Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

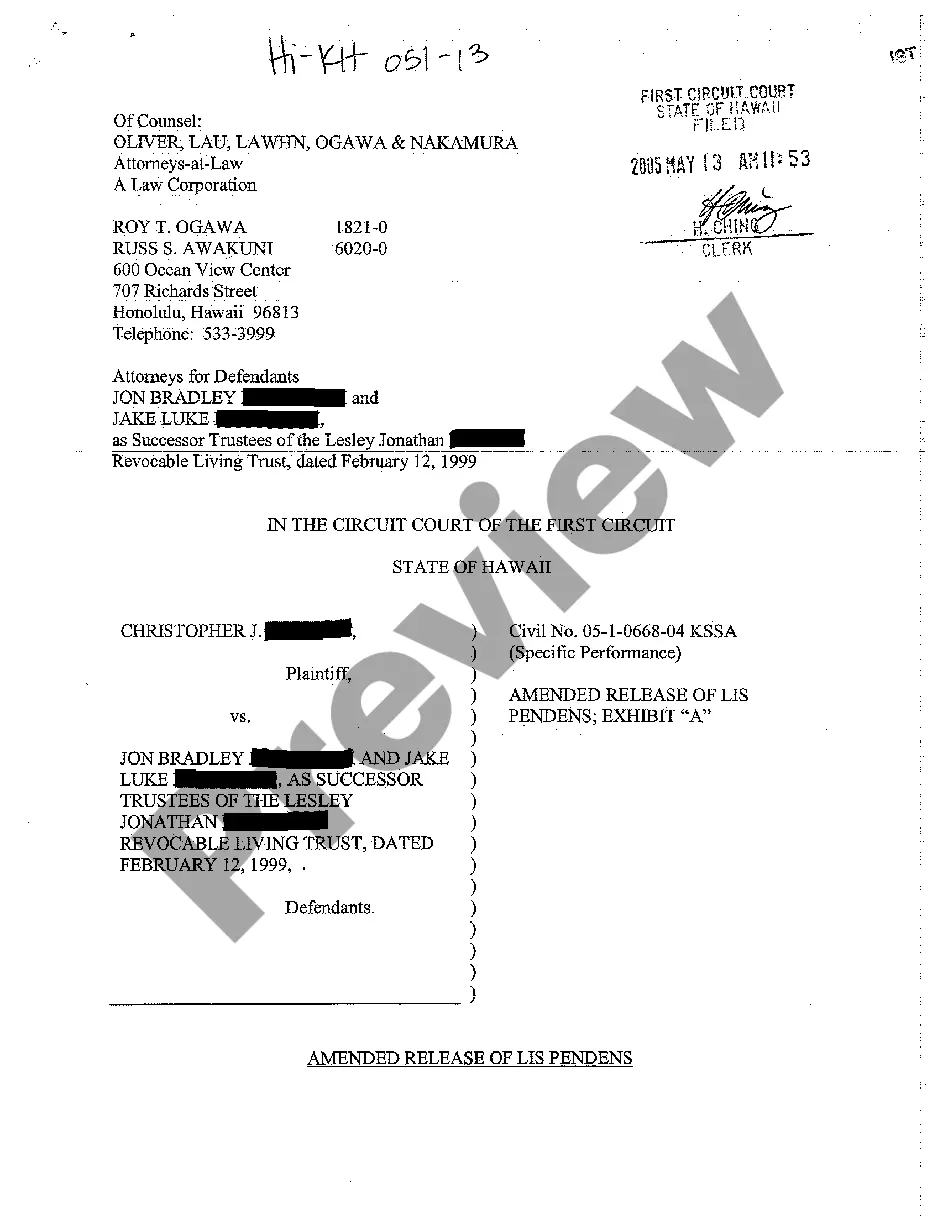

Use US Legal Forms to get a printable Sample Letter regarding Information for Foreclosures and Bankruptcies. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms library on the web and provides affordable and accurate samples for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and many of them can be previewed prior to being downloaded.

To download samples, users must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to easily find and download Sample Letter regarding Information for Foreclosures and Bankruptcies:

- Check to make sure you get the correct form with regards to the state it’s needed in.

