Alaska Sample Letter for Corporate Tax Return

Description

How to fill out Sample Letter For Corporate Tax Return?

If you want to comprehensive, obtain, or print out authorized papers layouts, use US Legal Forms, the most important selection of authorized varieties, which can be found on-line. Make use of the site`s simple and easy convenient research to discover the documents you will need. A variety of layouts for business and individual functions are sorted by groups and says, or search phrases. Use US Legal Forms to discover the Alaska Sample Letter for Corporate Tax Return in just a couple of click throughs.

Should you be currently a US Legal Forms consumer, log in for your accounts and then click the Obtain button to have the Alaska Sample Letter for Corporate Tax Return. You can even gain access to varieties you in the past downloaded within the My Forms tab of your accounts.

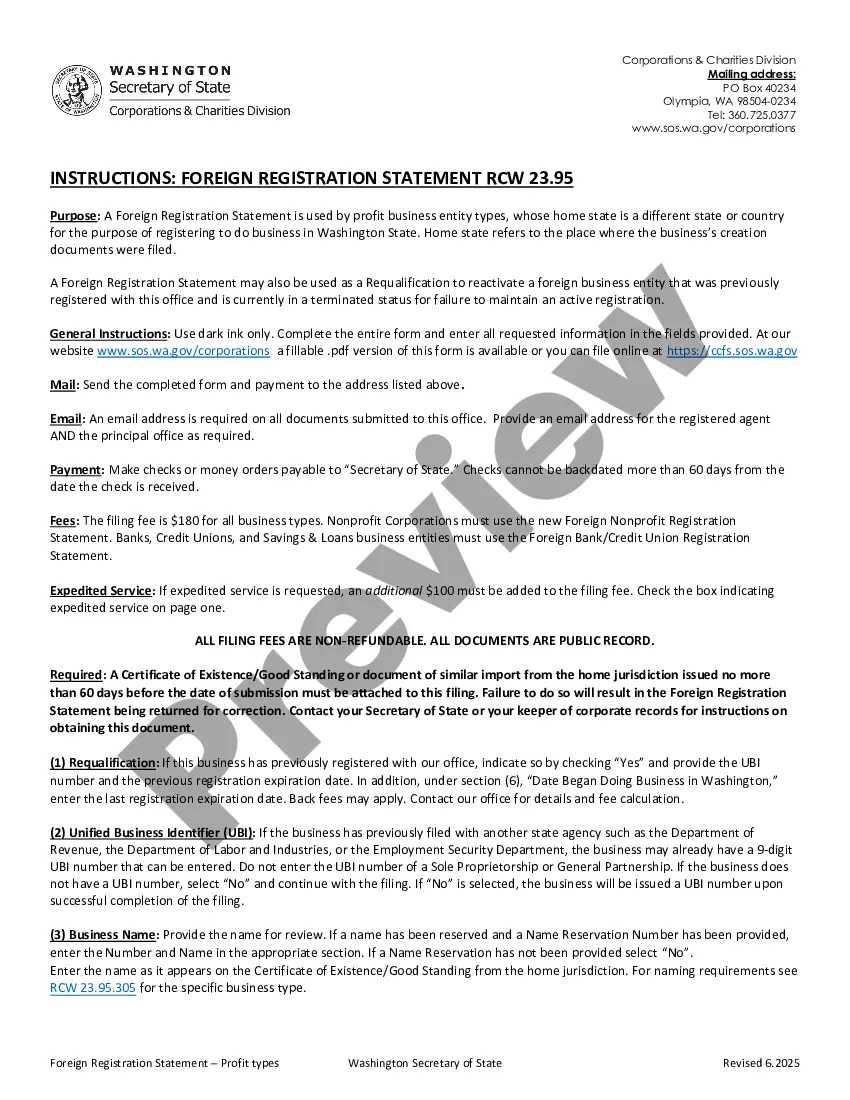

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for your appropriate metropolis/nation.

- Step 2. Take advantage of the Preview option to look through the form`s information. Never forget to see the description.

- Step 3. Should you be not satisfied together with the form, utilize the Research area at the top of the monitor to find other variations of the authorized form template.

- Step 4. Upon having discovered the form you will need, click on the Acquire now button. Opt for the costs prepare you favor and add your credentials to sign up to have an accounts.

- Step 5. Method the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Choose the structure of the authorized form and obtain it on the gadget.

- Step 7. Full, revise and print out or sign the Alaska Sample Letter for Corporate Tax Return.

Every authorized papers template you purchase is yours eternally. You have acces to every single form you downloaded inside your acccount. Click on the My Forms section and pick a form to print out or obtain again.

Compete and obtain, and print out the Alaska Sample Letter for Corporate Tax Return with US Legal Forms. There are thousands of professional and state-certain varieties you may use for the business or individual demands.

Form popularity

FAQ

Follow these five steps to start an Alaska LLC and elect Alaska S corp designation: Name Your Business. Choose a Registered Agent. File the Alaska Articles of Organization. Create an Operating Agreement. File Form 2553 to Elect Alaska S Corp Tax Designation.

Nevada, South Dakota, and Wyoming have no corporate or individual income tax (though Nevada imposes gross receipts tax. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding.

The State of Alaska does not have a tax exemption certificate, as it is not necessary to have one. The Alaska Constitution provides that the State of Alaska is exempt from all taxes emanating from within Alaska.

The Alaska corporate income tax already functions primarily as a worldwide combined tax. Our review of state tax data going back to 1991 finds that almost three quarters (74 percent) of Alaska's corporate income tax collections have come from the oil and gas sectors, which have long been subject to mandatory WWCR.

Alaska requires corporations to file a biennial report. The first report must be filed by January 2 of the year following incorporation and every two years thereafter. The report is considered delinquent if not filed before February 1 and fees and penalties may apply.

Since Alaska does not levy an income tax on individuals, you are not required to file an AK State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.

Alaska has a 2.0 to 9.40 percent corporate income tax rate. Alaska does not have a state sales tax, but has a max local sales tax rate of 7.50 percent and an average combined state and local sales tax rate of 1.76 percent. Alaska's tax system ranks 3rd overall on our 2024 State Business Tax Climate Index.

Alaska is one of just a few states with no personal income tax. That means that LLCs with default tax status pay no state income tax to the State of Alaska.