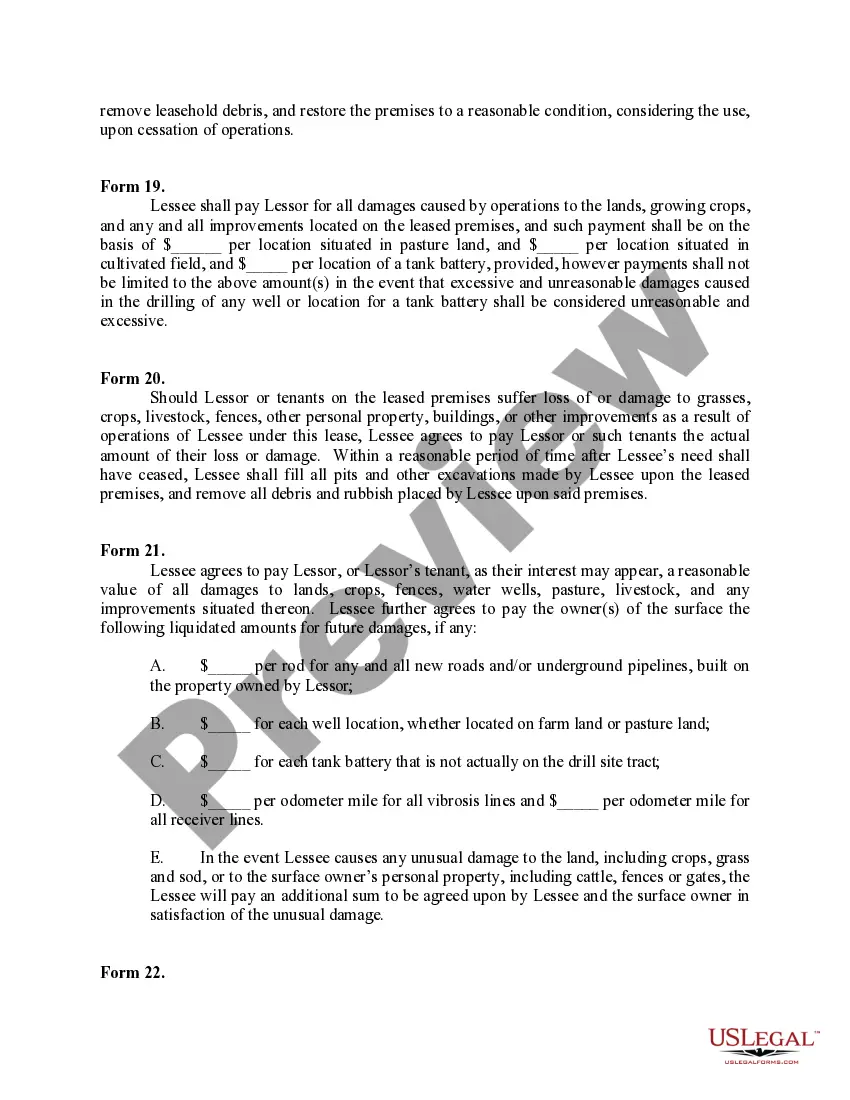

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Alaska Surface Damage Payments

Description

How to fill out Surface Damage Payments?

US Legal Forms - one of the largest libraries of authorized varieties in the USA - offers a wide range of authorized file templates you can down load or print out. Using the web site, you can find thousands of varieties for business and individual reasons, sorted by groups, suggests, or keywords.You will find the most recent models of varieties such as the Alaska Surface Damage Payments within minutes.

If you already possess a membership, log in and down load Alaska Surface Damage Payments in the US Legal Forms library. The Down load button will appear on each form you perspective. You have accessibility to all in the past saved varieties in the My Forms tab of the account.

If you wish to use US Legal Forms the very first time, listed here are straightforward directions to help you began:

- Make sure you have picked out the right form to your city/county. Select the Review button to check the form`s content material. Browse the form explanation to actually have chosen the correct form.

- In the event the form doesn`t fit your needs, utilize the Search discipline towards the top of the screen to obtain the one who does.

- If you are content with the form, affirm your option by simply clicking the Get now button. Then, opt for the prices strategy you prefer and provide your references to sign up to have an account.

- Approach the purchase. Use your charge card or PayPal account to complete the purchase.

- Select the file format and down load the form in your system.

- Make adjustments. Load, modify and print out and indicator the saved Alaska Surface Damage Payments.

Every template you included with your bank account lacks an expiration time and it is your own property permanently. So, if you want to down load or print out yet another backup, just proceed to the My Forms portion and click on the form you need.

Get access to the Alaska Surface Damage Payments with US Legal Forms, by far the most substantial library of authorized file templates. Use thousands of expert and express-particular templates that meet up with your small business or individual requirements and needs.

Form popularity

FAQ

The Oklahoma Surface Damage Act guides interactions and negotiations between land surface owners and the oil companies and others who have the mineral rights. In the state, and elsewhere throughout the U.S., the owners of land parcels do not always also have ownership of what may lay below the surface.

In Oklahoma, there are two major categories of land rights: surface rights and mineral rights. Surface rights are rights attached to the surface of the land. With surface rights, you have access to and the ability to build or otherwise use the surface of the land. Mineral rights are sub-surface rights.

Most likely, if you own land in Alaska, the state of Alaska owns what lies beneath. These ?subsurface rights? are dominant over your rights as a surface landowner and you cannot deny reasonable access to the state's resources, which could include anything from precious metals to oil and gas.

Effect of Property Taxes on Mineral Rights Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

The value of mineral rights is based on what a buyer is willing to pay today for your property. Without any royalty income it comes down to what buyers think the future income might be.

On average, a single acre's mineral rights can range from as low as $200 to over $10,000+ on the high end. As you might expect, the prices will vary depending on the mineral in question, the number of wells currently drilled, the current production rate, the existence of pipeline infrastructure, and much more.