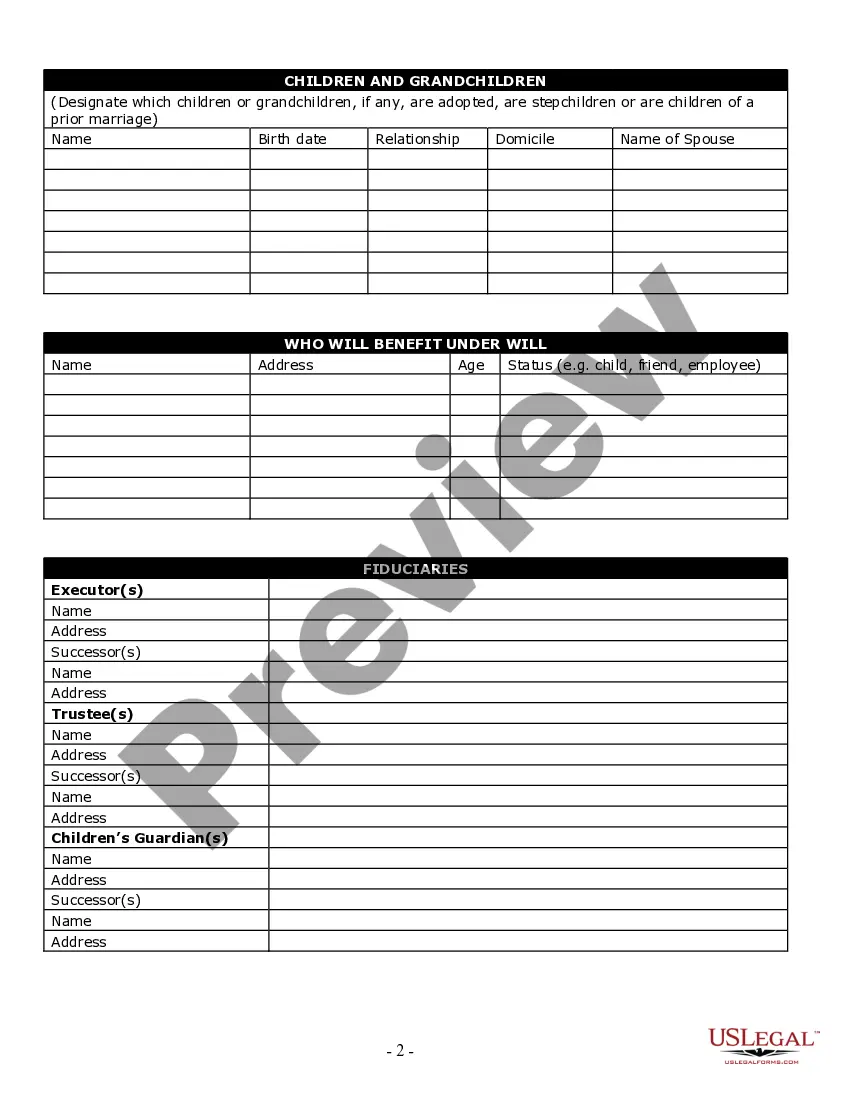

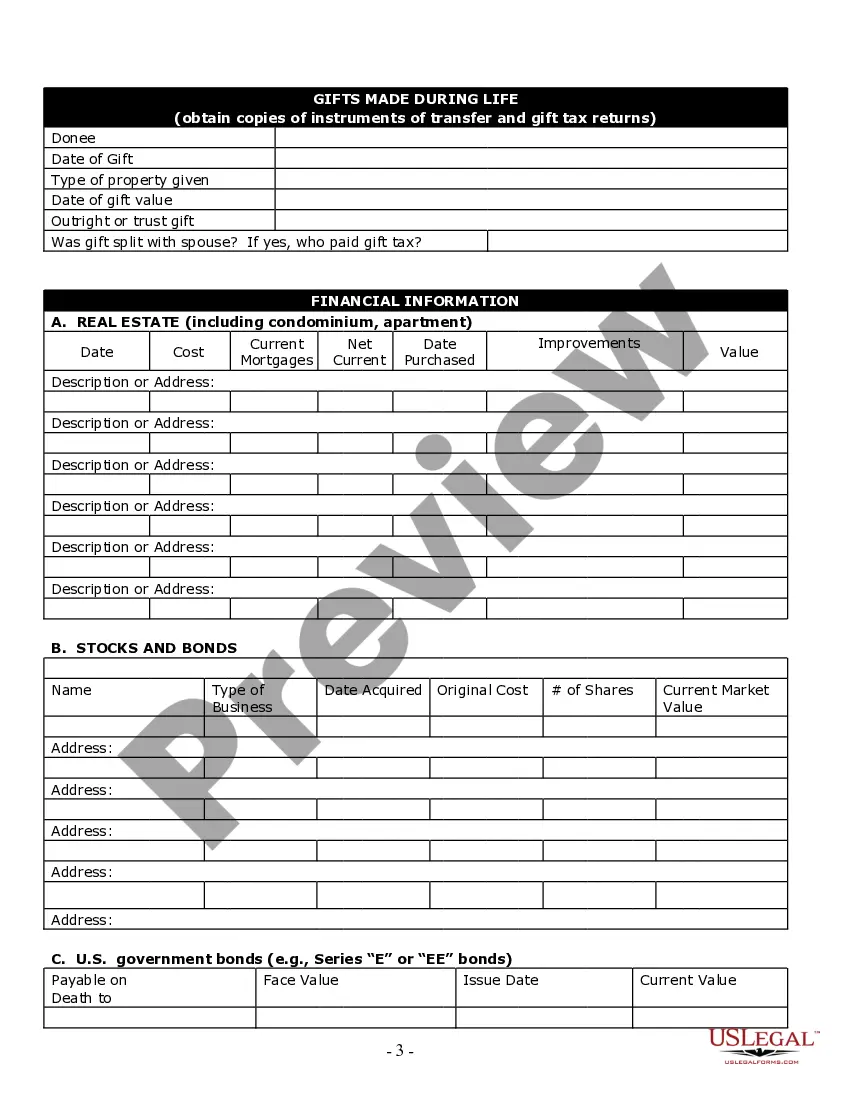

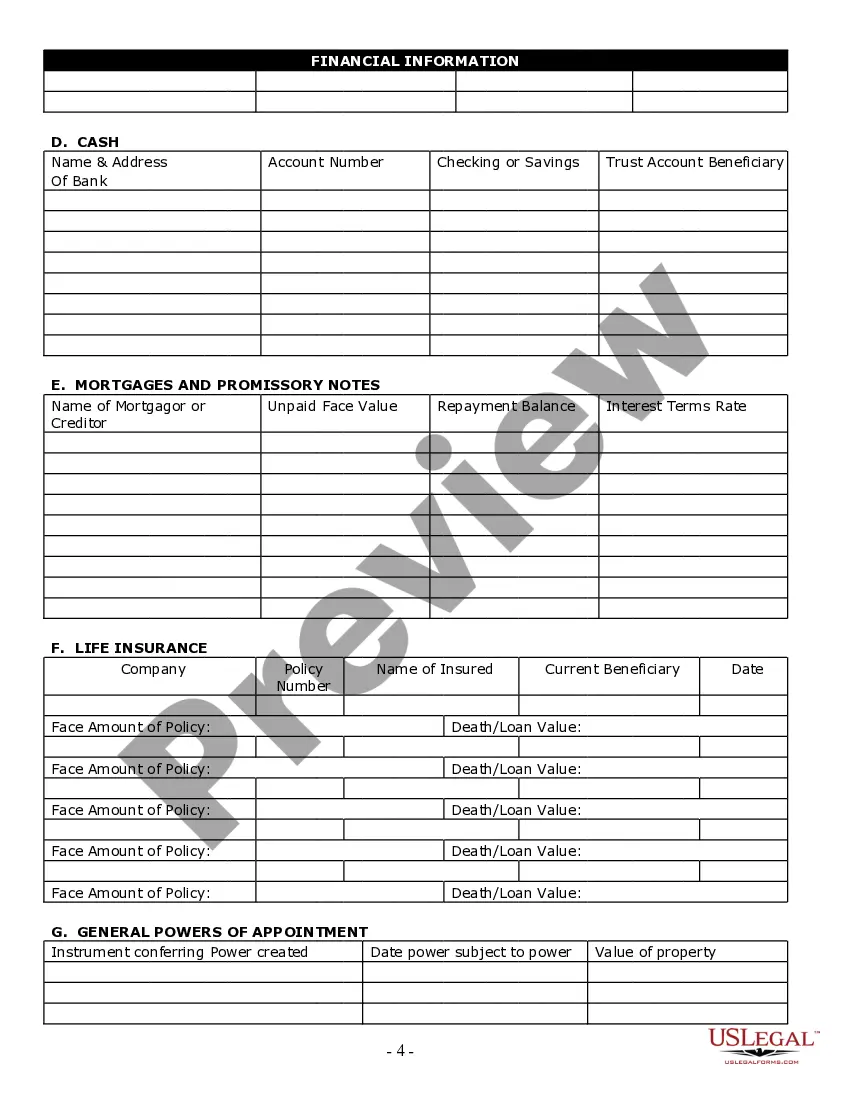

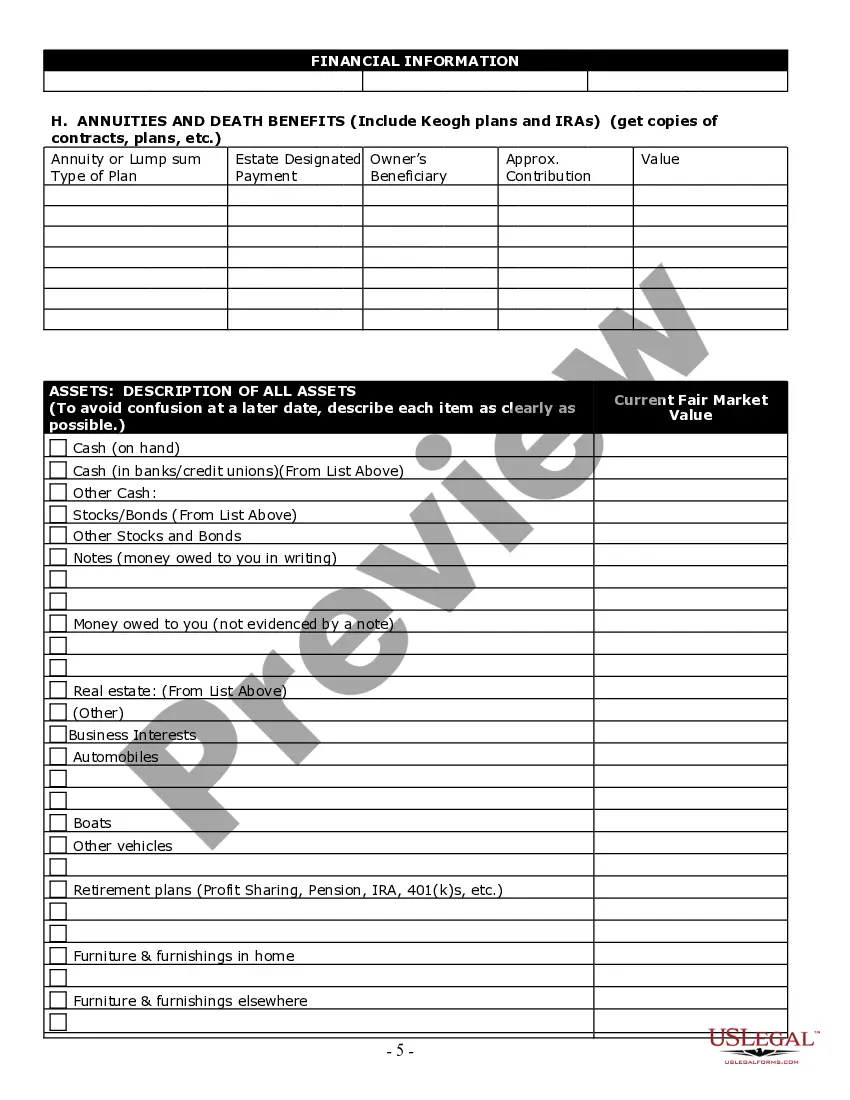

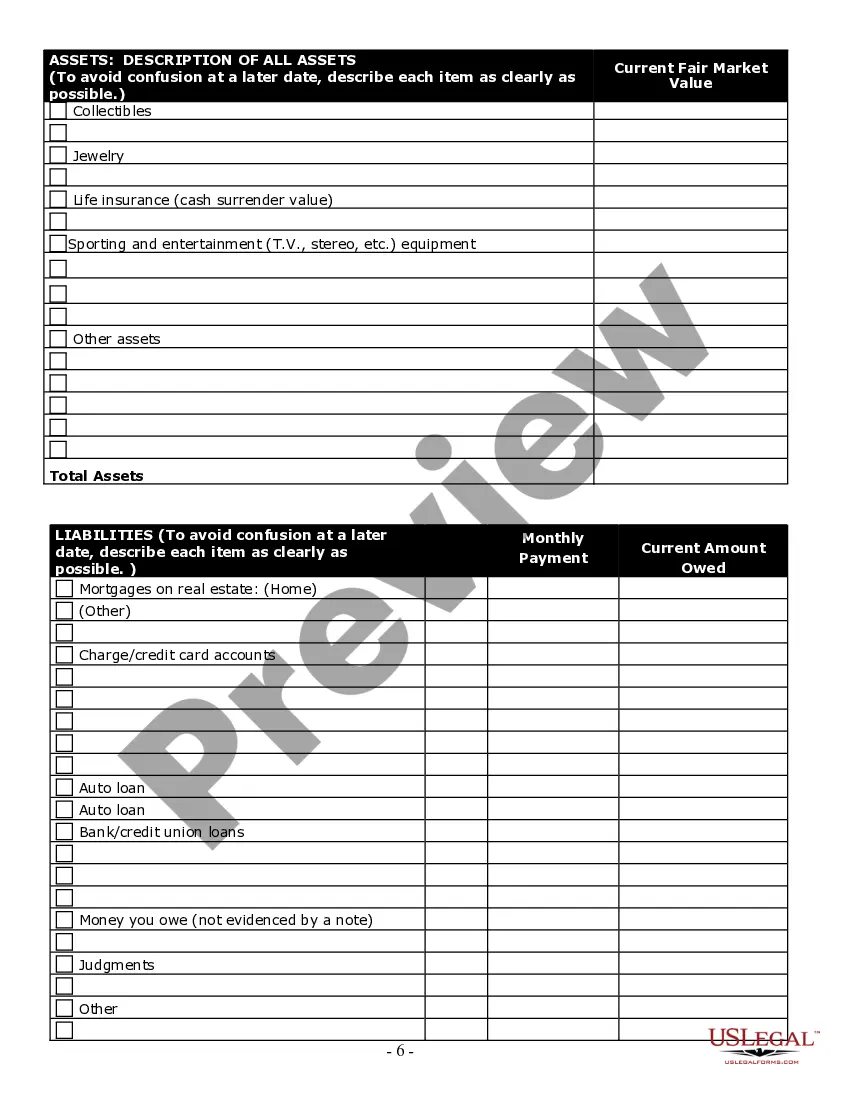

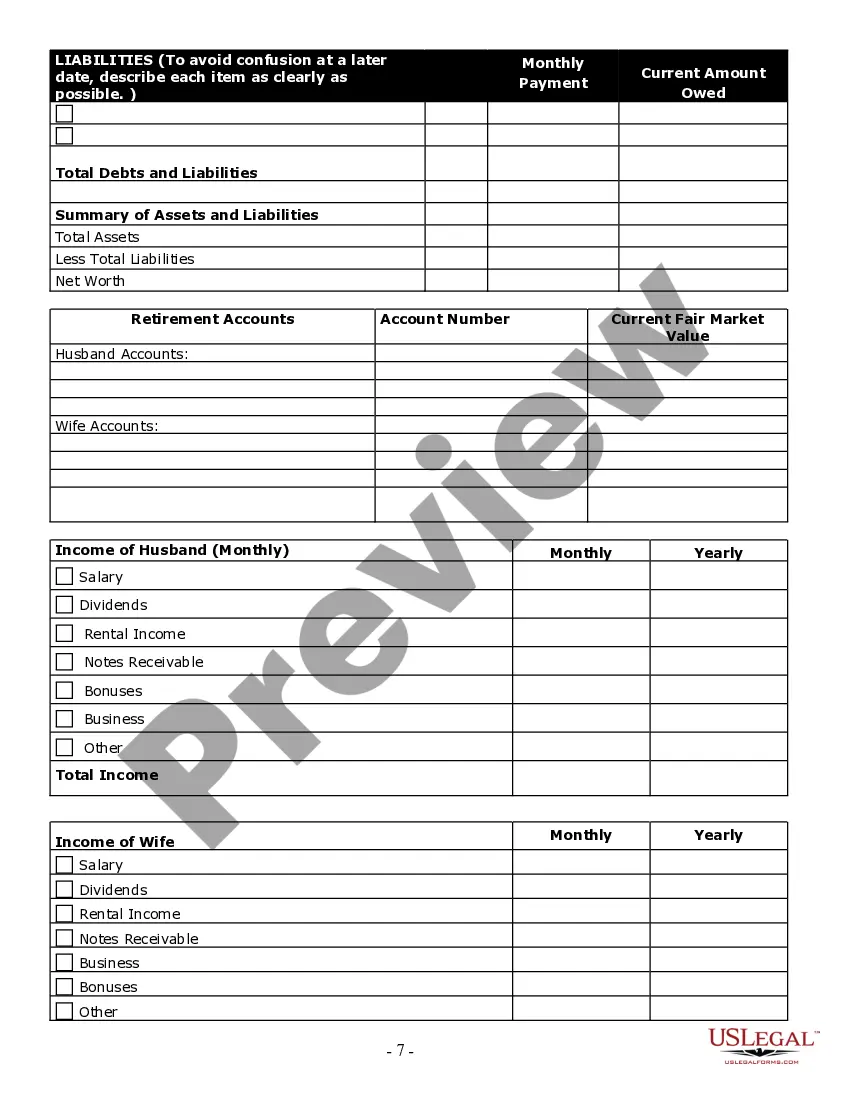

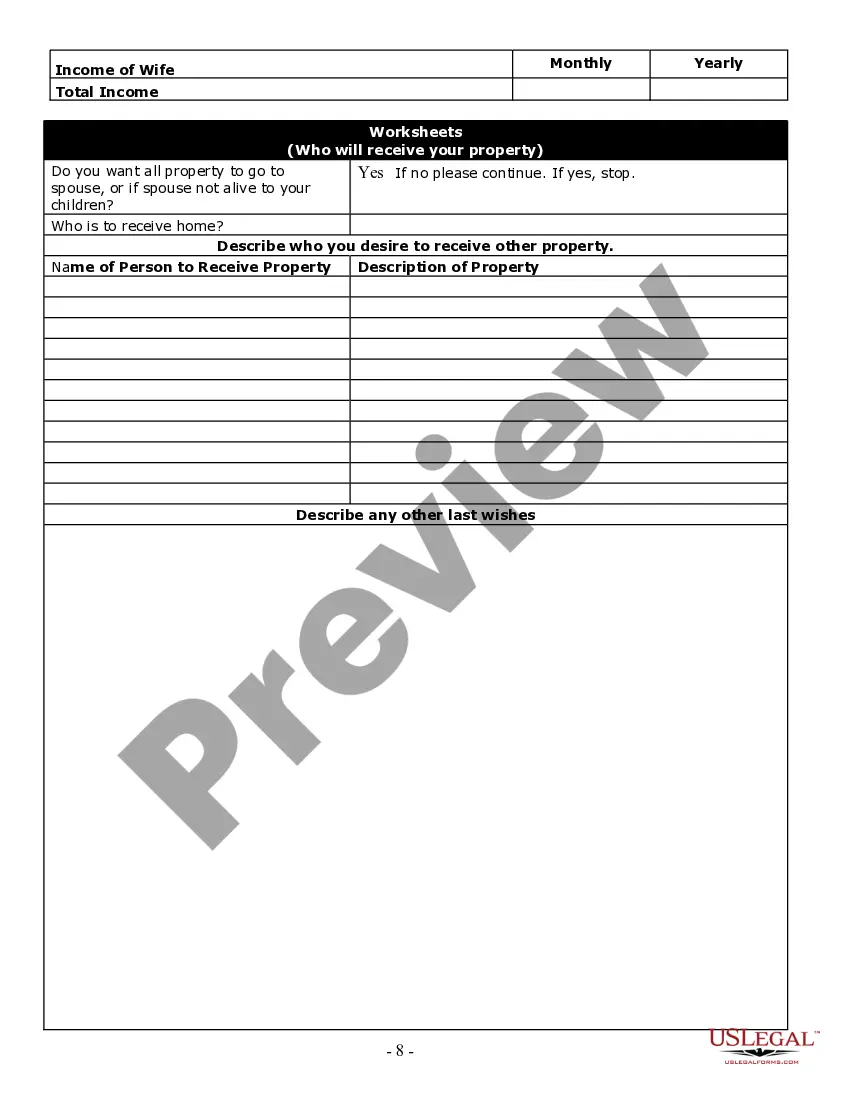

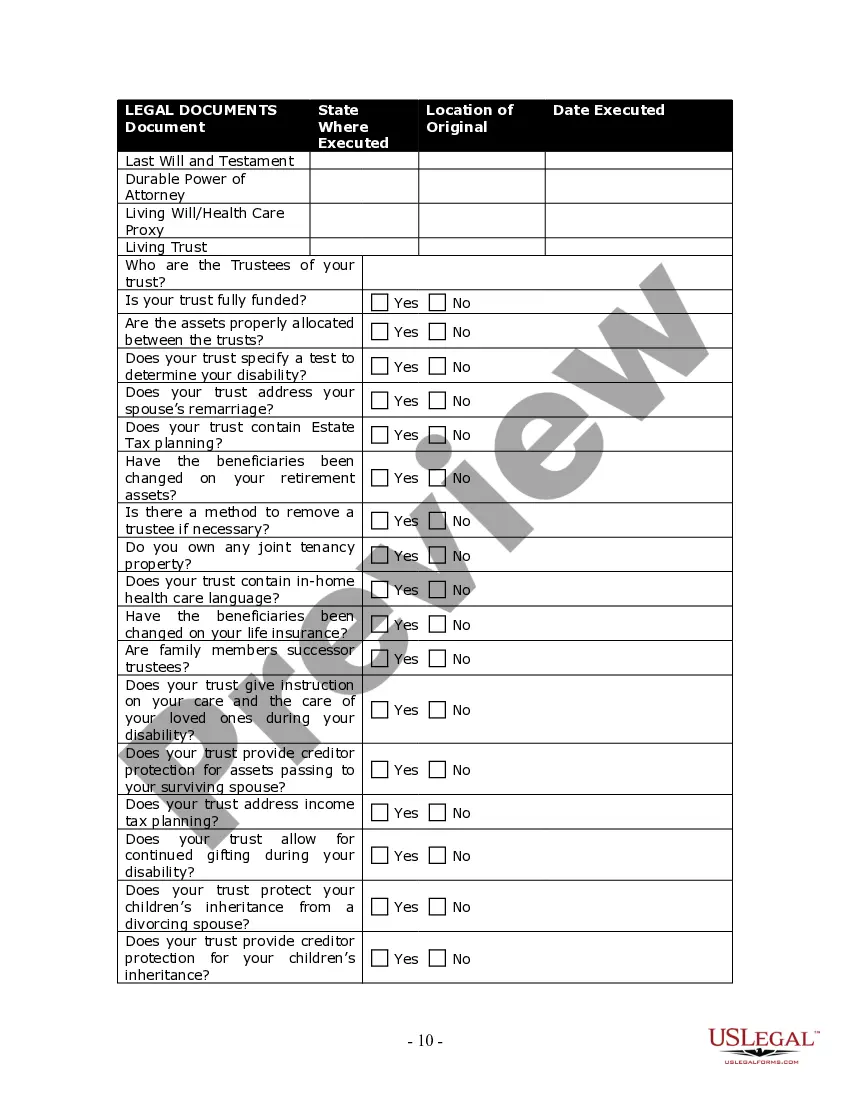

An Estate Planning Questionnaire is a document used by legal professionals to gather information about a person's estate. It is often completed by a person prior to meeting with an estate planning attorney. It is designed to provide