This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

Alaska Acquisition Divestiture Merger Agreement Summary

Description

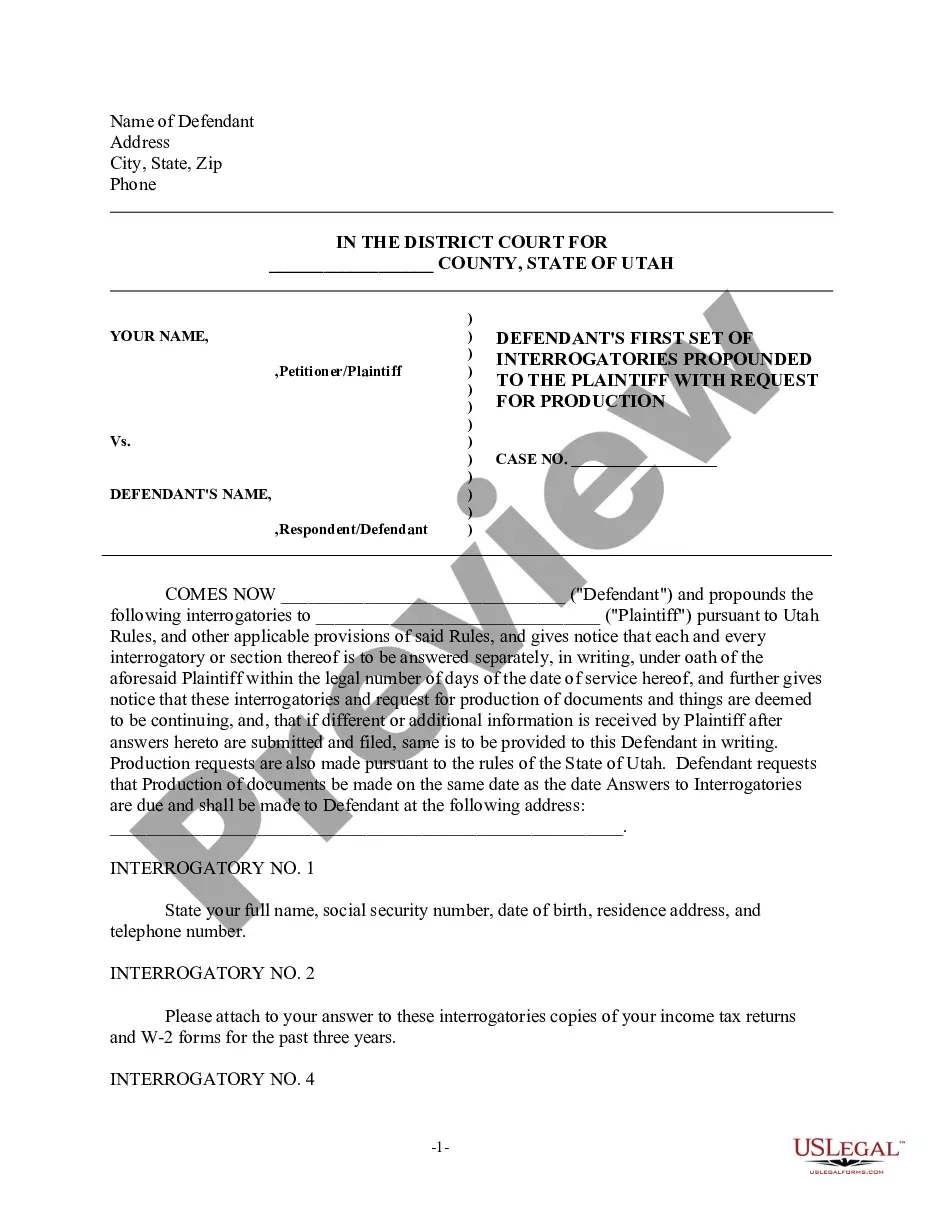

How to fill out Acquisition Divestiture Merger Agreement Summary?

Selecting the optimal legal document template can be quite a challenge.

Certainly, numerous templates can be found online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Alaska Acquisition Divestiture Merger Agreement Summary, suitable for both corporate and personal use.

First, ensure that you have selected the correct form for your city/state. You can preview the form using the Review option and read the form description to confirm that it is suitable for you.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Alaska Acquisition Divestiture Merger Agreement Summary.

- Use your account to browse through the legal documents you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

Form popularity

FAQ

A merger agreement generally follows a systematic structure, starting with an introduction and background of the involved parties. The Alaska Acquisition Divestiture Merger Agreement Summary includes sections detailing definitions, covenants, and closing procedures. Furthermore, it outlines any contingencies and post-closing obligations that the parties must fulfill. By recognizing this structured approach, businesses can better navigate the complexities of merger agreements and ensure compliance with all outlined terms.

The Alaska Acquisition Divestiture Merger Agreement Summary highlights key provisions such as the roles of both parties, terms for equity exchange, and conditions for closing the deal. It typically includes details on regulatory approvals, representations, warranties, and any material adverse effects that may impact the transaction. Additionally, the agreement outlines how assets and liabilities will be handled, ensuring that both companies are aligned in their strategic goals. Understanding these provisions is crucial for stakeholders involved in the merger process.

Alaska Airlines merged with Hawaiian Airlines to strengthen its position in the competitive airline market. This partnership allows for a wider range of flight options and services for passengers. Together, they can leverage each other’s strengths and improve overall travel experiences. The Alaska Acquisition Divestiture Merger Agreement Summary emphasizes the strategic advantages of this merger for travelers.

