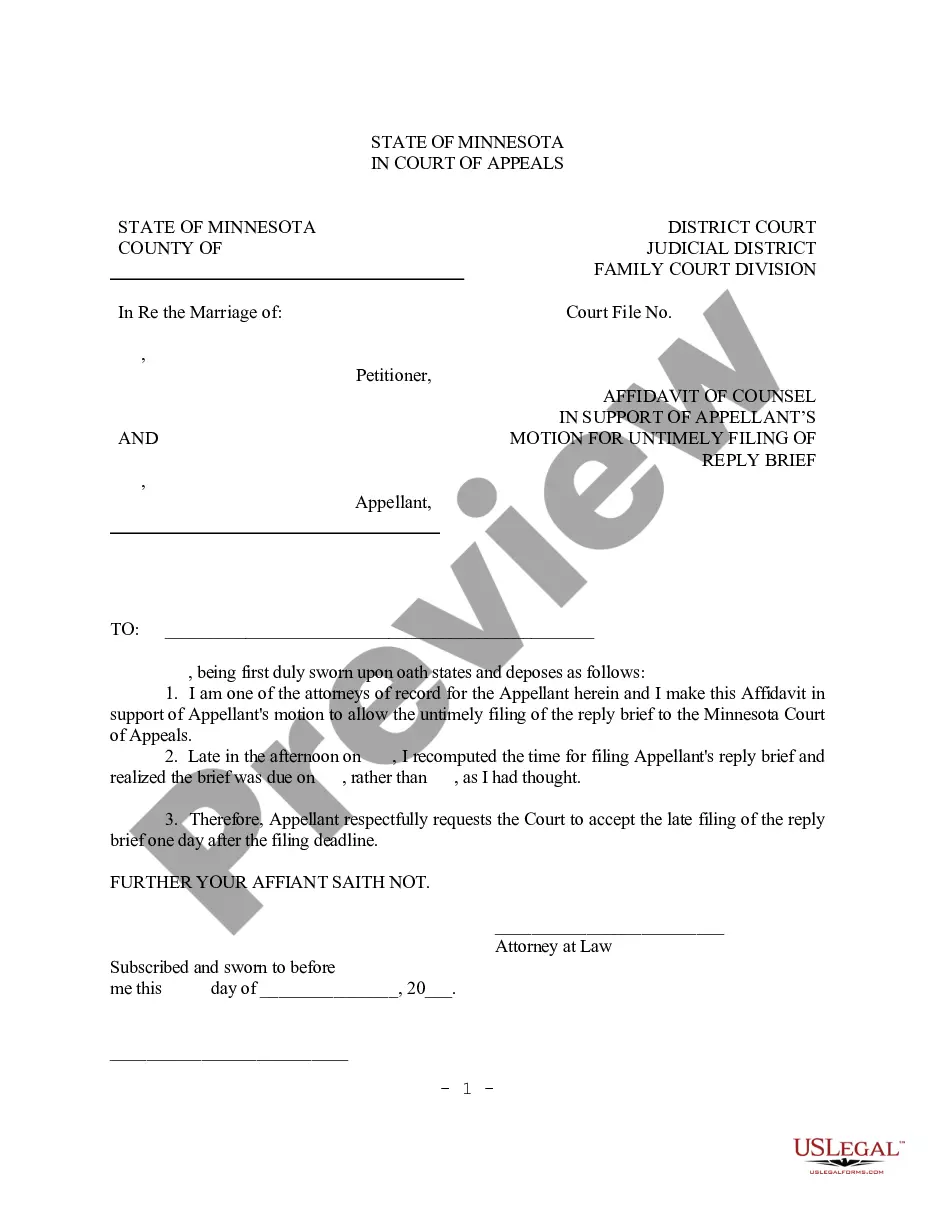

Alaska Subordination of Lien

Description

How to fill out Subordination Of Lien?

US Legal Forms - one of many greatest libraries of authorized types in the United States - gives a variety of authorized papers layouts it is possible to down load or printing. While using site, you will get 1000s of types for organization and personal uses, sorted by types, states, or key phrases.You can get the most up-to-date models of types like the Alaska Subordination of Lien in seconds.

If you currently have a monthly subscription, log in and down load Alaska Subordination of Lien through the US Legal Forms collection. The Acquire switch will appear on every develop you perspective. You gain access to all previously saved types inside the My Forms tab of your respective profile.

If you want to use US Legal Forms for the first time, allow me to share straightforward instructions to obtain started off:

- Ensure you have picked the correct develop for your personal metropolis/region. Click the Preview switch to review the form`s articles. Read the develop outline to ensure that you have selected the correct develop.

- When the develop does not suit your needs, take advantage of the Research field at the top of the display to find the one who does.

- Should you be content with the shape, verify your decision by clicking the Buy now switch. Then, select the costs prepare you favor and give your references to register for the profile.

- Approach the purchase. Make use of your bank card or PayPal profile to complete the purchase.

- Select the formatting and down load the shape in your device.

- Make alterations. Load, edit and printing and indicator the saved Alaska Subordination of Lien.

Every single template you included with your account lacks an expiration particular date and is also your own eternally. So, if you want to down load or printing an additional backup, just go to the My Forms section and click about the develop you need.

Gain access to the Alaska Subordination of Lien with US Legal Forms, probably the most substantial collection of authorized papers layouts. Use 1000s of skilled and express-particular layouts that satisfy your business or personal demands and needs.

Form popularity

FAQ

A subordination agreement must be signed and acknowledged by a notary and recorded in the official records of the county to be enforceable.

Subordination agreements ensure that a primary lender will be paid in the event the borrower takes on more debt. As with most legal documents, subordination agreements need to be notarized in order to be official in the eyes of the law.

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

To adjust their priority, subordinate lienholders must sign subordination agreements, making their loans lower in priority than the new lender. A subordination agreement puts the new lender into first position and reassigns an existing mortgage to second position or third position, and so on.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor.

The new lender prepares the subordination agreement in conjunction with the subordinating lienholder. Then, the parties typically sign the agreement. But in some cases, just the subordinating lender will need to sign the paperwork.