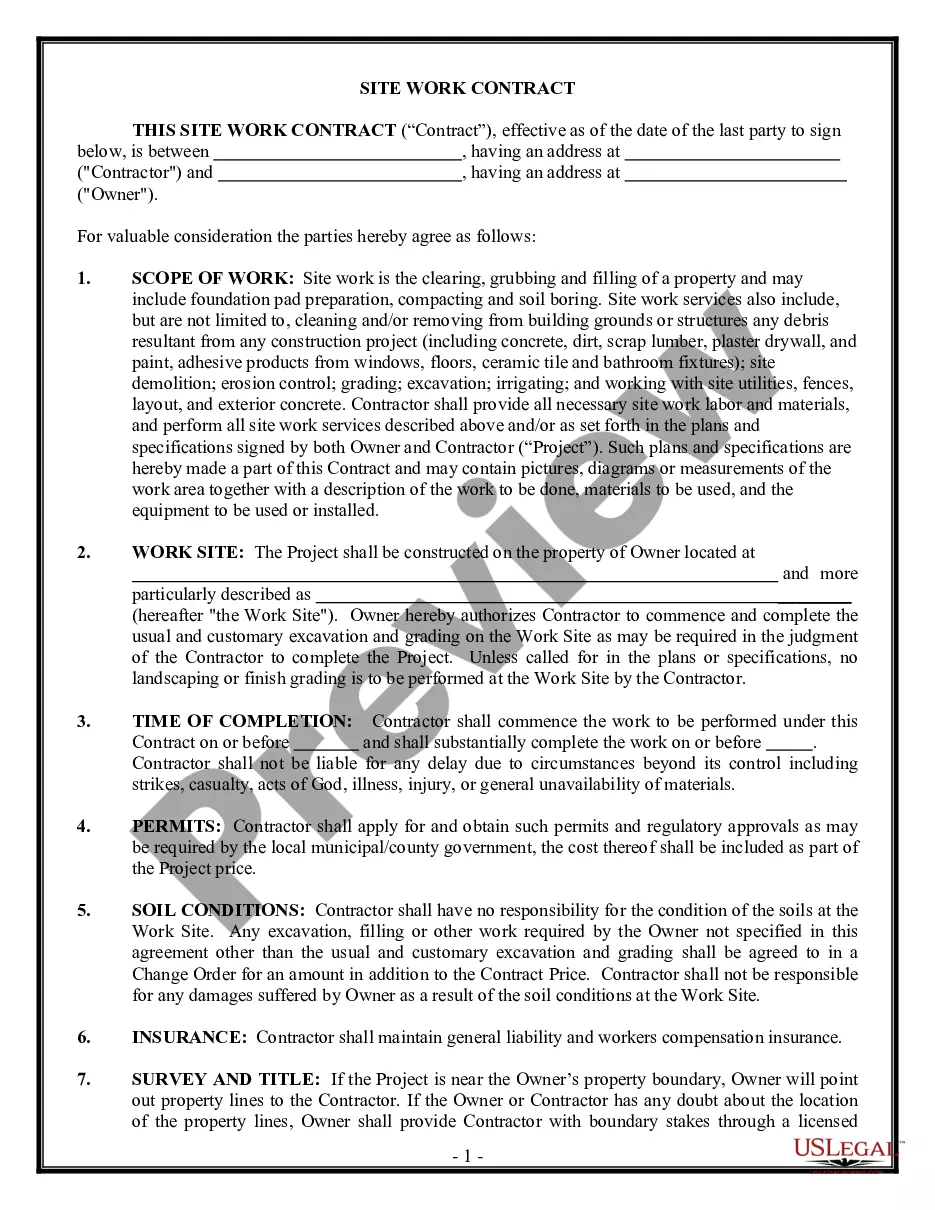

Alaska Site Work Contract for Contractor

About this form

This Site Work Contract for Contractor is a legal document used between site work contractors and property owners in Alaska. It details the expectations and responsibilities of both parties for construction projects, including payment arrangements, work scope, and liability issues. This form is essential for ensuring that all parties are aligned on project terms, unlike more general contracts that may not cover specific site work needs.

Form components explained

- Work site details: Specifies the location where the project will take place.

- Permits: Outlines the contractor's responsibility for obtaining necessary permits.

- Soil conditions: Clarifies the contractor's non-responsibility for soil-related issues.

- Insurance requirements: Mandates that the contractor maintains general liability and workers compensation insurance.

- Change orders: Governs how and when changes to the project scope can be made.

