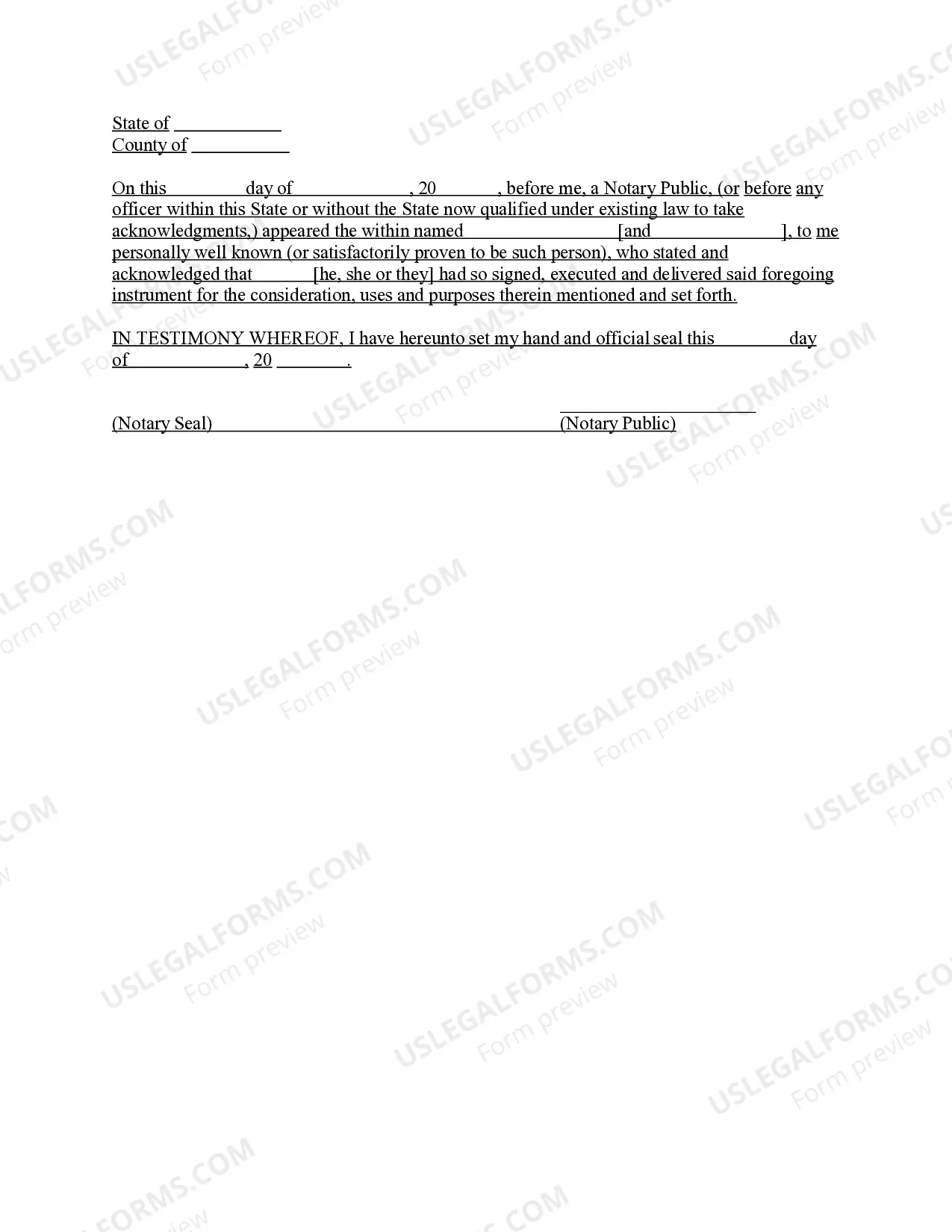

This due diligence workform is used to review property information and title commitments and policies in business transactions.

Alaska Fee Interest Workform

Description

How to fill out Fee Interest Workform?

Finding the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how do you identify the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast array of templates, such as the Alaska Fee Interest Workform, which can be utilized for both business and personal purposes. All templates are reviewed by experts and comply with state and federal regulations.

If you are currently a registered user, Log In to your account and click the Acquire button to locate the Alaska Fee Interest Workform. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Alaska Fee Interest Workform. US Legal Forms is the largest repository of legal documents where you can access various document templates. Utilize the service to obtain professionally crafted papers that meet state requirements.

- First, ensure you have selected the correct form for your region/county.

- You may preview the document using the Review option and read the form description to ensure it is suitable for your needs.

- If the document does not meet your requirements, use the Search field to find the proper form.

- Once you are sure that the document is appropriate, select the Get now button to acquire the form.

- Choose the pricing plan you wish to use and enter the necessary details.

- Create your account and complete the payment using your PayPal account or credit card.

Form popularity

FAQ

To register as a foreign corporation in Alaska, you need to file an application for a certificate of authority with the state. This filing includes submitting your Alaska Fee Interest Workform along with other required documents verifying your home state’s regulations. Utilizing tools from uslegalforms can assist you in ensuring that your application is complete and meets all necessary legal standards.

To change the ownership of your business license in Alaska, you must submit a new application as the original business license cannot simply be transferred. This process involves completing the required forms and may also require an updated Alaska Fee Interest Workform. For clarity and efficiency, technologies like uslegalforms simplify this task, guiding you smoothly through the necessary steps for your new ownership.

Changing your registered agent in Alaska involves filling out the registered agent change form and submitting it to the Division of Corporations. Be sure that your new agent meets the state's requirements to avoid any disruptions. If you're unsure how to proceed, uslegalforms can help you navigate the specifics, ensuring your Alaska Fee Interest Workform remains compliant with the law.

To change your registered agent in Alaska, you need to file the appropriate form with the state. This form allows you to officially designate a new agent and is key to maintaining legal compliance. Using a service like uslegalforms can streamline your process, ensuring that your Alaska Fee Interest Workform is submitted accurately and efficiently.

In Alaska, you can only designate one registered agent for your LLC at any given time. This agent is responsible for receiving legal documents and must be available during regular business hours. If you need assistance with this process or want to discuss the implications of multiple agents, consider using ulegalforms to guide you through filing your Alaska Fee Interest Workform correctly.

No, a registered agent does not have to be in the same city as your business. However, it's essential for the agent to be located in Alaska for service of process purposes. This ensures that legal documents related to your Alaska Fee Interest Workform are received promptly. You can choose a registered agent that meets your business needs, even if they operate in a different city within the state.

Corporations in Alaska must file several documents, including annual reports and corporate taxes based on income. They should also keep records of business transactions and comply with state regulations. The Alaska Fee Interest Workform can guide you through the necessary filings and help ensure you're fully compliant with all requirements. This organization aids in avoiding potential fines and supports business growth.

The corporate extension form for Alaska allows businesses to request additional time to file their corporate tax returns. This can be crucial for companies needing more time to gather financial information. Using tools like the Alaska Fee Interest Workform from uslegalforms can help streamline this process, ensuring you submit your extension request accurately and on time.

If you operate a business in Alaska, you will likely need to file taxes, depending on your earnings and business structure. While personal income taxes do not exist in Alaska, corporate taxes still apply. Consider using the Alaska Fee Interest Workform to ensure you meet all filing requirements without confusion. This efficient process will help you stay organized and compliant.

Yes, LLCs in Alaska are required to file an annual report to maintain good standing. This report keeps your business information updated with the state. Additionally, the Alaska Fee Interest Workform can simplify the filing process by ensuring you have all required details at your fingertips. Staying compliant with annual filings helps avoid penalties.