Alabama Business Incorporation Package to Incorporate Corporation

What is this form package?

The Alabama Business Incorporation Package to Incorporate Corporation provides all the necessary forms for establishing a corporation in Alabama. This comprehensive package simplifies the incorporation process by including essential documents such as Articles of Incorporation and By-Laws, along with a step-by-step guide to navigate the requirements and formalities unique to Alabama. Unlike generic form packages, this one is specifically tailored to meet Alabama's legal standards, ensuring compliance and smooth processing.

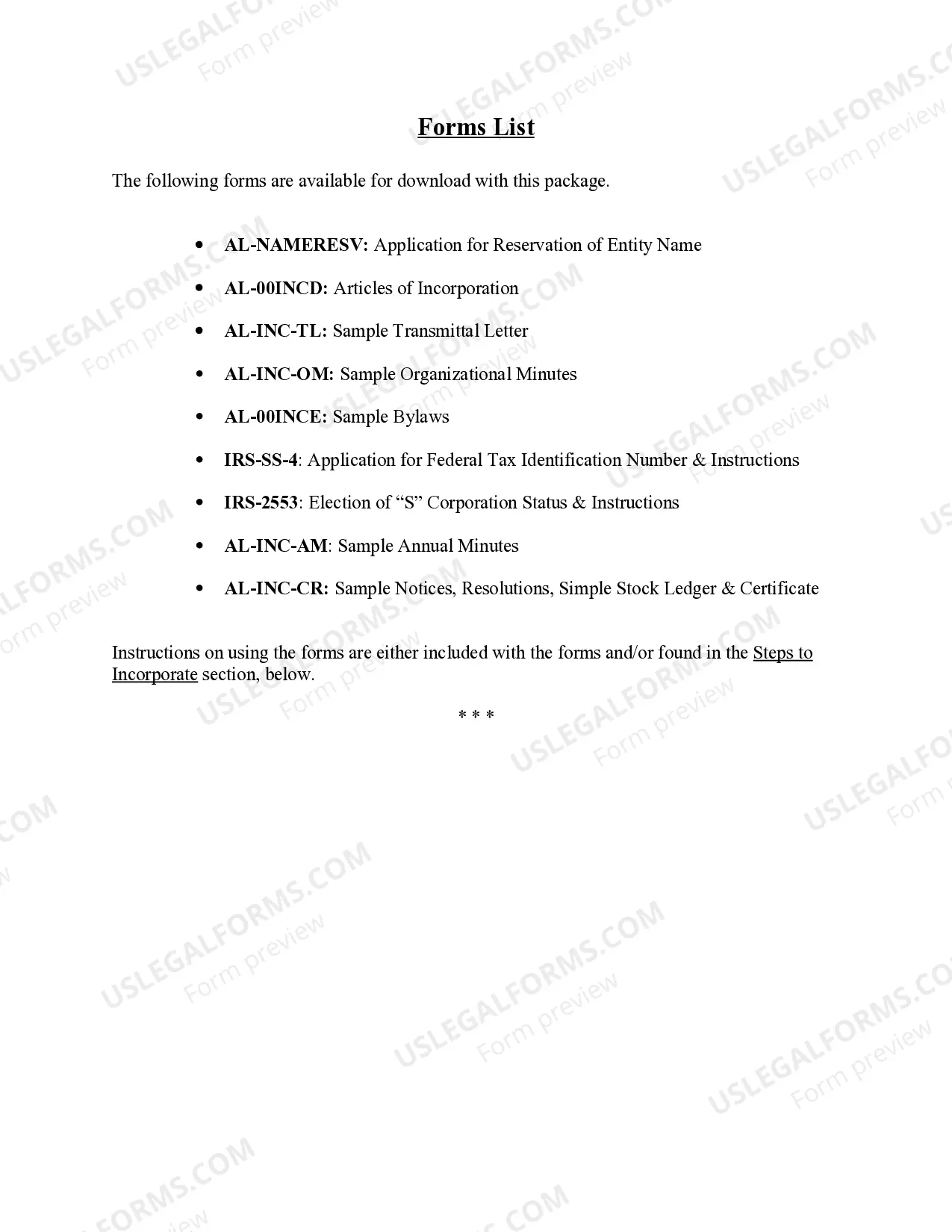

Forms you’ll find in this package

- Alabama Articles of Incorporation for Domestic For-Profit Corporation

- Alabama Bylaws for Corporation

- Annual Minutes

- Notices, Resolutions, Simple Stock Ledger and Certificate

- Minutes for Organizational Meeting

- Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

- Name Reservation Request Form for Domestic Entities

- Election of 'S' Corporation Status and Instructions - IRS 2553

- I.R.S. Form SS-4 (to obtain your federal identification number)

When this form package is needed

Use this form package when you are ready to start a business in Alabama and wish to incorporate it as a corporation. It is suitable for entrepreneurs looking to benefit from limited liability protection, pass-through taxation options, and the formal structure that corporate status provides. This package is also ideal for existing businesses that need to formalize their incorporation or for those who wish to apply for Subchapter S tax treatment.

Who needs this form package

- Entrepreneurs and small business owners seeking to incorporate their business in Alabama.

- Individuals who want to benefit from limited liability protection offered by a corporation.

- Business owners looking to formalize corporate structure and governance.

- Those interested in S corporation status for tax advantages.

How to prepare this document

- Review the included forms and instructions carefully.

- Choose a unique name for your corporation that complies with Alabama's naming rules.

