Alaska Simple Promissory Note for Tutition Fee

Description

How to fill out Simple Promissory Note For Tutition Fee?

Are you currently in a situation where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of template forms, such as the Alaska Simple Promissory Note for Tuition Fee, which are designed to meet federal and state regulations.

Once you locate the correct form, click Get now.

Choose the subscription plan you prefer, fill in the required information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alaska Simple Promissory Note for Tuition Fee template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct jurisdiction/area.

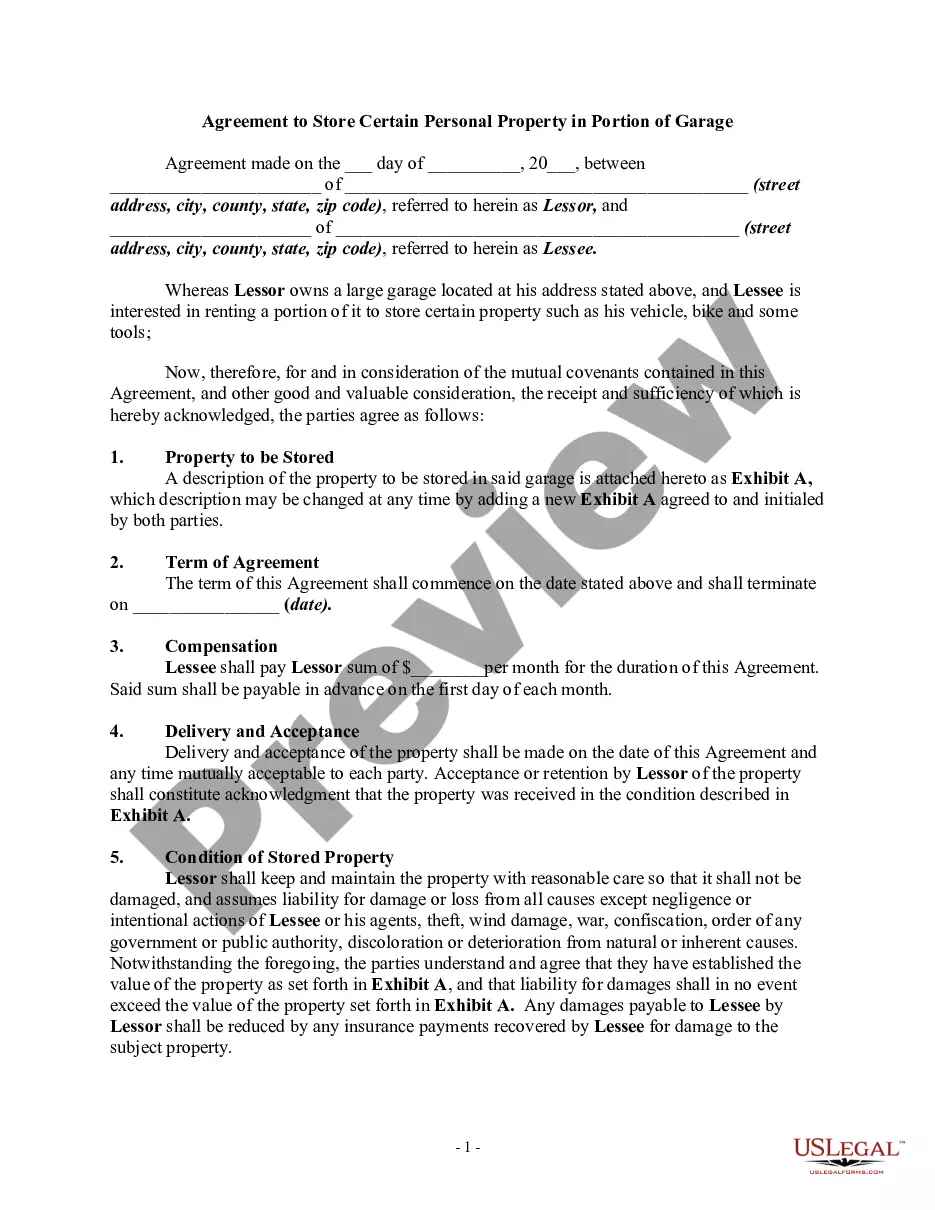

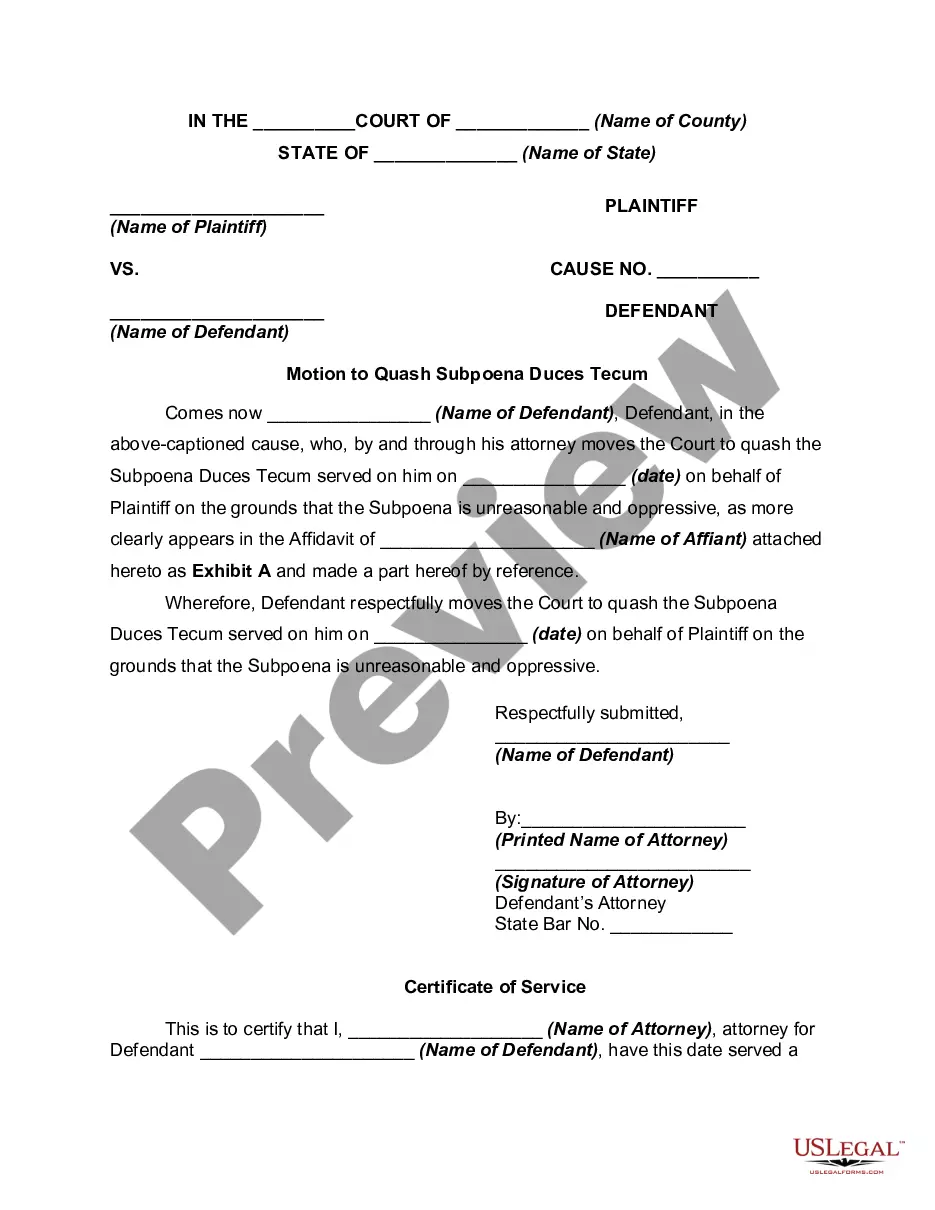

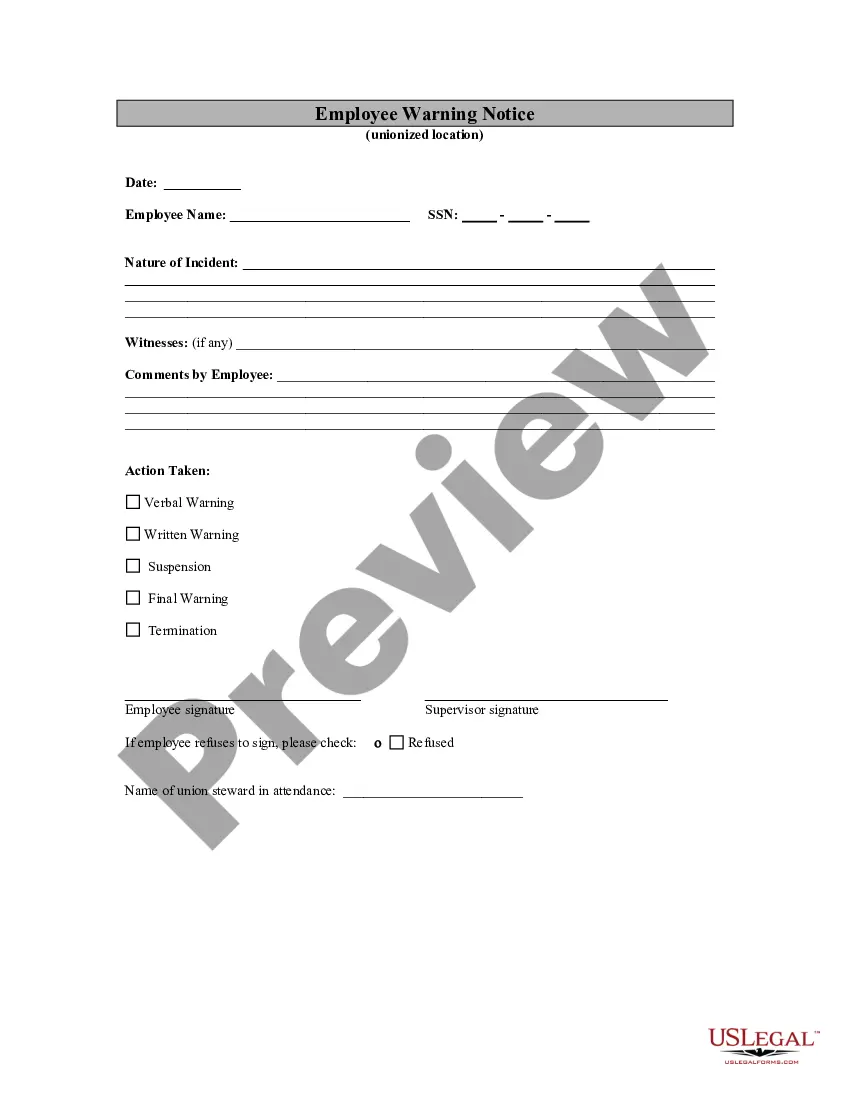

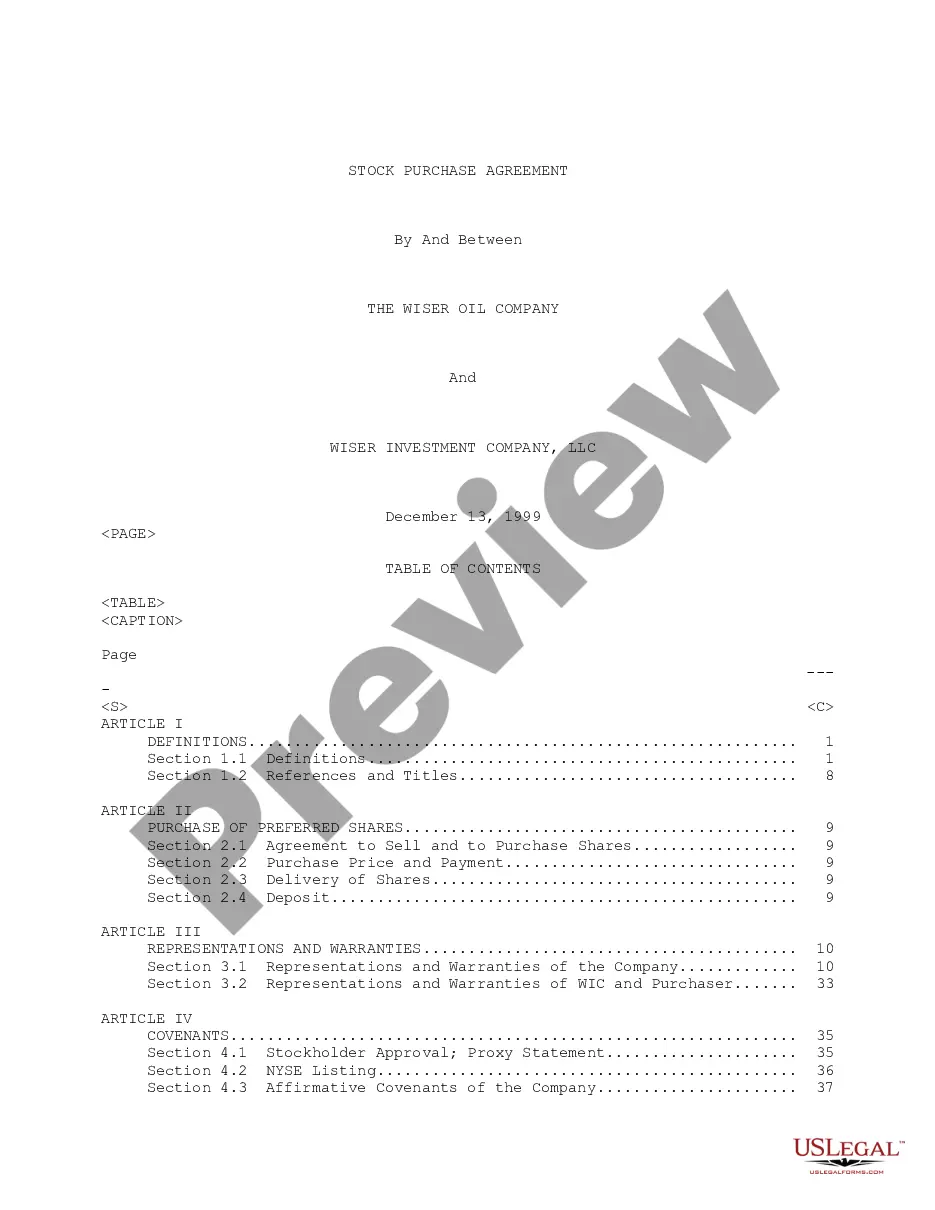