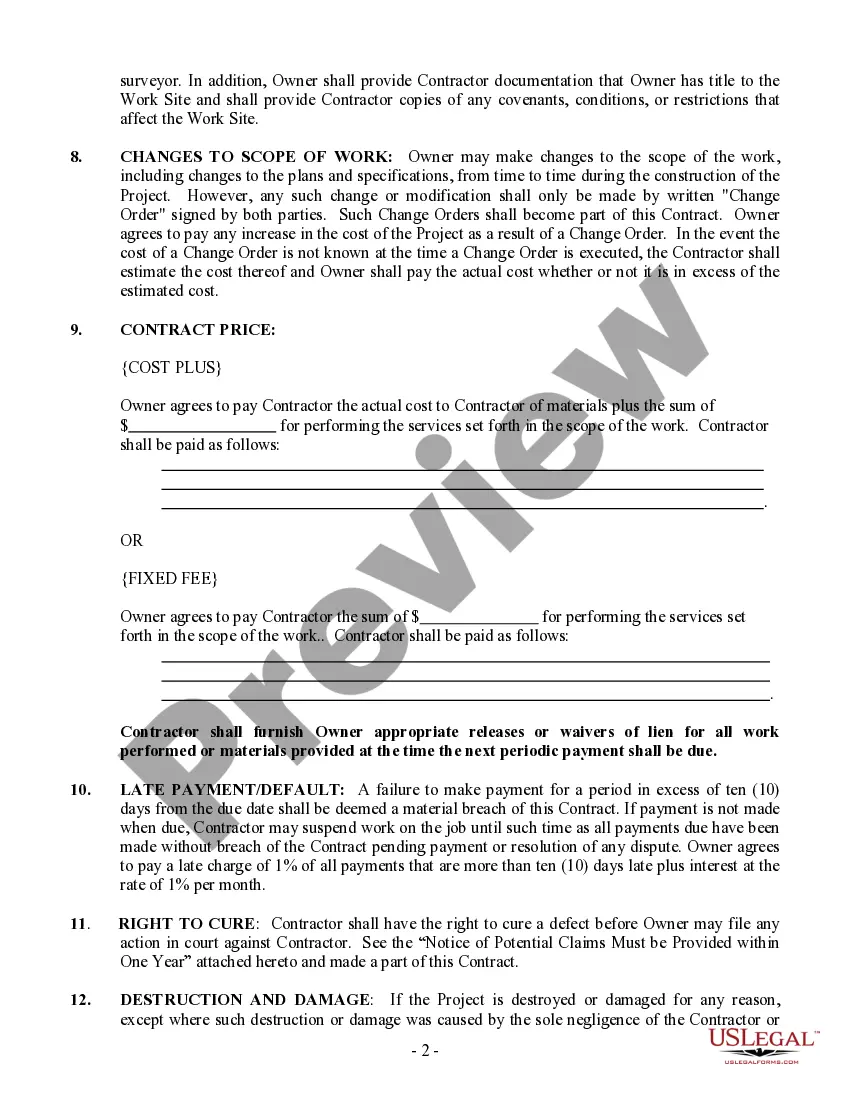

- Contract price and payment terms: Describes the payment arrangements, including late payment clauses.

When this form is needed

This Site Work Contract is ideal for property owners hiring contractors for construction work that involves excavation, grading, or other site preparations. Use this form when you want to establish a clear agreement that outlines project scope, payment provisions, and responsibilities to prevent disputes during and after the construction process.

Who should use this form

This form is intended for:

- Property owners in Alaska who need to contract with site work contractors.

- Contractors engaged in site preparation, excavation, and similar projects.

- Anyone involved in managing construction agreements who prefers detailed contracts tailored to specific projects.

Completing this form step by step

- Identify the parties involved: Enter the names and contact information of the contractor and property owner.

- Specify the work site: Clearly state the address of the property where the work will be performed.

- Outline the project scope: Describe the specific tasks and services to be performed under the contract.

- Detail payment arrangements: Indicate whether the payment will be a fixed price or cost plus, and include any late fees.

- Include signatures: Ensure both parties sign and date the contract to make it legally binding.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to specify the location of the work site accurately.

- Not detailing the scope of work, which can lead to disputes later.

- Neglecting to include payment terms or late fees in the agreement.

- Overlooking the need for permits and regulatory approvals.

- Not securing signatures from both parties before starting the project.

Why complete this form online

- Convenient access: Download and complete the form from anywhere at any time.

- Editability: Make changes easily based on your specific project needs.

- Legally reliable: The forms are drafted by licensed attorneys and compliant with Alaska law.

Looking for another form?

Form popularity

FAQ

When working as an independent contractor, your client does not have the right to control your project.According to the Communications Workers of America, Under the Copyright Act of 1976, an independent contractor who has created a work for an employer owns the rights to that work, except in limited circumstances.

There may be some factors suggesting a California worker is an employee and others suggesting he or she is an independent contractor. It is even possible that a worker can be considered an independent contractor for purposes of IRS tax filing, but they are considered an employee under California's wage and hours laws.

1. Not Having a Written Contract.The taxing, labor and employment, and insurance authorities expect a written contract that states that the worker is an independent contractor and will be paid as such with no tax withholding, no benefits, etc.

Contractors don't need employment laws to protect their contracting business from being mistreated by agencies and clients.Even when they are caught by IR35, which implies there is an employment relationship between the contractor and their client, contractors are unable to claim employment rights.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

While duration is only one factor among many that determines whether a worker is a contractor or an employee, six months is usually recommended as a safe duration and one-year should usually be considered an outside limit, assuming that the other independent contractor criteria are met.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

A: It is possible to transition an employee to a contactor if the worker truly meets the legal tests for independent contractor status.If the work is a core service of the nonprofit, it is less likely that the worker would have sufficient control over the work product to establish independent contractor status.

Both parties should sign the contract, and both should be bound by the terms and conditions spelled out in the agreement. In general that means the contractor will be obliged to provide specified materials and to perform certain services for you. In turn, you will be required to pay for those goods and that labor.