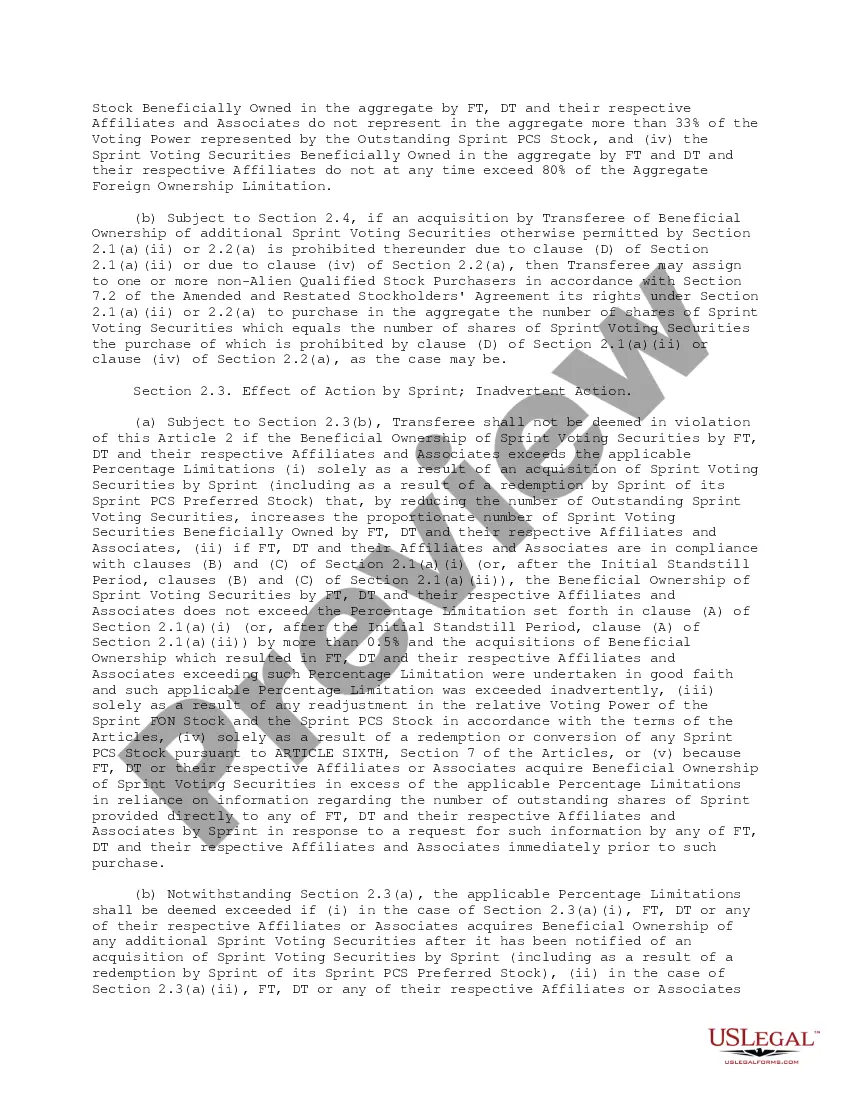

Alaska Standstill Agreement between Sprint Corp. and NAB Nordamerika Beteiligungs Holding GMBH

Description

How to fill out Standstill Agreement Between Sprint Corp. And NAB Nordamerika Beteiligungs Holding GMBH?

If you have to comprehensive, acquire, or print out lawful papers layouts, use US Legal Forms, the largest assortment of lawful varieties, which can be found online. Utilize the site`s simple and easy handy search to find the papers you require. Numerous layouts for enterprise and specific uses are sorted by classes and states, or search phrases. Use US Legal Forms to find the Alaska Standstill Agreement between Sprint Corp. and NAB Nordamerika Beteiligungs Holding GMBH in just a couple of clicks.

In case you are presently a US Legal Forms consumer, log in for your accounts and click on the Acquire button to get the Alaska Standstill Agreement between Sprint Corp. and NAB Nordamerika Beteiligungs Holding GMBH. You can even entry varieties you earlier delivered electronically inside the My Forms tab of the accounts.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the shape for that appropriate city/region.

- Step 2. Use the Review solution to check out the form`s content. Don`t forget to see the description.

- Step 3. In case you are not satisfied with the form, utilize the Research discipline near the top of the monitor to find other versions from the lawful form template.

- Step 4. Once you have located the shape you require, go through the Acquire now button. Choose the costs strategy you favor and include your references to sign up to have an accounts.

- Step 5. Method the deal. You may use your charge card or PayPal accounts to finish the deal.

- Step 6. Find the formatting from the lawful form and acquire it on your device.

- Step 7. Complete, modify and print out or indicator the Alaska Standstill Agreement between Sprint Corp. and NAB Nordamerika Beteiligungs Holding GMBH.

Each lawful papers template you get is yours for a long time. You might have acces to every form you delivered electronically within your acccount. Click the My Forms section and decide on a form to print out or acquire once more.

Compete and acquire, and print out the Alaska Standstill Agreement between Sprint Corp. and NAB Nordamerika Beteiligungs Holding GMBH with US Legal Forms. There are many professional and state-distinct varieties you can use for your personal enterprise or specific requires.

Form popularity

FAQ

A standstill agreement prevents a party from issuing proceedings during the currency of that agreement. As such a standstill agreement is a voluntary contractual arrangement between the parties to pause limitation for an agreed length of time (typically 3-6 months).

A standstill agreement is a contract that contains provisions that govern how a bidder of a company can purchase, dispose of, or vote stock of the target company. A standstill agreement can effectively stall or stop the process of a hostile takeover if the parties cannot negotiate a friendly deal.

A standstill agreement was an agreement signed between the newly independent dominions of India and Pakistan and the princely states of the British Indian Empire prior to their integration in the new dominions. The form of the agreement was bilateral between a dominion and a princely state.

The standstill agreement prevents these potential buyers from publicly announcing a bid for the target, without first acquiring the consent of the target (the public company exploring a sale). In this sense, the standstill agreement is seen to help the target company control the bidding process.

Example: if a party, in a trade agreement, commits to allowing 30% foreign ownership in domestic companies and later on decides unilaterally to allow 40%, the party can re-introduce the original level of 30% whenever it wishes (but it cannot restrict further below 30%).