Alaska Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

Selecting the appropriate legal document format can be a challenge.

Of course, there are numerous templates available online, but how can you find the legal document you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Alaska Door Contractor Agreement - Self-Employed, which can be utilized for both business and personal purposes.

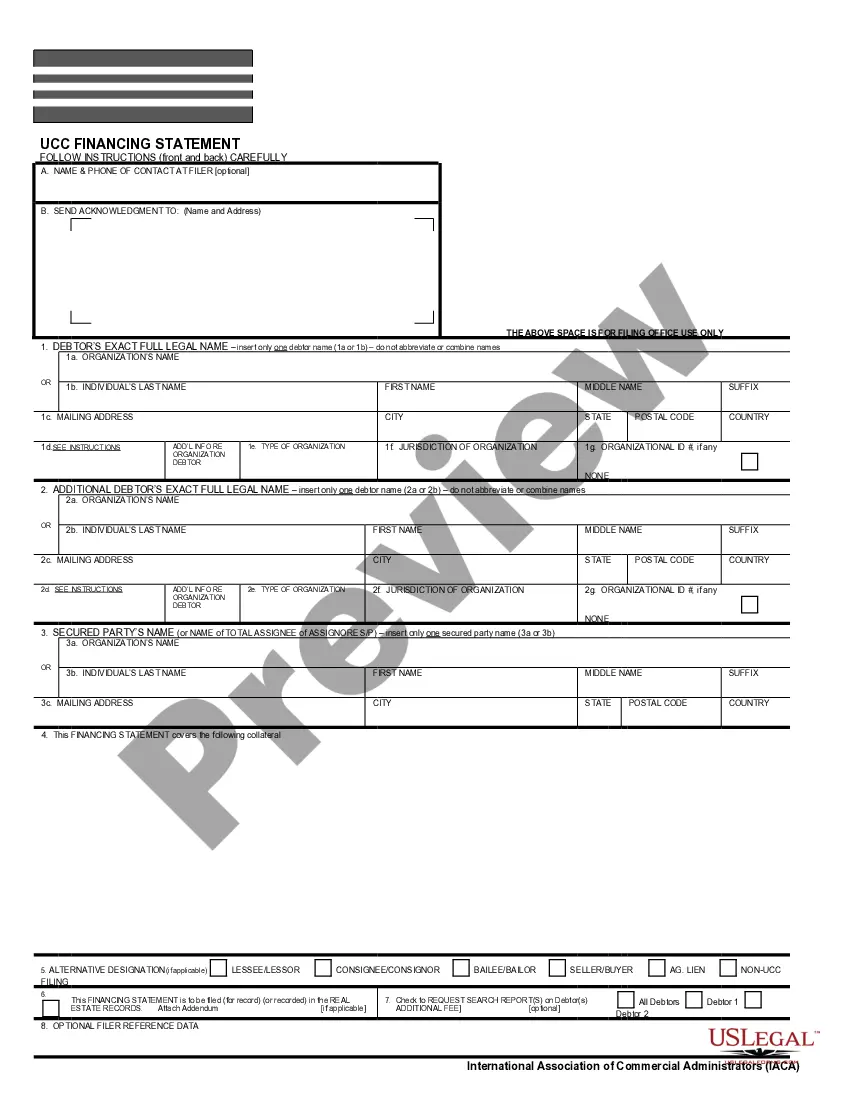

You can browse the form using the Preview button and review the document description to confirm it is suitable for you.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Alaska Door Contractor Agreement - Self-Employed.

- Use your account to view the legal documents you have purchased in the past.

- Go to the My documents section of your account and obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

- First, ensure you have selected the correct document for your location.

Form popularity

FAQ

Writing an independent contractor agreement involves several key steps. Start with an introduction that defines both parties and their roles. Next, outline the services to be performed, payment terms, and the duration of the agreement, particularly in relation to the Alaska Door Contractor Agreement - Self-Employed. Finally, include provisions for termination, confidentiality, and other essential clauses, ensuring both parties understand their obligations.

To fill out an independent contractor agreement, begin by clearly stating the working relationship between yourself and the client. Include specific details such as the scope of work, deadlines, and payment terms associated with the Alaska Door Contractor Agreement - Self-Employed. Make sure both parties review and sign the document to ensure mutual understanding and protection. This structured approach helps prevent disputes in the future.

Filling out an independent contractor form is straightforward. Start by entering your personal information, including your name, address, and contact details. Next, describe the services you will provide under the Alaska Door Contractor Agreement - Self-Employed, and outline the payment terms. Finally, review all the information for accuracy before submitting the form.

The primary difference between an independent contractor and an employee in Alaska lies in the level of control and independence. Independent contractors work autonomously and often have multiple clients, while employees typically follow company guidelines and have a schedule dictated by the employer. Understanding this distinction is crucial when drafting the Alaska Door Contractor Agreement - Self-Employed to accurately reflect your work relationship.

The new federal rule on independent contractors clarifies how workers are classified and focuses on the nature of their working relationships. It has emphasized the importance of written agreements to enhance transparency. For self-employed individuals, the Alaska Door Contractor Agreement - Self-Employed can help align with these federal guidelines and safeguard your business.

The independent contractor agreement in Alaska is a legal document that defines the working relationship between a contractor and a client. It covers essential aspects like payment, work location, and confidentiality. By using the right templates, such as the Alaska Door Contractor Agreement - Self-Employed, you can ensure compliance with state regulations and protect your interests.

Yes, you can absolutely have a contract when you are self-employed. A contract protects your rights and outlines your responsibilities with clients. The Alaska Door Contractor Agreement - Self-Employed provides a solid framework to ensure all parties understand their roles, which can lead to more successful projects.

A basic independent contractor agreement specifies the relationship between the contractor and the client. It includes details such as the payment terms, project descriptions, and timelines. If you are self-employed in Alaska, utilizing the Alaska Door Contractor Agreement - Self-Employed can help formalize your business relationships and clarify expectations.

To create an independent contractor agreement, start by outlining the scope of work and the terms for payment. Clearly define responsibilities and deadlines. By using resources like US Legal Forms, you can access templates specifically designed for the Alaska Door Contractor Agreement - Self-Employed, ensuring your contract includes all necessary legal elements.