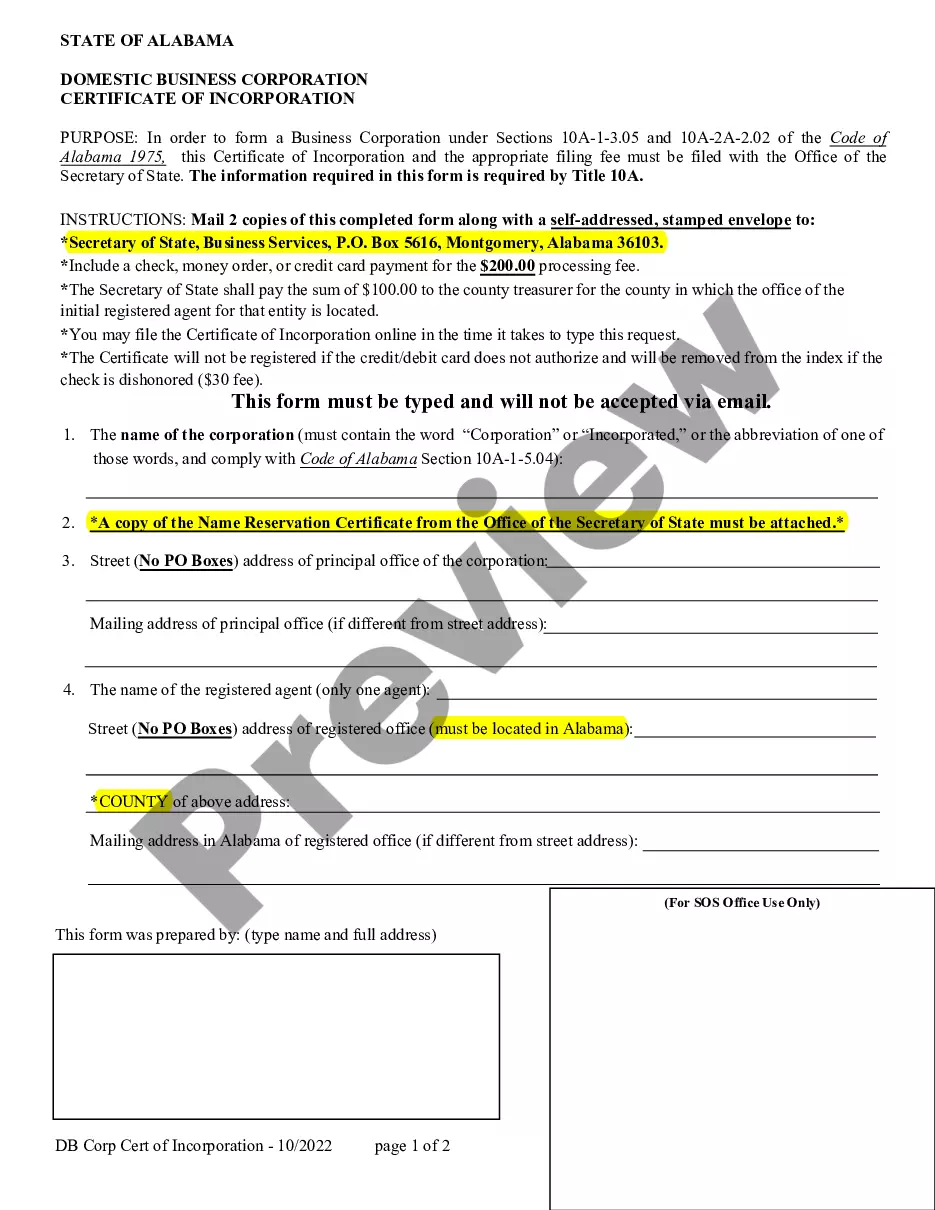

- Fill out the Articles of Incorporation and attach the Certificate of Name Reservation.

- Complete additional documents such as corporate by-laws and organizational minutes.

- File the completed forms with the Alabama Secretary of State and pay the required fees.

- Maintain proper records and conduct annual meetings as required to preserve corporate status.

Do forms in this package need to be notarized?

Notarization is not commonly needed for forms in this package. However, if your state’s laws require it, our notarization service, powered by Notarize, allows you to finalize documents online 24/7 without in-person visits.

Common mistakes

- Using a corporate name that has already been registered or is too similar to existing entities.

- Failing to properly fill out all sections of the Articles of Incorporation.

- Not obtaining a Federal Tax Identification Number (EIN) before starting business activities.

- Ignoring state requirements for annual meetings and corporate records.

Why complete this package online

- Convenience of downloading and completing forms from anywhere and at any time.

- Access to attorney-drafted forms that ensure legal compliance and accuracy.

- Editable PDF and Word formats that allow users to fill out forms digitally.

- Guidance throughout the process with detailed instructions included in the package.

Jurisdiction-specific notes

This form package reflects Alabama's specific legal requirements for incorporating a business. It includes forms that comply with the Alabama Code Title 10 Chapter 2B, ensuring that all filing procedures align with state laws. Users should note that Alabama has unique regulations regarding corporate naming, annual reporting, and record-keeping obligations that this package adequately addresses.

Legal use & context

- The forms provided in this package are legally binding once properly completed and filed with the state.

- Incorporating a business protects personal assets by limiting liability to the corporation itself.

- Completing the incorporation process correctly is essential to avoid administrative issues and maintain corporate status.

Quick recap

- The Alabama Business Incorporation Package is a comprehensive tool for establishing a corporation in Alabama.

- It includes essential forms and a step-by-step guide tailored to Alabama's legal requirements.

- This package is ideal for entrepreneurs looking to limit personal liability and formalize their business structure.

Form popularity

FAQ

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

To incorporate in Alabama, you must file the articles of incorporation, also known in Alabama as the Domestic Business Corporation Certificate of Formation, and a Certificate of Name Reservation in the office of the probate judge in the county where your corporation's business offices are located.

Choose a Corporate Name. Prepare a Certificate of Formation. Appoint a Registered Agent. Set Up a Corporate Records Book. Prepare Corporate Bylaws. Initial Corporate Directors. Hold Your First Board of Directors Meeting. Issue Stock.

The Alabama Secretary of State charges a $100 fee to file the Certificate of Formation. You must also pay a separate Probate Court filing fee, which is at least $50. You must reserve your business name by filing an LLC name reservation. It costs $28 to file online and $10 if filed by mail.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

If you incorporate your small business, you can determine when and how you receive income from the business, which is a real tax advantage. Instead of taking a salary from the business when the business receives income, being incorporated allows you to take your income at a time when you'll pay less in tax.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.