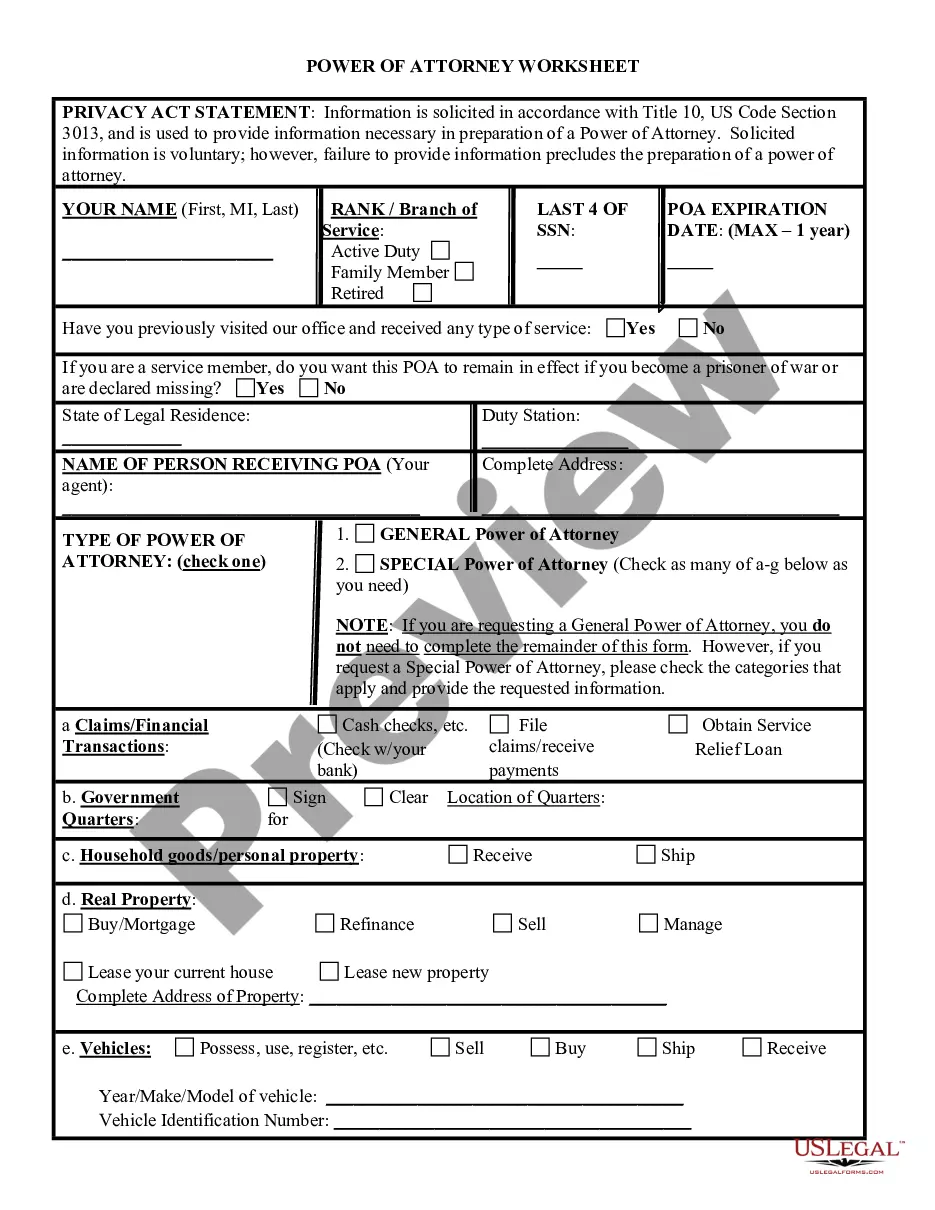

This due diligence form lists all of the attendees and events of its corporate meetings.

Alaska Corporate Partnership LLC Meeting Analysis

Description

How to fill out Corporate Partnership LLC Meeting Analysis?

You can spend hours online trying to locate the legal document template that fulfills the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that have been evaluated by professionals.

You can download or create the Alaska Corporate Partnership LLC Meeting Analysis from the service.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- After that, you are able to complete, modify, print, or sign the Alaska Corporate Partnership LLC Meeting Analysis.

- Each legal document template you download is yours indefinitely.

- To obtain another copy of any downloaded form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/town you choose.

- Check the form description to confirm you have selected the proper form.

Form popularity

FAQ

In Alaska, an LLC does require a business license to operate legally. This license must be renewed periodically, and the requirements can vary based on business activities. Understanding the nuances of Alaska Corporate Partnership LLC Meeting Analysis can ensure you remain compliant. Our platform can help you navigate the licensing process and keep you informed of any changes.

Yes, LLCs in Alaska are required to file an annual report each year. This report helps the state maintain up-to-date information about your company. Conducting Alaska Corporate Partnership LLC Meeting Analysis can guide you through this process effectively. Our services can assist you in preparing and submitting your annual report on time.

Corporations in Alaska must file several documents, including the Articles of Incorporation and an annual report. Depending on your business activities, additional filings may be necessary. By focusing on Alaska Corporate Partnership LLC Meeting Analysis, you can gain insights into all required documentation. Our platform provides comprehensive support to ensure you meet all obligations.

Yes, if your business generates income in Alaska, you are required to file taxes. However, it's important to note that Alaska does not have a state sales tax, which can be advantageous for many businesses. Engaging in Alaska Corporate Partnership LLC Meeting Analysis can help you better understand the tax obligations specific to your entity type. Our resources are designed to simplify tax compliance for your peace of mind.

Corporations in Alaska must file Articles of Incorporation with the Division of Corporations. Additionally, they need to submit an annual report to maintain good standing. If you're involved in Alaska Corporate Partnership LLC Meeting Analysis, knowing these requirements is essential for compliance. Our platform can provide the necessary forms and information to streamline the process.

Alaska does impose corporate taxes, but the state has no personal income tax. Businesses, including those formed as LLCs or corporations, are subject to a corporate tax on their net income. For those engaged in Alaska Corporate Partnership LLC Meeting Analysis, understanding these taxes is crucial. Minimizing tax liability is a common goal, and our platform can guide you through the process.

The richest native corporation in Alaska is often considered to be the Arctic Slope Regional Corporation (ASRC). Established to foster economic growth and development, ASRC has diversified its business interests, particularly in oil and gas. Conducting an Alaska Corporate Partnership LLC Meeting Analysis that includes insights on successful companies like ASRC can provide valuable lessons in strategic growth and partnership ventures.

Forming an LLC in Alaska offers several advantages for business owners. It provides limited liability protection, which means personal assets are typically safe from business debts. Additionally, LLCs are flexible in terms of management and taxation options, making them attractive for various business models. A comprehensive Alaska Corporate Partnership LLC Meeting Analysis can help you explore these benefits and strategically plan for your company's growth.

The Alaska Native Corporation is collectively owned by Alaska Native shareholders, who are descendants of the original inhabitants of Alaska. These corporations were established under the Alaska Native Claims Settlement Act to promote economic development and land ownership among native peoples. Analyzing the structure and governance of these corporations is essential when conducting an Alaska Corporate Partnership LLC Meeting Analysis. This insight can enhance collaboration and decision-making within your organization.

Statute 10.06.490 outlines the rules for corporate partnerships in Alaska. It defines the roles and responsibilities of partners within a partnership structure, including the rights and obligations. Understanding this statute is crucial for conducting a thorough Alaska Corporate Partnership LLC Meeting Analysis. This knowledge helps you ensure compliance and make informed decisions for your business.