Alaska Assignment of Member Interest in Limited Liability Company - LLC

Description

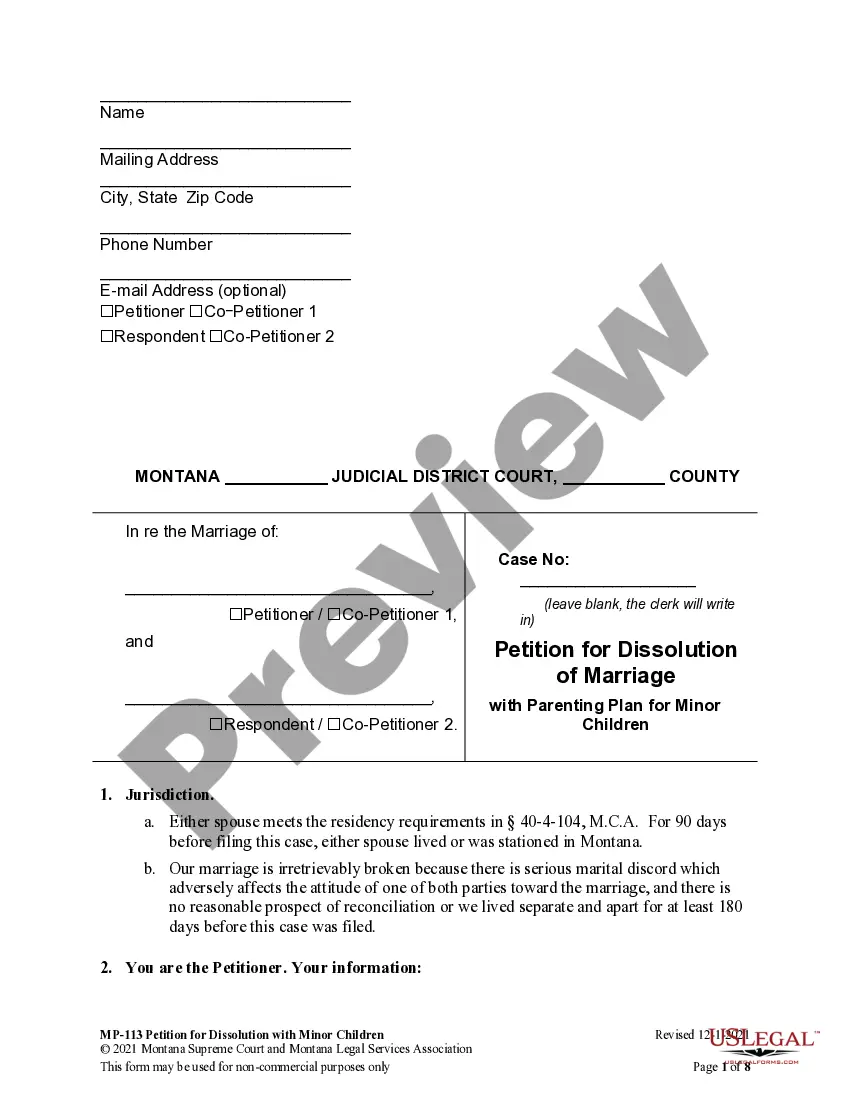

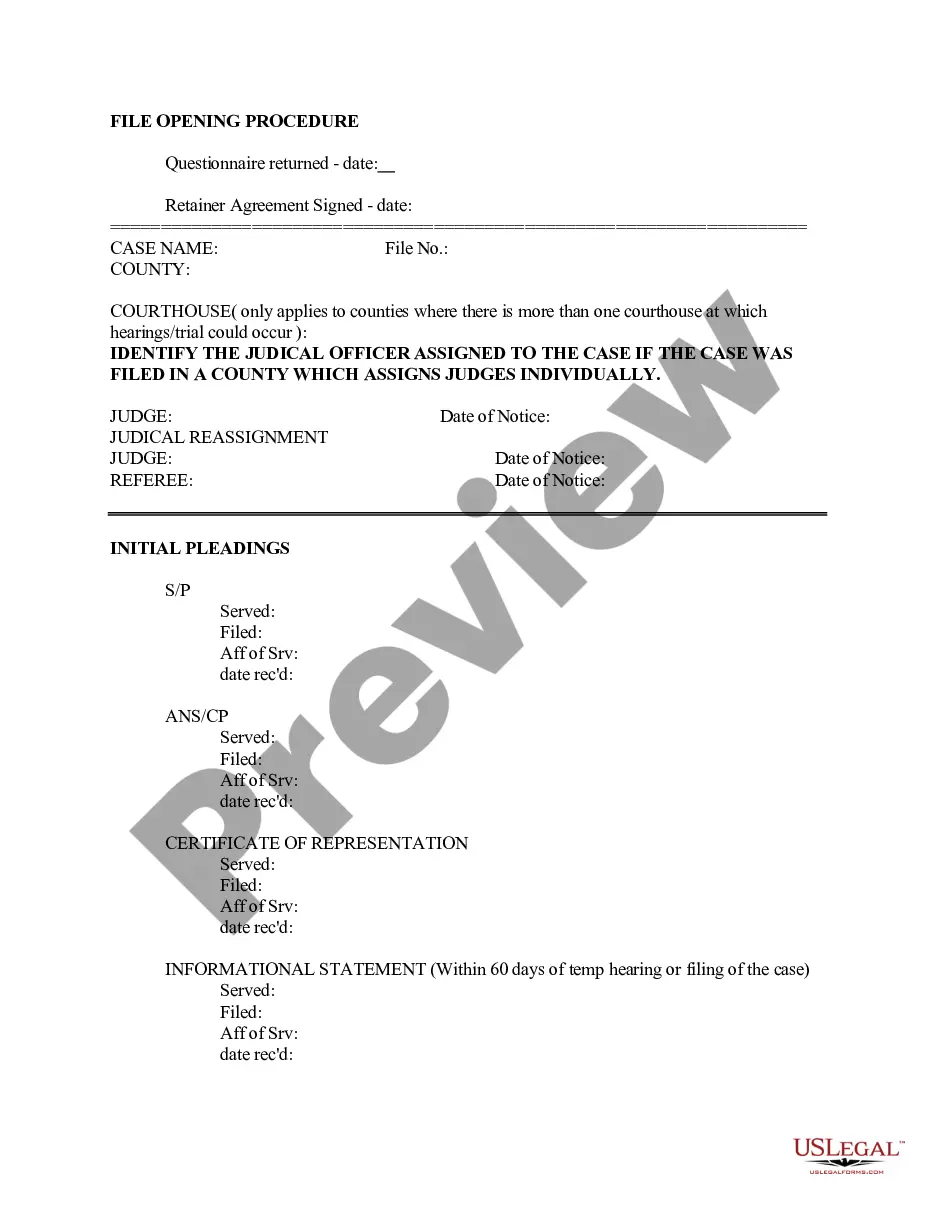

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

US Legal Forms - one of many most significant libraries of lawful types in the USA - offers a wide array of lawful file templates it is possible to down load or produce. While using website, you can find a large number of types for organization and personal purposes, sorted by classes, suggests, or key phrases.You will discover the most recent types of types like the Alaska Assignment of Member Interest in Limited Liability Company - LLC within minutes.

If you have a registration, log in and down load Alaska Assignment of Member Interest in Limited Liability Company - LLC from your US Legal Forms catalogue. The Down load switch will show up on every single develop you see. You have access to all previously delivered electronically types in the My Forms tab of your own bank account.

If you want to use US Legal Forms initially, listed below are straightforward recommendations to obtain started off:

- Be sure to have chosen the best develop to your metropolis/state. Click the Review switch to check the form`s articles. Look at the develop information to actually have chosen the right develop.

- When the develop doesn`t satisfy your needs, use the Lookup field on top of the screen to discover the one that does.

- If you are satisfied with the shape, confirm your selection by visiting the Get now switch. Then, pick the prices prepare you prefer and give your references to sign up for an bank account.

- Method the purchase. Utilize your Visa or Mastercard or PayPal bank account to accomplish the purchase.

- Pick the file format and down load the shape in your product.

- Make changes. Load, edit and produce and indicator the delivered electronically Alaska Assignment of Member Interest in Limited Liability Company - LLC.

Every single template you included in your bank account does not have an expiry time and is also your own permanently. So, if you want to down load or produce an additional backup, just check out the My Forms portion and click around the develop you want.

