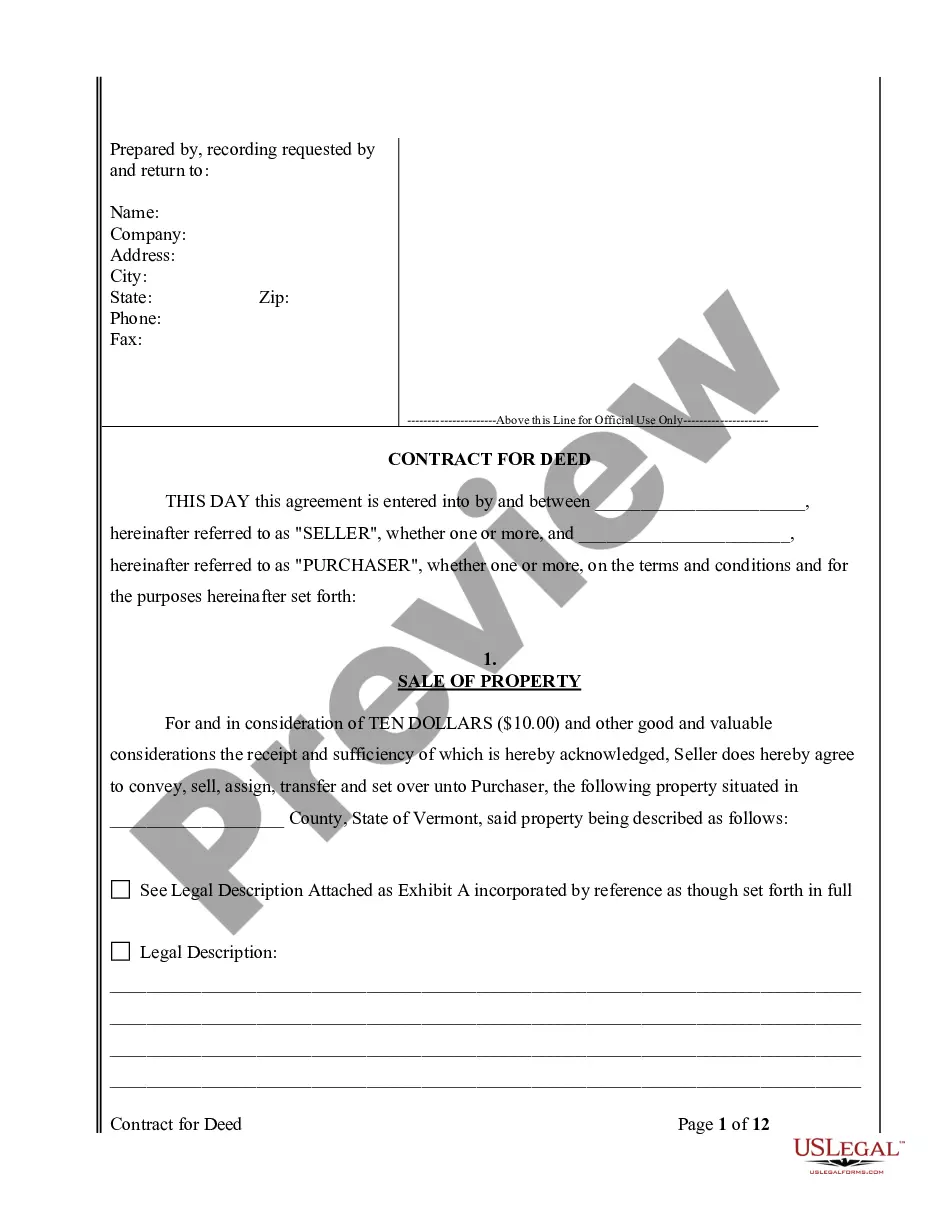

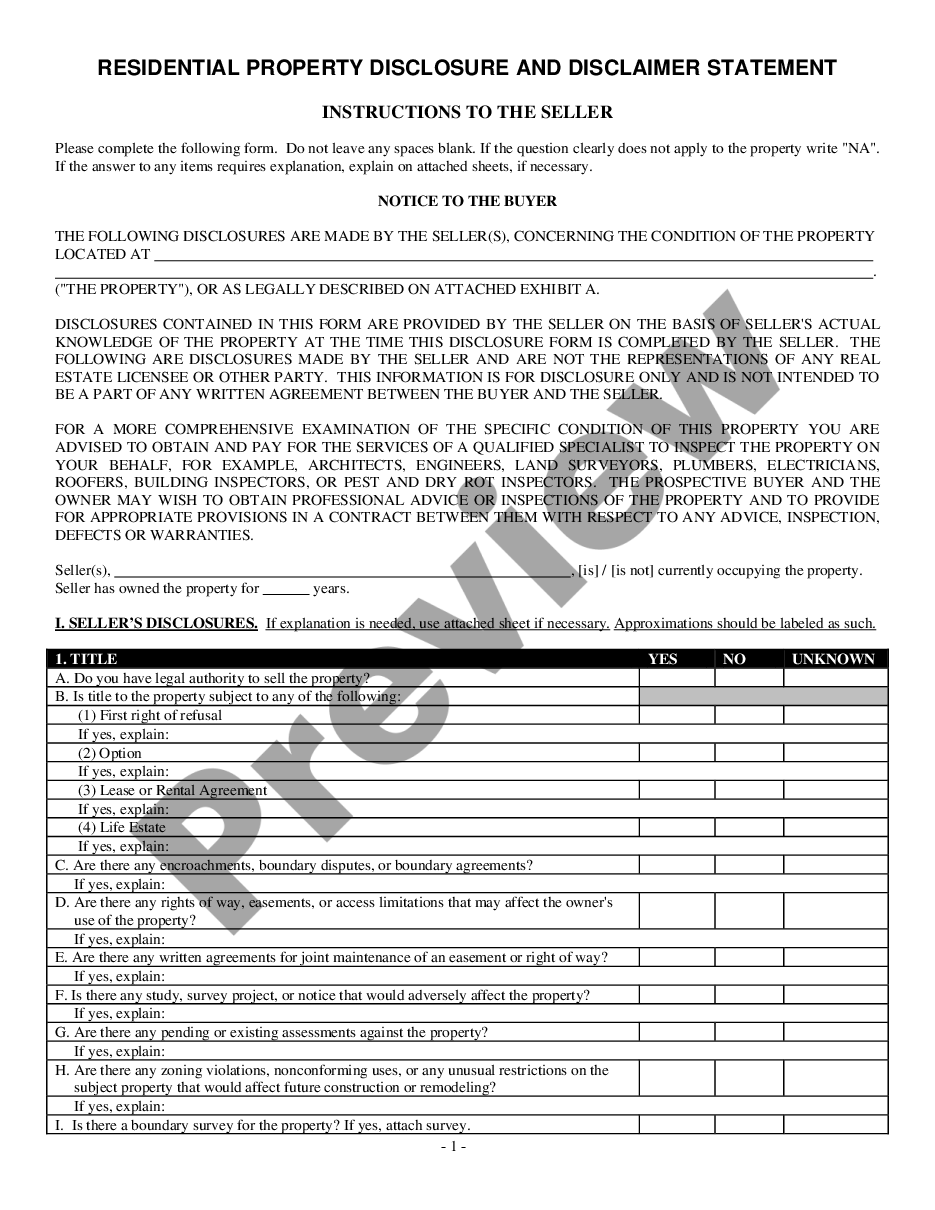

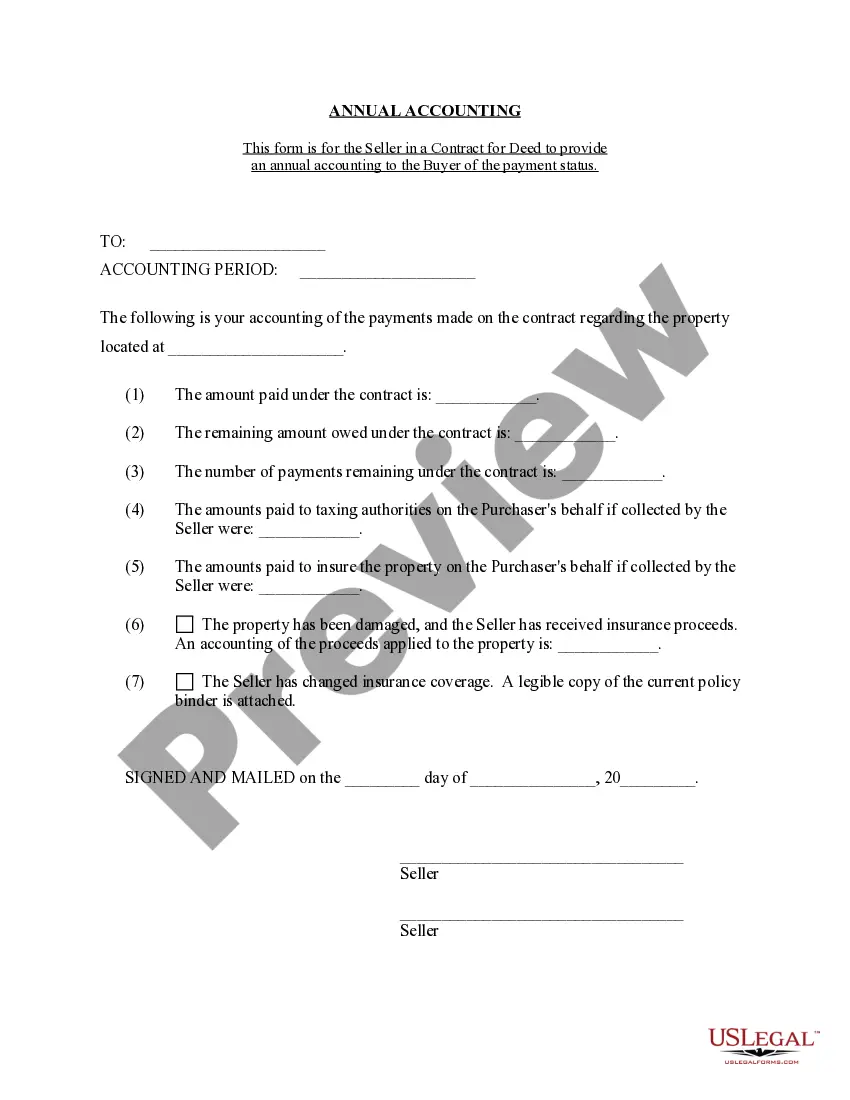

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Vermont Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Vermont Contract For Deed Seller's Annual Accounting Statement?

Use US Legal Forms to obtain a printable Vermont Contract for Deed Seller's Annual Accounting Statement. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most comprehensive Forms catalogue on the internet and offers cost-effective and accurate samples for customers and legal professionals, and SMBs. The documents are grouped into state-based categories and a number of them might be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For people who don’t have a subscription, follow the tips below to easily find and download Vermont Contract for Deed Seller's Annual Accounting Statement:

- Check to ensure that you get the right form in relation to the state it is needed in.

- Review the document by looking through the description and by using the Preview feature.

