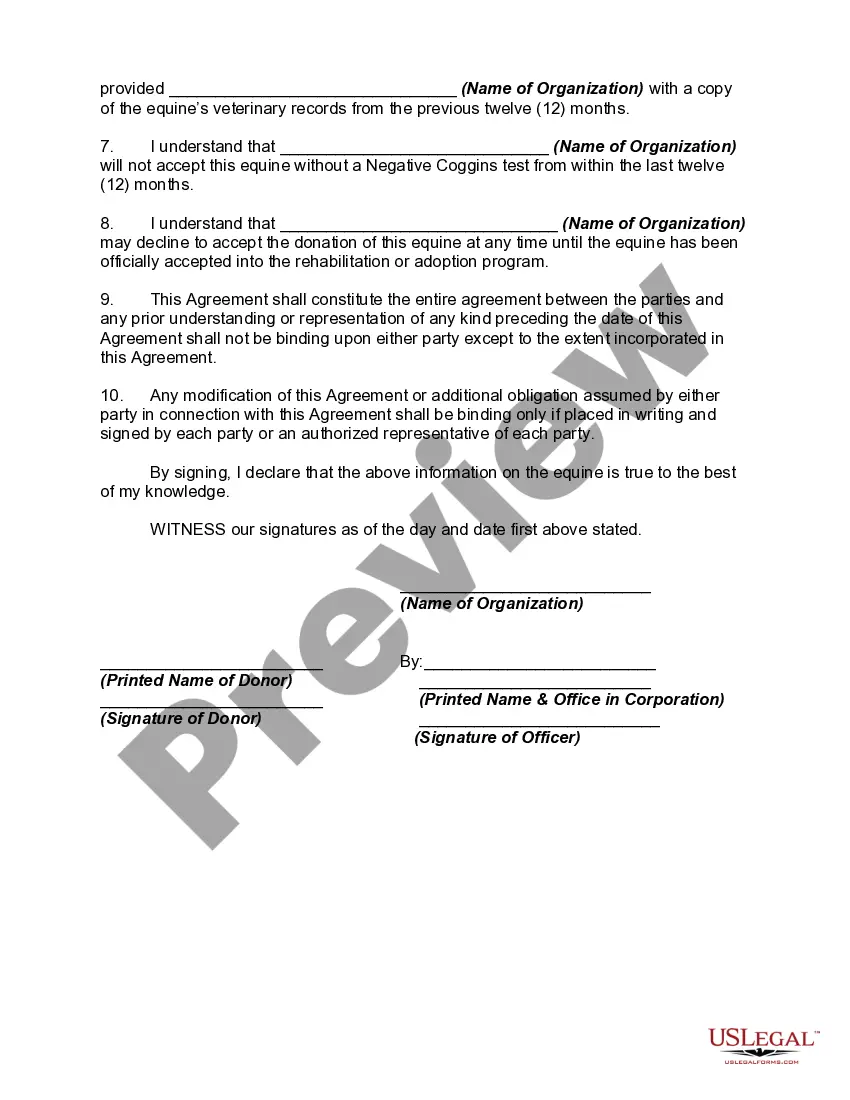

This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

Selecting the appropriate legal document format can be a challenge.

Of course, there are numerous templates accessible online, but how can you locate the legal document you need.

Utilize the US Legal Forms website.

First, ensure that you have selected the correct form for your region/county. You can review the form using the Preview button and check the form details to make sure it is suitable for you.

- This service provides thousands of templates, such as the Alaska Equine or Horse Donation Agreement, which you can use for both business and personal purposes.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to acquire the Alaska Equine or Horse Donation Agreement.

- Use your account to browse through the legal documents you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

For tax purposes, a horse is classified as personal property. This means that when you donate a horse, it may qualify as a charitable contribution. You must maintain accurate records and follow IRS guidelines to substantiate your claims. An Alaska Equine or Horse Donation Contract can help clarify the details of the donation in legal terms.

To receive a tax write-off, there is no specific minimum amount you must donate. However, the amount must be supported by a qualified appraisal if the value exceeds $5,000. Using an Alaska Equine or Horse Donation Contract can simplify this process by ensuring all necessary information is included for tax reporting.

Yes, donations made to a recognized horse rescue organization can be tax write-offs. If you donate a horse to such a rescue, it likewise qualifies you for potential tax deductions. It’s important that the organization is a registered 501(c)(3) entity. An Alaska Equine or Horse Donation Contract solidifies your contribution for tax purposes.

Yes, donating a horse can be tax-deductible if you follow the IRS guidelines. To qualify for a deduction, you need to donate your horse to a qualified charitable organization. Keep in mind, you'll need to document the donation properly. Using an Alaska Equine or Horse Donation Contract can help ensure you meet all legal requirements.

Yes, you can write off a horse donation, but there are specific conditions to meet. To qualify for a tax deduction, the donation must be made to a qualified charitable organization, and you should have a properly executed Alaska Equine or Horse Donation Contract. Keep in mind that the value of the deduction may depend on the fair market value of the horse at the time of donation. Ensuring proper documentation and following IRS guidelines will help you maximize your tax benefits.

To give away a horse, start by assessing potential candidates who can offer a loving home. It's important to create an Alaska Equine or Horse Donation Contract to ensure that the transfer of ownership is clear and responsible. This documentation acts as a safeguard, so both you and the new owner have a mutual understanding of care expectations.

Yes, you can donate a horse to charity, and this action can provide immense benefits for both you and the horse. Using an Alaska Equine or Horse Donation Contract helps formalize the donation, ensuring the horse is well cared for. Many charities appreciate donations of horses, contributing to their mission while giving your horse a new purpose.

If you find yourself with an unwanted horse, consider your options carefully. You might choose to donate the horse to an accredited organization using an Alaska Equine or Horse Donation Contract. This method provides a safe and compassionate way to part with your horse while ensuring it finds a suitable, loving home.

The 123 rule is a training guideline that emphasizes the importance of rewards in horse training. It means you give a reward to the horse after it successfully performs a desired behavior once, then twice, and then three times. Utilizing such training principles can foster better communication with your horse, making it easier if you need to think about a horse donation contract later.

The 20% rule in horse care states that you should not work a horse harder than 20% of its total body weight. This principle ensures that your horse stays healthy and avoids injuries. Understanding and applying safe practices like these can enhance your equine experience, especially when considering an Alaska Equine or Horse Donation Contract.