Alaska Restricted Stock Plan of RPM, Inc.

Description

How to fill out Restricted Stock Plan Of RPM, Inc.?

Choosing the right lawful document design can be quite a have a problem. Naturally, there are plenty of layouts available on the net, but how would you obtain the lawful develop you need? Make use of the US Legal Forms website. The assistance provides thousands of layouts, for example the Alaska Restricted Stock Plan of RPM, Inc., that can be used for enterprise and personal requirements. All the kinds are examined by specialists and fulfill federal and state specifications.

If you are previously registered, log in in your bank account and click on the Download button to find the Alaska Restricted Stock Plan of RPM, Inc.. Make use of your bank account to appear from the lawful kinds you may have purchased previously. Go to the My Forms tab of your bank account and get one more backup of your document you need.

If you are a fresh end user of US Legal Forms, allow me to share straightforward directions so that you can adhere to:

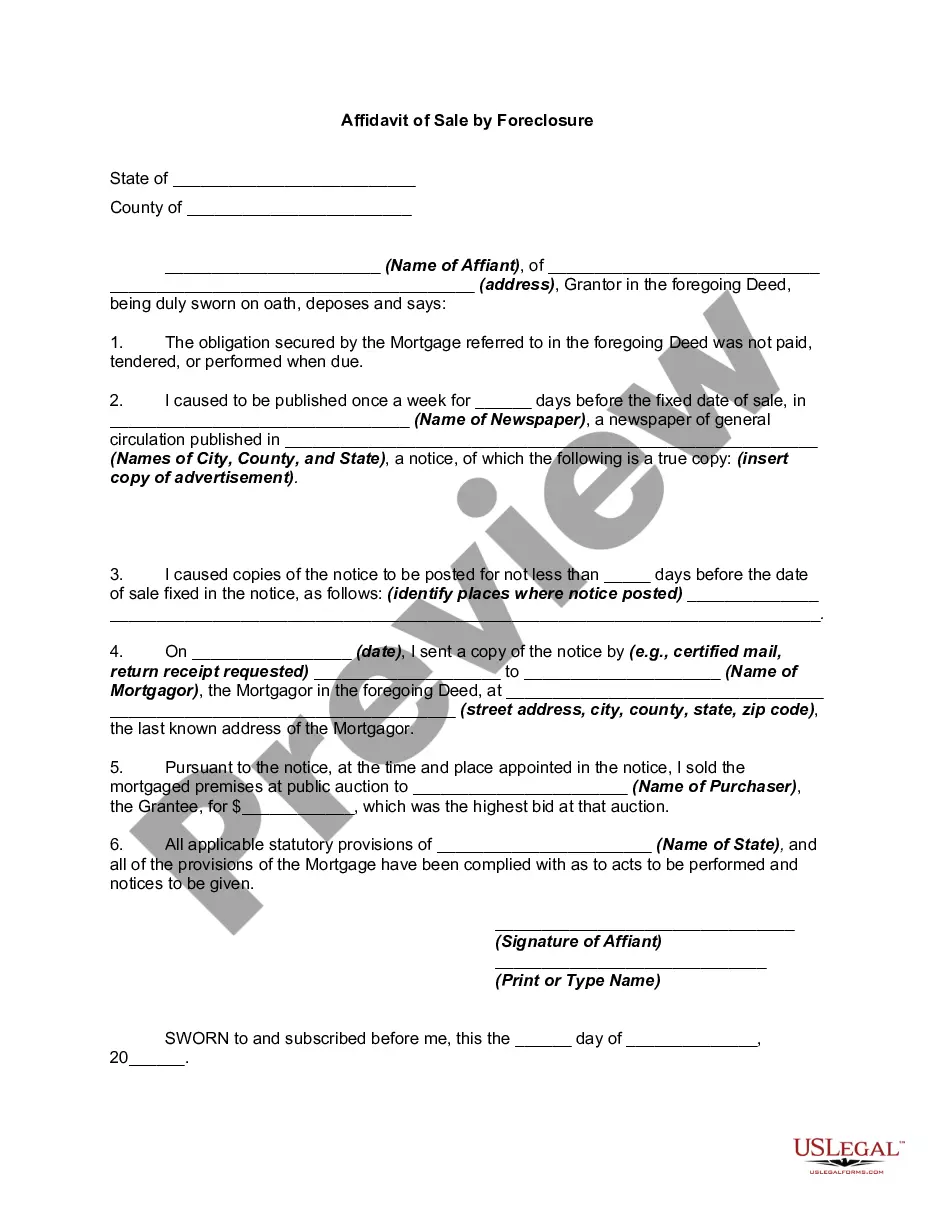

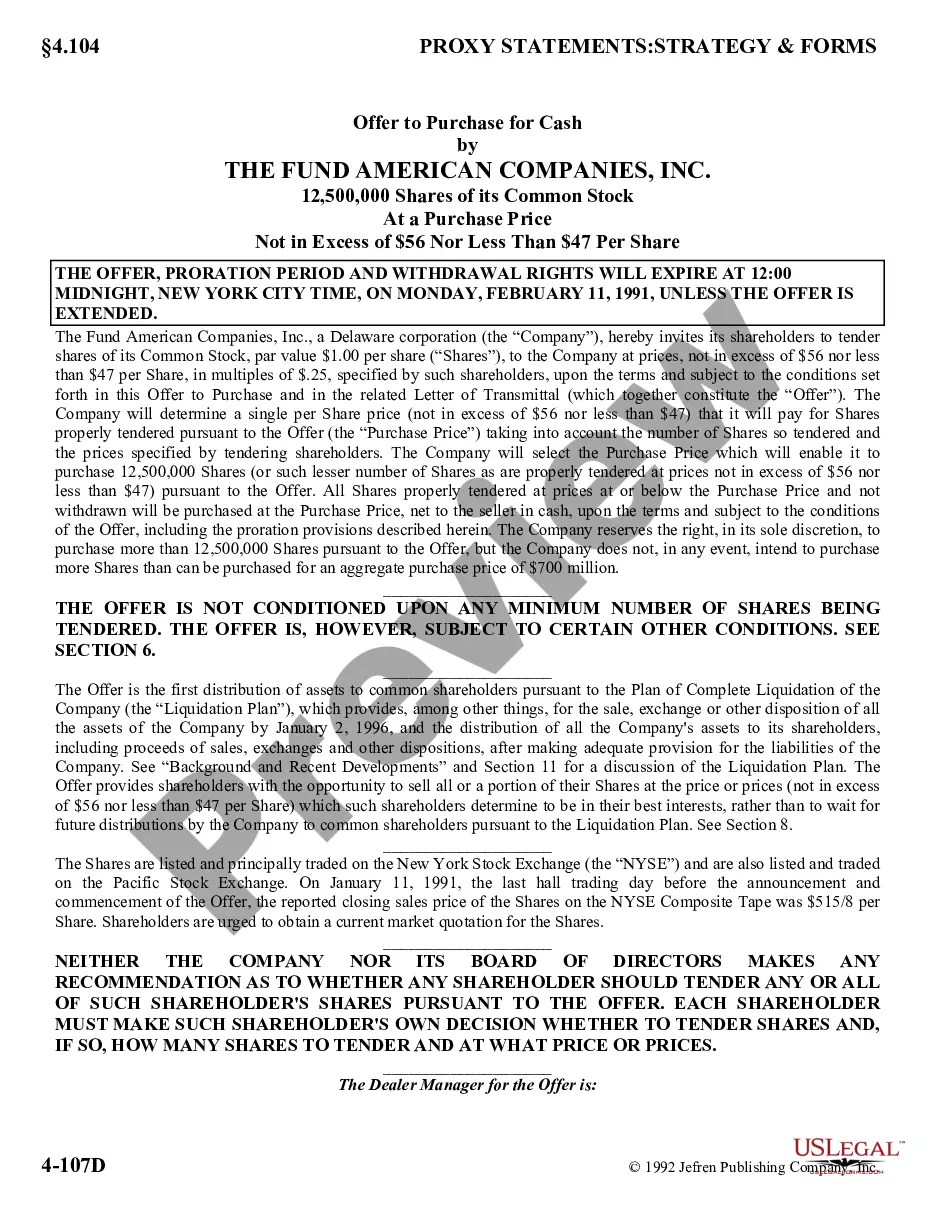

- Very first, be sure you have selected the appropriate develop for the area/state. You are able to examine the shape using the Review button and study the shape outline to ensure this is basically the right one for you.

- When the develop fails to fulfill your expectations, take advantage of the Seach industry to get the appropriate develop.

- Once you are certain the shape would work, click the Get now button to find the develop.

- Choose the rates strategy you want and type in the required info. Create your bank account and pay for your order making use of your PayPal bank account or Visa or Mastercard.

- Choose the file format and obtain the lawful document design in your gadget.

- Full, revise and print and indication the received Alaska Restricted Stock Plan of RPM, Inc..

US Legal Forms is the largest library of lawful kinds where you will find a variety of document layouts. Make use of the service to obtain professionally-created papers that adhere to condition specifications.

Form popularity

FAQ

One advantage of restricted stock is that when the award vests, your employer commonly withholds income tax on the vested value. Employers will often also include the value of your vested restricted stock units in your W2 at year end.

In almost all situations, it will be in your best interest to sell RSUs immediately upon vesting. As mentioned above, there is no tax benefit to holding on to RSU shares. Yes, hanging on to them for a year before selling allows you to pay long term capital gains rates. But that's true for any common stock.

The merits of Stock Options vs RSUs primarily depends on the stage of the company. Stock Options are usually better for both employee and employer at an early stage company. For a later stage company, RSUs are usually better for both.

A restricted stock unit (RSU) is a form of equity compensation that companies issue to employees. An RSU is a promise from your employer to give you shares of the company's stock (or the cash equivalent) on a future date?as soon as you meet certain conditions.