Alaska Promissory Note with Payments Amortized for a Certain Number of Years

Description

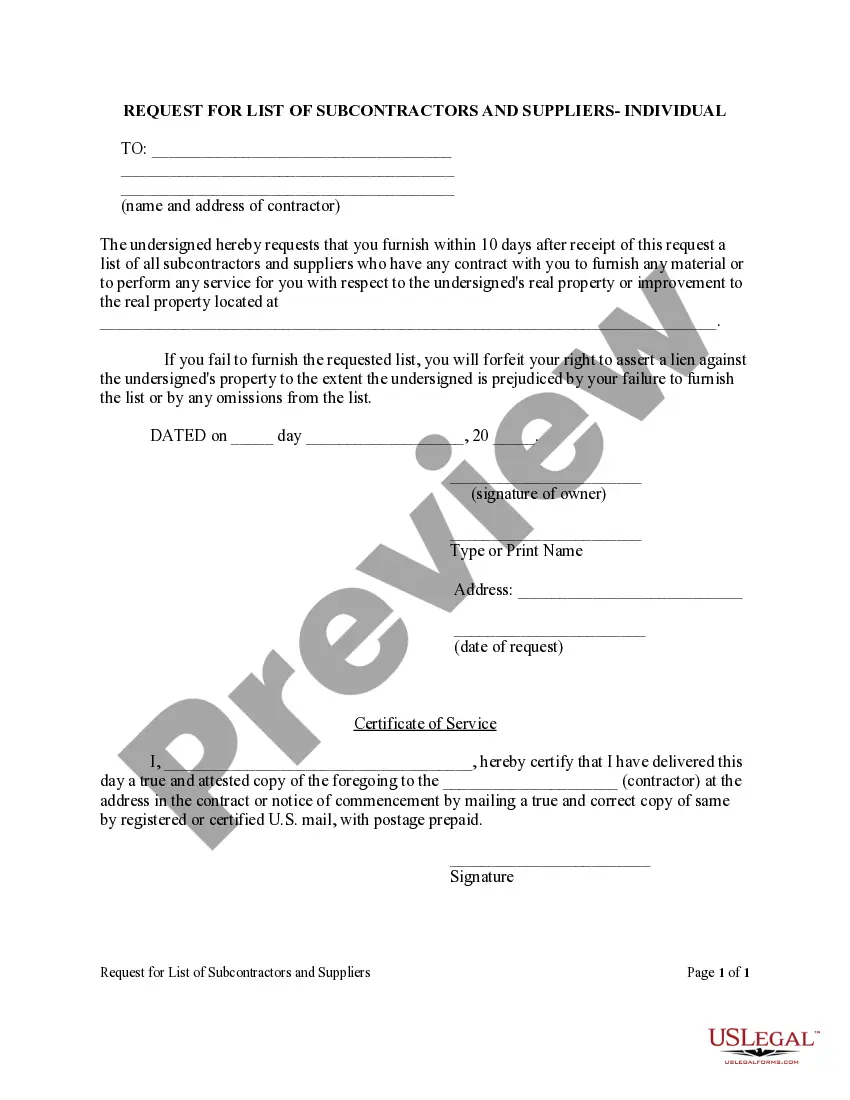

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

If you need to gather, download, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Leverage the site’s straightforward and user-friendly search feature to find the documents you need.

A range of templates for business and individual uses are organized by categories and titles, or keywords. Use US Legal Forms to locate the Alaska Promissory Note with Payments Amortized for a Specific Number of Years in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you’ve acquired within your account.

Download and print the Alaska Promissory Note with Payments Amortized for a Specified Number of Years from US Legal Forms. There are numerous professional and state-specific forms available for your business or individual needs.

- If you are currently a US Legal Forms client, Log In to your account and then click the Buy button to obtain the Alaska Promissory Note with Payments Amortized for a Specific Number of Years.

- You can also access forms you have previously purchased in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the guidelines below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the form’s content. Remember to read through the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the page to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Process your order. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your system.

- Step 7. Complete, edit, and print or sign the Alaska Promissory Note with Payments Amortized for a Specified Number of Years.

Form popularity

FAQ

When considering an Alaska Promissory Note with Payments Amortized for a Certain Number of Years, you may wonder about the limitations on the amount. Generally, there is no specific cap on how much you can include in a promissory note; however, lenders often set their own acceptable ranges. It's crucial to assess the borrower's creditworthiness and the anticipated repayment capacity. For a seamless experience, you might want to explore the resources available on uslegalforms, which can guide you in drafting a compliant and effective promissory note.

You can generally collect on an Alaska Promissory Note with Payments Amortized for a Certain Number of Years for a period defined by state laws, often ranging from three to six years. This means that once the note goes into default, you should take action within this timeframe to avoid losing your rights. Understanding these limits is crucial for effective management of your notes and for fostering healthy financial relations. Platforms like US Legal Forms provide essential resources to help you understand your collection rights.

Yes, you can collect on an Alaska Promissory Note with Payments Amortized for a Certain Number of Years as long as it is valid and enforceable. Collection typically involves obtaining payments according to the terms stated in the note. If someone fails to make the required payments, you may need to consider legal action to recover the owed amount. Using a platform like US Legal Forms can help you navigate the collection process effectively.

An Alaska Promissory Note with Payments Amortized for a Certain Number of Years typically does not have a specific expiration date. Instead, it outlines the repayment terms, including the duration over which payments are made. However, the ability to enforce the payment may be subject to state statutes of limitations, which establish a timeframe for legal action. Therefore, it is crucial to understand these timelines to protect your rights.

A promissory note, including the Alaska Promissory Note with Payments Amortized for a Certain Number of Years, does not typically have an expiration date per se, but it can become unenforceable after a certain period. This period varies by state, commonly ranging from 3 to 10 years, depending on the type of note and local laws. It's essential to keep track of payments and any agreements made to ensure that the note remains valid. Using a platform like uslegalforms can help you manage these aspects effectively.

The length of time an Alaska Promissory Note with Payments Amortized for a Certain Number of Years remains valid generally depends on the length specified in the agreement. It is often structured for a specific number of years, which can typically range from one to twenty years. Understanding the duration outlined in your note helps build confidence in your financial planning.

Yes, an Alaska Promissory Note with Payments Amortized for a Certain Number of Years typically includes a specified time frame for repayment. The time limit varies based on the agreement between the parties involved. It is crucial to clearly outline this time limit in the promissory note to avoid any misunderstandings regarding repayment expectations.