Alaska Self-Employed Seasonal Picker Services Contract

Description

How to fill out Self-Employed Seasonal Picker Services Contract?

Selecting the appropriate legal document template can be challenging. Clearly, there are numerous templates accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Alaska Self-Employed Seasonal Picker Services Contract, that you can utilize for business and personal needs. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, sign in to your account and click the Download button to obtain the Alaska Self-Employed Seasonal Picker Services Contract. Use your account to browse through the legal forms you have previously acquired. Visit the My documents section of your account to get another copy of the document you require.

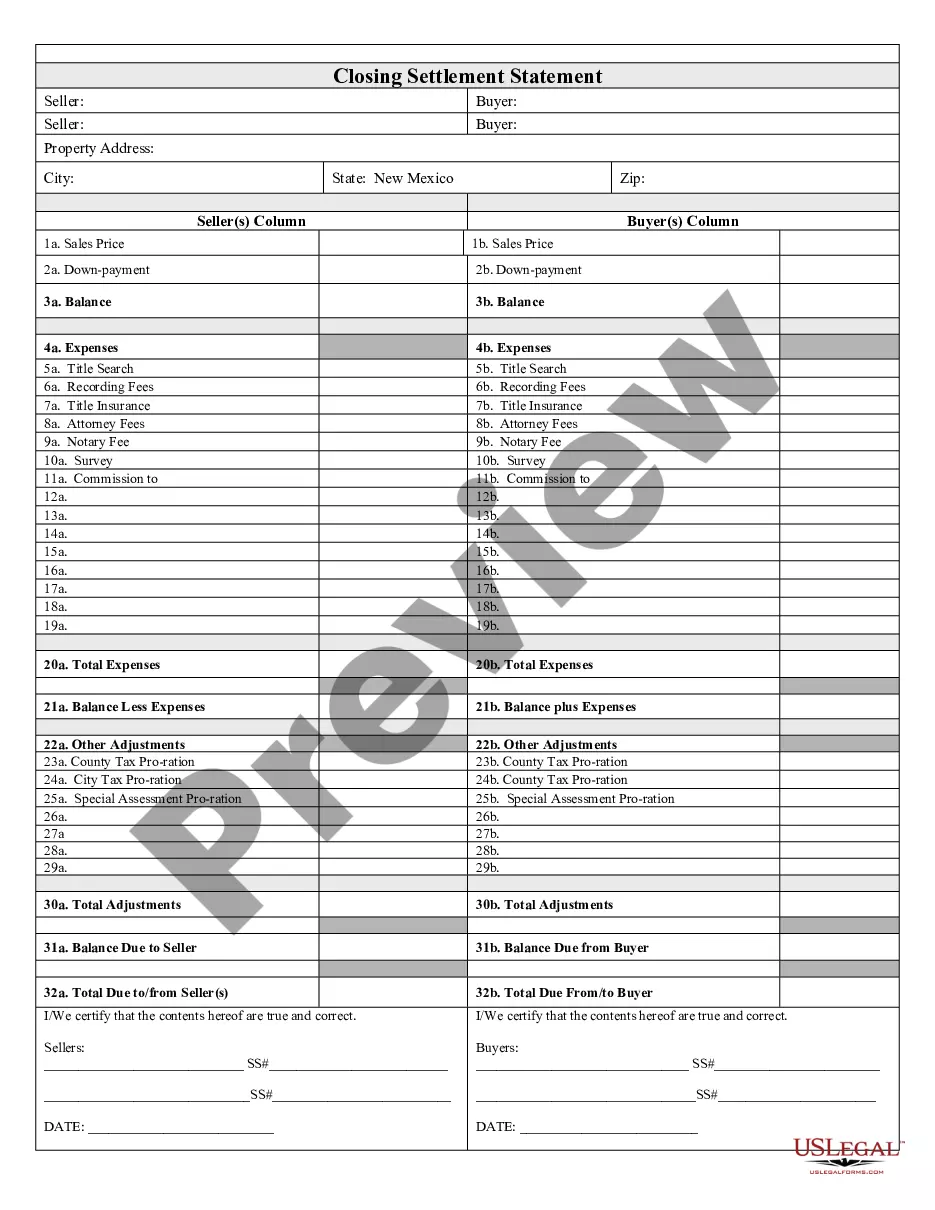

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure that you have selected the correct form for your city/state. You can preview the form using the Preview button and review the form details to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is correct, click on the Download now button to obtain the form. Choose the payment plan you prefer and enter the required information. Create your account and complete a transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Alaska Self-Employed Seasonal Picker Services Contract.

Take advantage of US Legal Forms to simplify your legal documentation needs and ensure compliance with applicable laws.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Utilize the service to acquire properly crafted documents that adhere to state requirements.

- The website offers a user-friendly interface for easy navigation.

- All forms are designed to meet legal standards and regulations.

- You can manage your documents efficiently through your user account.

- Download options are available in multiple formats for convenience.

Form popularity

FAQ

In Alaska, the statute of limitations for enforcing a written contract, such as an Alaska Self-Employed Seasonal Picker Services Contract, is typically three years. This means you have three years from the date of the breach to file a lawsuit. It’s important to keep this timeframe in mind to protect your rights. If you are unsure about any specifics, US Legal Forms offers resources to help you understand your contract obligations.

In Alaska, minors working under an Alaska Self-Employed Seasonal Picker Services Contract can work a limited number of hours. Generally, minors aged 14 and 15 can work up to 40 hours a week, but there are restrictions on the hours they can work during school weeks. It's important to adhere to these regulations to ensure compliance and protect the minors involved. For more detailed information, you might find US Legal Forms helpful for accessing legal guidelines.

In Alaska, independent contractors, including those engaged in an Alaska Self-Employed Seasonal Picker Services Contract, may not be required to carry workers' compensation insurance. However, it is crucial to assess your specific situation and consult with a legal expert. Having insurance can provide you with financial protection in the event of work-related injuries. If you need help navigating these requirements, consider using the services from US Legal Forms.

The independent contractor agreement in Alaska is a specific contract that governs the relationship between self-employed individuals and their clients within the state. This agreement is designed to address unique local regulations and industry standards, particularly for seasonal work like picking services. By utilizing the Alaska Self-Employed Seasonal Picker Services Contract, you can ensure your agreement meets state requirements while protecting your rights as a contractor.

An independent contractor agreement is a legal document that outlines the terms and conditions of the working relationship between a contractor and a client. This agreement typically includes details about the scope of work, payment terms, and deadlines, ensuring both parties understand their rights and obligations. For those utilizing the Alaska Self-Employed Seasonal Picker Services Contract, having a solid agreement in place protects your interests and clarifies expectations.

To operate as an independent contractor under the Alaska Self-Employed Seasonal Picker Services Contract, you must comply with several legal requirements. First, you need to obtain the necessary business licenses and permits specific to your industry. Additionally, maintaining proper tax documentation is vital to ensure you report your income correctly. Understanding these requirements helps you avoid legal issues and navigate the contracting process smoothly.

In Alaska, a 14 year old can seek employment, but there are specific regulations to follow. Minors must adhere to labor laws that limit the number of hours and types of work they can perform. For instance, a 14 year old can work in jobs like delivering newspapers or assisting in family businesses. If you are considering hiring a minor for your Alaska Self-Employed Seasonal Picker Services Contract, ensure you understand these regulations to maintain compliance.

In Alaska, independent contractors are generally not required to carry workers' compensation insurance, but there are exceptions. If you hire employees or if your contract specifies it, you may need to obtain coverage. The Alaska Self-Employed Seasonal Picker Services Contract can address insurance requirements, ensuring you understand your obligations regarding workplace safety. It's always wise to consult legal resources or professionals to ensure compliance with state regulations.

The main legal differences between an employee and an independent contractor involve taxation, benefits, and liability. Employees are typically entitled to benefits and have taxes withheld by their employer, while independent contractors manage their tax responsibilities and have no access to employee benefits. The Alaska Self-Employed Seasonal Picker Services Contract clarifies these aspects, ensuring that both parties understand their rights and responsibilities. This clarity helps prevent potential legal disputes.

The difference between an employee and a contractor in Alaska often centers on the nature of work and contractual obligations. Employees usually receive benefits and have taxes withheld from their paychecks, while contractors operate as separate entities responsible for their taxes. The Alaska Self-Employed Seasonal Picker Services Contract highlights these distinctions, allowing contractors to work flexibly without the constraints of traditional employment. Knowing these differences helps in making informed decisions about your work arrangement.