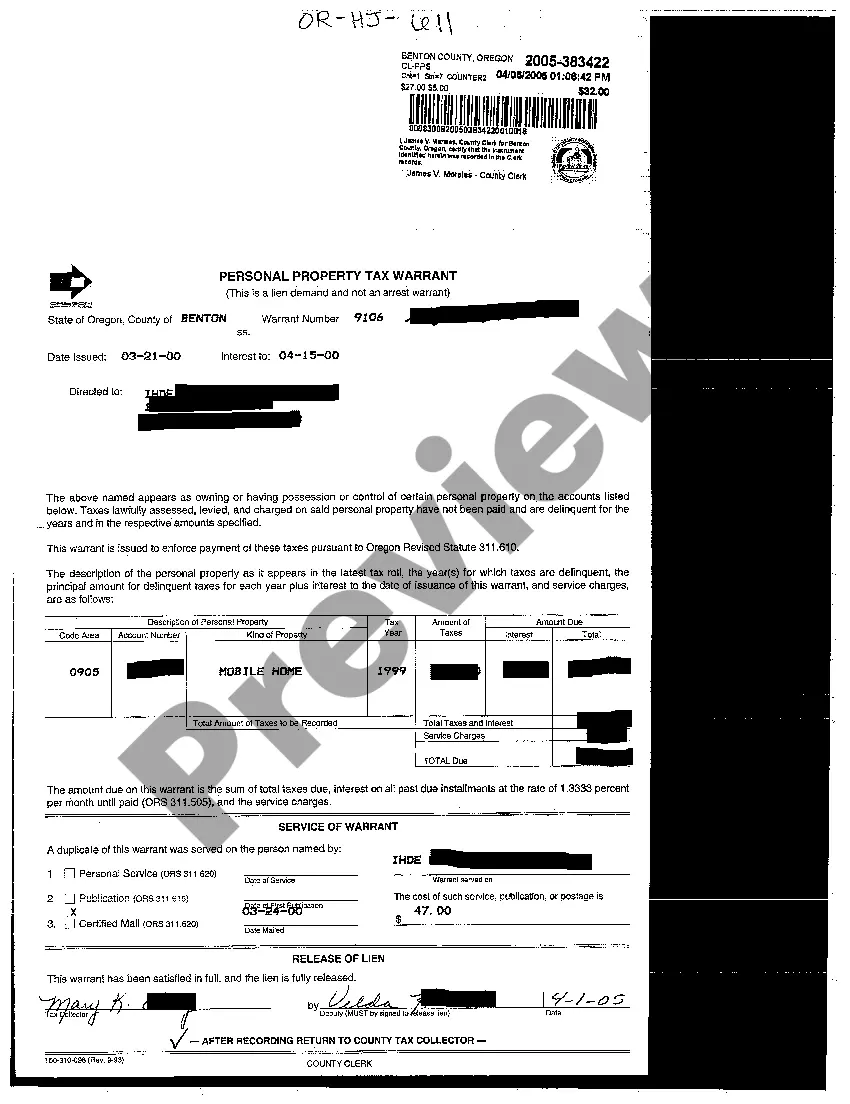

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Alaska Notice to Debt Collector - Falsely Representing a Document is Legal Process

Description

How to fill out Notice To Debt Collector - Falsely Representing A Document Is Legal Process?

US Legal Forms - one of the most prominent repositories of legal templates in the United States - provides a variety of legal document templates that you can obtain or print. With the site, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can locate the latest versions of forms such as the Alaska Notice to Debt Collector - Misrepresenting a Document as Legal Process in just a few minutes.

If you already have an account, Log In and access Alaska Notice to Debt Collector - Misrepresenting a Document as Legal Process from the US Legal Forms collection. The Download option will appear on each form you view. You can access all previously saved forms in the My documents tab of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form onto your device. Edit. Fill out, modify, print, and sign the downloaded Alaska Notice to Debt Collector - Misrepresenting a Document as Legal Process. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the Alaska Notice to Debt Collector - Misrepresenting a Document as Legal Process from US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your personal or business requirements.

- Ensure you have selected the correct form for your city/county.

- Click the Preview option to review the content of the form.

- Read the form description to confirm that you have selected the right one.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Download now button.

- Next, choose your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

One of the most frequent violations of the Fair Debt Collection Practices Act occurs when collectors falsely represent a document as part of the legal process. This practice includes sending misleading letters or making deceptive claims about legal actions. In such cases, consumers can reference the Alaska Notice to Debt Collector - Falsely Representing a Document is Legal Process to protect their rights. By using tools and resources on the USLegalForms platform, individuals can easily understand their rights and take appropriate action against dishonest collectors.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

You can sue a company for sending you to collections for a debt that you don't owe. If a debt collector starts calling you out of the blue, but you know perfectly well that you made the payment in question, the law gives you the right to file an action in court against the company.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

A copy of the original written agreement between the parties, such as the loan note or credit card agreement, preferably signed by you. If the account has been sold to another creditor, then that creditor must prove that it has the right to sue to collect the debt.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.