Obtain access to the Alaska Assignment of Member Interest in Limited Liability Company - LLC with US Legal Forms, probably the most considerable catalogue of lawful file templates. Use a large number of professional and state-particular templates that meet your small business or personal demands and needs.

Form popularity

FAQ

An LLC owner (called a member) can transfer an ownership interest (called a membership interest) by complying with the transfer provisions within the LLC's operating agreement and state law. An assignment is one of the key documents a member must prepare to officially transfer a membership interest to a transferee.

When a taxpayer sells an LLC interest, the taxpayer will usually have a capital gain or loss on the sale of the interest. However, capital gain or loss treatment does not apply to the sale of every LLC interest.

form agreement for the redemption of a minority membership interest in a limited liability company (LLC). This Standard Document assumes that the redeeming member is selling its entire membership interest back to the LLC at the closing of the redemption.

A membership interest represents a member's ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC.

In LLCs, however, this does not apply. Since LLCs are more like partnerships, you cannot force partnerships between people without their agreement. You can only transfer an LLC's ownership interests if all the other LLC owners agree, and even then, only if the state law allows for it.

A membership interest purchase agreement, sometimes called a MIPA, is a contract between a seller and a buyer to transfer the ownership of an LLC.

An assignment and assumption of membership interests used when a member of a limited liability company (LLC) wants to transfer its membership interest in the LLC to another entity. This Standard Document has integrated notes with important explanations and drafting and negotiating tips.

After the terms of sale are negotiated, a written membership interest sales agreement can be created to record the transaction. This agreement should detail the new member's ownership percentage, the amount of the buy-in, and require that the new member agree to be bound by the existing Operating Agreement of the LLC.