Alaska Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

How to fill out Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

US Legal Forms - one of several largest libraries of legitimate kinds in America - provides a wide range of legitimate record themes you may acquire or printing. Making use of the site, you can get a large number of kinds for enterprise and person reasons, categorized by types, says, or search phrases.You will find the most up-to-date versions of kinds like the Alaska Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 in seconds.

If you currently have a monthly subscription, log in and acquire Alaska Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 from the US Legal Forms library. The Obtain option will appear on each and every kind you view. You have access to all earlier downloaded kinds within the My Forms tab of your respective profile.

If you would like use US Legal Forms initially, listed here are easy recommendations to help you get began:

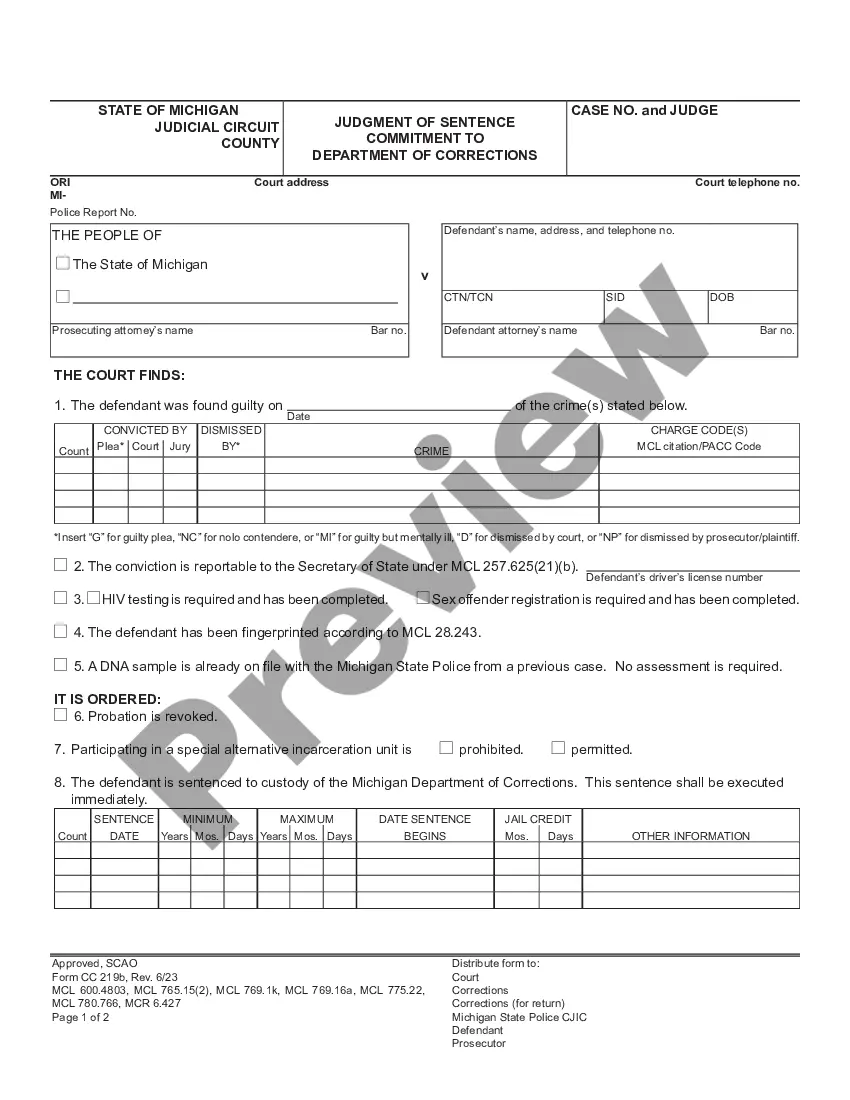

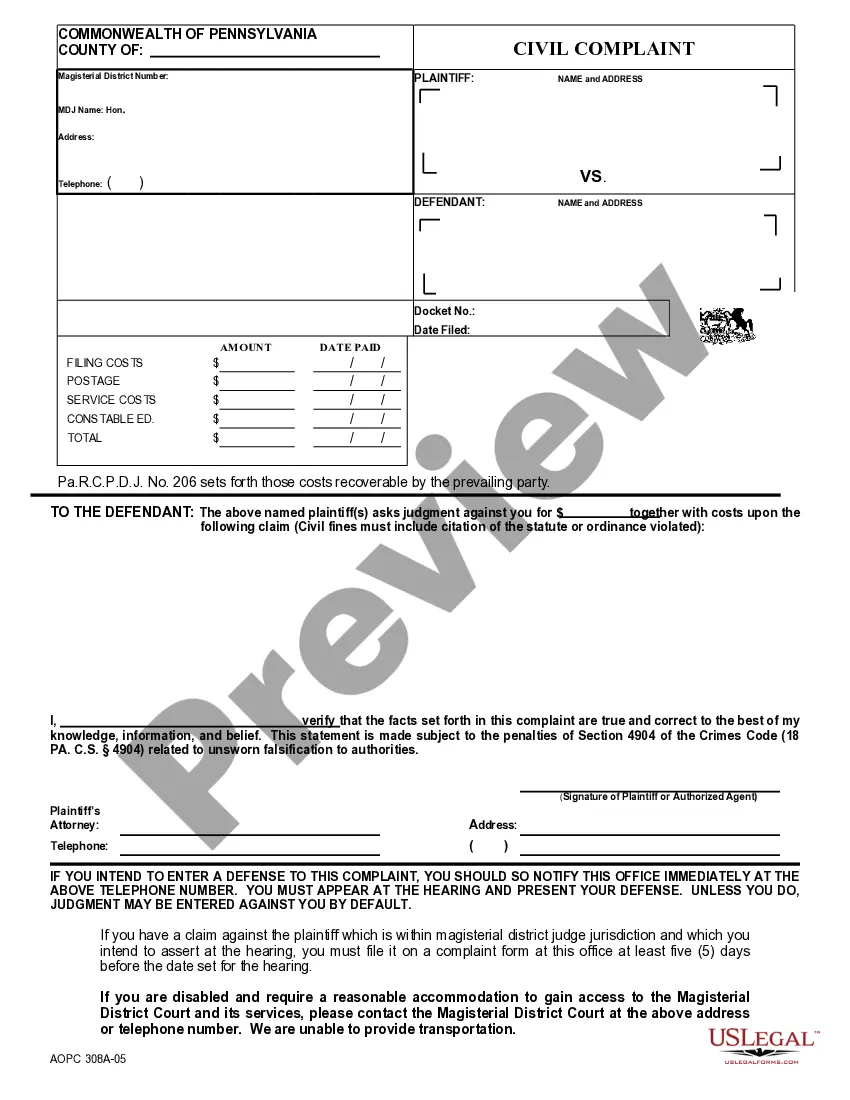

- Be sure you have picked the best kind for your personal metropolis/county. Select the Review option to analyze the form`s content material. See the kind description to ensure that you have chosen the appropriate kind.

- If the kind doesn`t suit your needs, take advantage of the Look for discipline on top of the display screen to discover the one which does.

- If you are content with the form, verify your choice by clicking the Get now option. Then, choose the prices program you like and supply your references to register for an profile.

- Method the financial transaction. Make use of your Visa or Mastercard or PayPal profile to accomplish the financial transaction.

- Pick the format and acquire the form in your device.

- Make modifications. Fill out, revise and printing and signal the downloaded Alaska Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005.

Each and every format you added to your account lacks an expiration date and is also your own property eternally. So, in order to acquire or printing yet another copy, just proceed to the My Forms section and then click about the kind you will need.

