Sample Letter regarding Discharge of Debtor

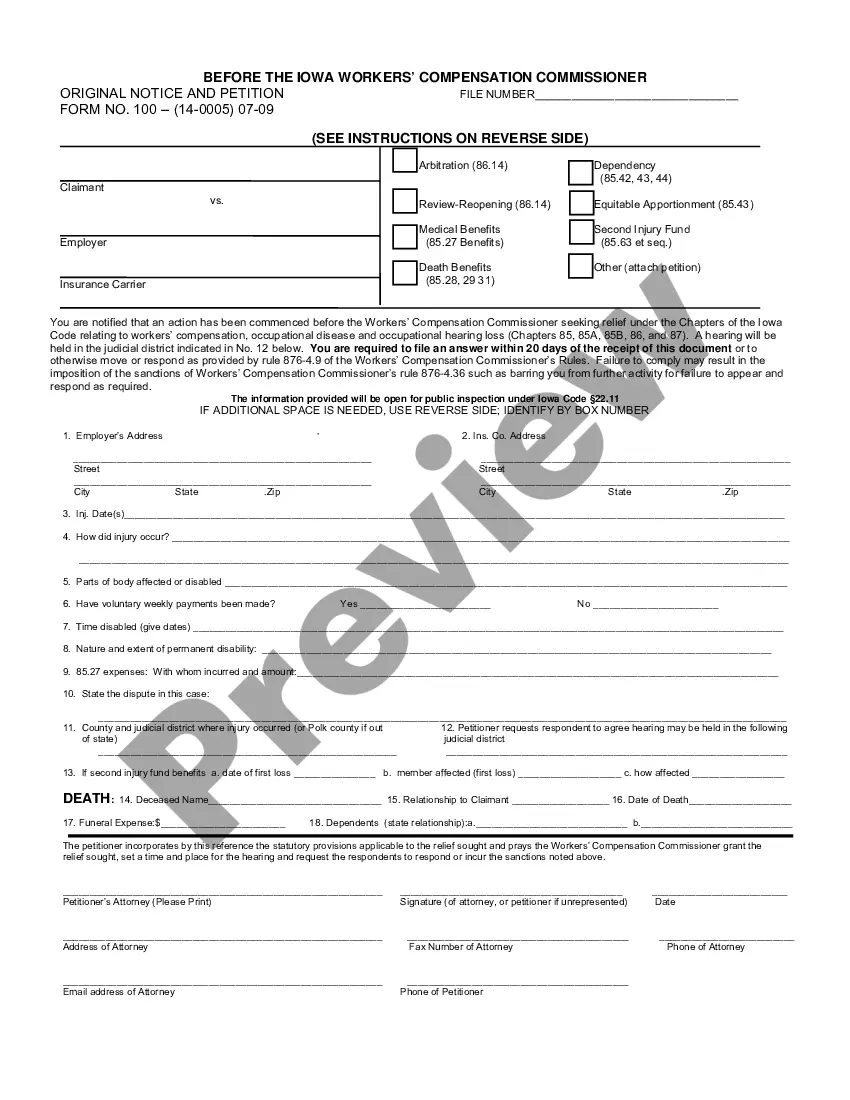

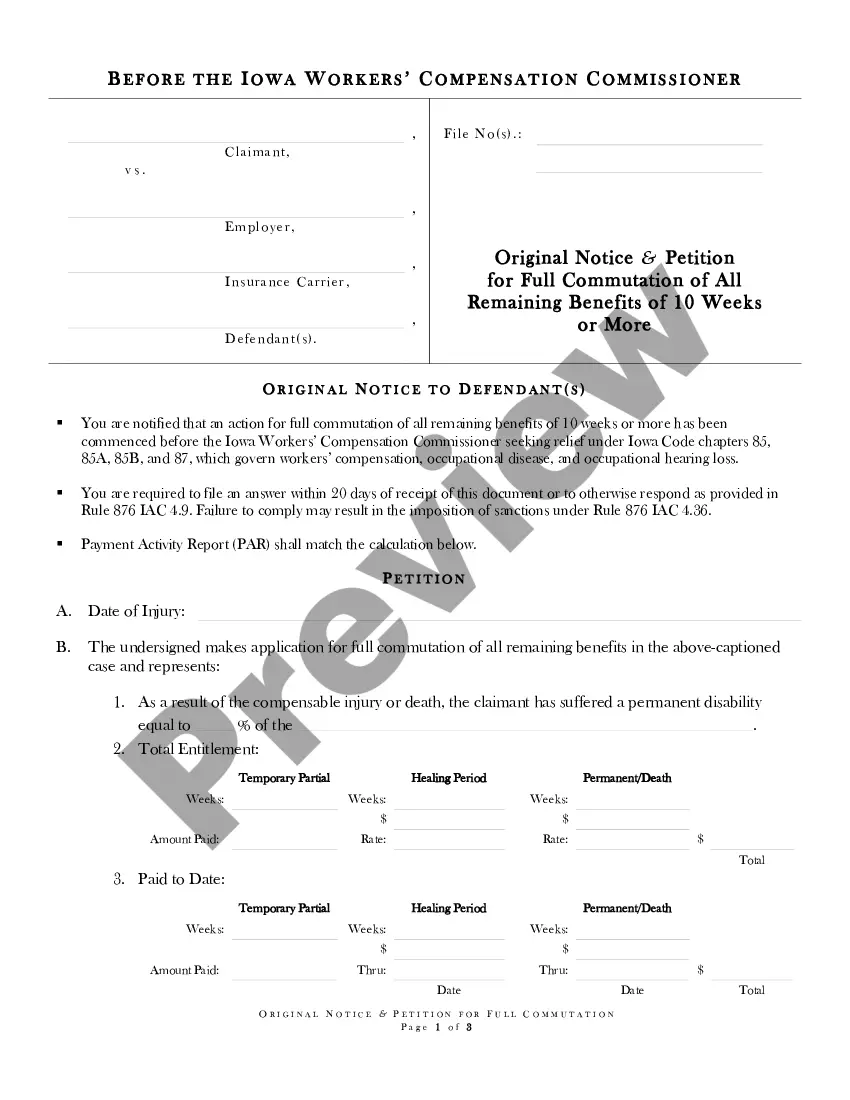

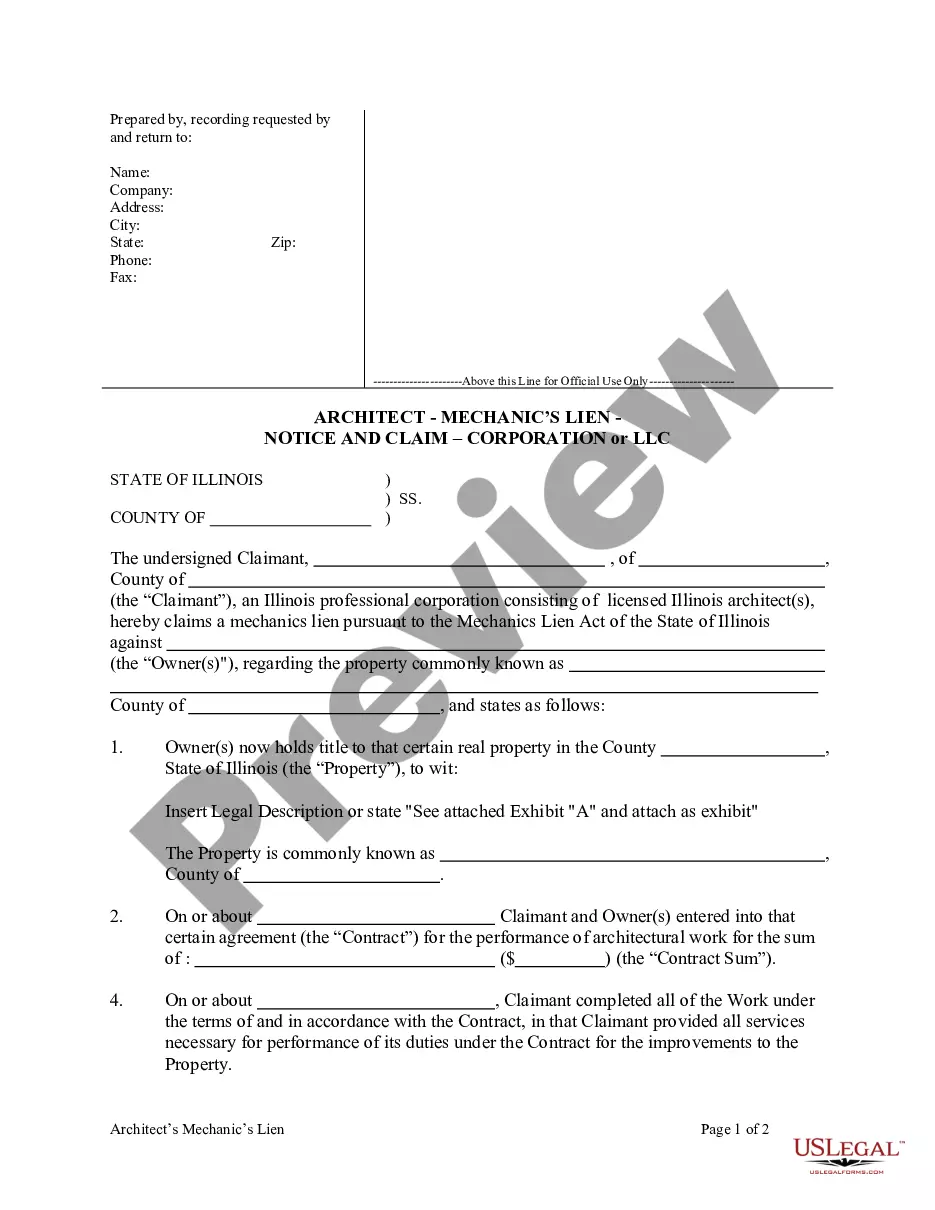

Description

How to fill out Sample Letter Regarding Discharge Of Debtor?

Use US Legal Forms to obtain a printable Sample Letter regarding Discharge of Debtor. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms catalogue online and offers cost-effective and accurate samples for consumers and legal professionals, and SMBs. The documents are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the following guidelines to easily find and download Sample Letter regarding Discharge of Debtor:

- Check to ensure that you have the proper template in relation to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Hit Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you need to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Sample Letter regarding Discharge of Debtor. Over three million users have already utilized our service successfully. Choose your subscription plan and obtain high-quality documents in a few clicks.