Hawaiian Airlines merged with Alaska Airlines to create a stronger airline capable of better serving its customers. This merger aims to enhance operational efficiencies and expand the route offerings for both airlines. By combining resources, they can provide improved connectivity and customer benefits to travelers. The Alaska Acquisition Divestiture Merger Agreement Summary showcases how this merger aligns with customer needs.

Yes, the Department of Transportation (DOT) has officially approved the merger between Alaska Airlines and Hawaiian Airlines. This approval marks a significant step toward creating a more competitive airline industry. Travelers will soon benefit from the combined networks and services offered by both airlines. Keeping updated on the Alaska Acquisition Divestiture Merger Agreement Summary can provide you with more insights into this development.

Hawaiian Airlines is expected to continue its operations while integrating services with Alaska Airlines. This merger aims to expand network routes and customer benefits, creating a stronger airline partnership. Travelers can look forward to enhanced service offerings, making their journey smoother and more enjoyable. The Alaska Acquisition Divestiture Merger Agreement Summary highlights how this synergy can elevate customer experiences.

The acquisition of Hawaii and Alaska played a crucial role in expanding the United States' territory and economic potential. Alaska provided vast natural resources like oil, while Hawaii offered strategic military advantages and tourism opportunities. These acquisitions aimed to enhance US influence in the Pacific region. Understanding the historical context can enrich your knowledge of the Alaska Acquisition Divestiture Merger Agreement Summary.

As of now, there is no confirmed merger between Alaska Airlines and Hawaiian Airlines. However, if discussions were to start, they would likely be summarized in an Alaska Acquisition Divestiture Merger Agreement Summary. Keep an eye on industry news and official announcements for any developments regarding potential partnerships or mergers.

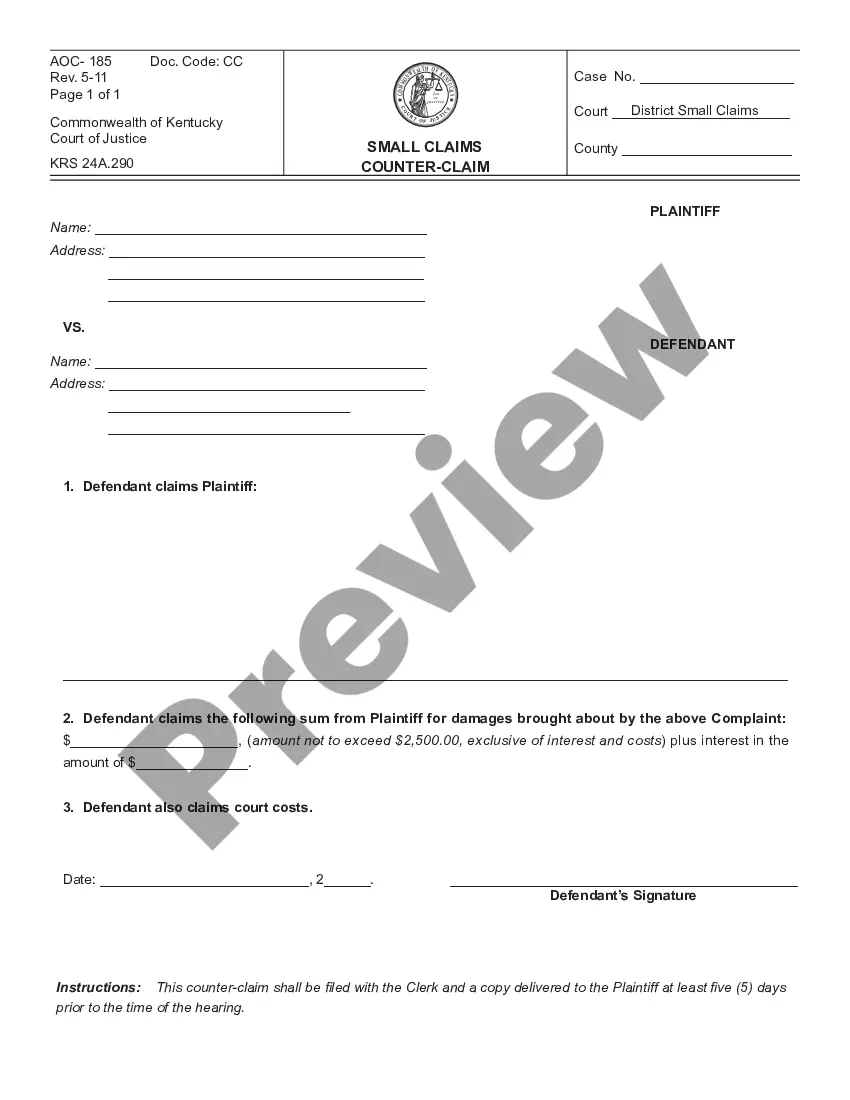

Mergers and acquisitions refer to the processes of combining companies to improve efficiency, expand market reach, or enhance resources. Divestitures, on the other hand, involve selling off assets or divisions to streamline operations. All these actions are often summarized within an Alaska Acquisition Divestiture Merger Agreement Summary, which captures the key terms and conditions of the deal.

One critical step in performing a merger or acquisition involves conducting thorough due diligence. This process examines the financial, legal, and operational aspects of the companies involved. Understanding these factors is pivotal for forming a detailed Alaska Acquisition Divestiture Merger Agreement Summary, ensuring all parties are informed about potential risks and benefits.