- Hit Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Vermont Contract for Deed Seller's Annual Accounting Statement. Over three million users already have used our service successfully. Choose your subscription plan and obtain high-quality forms in a few clicks.

Form popularity

FAQ

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

Loss of Service Control. A major disadvantage of contract management is that the organization gives up a considerable amount of control over the services that will be provided to customers. Potential Time Delays. Loss of Business Flexibility. Loss of Product Quality. Compliance and Legal Issues.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

'Contract by deed' is a deed of formal legal evidence that is signed, witnessed and delivered to create a legal obligation and for 'Simple contract' is a contract that are not deeds. They are informal contract that can make in many ways such as orally, writing, and conduct.

The Difference Between Renting to Own and a Contract for Deed. Renting to own usually means renting now, with an option to buy later.A contract for deed is very different. As soon as you sign the contract, you are the homeowner in every way, except you don't have the title yet.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

One of the biggest negatives that can occur with a land contract is when a buyer purchases a property on which the seller is still making mortgage payments.

A seller using a contract for deed doesn?t have that option, unless you agree to include that clause in your contract. Other benefits include: no loan qualifying, low or flexible down payment, favorable interest rates and flexible terms, and a quicker settlement.

One disadvantage of a contract for deed to the seller is that clearing the title may take time and money if the buyer defaults on the contract, according to Real Town. In addition, the seller can immediately foreclose on the property if the buyer defaults, and the buyer has no recourse against the seller.