Alaska Reduce Capital - Resolution Form - Corporate Resolutions

Description

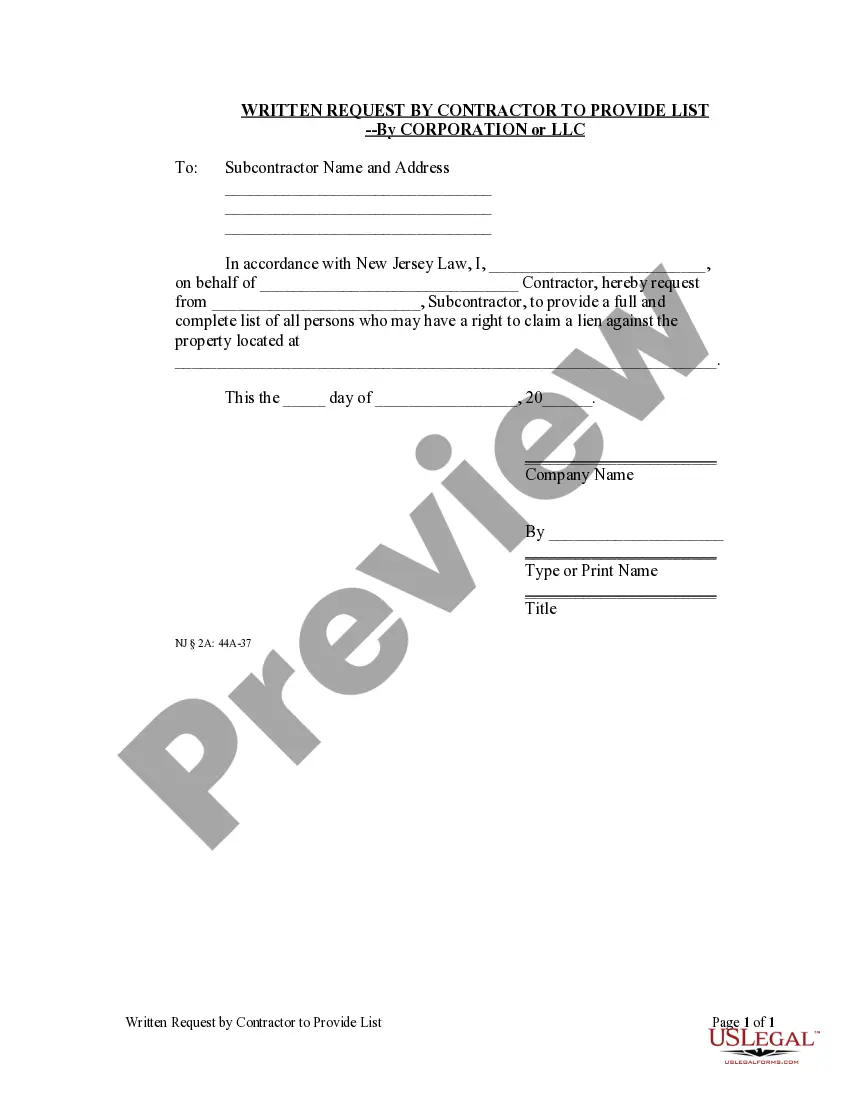

How to fill out Reduce Capital - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

By using the website, you will find thousands of forms for business and personal needs, categorized by categories, states, or keywords. You can access the latest versions of forms such as the Alaska Reduce Capital - Resolution Form - Corporate Resolutions in just minutes.

If you already have a monthly membership, Log In to obtain the Alaska Reduce Capital - Resolution Form - Corporate Resolutions from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill in, modify, and print and sign the downloaded Alaska Reduce Capital - Resolution Form - Corporate Resolutions. Each template you add to your account has no expiration date and is yours permanently, so, to download or print another version, simply go to the My documents section and click on the form you need. Gain access to the Alaska Reduce Capital - Resolution Form - Corporate Resolutions with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that align with your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct form for your area/region

- Click the Review button to examine the content of the form.

- Check the form outline to ensure you have selected the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Purchase now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Filling out a corporate resolution form involves providing key information such as the resolution details, the meeting date, and signatures from authorized individuals. The Alaska Reduce Capital - Resolution Form - Corporate Resolutions from uslegalforms guides you through this process, ensuring you capture all necessary elements accurately and in compliance with legal standards.

Shareholder resolutions are often available through your company's internal resources or legal document services. You may also find templates online that cater specifically to corporate needs. The uslegalforms platform offers the Alaska Reduce Capital - Resolution Form - Corporate Resolutions, which can facilitate the documentation of any shareholder decisions.

Corporate resolution documents serve as official records that outline decisions made by a company's governing body. They can include actions such as issuing shares or making significant business changes. By utilizing the Alaska Reduce Capital - Resolution Form - Corporate Resolutions, you ensure that these important decisions are documented correctly and efficiently.

A board resolution typically pertains to decisions made by a company's board of directors, while a corporate resolution can refer to decisions at various levels within an organization, including shareholders and LLCs. Understanding this distinction is vital, especially when utilizing the Alaska Reduce Capital - Resolution Form - Corporate Resolutions, which can assist in formalizing various types of decisions.

You can find corporate resolution templates online through various legal document services. One reliable option is the uslegalforms platform, which offers an array of resources, including the Alaska Reduce Capital - Resolution Form - Corporate Resolutions. This makes it easy to access well-structured documents tailored to your needs.

Not every LLC is required to have a corporate resolution. However, if your LLC engages in significant decisions, a corporate resolution can help document the approval of these actions. Using the Alaska Reduce Capital - Resolution Form - Corporate Resolutions simplifies this process, providing a clear record for your organization's important choices.

Changing your registered agent in Alaska involves submitting a change form to the state. You need to provide updated information about the new agent and ensure they agree to serve in that role. The US Legal Forms platform can offer the necessary forms and guidance to streamline this process.

To notify the IRS of a corporation's dissolution, you should file the final tax return for the year. Mark the return to indicate it is a final return and include the date of dissolution. This ensures proper communication with the IRS and helps avoid any future tax liabilities.

To successfully dissolve a corporation in Alaska, you must first hold a board meeting to pass a resolution. After obtaining their approval, fill out and file the Alaska Reduce Capital - Resolution Form - Corporate Resolutions with the state. Finally, settle outstanding debts and distribute remaining assets to shareholders to wrap up your corporate affairs.

Corporations often dissolve for various reasons, including financial difficulties and a change in business strategy. Another common reason is achieving the business's goals, where owners decide to cease operations. Understanding these reasons can help you make informed decisions regarding the Alaska Reduce Capital - Resolution Form - Corporate Resolutions.