Pursuant to 15 USC 1692g Sec. 809 (of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to them. This would be a situation where the original creditor had assigned the debt to the collection agency. Use this form letter requires that the agency verify that the debt is actually the alleged creditor and owed by the alleged debtor.

Letter Requesting a Collection Agency to Validate That You Owe Them a Debt

Description

Definition and meaning

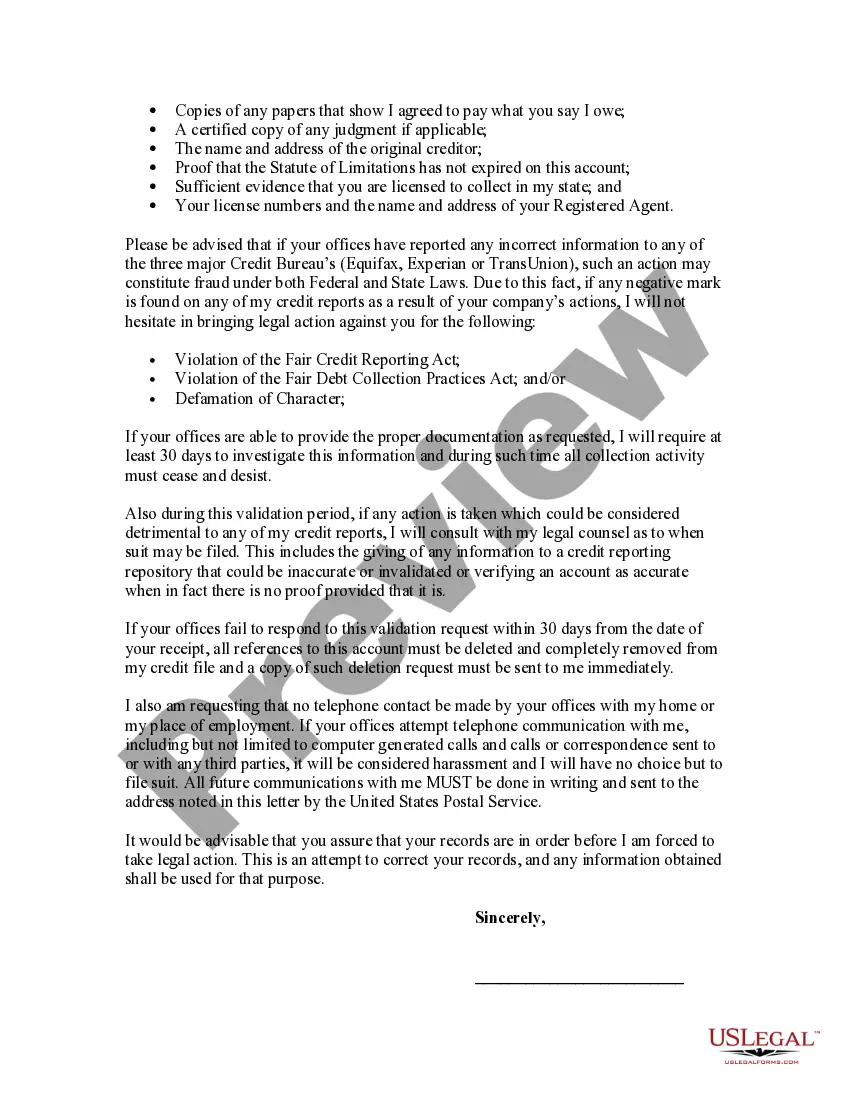

A Letter Requesting a Collection Agency to Validate That You Owe Them a Debt is a formal written request sent to a collection agency. This letter is used by individuals who wish to challenge the legitimacy of a debt claimed by the agency. The request is made under Section 809 of the Fair Debt Collection Practices Act (FDCPA), which ensures that consumers have the right to seek validation of the debt.

Key components of the form

This letter typically includes several key elements that serve to clearly communicate your request to the collection agency. Important components of the letter are:

- Your personal contact information.

- The date of the letter.

- The name and contact information of the collection agency.

- A reference to the alleged debt and case number.

- A list of validation requests, including details about the debt.

How to complete a form

To effectively complete the letter, follow these steps:

- Begin by filling in your name and address at the top of the letter.

- Include the date you are writing the letter.

- Write the collection agency's name and address.

- Clearly state your request for debt validation, including the relevant case number.

- List all the specific information you require from the agency as proof of the debt.

- Sign the letter, providing both your printed name and signature.

Common mistakes to avoid when using this form

When writing a letter requesting validation from a collection agency, be cautious of the following mistakes:

- Failing to include all required personal information.

- Not specifying the debt in question or the case number.

- Making vague requests or not clearly stating your need for validation.

- Sending the letter without a return receipt to confirm its delivery.

How to fill out Letter Requesting A Collection Agency To Validate That You Owe Them A Debt?

When it comes to drafting a legal form, it is easier to leave it to the professionals. Nevertheless, that doesn't mean you yourself can’t find a sample to utilize. That doesn't mean you yourself can’t get a template to use, however. Download Letter Requesting a Collection Agency to Validate That You Owe Them a Debt straight from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. Once you are signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve provided an 8-step how-to guide for finding and downloading Letter Requesting a Collection Agency to Validate That You Owe Them a Debt quickly:

- Be sure the form meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Click Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Choose a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

When the Letter Requesting a Collection Agency to Validate That You Owe Them a Debt is downloaded you may fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

For the name and contact information of the original creditor. why the collector believes you own the debt in the first place. for a record of all owners of the debt. the amount and age of the debt (including an account number if you're able). under what authority the collector has to collect.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

It's a violation of the collection practices act for a debt collector to refuse to send a validation notice or fail to respond to your verification letter. If you encounter such behavior, you can file a complaint with the Consumer Financial Protection Bureau.

This is not a good time. Please call back at 6. I don't believe I owe this debt. Can you send information on it? I prefer to pay the original creditor. Give me your address so I can send you a cease and desist letter. My employer does not allow me to take these calls at work.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request that the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

If the collector completely fails to respond to the validation letter, again they have 30 days to do so, then legally they must cease collection efforts, and remove negative items placed by them on your credit report.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or longer. Instructions on how to pay the debt.