Wisconsin Warranty Deed from Husband and Wife to Corporation

Definition and meaning

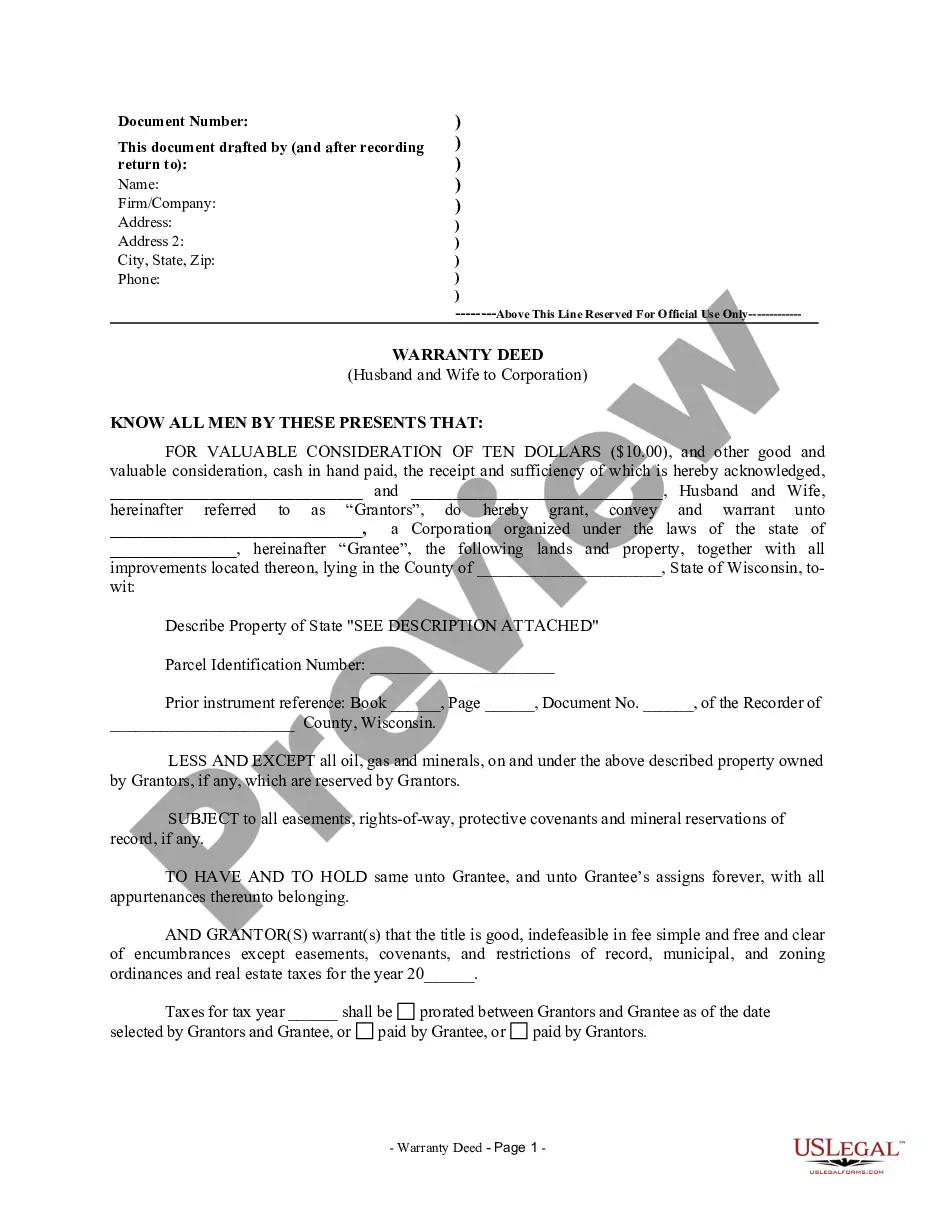

A Wisconsin Warranty Deed from Husband and Wife to Corporation is a legal document utilized to transfer ownership of real estate from a married couple to a corporate entity. This type of deed guarantees that the grantors (the husband and wife) have clear title to the property being transferred and provides certain assurances to the grantee (the corporation) regarding the property's condition and title. The deed is a formal acknowledgment of the transfer and is recorded in the county where the property is located.

How to complete a form

Completing the Wisconsin Warranty Deed involves several key steps:

- Identify the parties: Clearly state the names of the grantors (husband and wife) and the grantee (corporation).

- Legal descriptions: Accurately describe the property being transferred, including the parcel identification number and any prior instrument references.

- Consideration amount: Indicate the consideration being exchanged for the property, typically at least ten dollars.

- Conditions and subjects: Include any reserved rights or exceptions, such as mineral rights.

- Signatures and notarization: All parties must sign the document, and it needs to be notarized to be enforceable.

Who should use this form

This form is suitable for married couples who wish to transfer real property to a corporation, whether it's for business purposes or other reasons. It may be used in scenarios where couples are managing properties jointly held and aim to simplify ownership structures or when transitioning into corporate ownership for tax or liability considerations.

Legal use and context

The Wisconsin Warranty Deed from Husband and Wife to Corporation is recognized under Wisconsin state law and serves as a legal instrument to transfer property. This deed creates a binding record of the transaction, providing essential protections against future claims on the title. It is critical in ensuring that the new owners (the corporation) have the right to use, sell, or develop the property without disputes regarding ownership.

Key components of the form

The essential components of this warranty deed include:

- Grantor(s): Names and addresses of the husband and wife transferring the property.

- Grantee: Name and details of the corporation receiving the property.

- Property description: Legal description of the property, including parcel ID.

- Consideration: Monetary value exchanged for the property.

- Signatures: Signatures of the grantors along with a notary acknowledgment.

State-specific requirements

In Wisconsin, specific requirements must be followed when executing a Warranty Deed, including:

- Recording the deed with the county Register of Deeds office to ensure public notice of the property transfer.

- The deed must comply with Wisconsin Statutes governing property transfers.

- Notation of any easements, covenants, or restrictions that may impact the property.

What documents you may need alongside this one

When completing the Wisconsin Warranty Deed from Husband and Wife to Corporation, consider having the following documents on hand:

- Previous deed to establish the current ownership.

- Property title report to affirm that the title is clear of any liens.

- Corporate resolution or consent if the corporation needs board approval for the property acquisition.

Form popularity

FAQ

Key Takeaways. A property deed is a legal document that transfers the ownership of real estate from a seller to a buyer.General warranty deeds give the grantee the most protection, special warranty deeds give the grantee more limited protection, and a quitclaim deed gives the grantee the least protection under the law

As defined in section 706.10(5) of the Wisconsin Statutes, a warranty deed conveys real property in fee simple to the grantee and contains covenants by the grantor that he or she holds title to the property and has "good right to convey the same land or its title." The grantor guarantees that the property is "free from

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.

A warranty deed is a higher level of protection produced by the seller upon the real estate closing. It includes a full legal description of the property, and confirms the title is clear and free from all liens, encumbrances, or title defects. Most property sales make use of a warranty deed.Our title agents can help.

In a Non-Warranty Deed, the seller gives no warranties.In a Non-Warranty or Quitclaim Deed, the seller merely is giving the buyer whatever rights, if any, that the seller has in the property and the seller makes no warranties of any nature about the seller's rights in the property.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.