Alaska Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

How to fill out Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

If you wish to access, download, or print authentic document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

A variety of templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Alaska Notice of Private Sale of Collateral (Non-consumer Goods) on Default in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Alaska Notice of Private Sale of Collateral (Non-consumer Goods) on Default.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

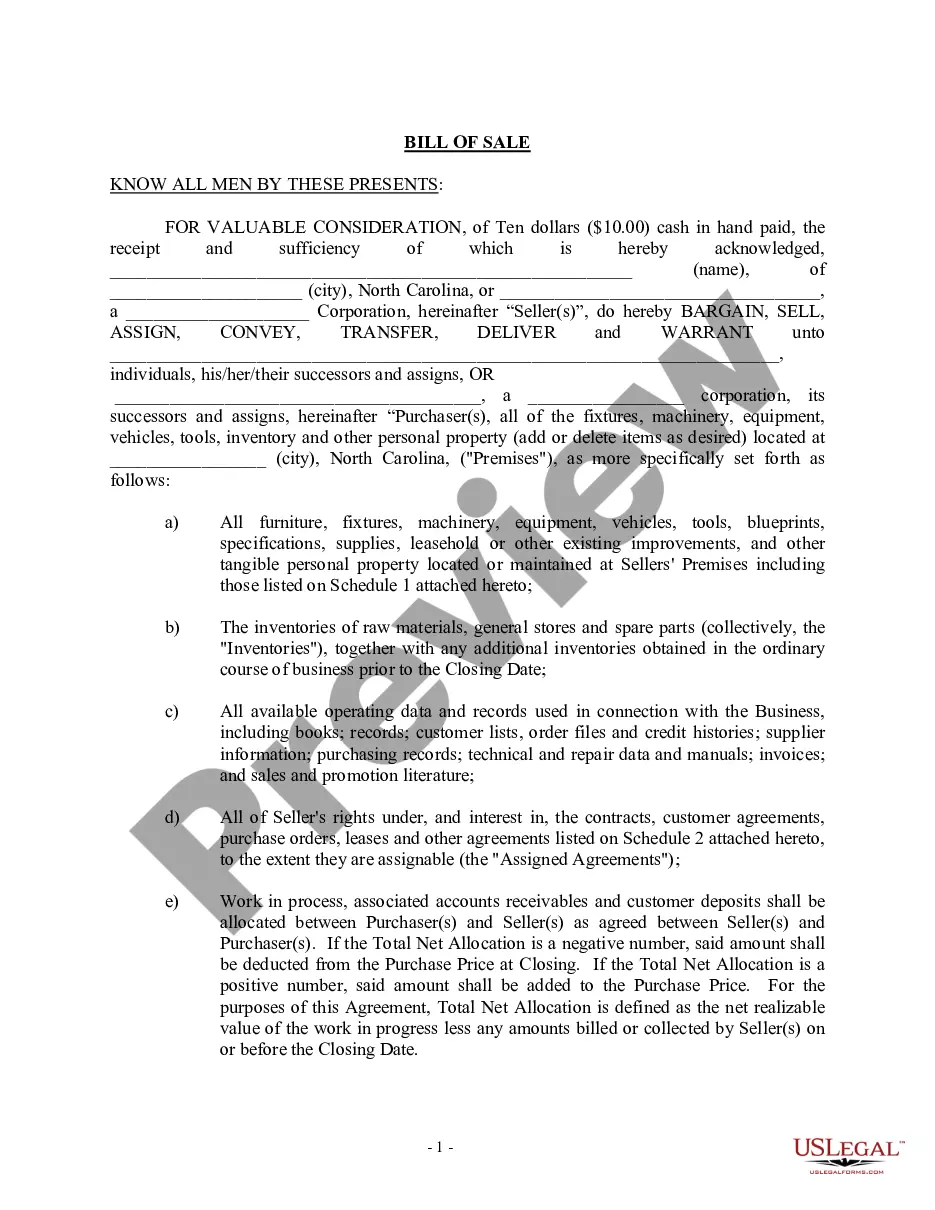

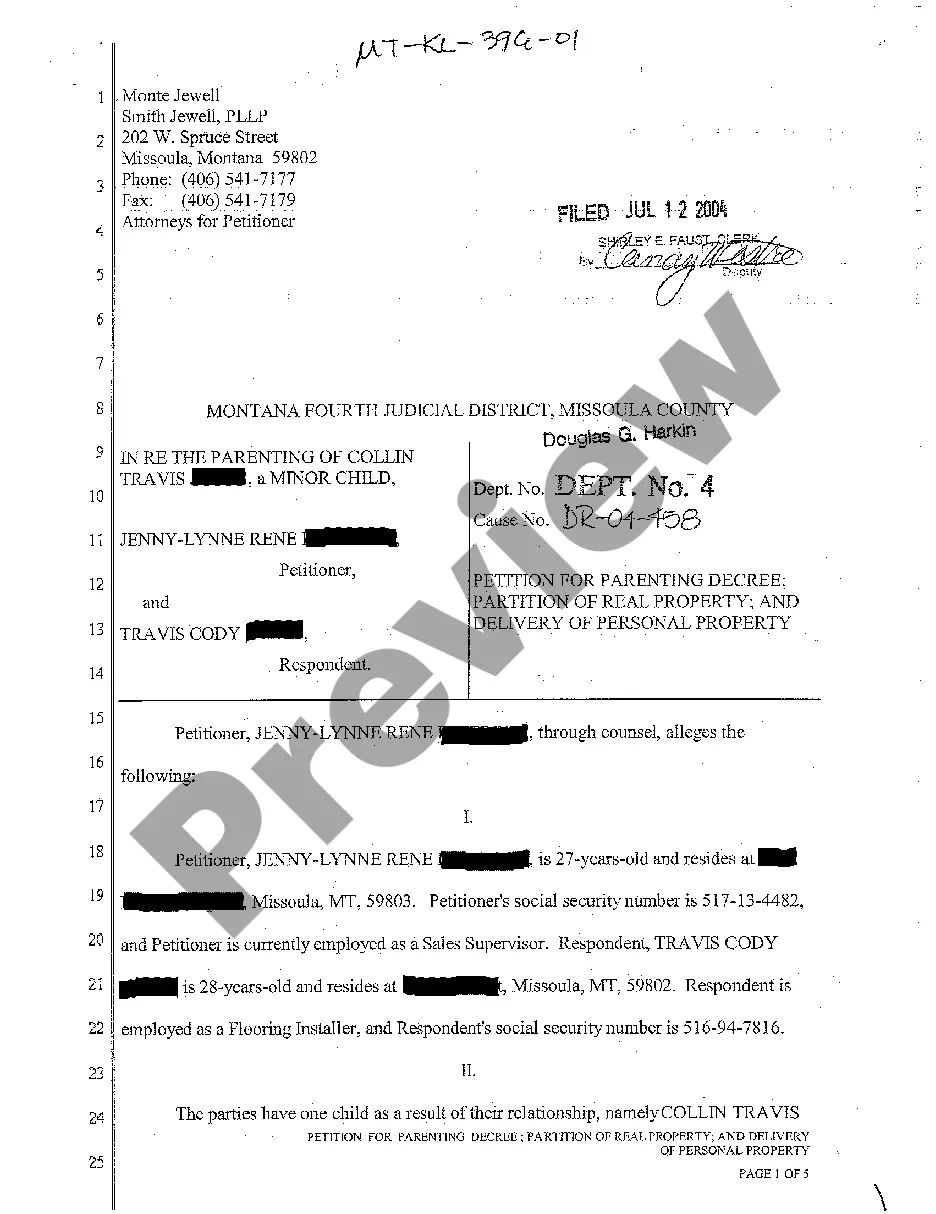

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of your legal form template.

Form popularity

FAQ

Article 9 of the Uniform Commercial Code (UCC) governs secured transactions in the United States, providing a legal framework for the creation and enforcement of security interests. It outlines procedures for the attachment, perfection, and enforcement of security interests, including provisions for the Alaska Notice of Private Sale of Collateral (Non-consumer Goods) on Default. Understanding Article 9 is crucial for secured parties to navigate their rights and obligations effectively. This article helps ensure transparency and predictability in secured transactions.

(12) "Collateral" means the property subject to a security interest or agricultural lien. The term includes: (A) proceeds to which a security interest attaches; (B) accounts, chattel paper, payment intangibles, and promissory notes that have been sold; and. (C) goods that are the subject of a consignment.

Through Pledge: Transfer of collateral to the secured party for the purpose of perfection. Some types of collateral can only be perfected through possession eg; CDs, stocks and bonds.

A secured transaction is any deal in which a creditor receives a security interest in the debtor's property. The creditor is known as the secured party and holds a security interest in the debtor's property. The property is known as the collateral for the loan. The security interest helps ensure the debtor's payment.

Under §9-622, a proposal to accept collateral in full satisfaction of the debt that is consented to by the debtor discharges the obligation not just the consenting debtor's liability for that obligation.

Collateral Disposition means any sale, transfer or other disposition (whether voluntary or involuntary) to the extent involving assets or other rights or property that constitute Collateral.

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

If the debtor defaults and does not repay the loan, generally the secured party can foreclose and recover the collateral. A person who has an ownership or other interest in the collateral and owes payment of a secured obligation Revised UCC 9-102(a)(28).

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase