Alaska Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

Choosing the best legal document web template can be a have difficulties. Obviously, there are tons of templates available on the net, but how can you find the legal develop you will need? Use the US Legal Forms website. The assistance provides 1000s of templates, such as the Alaska Proposal to approve material terms of stock appreciation right plan, that you can use for company and personal requirements. Each of the types are checked by experts and fulfill federal and state needs.

Should you be already registered, log in for your bank account and click on the Obtain switch to have the Alaska Proposal to approve material terms of stock appreciation right plan. Make use of your bank account to look through the legal types you possess acquired earlier. Visit the My Forms tab of your bank account and have another version in the document you will need.

Should you be a whole new customer of US Legal Forms, here are basic instructions that you can stick to:

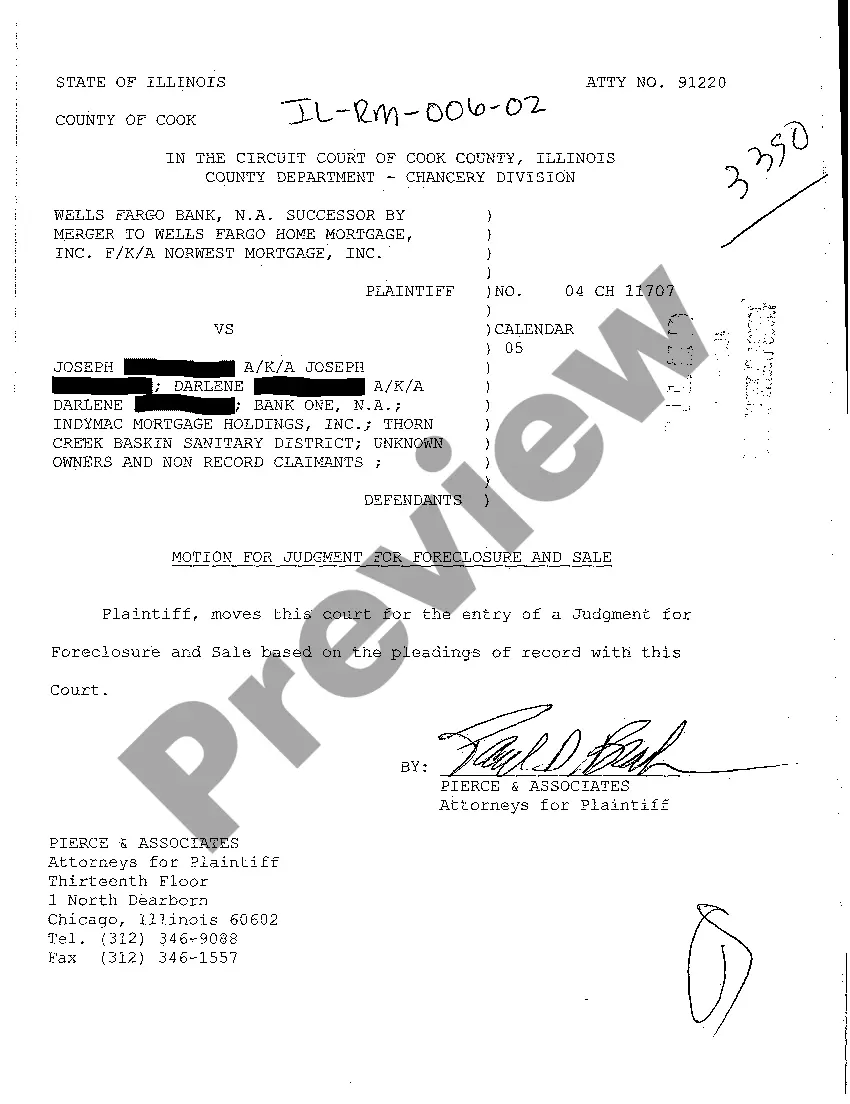

- Initially, make sure you have chosen the proper develop for the area/region. It is possible to look over the form while using Preview switch and read the form outline to make certain it is the right one for you.

- When the develop is not going to fulfill your expectations, use the Seach discipline to find the correct develop.

- Once you are positive that the form is proper, select the Buy now switch to have the develop.

- Opt for the pricing prepare you want and type in the required information and facts. Design your bank account and pay for your order with your PayPal bank account or Visa or Mastercard.

- Pick the data file file format and download the legal document web template for your device.

- Full, revise and produce and sign the received Alaska Proposal to approve material terms of stock appreciation right plan.

US Legal Forms is the greatest library of legal types for which you can see a variety of document templates. Use the service to download expertly-made files that stick to status needs.

Form popularity

FAQ

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an ?exercise price? or ?grant price? over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant.

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

For example, let's say you were granted stock appreciation rights on 10 shares of your company ABC's stock, valued at $10 per share. Over time, the share price increases from $10 to $12. This means you'd receive $2 per share since that was the increased value.

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.

A Stock Appreciation Right (SAR) refers to the right to be paid compensation equivalent to an increase in the company's common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market.

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

The part of the change in the value of the stocks held by a business over any period which is due to price changes.