Alaska Security Agreement regarding borrowing of funds and granting of security interest in assets

Description

How to fill out Security Agreement Regarding Borrowing Of Funds And Granting Of Security Interest In Assets?

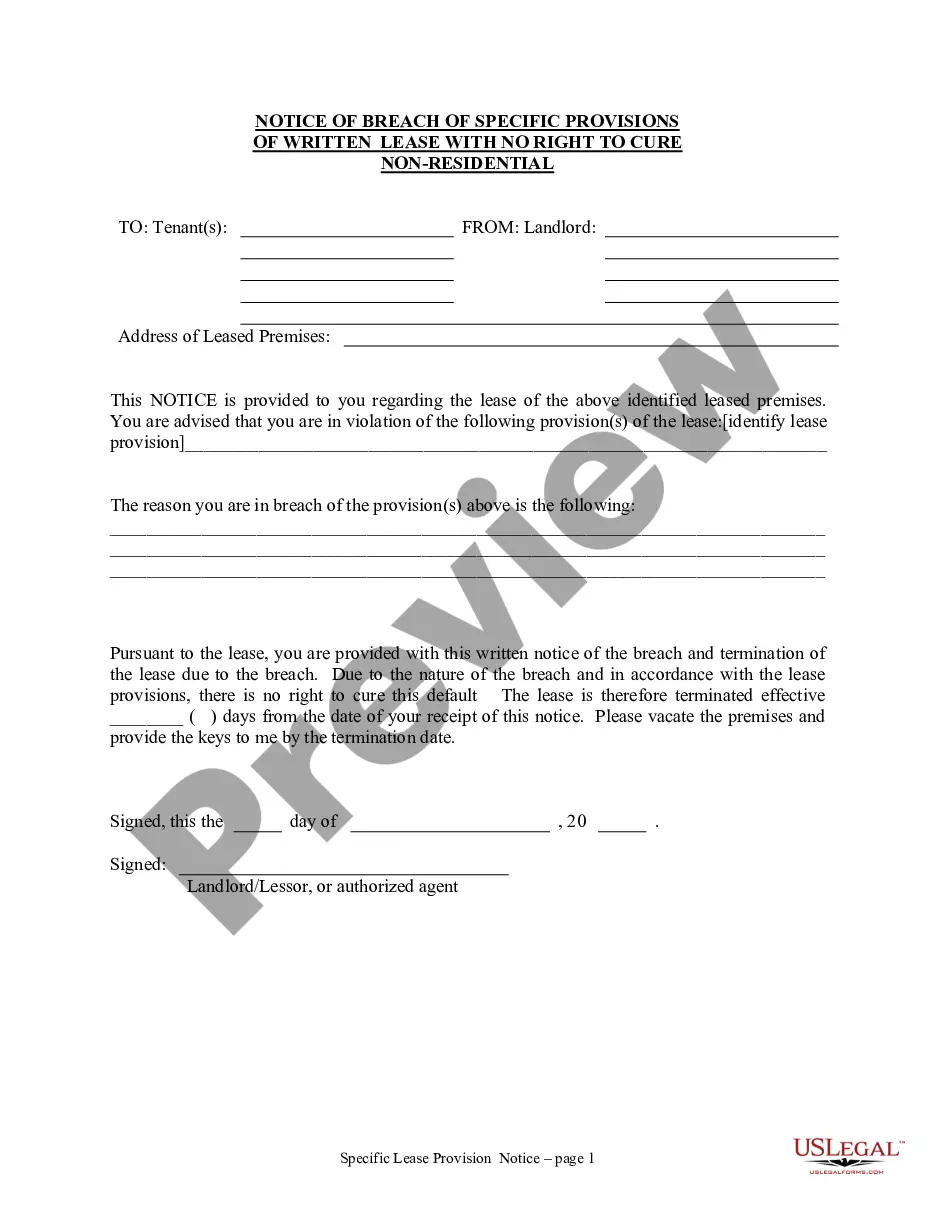

Choosing the right lawful papers design can be a battle. Obviously, there are a variety of themes available online, but how would you discover the lawful develop you will need? Make use of the US Legal Forms internet site. The services delivers 1000s of themes, for example the Alaska Security Agreement regarding borrowing of funds and granting of security interest in assets, which you can use for business and private demands. Every one of the forms are checked by professionals and meet state and federal demands.

When you are presently signed up, log in to your bank account and click the Obtain switch to find the Alaska Security Agreement regarding borrowing of funds and granting of security interest in assets. Use your bank account to appear from the lawful forms you may have ordered in the past. Go to the My Forms tab of the bank account and obtain another version of the papers you will need.

When you are a brand new consumer of US Legal Forms, allow me to share basic directions so that you can follow:

- Very first, be sure you have chosen the correct develop for the area/state. You can check out the form utilizing the Review switch and browse the form explanation to guarantee this is the best for you.

- If the develop will not meet your preferences, use the Seach field to obtain the correct develop.

- Once you are certain the form would work, click the Purchase now switch to find the develop.

- Opt for the costs prepare you need and enter in the necessary info. Make your bank account and pay for an order utilizing your PayPal bank account or credit card.

- Select the document formatting and acquire the lawful papers design to your device.

- Full, edit and print and indication the received Alaska Security Agreement regarding borrowing of funds and granting of security interest in assets.

US Legal Forms will be the most significant library of lawful forms in which you can discover various papers themes. Make use of the company to acquire professionally-manufactured paperwork that follow state demands.

Form popularity

FAQ

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

Security agreement is the agreement between the secured party and the debtor that creates or provides for a security interest. Collateral refers to the items of property in which a security interest is granted by the debtor.

To create a valid security interest in equipment, inventory, receivables and shares in companies (as well as the other categories of collateral governed by the UCC, (i) a security provider (the grantor) must execute or authenticate a written or electronic security agreement that provides an adequate description of the ...

You give the lender this right when you sign your closing forms. The document granting the security interest can be called by different names, but the most common names are "Mortgage" or "Deed of Trust."

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

There are three requirements for attachment: (1) the secured party gives value; (2) the debtor has rights in the collateral or the power to transfer rights in it to the secured party; (3) the parties have a security agreement ?authenticated? (signed) by the debtor, or the creditor has possession of the collateral.