Conspiracy to Defraud the Government With Respect to Claims is a type of federal fraud crime in which two or more people conspire to submit false or fraudulent claims for payment from the U.S. government or its agencies. It can also include submitting false information in order to secure a payment, or for the purpose of avoiding a payment. It is a serious crime that can result in jail time, fines, and other punishments. There are several types of Conspiracy to Defraud the Government With Respect to Claims, including: • Falsifying or altering documents: This type of fraud involves submitting false documents or altering existing documents in order to receive payment from the government. • Making false statements: Making false statements in order to receive payment from the government is a form of fraud. • Submitting false claims: Submitting false claims for payment from the government is a form of fraud. • Misrepresenting goods or services: Misrepresenting the quality or type of goods or services provided to the government is a form of fraud. • Overcharging the government: Charging the government more than the agreed upon price for goods or services is a form of fraud. • Making false certifications: Making false certifications to the government about products or services provided is a form of fraud.

Conspiracy to Defraud the Government With respect to Claims

Description

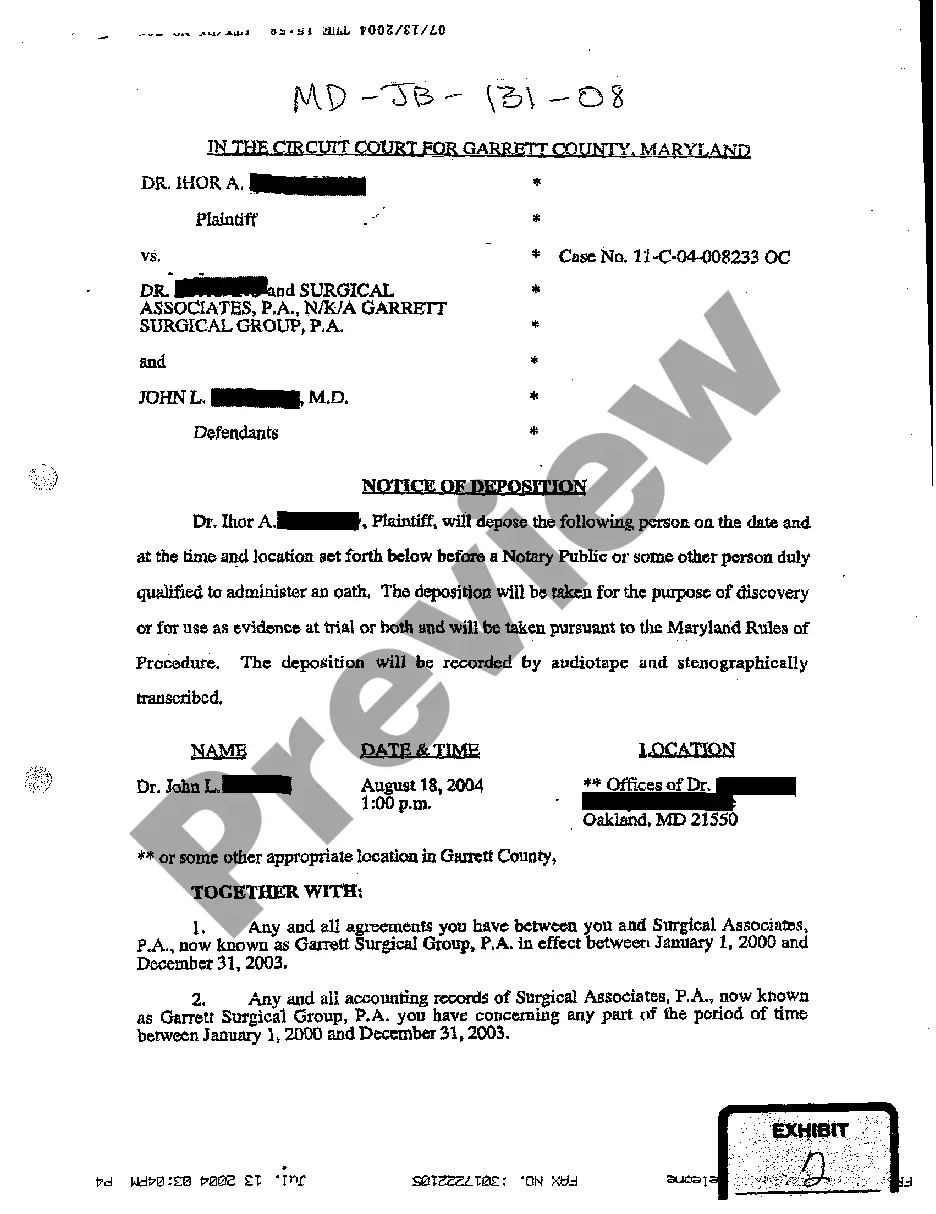

How to fill out Conspiracy To Defraud The Government With Respect To Claims?

US Legal Forms is the most easy and affordable way to find suitable legal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable blanks that comply with federal and local laws - just like your Conspiracy to Defraud the Government With respect to Claims.

Obtaining your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Conspiracy to Defraud the Government With respect to Claims if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one meeting your requirements, or locate another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Create an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Conspiracy to Defraud the Government With respect to Claims and download it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reputable assistant in obtaining the required official documentation. Give it a try!

Form popularity

FAQ

What is an example of a conspiracy charge? An example of a conspiracy charge could be two people that make an agreement to kill someone and buy the weapons to do it. They are charged with conspiracy, even if they never fully follow through on killing the person.

The maximum penalty for major fraud against the government in violation of 18 U.S.C. Section 1031 is 10 years' incarceration and/or a fine of up to $1,000,000.00. The maximum penalty for violations of 18 U.S.C. Section 287, the false claims statute, is 5 years in prison and/or a fine.

That's something to keep in mind when you're wondering what is the penalty for tax evasion. For fraud and tax evasion, the tax law dictates that if you're convicted, you may be fined up to $100,000 and sent to jail for up to five years. The maximum fine for corporations is $500,000.

If, for example, you conspire with others to commit tax evasion or refund fraud, and any member of the group takes a step to carry out those crimes, you may be charged with conspiracy as well as with the underlying crimes. Conspiracies to defraud the IRS are prosecuted under the federal conspiracy statute (18 U.S.C.

The general Conspiracy statute provides a maximum punishment of not more than five (5) years, as well as a fine up to $250,000.00 for a felony offense. For a misdemeanor offense, the maximum punishment cannot exceed the maximum possible punishment for the misdemeanor. M.

To conspire to defraud the United States means primarily to cheat the Government out of property or money, but it also means to interfere with or obstruct one of its lawful governmental functions by deceit, craft or trickery, or at least by means that are dishonest.

What Are Some Common Conspiracy Crimes? Racketeering (RICO); Drug trafficking, Money laundering, Counterfeiting, Healthcare fraud, Wire fraud, Mail fraud, Bank fraud,