Form popularity

FAQ

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. You can use this sample dispute letter (PDF) as a model. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt.

Once filed, a Chapter 7 bankruptcy typically takes about 4 - 6 months to complete. The bankruptcy discharge is granted 3 - 4 months after filing in most cases. Written by Attorney Andrea Wimmer. Most Chapter 7 bankruptcy cases take between 4 - 6 months to complete after filing the case with the court.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request that the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

A discharge releases a debtor from personal liability of certain debts known as dischargeable debts, and prevents the creditors owed those debts from taking any action against the debtor or the debtor's property to collect the debts.

When writing the letter, it is crucial to use a simple and professional language. Do not be harsh or threat the debtor in your letter as it can turn the tables against you. The letter should be addressed to the debtor's home address or any other address that the debtor has provided before.

For most filers, a Chapter 7 case will end when you receive your dischargethe order that forgives qualified debtabout four to six months after filing the bankruptcy paperwork.Your case will close after the trustee sells the assets, pays out the funds, and files a report with the court.

A bankruptcy discharge, also known as a discharge in bankruptcy, refers to a permanent court order that releases a debtor from personal liability for certain types of debts. It is sometimes referred to simply as a discharge and comes at the end of a bankruptcy.

The Chapter 7 Discharge. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor.

The name 623 dispute method refers to section 623 of the Fair Credit Reporting Act (FCRA). The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the credit bureau and completed their process.