Gain access to the Alaska Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 with US Legal Forms, probably the most extensive library of legitimate record themes. Use a large number of specialist and express-specific themes that fulfill your small business or person requirements and needs.

Form popularity

FAQ

Non-priority debts include the bulk of unsecured debts, such as: Past-due credit card bills and outstanding credit card balances. Unpaid personal loan payments. Private debts to friends and family members.

Subsequently, creditors are paid in the following order: Secured creditors, categorised into fixed and floating charge holders; preferential creditors; and lastly, unsecured creditors.

Unsecured creditors are generally placed into two categories: priority unsecured creditors and general unsecured creditors. As their name suggests, unsecured priority creditors are higher in the pecking order than general unsecured creditors when it comes to claims over any assets in a bankruptcy filing.

Here's the order of payout during a company's liquidation: Unpaid wages. Unpaid taxes. Secured creditors. Unsecured creditors. Junior unsecured creditors. Preferred stockholders. Common stockholders.

Some assets may have multiple liens placed upon them; in these cases, the first lien has priority over the second lien. Unsecured creditors are divided between preferred and non-preferred, as certain unclaimed creditors like employees and tax agencies are given priority.

Meanwhile, repayment to unsecured creditors is generally dependent on bankruptcy proceedings or successful litigation. An unsecured creditor must first file a legal complaint in court and obtain a judgment before proceeding with collection through wage garnishment and other types of liquidated borrower-owned assets.

Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation. Preferential creditors are generally employees of the company, entitled to arrears of wages and other employment costs up to certain limits.