Alaska Financial Statement Form - Universal Use

Description

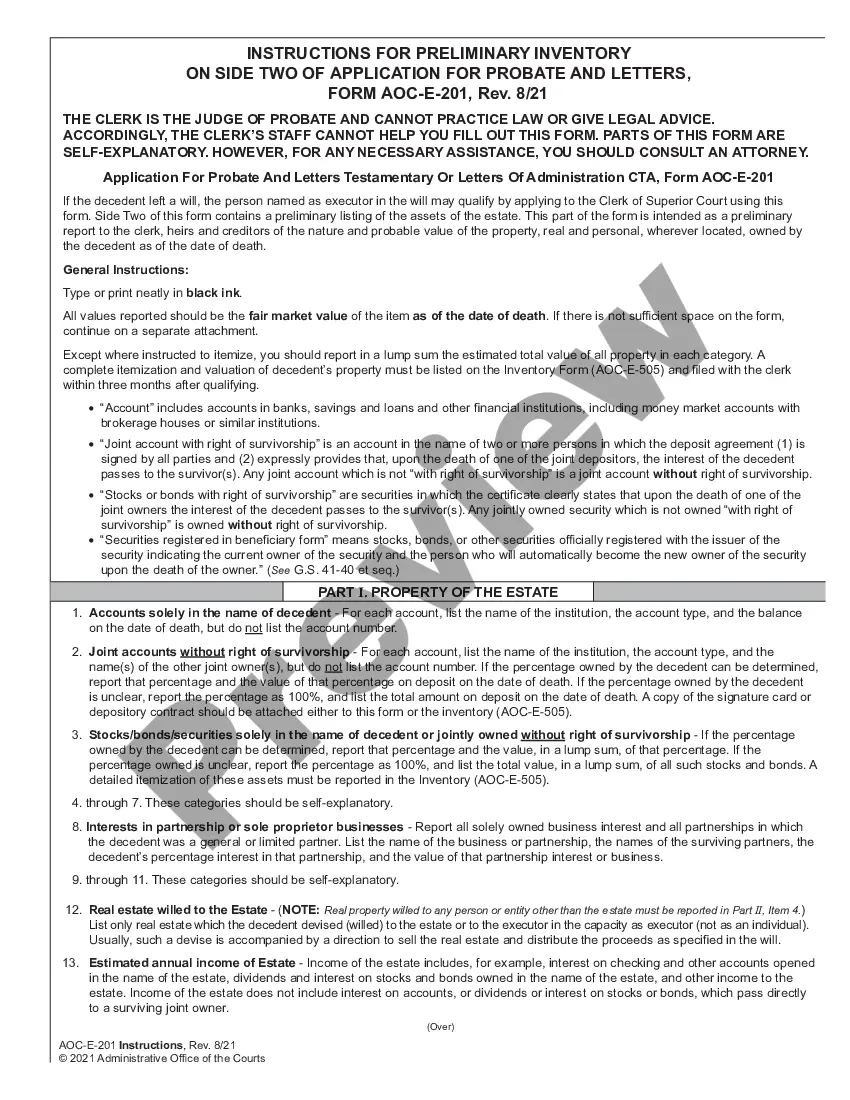

How to fill out Financial Statement Form - Universal Use?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of documents for business and personal purposes, sorted by categories, states, or keywords. You can find the latest document types like the Alaska Financial Statement Form - Universal Use in moments.

If you hold a membership, Log In to obtain the Alaska Financial Statement Form - Universal Use from your US Legal Forms library. The Acquire button will appear on each document you view. You can access all previously saved documents from the My documents section of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the purchase.

Choose the format and acquire the document to your system. Make modifications. Fill in, edit, and print and sign the saved Alaska Financial Statement Form - Universal Use. Each template you added to your account has no expiration date and belongs to you permanently. Therefore, to acquire or print another copy, simply navigate to the My documents section and click on the document you need. Gain access to the Alaska Financial Statement Form - Universal Use with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and specifications.

- Ensure you have selected the appropriate document for your city/state.

- Press the Preview button to check the document's details.

- Examine the document information to confirm that you have chosen the correct one.

- If the document does not meet your requirements, use the Lookup field at the top of the screen to find the one that does.

- If you are satisfied with the document, finalize your choice by clicking the Acquire now button.

- Then, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Preparing a personal financial statement involves collecting detailed information about your finances, including income, expenses, assets, and debts. The Alaska Financial Statement Form - Universal Use serves as an excellent tool for organizing this information. By following its structured approach, you can ensure that your personal financial statement reflects your financial status accurately.

An example of a financial statement could be a personal financial statement detailing an individual's income, expenses, assets, and liabilities. By using the Alaska Financial Statement Form - Universal Use, you can create a comprehensive example that highlights financial stability or shortcomings. This structured example can guide decisions regarding budgeting, credit applications, or financial planning.

Completing a financial statement requires a detailed approach to compiling all necessary financial data. Using the Alaska Financial Statement Form - Universal Use can simplify this process as it guides you through every required section. Double-check your information for accuracy and clarity, as an accurately completed financial statement is essential for lenders and financial advisors.

To fill out an SBA financial statement, you need to provide clear and precise information about your business's financial health. Utilize the Alaska Financial Statement Form - Universal Use as a foundation to efficiently gather and present your data. Ensure you include all revenues, expenses, and assets, as the SBA requires comprehensive information to assess your application.

Filling out a financial statement involves providing specific details about your income, expenses, assets, and debts. The Alaska Financial Statement Form - Universal Use provides templates that guide you in entering accurate information. Be thorough and honest, as this form plays a crucial role in various financial assessments and decisions.

The format of a financial statement generally includes sections for income, expenses, assets, and liabilities. In the Alaska Financial Statement Form - Universal Use, these categories are organized to help you present a clear overview of your financial status. Following this format allows for easy comprehension, ensuring that any reader can understand your financial situation at a glance.

Alaska Rule 403 outlines the requirement for filling out the Alaska Financial Statement Form - Universal Use in various legal proceedings. This rule mandates that parties in a case provide financial information to ensure transparency and fairness. By using the Alaska Financial Statement Form - Universal Use, individuals streamline the process of disclosure, making it easier for all involved to assess financial situations accurately. Whether you're dealing with divorce, child custody, or other financial matters, understanding this rule helps in complying with legal standards effectively.

The annual revenue of the state of Alaska consists mainly of oil revenue, federal funding, and other taxes. With fluctuating oil prices, the revenue can significantly impact state budgets and services. By understanding the financial landscape through the Alaska Financial Statement Form - Universal Use, you can appreciate how these funds contribute to resident benefits like the PFD.

Qualifying for the Alaska PFD requires you to meet specific residency criteria and submit an application by the deadline. You must reside in Alaska for the entire qualifying year, and a proper submission of your Alaska Financial Statement Form - Universal Use will help you furnish all necessary details to secure your dividend.

To qualify as an Alaska resident, you must live in the state for a certain period and demonstrate intent to remain. This includes actions such as obtaining an Alaska driver’s license, registering to vote, or securing employment in the state. Using the Alaska Financial Statement Form - Universal Use can assist you in organizing and presenting your residency information effectively.