Have you been inside a situation the place you require paperwork for both business or personal purposes almost every time? There are a lot of lawful file templates available on the net, but getting ones you can depend on is not effortless. US Legal Forms gives a huge number of develop templates, much like the Alaska Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act, which can be written to meet federal and state requirements.

When you are previously informed about US Legal Forms website and get your account, basically log in. Afterward, it is possible to obtain the Alaska Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act format.

If you do not provide an bank account and want to start using US Legal Forms, follow these steps:

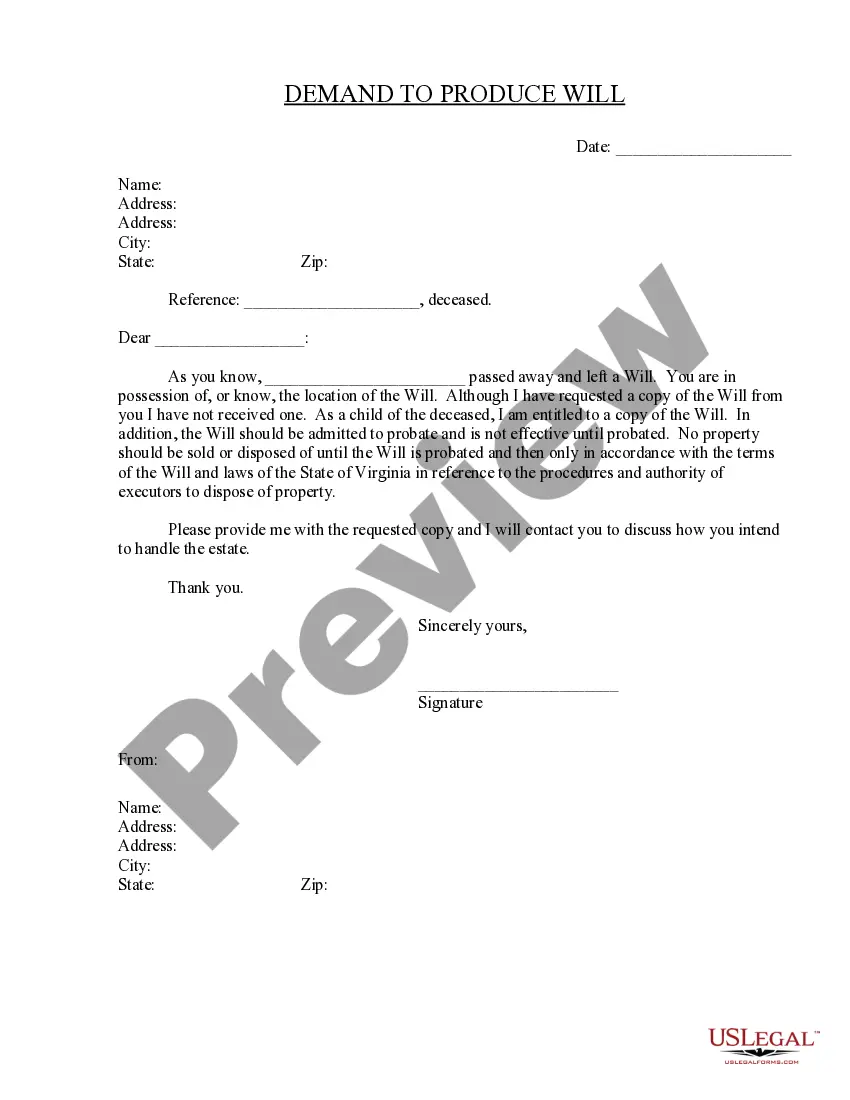

- Find the develop you will need and make sure it is for that correct town/region.

- Utilize the Review switch to review the form.

- See the information to actually have chosen the correct develop.

- In case the develop is not what you`re trying to find, utilize the Research area to obtain the develop that fits your needs and requirements.

- Whenever you find the correct develop, click on Buy now.

- Select the costs strategy you would like, submit the specified information and facts to produce your bank account, and buy the order using your PayPal or bank card.

- Pick a practical document file format and obtain your version.

Find every one of the file templates you may have bought in the My Forms menu. You can aquire a extra version of Alaska Answer of Defendants to Complaint by Debtor For Harassment in Attempting to Collect a Debt, Using Harassing and Malicious Information, and Violating the Federal Fair Debt Collection Practices Act whenever, if required. Just go through the needed develop to obtain or printing the file format.

Use US Legal Forms, the most considerable variety of lawful varieties, to save lots of time as well as avoid blunders. The assistance gives appropriately produced lawful file templates that can be used for an array of purposes. Produce your account on US Legal Forms and commence making your lifestyle a little easier.