere to the instructions below to register for an account online, acquire, and fill out your Alabama Order for Wage Withholding template.

- Ensure that you are downloading the correct state-specific document.

Form popularity

FAQ

To file employer withholding tax in Alabama, you must complete the appropriate forms and submit them to the state tax authority. Make sure to include accurate records of wages and taxes withheld. Utilizing services like US Legal Forms can guide you through this process, ensuring your filing is correct and efficient when addressing forms related to Alabama Order for Wage Withholding.

While the post office generally does not stock tax forms, it is still possible to find some common forms during tax season. However, to ensure you receive the correct forms, including those for Alabama Order for Wage Withholding, it is better to obtain them online or through the state tax authority. Using platforms like US Legal Forms guarantees you have access to the necessary forms in a timely manner.

If you prefer to have tax forms mailed to you, you can request them through the Alabama Department of Revenue or use services like US Legal Forms. You will need to provide relevant details such as your name, address, and the specific forms you require, including any related to Alabama Order for Wage Withholding. Processing times may vary, so allow ample time for delivery.

To obtain your tax forms online, you can visit the official Alabama Department of Revenue website or utilize services like US Legal Forms. These platforms allow you to access various tax forms directly, including those related to Alabama Order for Wage Withholding. By using an online resource, you save time and ensure you have the most up-to-date forms for your needs.

Yes, Alabama provides a state withholding form that is necessary for employers to correctly manage employee wages. This form ensures compliance with state tax regulations during the wage withholding process. You can easily access this form through state tax authority websites or platforms like US Legal Forms, which streamline obtaining essential documentation.

To stop your employer from withholding state taxes, you should submit a revised Alabama Form A4 indicating your tax exemptions or request a change in withholding status. Open communication with your employer about your tax situation is essential. Additionally, consult a tax professional to ensure you are following the correct procedures and to avoid any legal complications.

Many states in the U.S. require mandatory state tax withholding, including Alabama, California, and New York, among others. Each state has specific regulations regarding how much should be withheld and the process for employers. It is important to review these regulations to ensure compliance effectively.

You can order Alabama tax forms by visiting the Alabama Department of Revenue's website. The site offers options for online requests, downloadable forms, and information on how to receive physical copies. Utilizing the Alabama Order for Wage Withholding forms correctly ensures compliance with state laws.

Yes, Alabama has state withholding requirements for income taxes. Employers are responsible for withholding a specified amount from their employees’ paychecks, based on the Alabama Order for Wage Withholding. This ensures that employees meet their tax obligations.

Yes, Alabama is a mandatory withholding state. Employers must withhold state income tax from their employees' wages according to the Alabama Order for Wage Withholding guidelines. Understanding these requirements is vital for compliance and to avoid penalties.