Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Declaration of Gift Over Several Year Period

Description

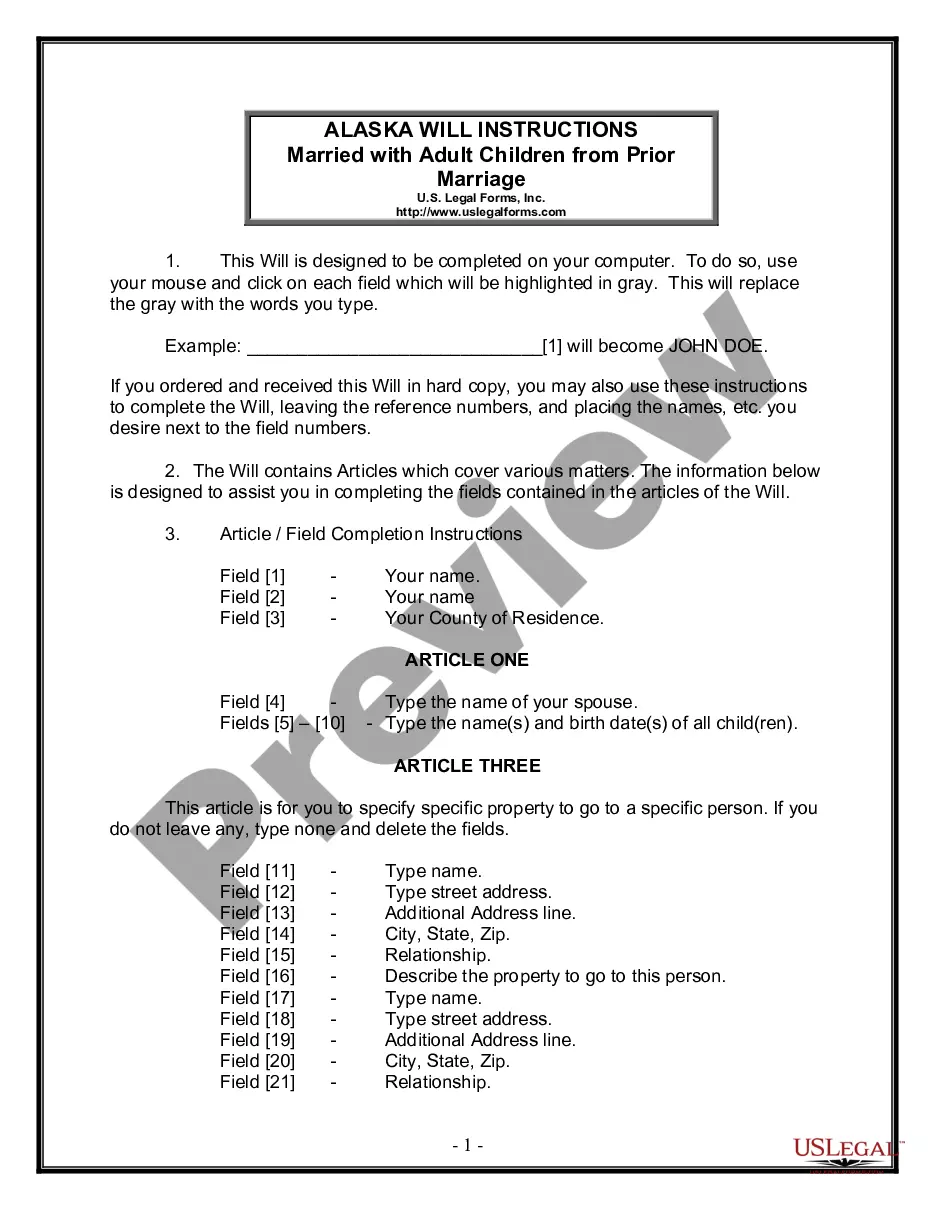

How to fill out Declaration Of Gift Over Several Year Period?

It is feasible to spend hours online trying to locate the legal document template that satisfies both federal and state requirements you have.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can download or print the Alaska Declaration of Gift Over Several Year Period from our service.

First, ensure that you have selected the correct form template for the county/city of your choice. Review the form description to guarantee you have chosen the right one. If available, utilize the Review button to browse the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Alaska Declaration of Gift Over Several Year Period.

- Every legal document template you obtain is yours indefinitely.

- To get an additional copy of a purchased form, go to the My documents tab and click the applicable button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

Unfortunately, gift tax returns, including Form 709, cannot be filed electronically. This can be an inconvenience, especially for individuals adhering to the Alaska Declaration of Gift Over Several Year Period. You will need to print and mail the form to the IRS after completing it. To help streamline this process, consider using platforms like uslegalforms, which offer guidance and resources for filing your gift tax returns accurately.

Form 709 does not need to be filed every year; it only needs to be submitted for years when you make taxable gifts. For donors engaged in the Alaska Declaration of Gift Over Several Year Period, it's essential to assess your gifting activity annually. If your gifts exceed the annual exclusion amount, you will need to file. Keeping track of your gifts each year will simplify the process.

No, Form 709 cannot be electronically signed; it requires a manual signature. This is crucial when submitting a gift tax return for gifts reported under the Alaska Declaration of Gift Over Several Year Period. A physical signature ensures the IRS recognizes your submission as valid. Therefore, make certain to review and sign the form before mailing it to the IRS.

Certain tax forms, including Form 709, cannot be electronically filed according to IRS regulations. While e-filing is convenient, it is essential to understand which forms need to be submitted by mail. Gifts reported under the Alaska Declaration of Gift Over Several Year Period will require this traditional filing method. Be sure to check with your tax advisor for the latest updates on IRS rules.

The deadline for filing a gift tax return, using Form 709, is usually April 15 of the following year. If you need more time to file, you can request an extension, but any gift tax owed is still due by the original deadline. This timeframe is important to remember, especially for gifts made under the Alaska Declaration of Gift Over Several Year Period. Timely filing can help you avoid interest and penalties.

The carryover basis for gifts refers to the tax basis that the recipient takes on a gifted asset. When you give a gift under the Alaska Declaration of Gift Over Several Year Period, the recipient's basis is typically the same as yours. This means that if you have a lower basis in the asset, the recipient will also inherit that lower basis. Understanding this can help when they decide to sell the gift in the future.

To report a gift on your tax return, you must file Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. This form allows you to report gifts made during the year, especially under the Alaska Declaration of Gift Over Several Year Period. Be sure to include details of the recipient and the value of the gifts. Accurate reporting can help you avoid penalties and ensure compliance with tax regulations.

Yes, your parents can gift you $30,000, but they need to be mindful of federal gift tax laws. They can take advantage of the annual exclusion limit, allowing them to give amounts without incurring taxes. If they exceed the annual limit, they may need to file a gift tax return. An Alaska Declaration of Gift Over Several Year Period can help track these larger gifts effectively.

Alaska, along with several other states, does not impose a state gift tax. This law makes Alaska an appealing choice for individuals planning to give gifts to family and friends. Planning your gifts carefully can help you maximize your financial benefits. Consider documenting gifts with an Alaska Declaration of Gift Over Several Year Period for clarity.

In Alaska, gift certificates do not generally expire, thanks to specific consumer protection laws. This ensures that recipients can enjoy the gift at their convenience without worrying about deadlines. However, it's always good to check the specific terms and conditions of the gift certificate. Using an Alaska Declaration of Gift Over Several Year Period might help if you consider gifting certificates in larger amounts.