A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Alaska Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

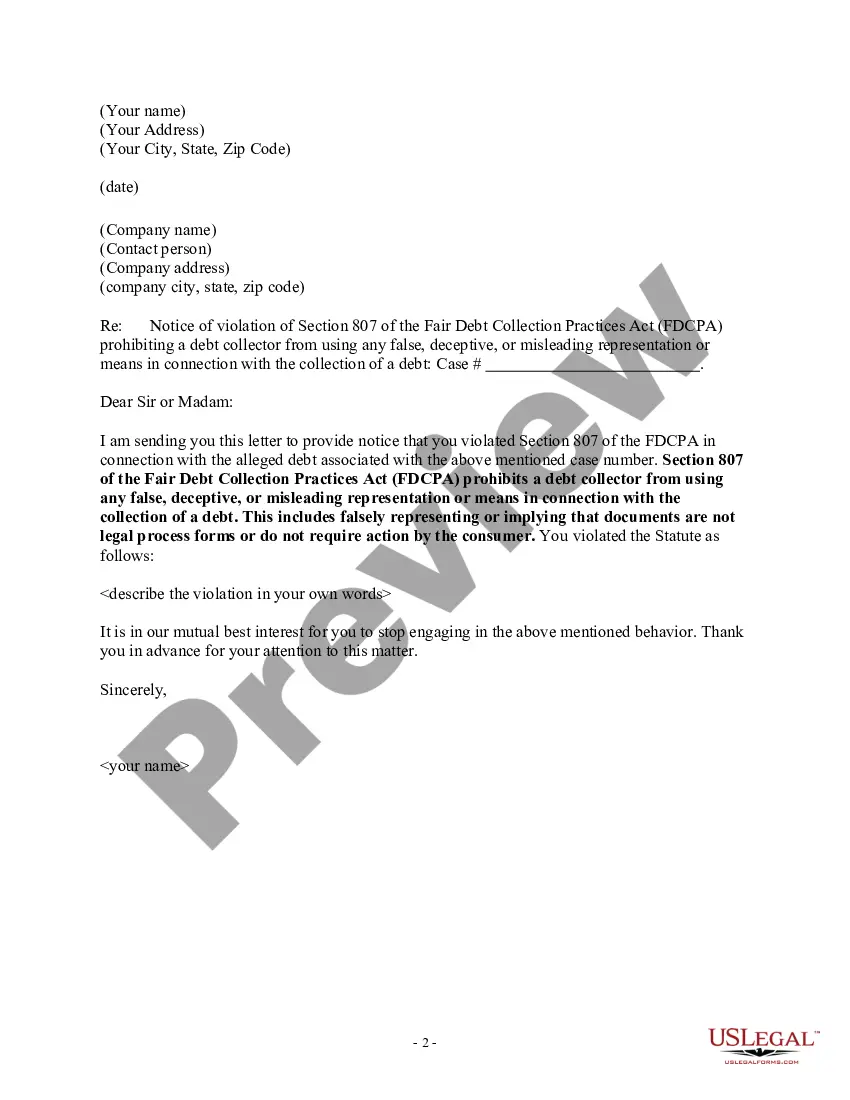

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

You may utilize your time online looking for the authentic document template that meets the federal and state requirements you will require.

US Legal Forms provides a vast selection of genuine forms that are reviewed by experts.

You can download or print the Alaska Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action from the service.

First, ensure you have selected the correct document template for the region/city of your preference. Review the form outline to confirm you have chosen the right form. If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can fill out, modify, print, or sign the Alaska Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- Every legal document template you obtain is yours indefinitely.

- To acquire another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

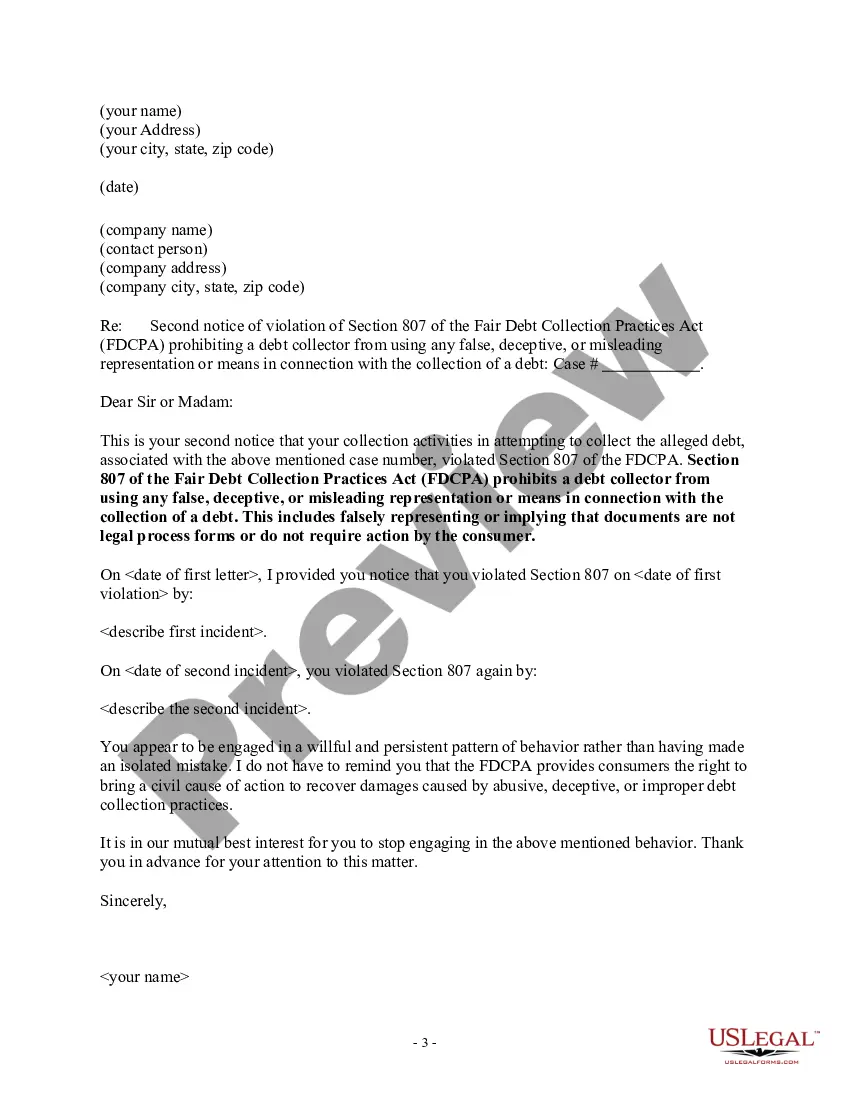

The most common violation of the Fair Debt Collection Practices Act involves harassment or abusive practices by debt collectors. This includes making continuous phone calls at unreasonable hours or using threatening language. If you encounter tactics related to the Alaska Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, you may have grounds to file a complaint. By understanding your rights, you can fight back against unethical practices.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

You can sue a company for sending you to collections for a debt that you don't owe. If a debt collector starts calling you out of the blue, but you know perfectly well that you made the payment in question, the law gives you the right to file an action in court against the company.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

The name of the creditor seeking payment. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail.