Alaska Premarital Agreements Package

Overview of this form package

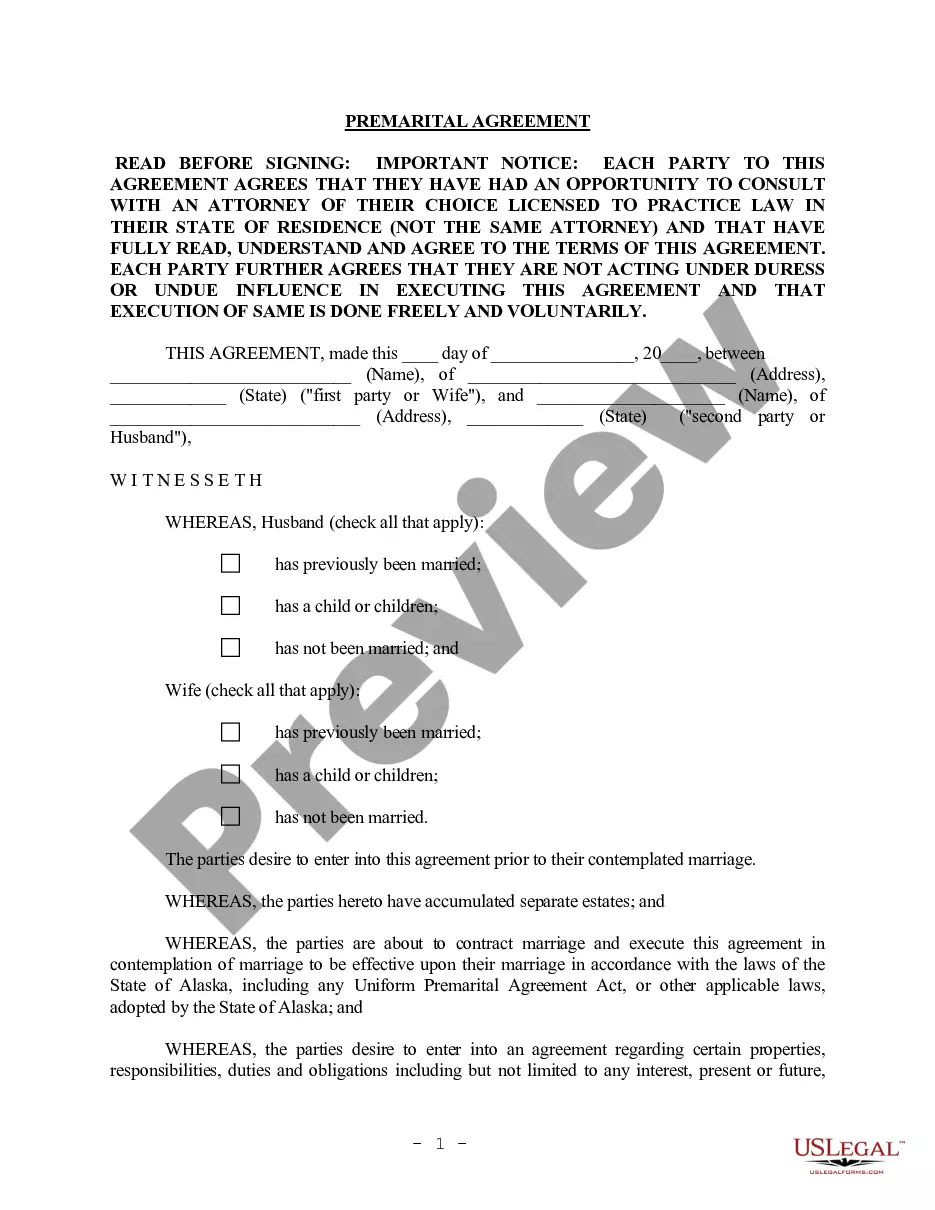

The Alaska Premarital Agreements Package is a comprehensive set of legal forms designed for individuals entering into a marriage. This package is especially useful for those who have been previously married or are marrying for the first time. Unlike other legal agreements, these forms specifically address asset and debt disclosures, and property rights during marriage and upon its termination through divorce or death. Utilizing this package helps ensure that both parties have an organized and clear understanding of their rights and obligations, potentially avoiding costly disputes in the future.

What’s included in this form package

When to use this document

This package is ideal for use in various scenarios, including:

- When either party has significant assets or debts to protect before entering into marriage.

- When individuals wish to clarify financial responsibilities and property rights during the marriage.

- When parties want to establish clear procedures for asset division in case of divorce or death.

- When either party has children from previous relationships and wishes to protect their interests.

Intended users of this form package

- Individuals marrying for the first time who want to establish clear financial expectations.

- Those who have been previously married and want to create an updated agreement.

- Couples looking to protect family heirlooms or business interests.

- Anyone wishing to ensure their assets are appropriately handled upon divorce or death.

How to prepare this document

- Review the included forms carefully to understand each document's purpose.

- Identify the parties involved and ensure all necessary information is accurate.

- Complete the required fields in each form, including financial disclosures where applicable.

- Have both parties sign the agreements in the presence of a notary public if required.

- Keep copies of all completed forms for personal records and future references.

Notarization details for included forms

Some forms in this package need notarization to be legally binding. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

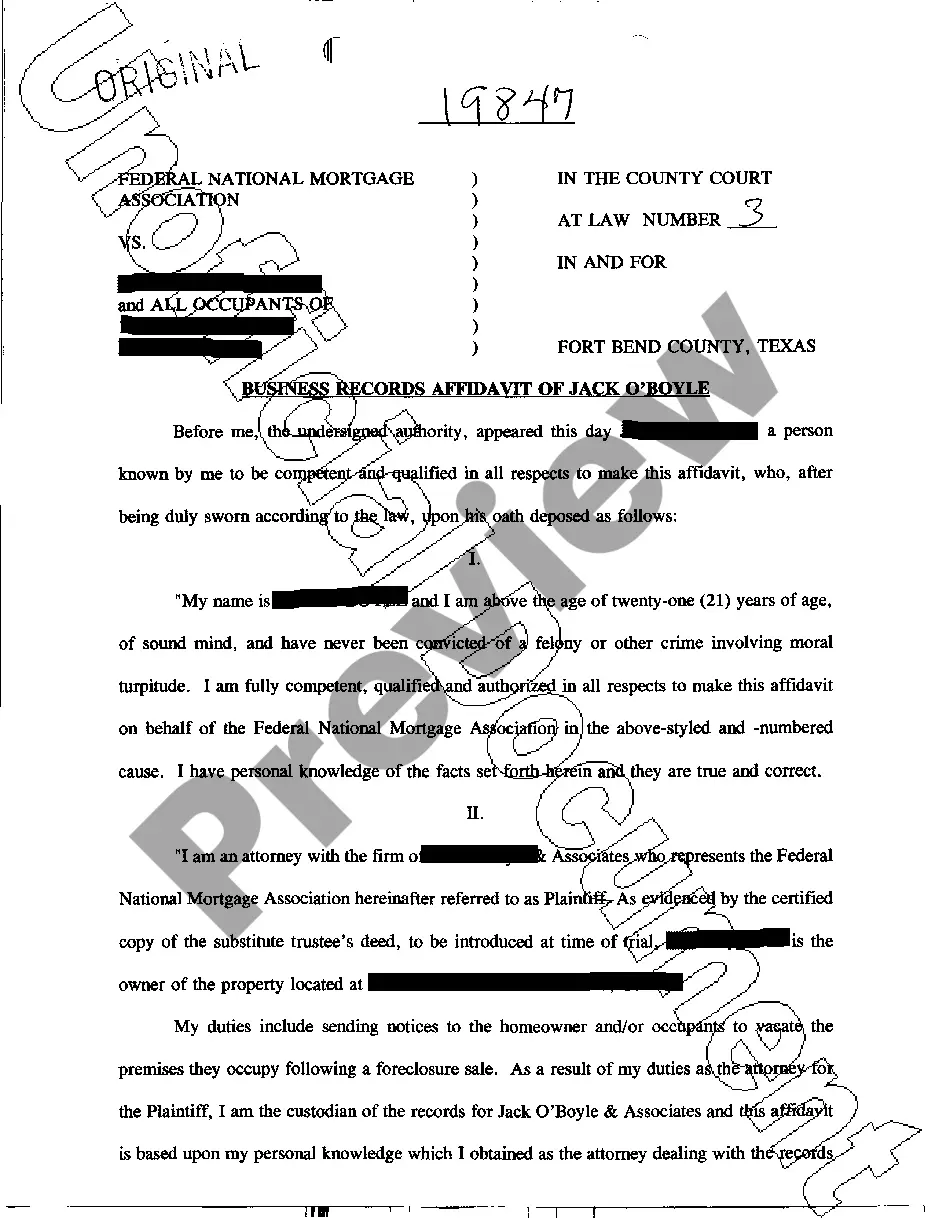

- Failing to fully disclose all assets and debts, leading to potential legal challenges.

- Not having the agreement notarized when required by law.

- Assuming verbal agreements can replace a written prenup.

- Using outdated versions of forms that do not meet current legal requirements.

Advantages of online completion

- Convenient access to necessary legal forms from the comfort of your home.

- Edit and customize documents as required to fit your specific situation.

- Reliable formats created by licensed attorneys, ensuring compliance with Alaska laws.

- Download and store forms digitally for easy access and sharing with parties involved.

Looking for another form?

Form popularity

FAQ

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.

Pitfall 1: Negotiating a prenuptial agreement may irrevocably damage your relationship and make divorce more likely.Some fiances pushing for a prenuptial agreement may be demonstrating a lack of faith in their partner and a lack of commitment to the marriage.

Despite the fact that a prenup is arranged before a marriage, you can still sign one after exchanging "I do's." This contract, known as a post-nuptial agreement, is drafted after marriage by those who are still married and either are contemplating separation or divorce or simply want to protect themselves from the

The average cost of a prenup ranges from about $1,200 for low-cost, simple agreements to $10,000 for more complicated situations.

Prenups aren't just for the rich or famous more millennials are signing them before getting married, and you probably should too.Prenups set expectations for a division of assets and finances in the event of divorce. They may not be romantic to bring up, but most couples will benefit from having one.

Assets and Debts. A Prenuptial Agreement is a good way for you and your partner to maintain separate control over personal assets or property that you accumulated before you were together. Dependent Children. Protection of Your Estate Plan.

Just as a future asset can be protected by a prenup if adequately described, future income can also be treated as belonging to one partner but not both.

The legal advice website Avvo.com suggests that you'll likely pay $600 to $800 for an attorney to draft a prenup. You can certainly pay much more. Generally, the more money you have to protect, and the more complicated your and your beloved's finances are, the more you will spend on a prenup.

In the event of divorce, a prenup can protect a spouse from being liable for any debt the other spouse brought into the marriage.A prenup can also protect any income or assets you earn during the marriage, as well as unearned income from a bequest or a trust distribution.