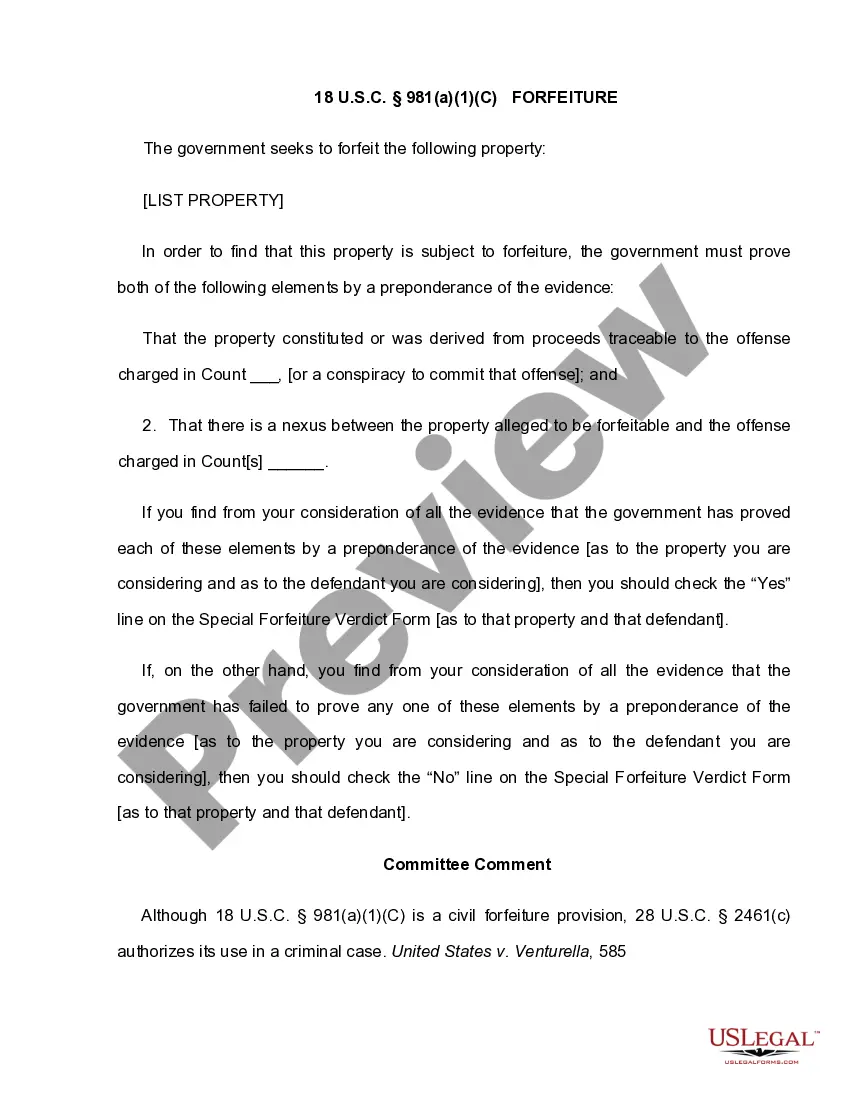

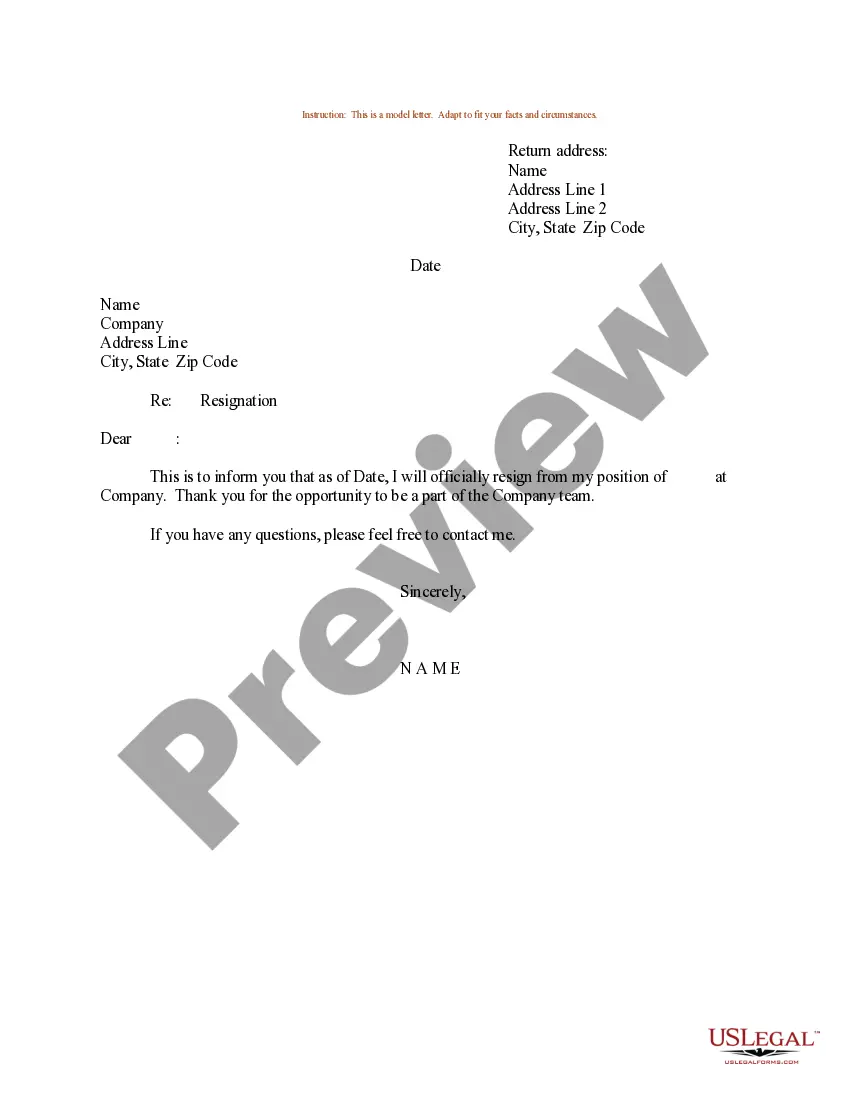

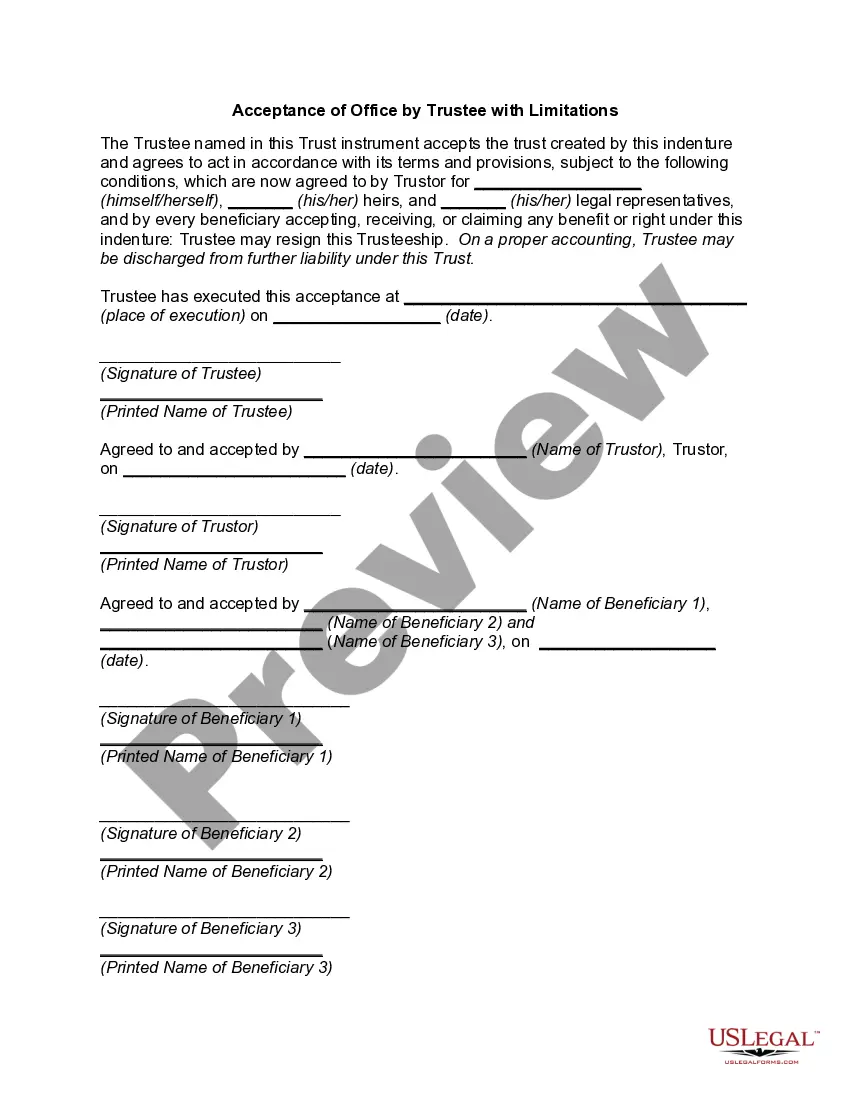

- Use the Preview button to review the form.

- Check the details to confirm that you have selected the right document.

- If the document isn’t what you’re looking for, use the Search section to find the form that meets your needs and criteria.

Form popularity

FAQ

To write a simple promissory note for tuition, start by specifying the amount owed and the names of both the lender and borrower. Clearly outline the repayment schedule, including when payments are due and the total repayment period. Sign and date the note to finalize your agreement and to ensure both parties have a clear understanding of the terms.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.