Alaska Assignment of Equipment Lease by Dealer to Manufacturer

Description

How to fill out Assignment Of Equipment Lease By Dealer To Manufacturer?

You can spend time online attempting to locate the correct legal document template that meets the federal and state criteria you require.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

It is easy to download or print the Alaska Assignment of Equipment Lease by Dealer to Manufacturer from my services.

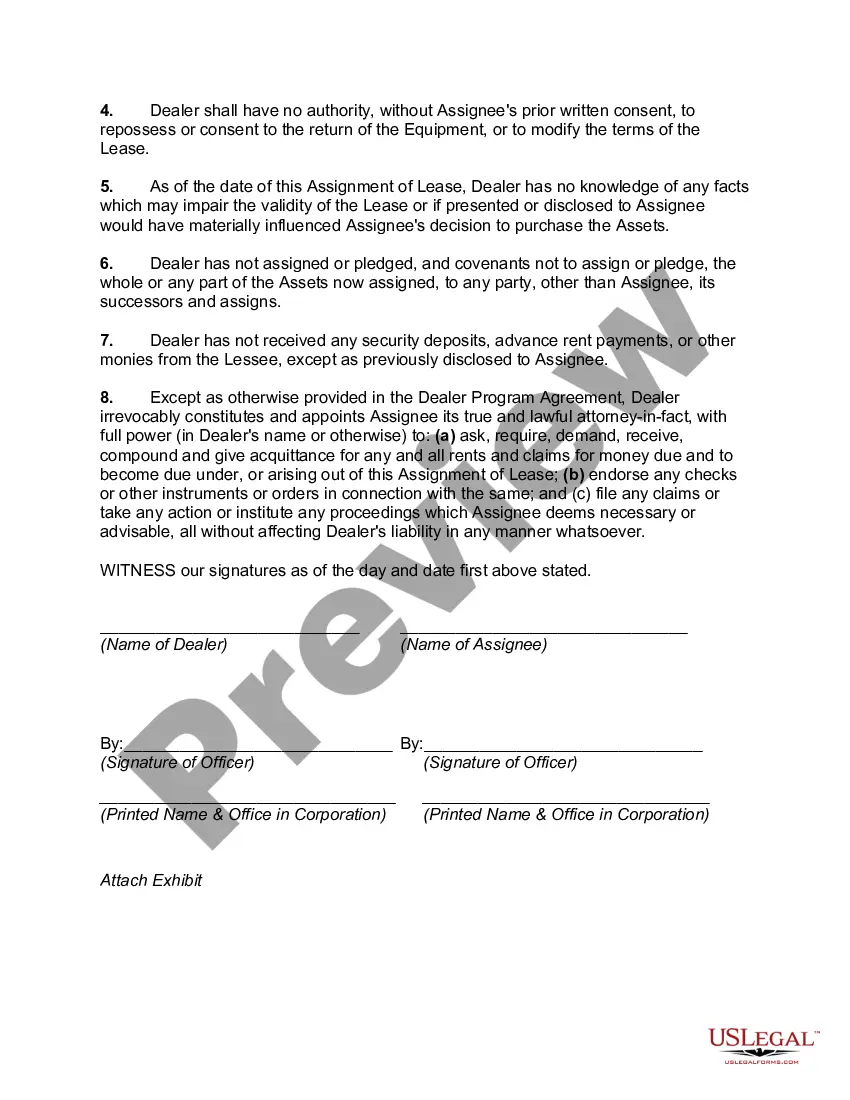

If available, use the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the Alaska Assignment of Equipment Lease by Dealer to Manufacturer.

- Every legal document template you obtain is yours indefinitely.

- To get an additional copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the appropriate document template for your selected county/city.

- Review the form description to confirm that you have selected the correct form.

Form popularity

FAQ

Accounting: Lease is considered an asset (leased asset) and liability (lease payments). Payments are shown on the balance sheet. Tax: As the owner, the lessee claims depreciation expense and interest expense.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

For example, if the present value of all lease payments for a production machine is $100,000, record it as a debit of $100,000 to the production equipment account and a credit of $100,000 to the capital lease liability account. Lease payments.

Leases are usually easier to obtain and have more flexible terms than loans for buying equipment. This can be a significant advantage if you have bad credit or need to negotiate a longer payment plan to lower your costs. Easier to upgrade equipment. Leasing allows businesses to address the problem of obsolescence.

Factors to consider when making the lease or buy decisionYou want control of the property.You can consider the long-term cost.For some businesses, such as certain retail and service businesses, location is all important.You haven't found a suitable property to lease.You are in an area of appreciating land values.More items...

Evaluation of Lease Decision: 3 Methods (with formula)Present Value Method: Under this method the present value of lease rentals are compared with the present value of the cost of an asset acquired on outright purchase by availing a loan.Cost of Capital Method: ADVERTISEMENTS:Bower-Herringer-Williamson Method:

4 Factors to Evaluating a Lease OptionA lease option comes at the end of a lease contract. You may be able to extend the lease, stop the lease, or even purchase the home you are renting.Maintenance Record.Cost to Lease vs. Cost to Buy.Cost to Extend Lease vs. Cost of New Lease.Market Considerations.

Equipment Leasing Definition: Obtaining the use of machinery, vehicles or other equipment on a rental basis. This avoids the need to invest capital in equipment. Ownership rests in the hands of the financial institution or leasing company, while the business has the actual use of it.

If the monthly payment for leasing is less than the monthly payment for buying, this also includes any lost interest due to the higher monthly payments. If leasing is more expensive than buying, your interest costs for buying are reduced by the amount of interest you would earn on the difference.

Factors Favoring Leasing:Cash flow: A business can conserve its cash flow by leasing.Credit rating: The company has not established a credit rating sufficient to support a mortgage.Maintenance: The landlord is responsible for maintaining the property.More items...