the attorney with a comprehensive understanding of a person's assets, debts, and estate plan. The types of Estate Planning Questionnaires vary depending on a person's needs and their estate planning goals. Common questions include details about assets and debts, financial goals, tax considerations, powers of attorney, and other estate planning matters. Generally, the more detailed the questionnaire, the better the estate plan that the attorney can create. In addition to the traditional Estate Planning Questionnaire, there are also specialized questionnaires for special circumstances, such as those designed for business owners or those with large estates. These questionnaires provide more detailed information about the specific needs of these individuals.

Estate Planning Questionnaire

Description

How to fill out Estate Planning Questionnaire?

Dealing with legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Estate Planning Questionnaire template from our library, you can be certain it complies with federal and state regulations.

Dealing with our service is straightforward and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your Estate Planning Questionnaire within minutes:

- Remember to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Estate Planning Questionnaire in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Estate Planning Questionnaire you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Write a Will and Update Account Beneficiaries Simasko believes that a standard estate-planning toolbox should include a will, up-to-date beneficiary designations, a living will and a financial power of attorney, also known as a POA. A will is what people usually think of first for estate planning. The Essentials You Need for an Estate Plan Kiplinger kiplinger.com ? retirement ? the-essentials-y... kiplinger.com ? retirement ? the-essentials-y...

A will or trust should be one of the main components of every estate plan, even if you don't have substantial assets. Wills ensure property is distributed ing to an individual's wishes (if drafted ing to state laws). 6 Estate Planning Must-Haves - Investopedia investopedia.com ? estateplanchecklist investopedia.com ? estateplanchecklist

There are six important components to an estate plan. THE WILL. The first and well-known component of an estate plan is a will.TRUSTS.POWER OF ATTORNEY.HEALTH CARE DIRECTIVE.BENEFICIARY DESIGNATIONS.REGULAR REVIEW AND REVISION.

A: The three main priorities of an estate plan are to ensure that your assets are distributed in the way you prefer, that someone else has the authority to make decisions on your behalf if you are unable to do so, and that your beneficiaries are clearly defined.

Upon your death, the primary objectives are to wrap up your affairs, provide for the support of your spouse and children, avoid unnecessary probate expenses, minimize the costs of estate taxes, and to transfer your property to your heirs and legatees. Objectives of Estate Planning. chicagoestateplanning.com ? articles ? objectives-... chicagoestateplanning.com ? articles ? objectives-...

Estate planning checklist Create an inventory. Account for your family's needs. Establish your directives. Review your beneficiaries. Note your state's estate tax laws. Weigh the value of professional help. Plan to reassess.

A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.