Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

Are you in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legitimate document templates available online, but locating reliable versions isn’t easy.

US Legal Forms offers thousands of form templates, such as the Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, which can be tailored to meet state and federal regulations.

Once you find the correct form, click Purchase now.

Select the payment plan you want, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

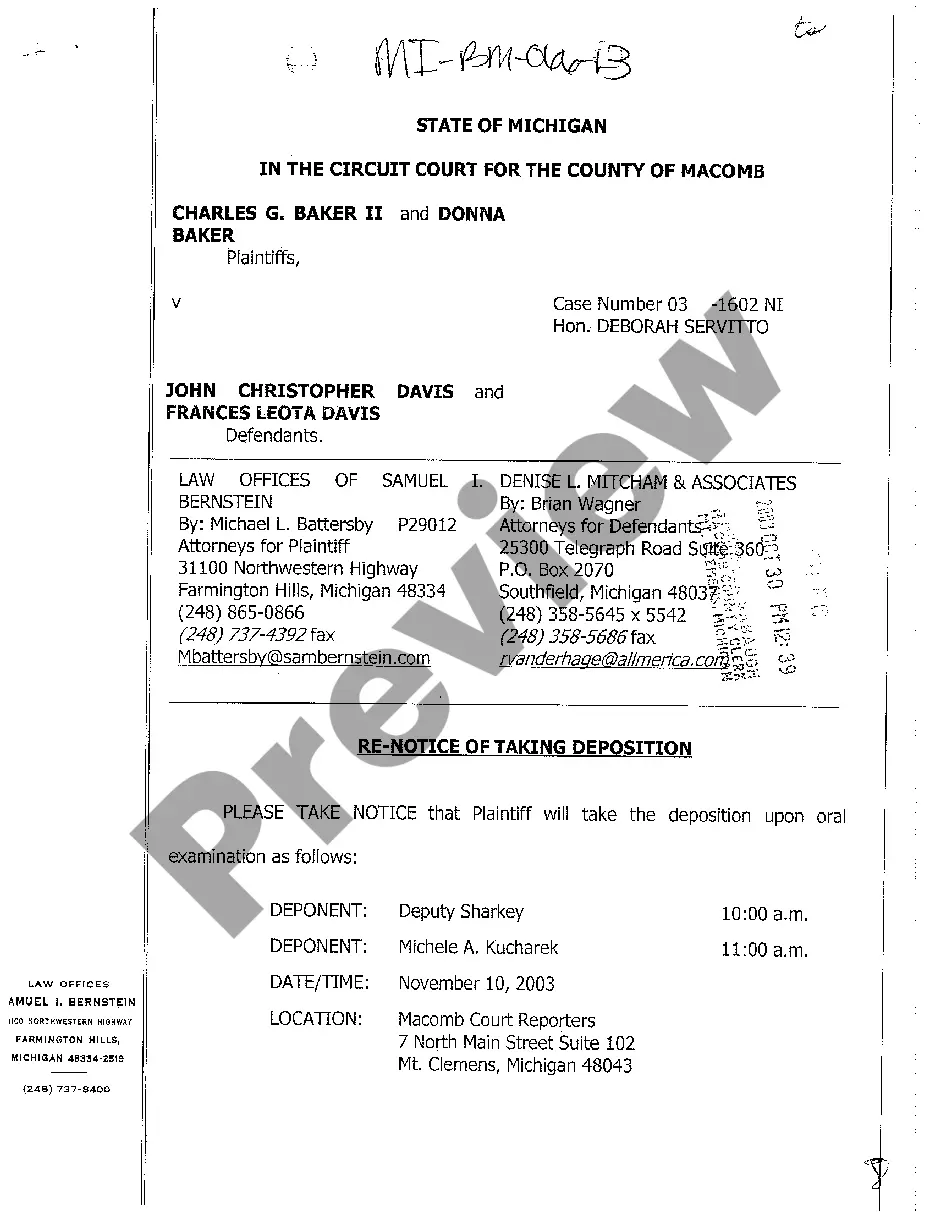

- Use the Review option to scrutinize the form.

- Read the description to make sure that you have selected the accurate form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that fits your needs and requirements.

Form popularity

FAQ

To fill out a personal guaranty, begin by entering your personal information, including your full name and address, in the designated areas of the form. Carefully review the terms of the contract to ensure you understand the obligations you are agreeing to guarantee. Finally, sign and date the document to make it legally binding. Streamlining this process is possible through uslegalforms, which provides user-friendly templates for the Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Yes, a contract of guarantee must be in writing to be legally enforceable. This written format ensures that all parties clearly understand the terms and conditions, providing a concrete reference point. By documenting the agreement, you protect yourself and the other party from misunderstandings. Using resources like the Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can help fulfill this requirement.

A personal guarantee form is a legal document used to secure obligations in a lease or real estate purchase agreement. When you sign it, you agree to take personal responsibility for the duties outlined in the contract. This form acts as a safety net for landlords and lenders, ensuring that they can seek compensation from you if the primary party defaults. Utilizing the Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate offers protection for both parties.

The 13.52 statute in Alaska primarily addresses the Uniform Commercial Code which addresses various aspects of commercial transactions. This statute helps standardize contract practices and offers legal remedies for breaches. If you're involved in agreements related to an Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, familiarity with such statutes can be advantageous in understanding your rights and responsibilities.

Contract law in Alaska governs the creation and enforcement of agreements between parties. Under these laws, contracts must meet certain requirements to be legally binding, such as offer, acceptance, and consideration. If you engage in contracts concerning an Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, knowing the basics of this law helps you navigate potential disputes.

The statute of limitations for breach of contract in Alaska is three years. This is the period during which a party can file a lawsuit after a breach occurs. Remember, when dealing with contracts like the Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, it's vital to be aware of these limits to protect your interests.

When it comes to a breach of contract, the time limits are often set at three years in Alaska. This limitation period starts from the day you became aware of the breach. Therefore, it is essential to understand these timelines to effectively enforce your rights, particularly concerning an Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

The statute of limitations on contracts in Alaska typically stands at three years. This rule applies to most contractual agreements, including those involving an Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. If you believe a contract has been breached, ensure you act before this period expires.

In Alaska, the limitation period for a breach of contract generally spans three years. This means that you have three years from the date of the breach to file a lawsuit. It's crucial to keep this time frame in mind, especially when dealing with agreements related to an Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Rent-to-own options prove beneficial for individuals who may struggle with traditional financing methods, such as first-time homebuyers or those with less-than-perfect credit. This arrangement allows them to build equity while renting, offering a pathway to homeownership. An Alaska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can also be advantageous for property owners looking to attract potential buyers while maintaining control over their investment.