- Review the document by looking through the description and using the Preview feature.

- Press Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Sample Letter regarding Information for Foreclosures and Bankruptcies. More than three million users have already utilized our platform successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

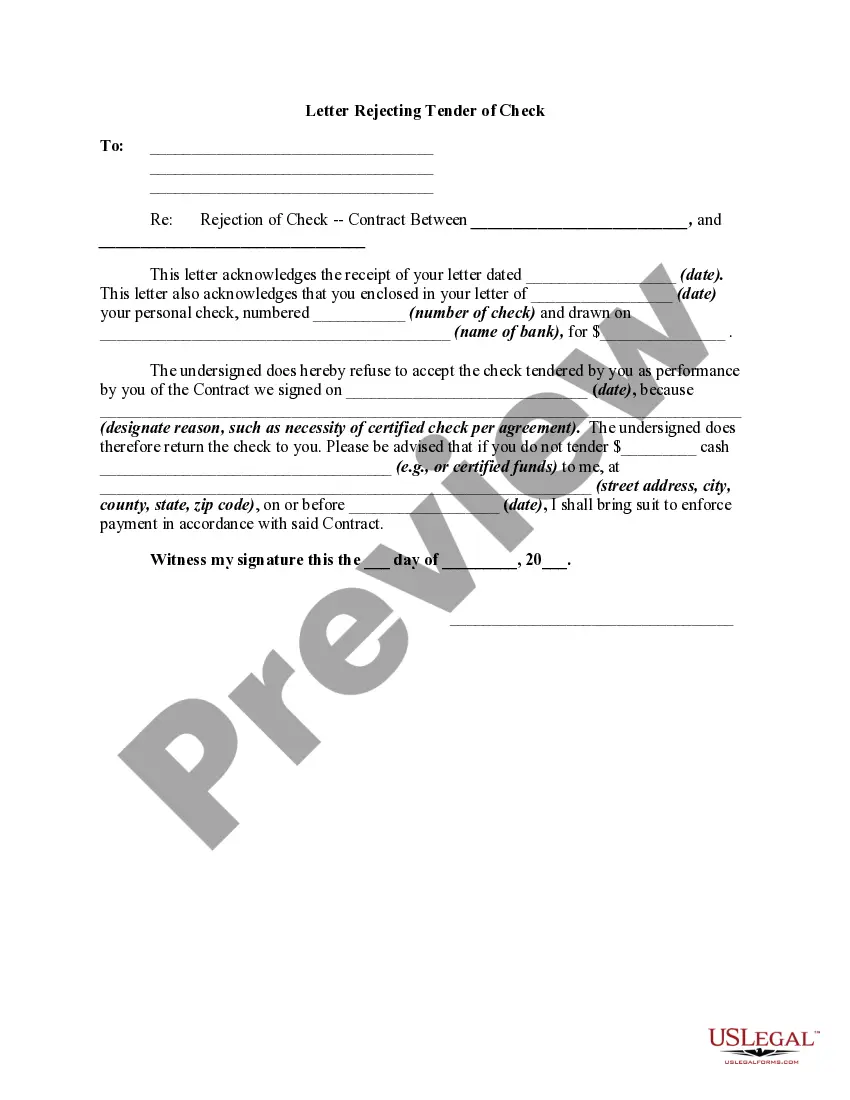

Facts. Include all the details with correct dates and dollar amounts. Resolution. Explain how and when the situation was resolved. Acknowledge. It's important that the letter outline why the problem won't arise again.

Hardship Examples. There are a variety of situations that may qualify as a hardship. Keep it original. Be honest. Keep it concise. Don't cast blame or shirk responsibility. Don't use jargon or fancy words. Keep your objectives in mind. Provide the creditor an action plan.

Include your name, property address, and mortgage account number. o Use the name that is on your mortgage and include your spouse or other co- borrower if they are on the mortgage. Do not write your letter on your payment coupon or other payment form you get from your servicer. Send the letter to the proper address.

Begin the letter with the date, a salutation, and an introduction of the incident or issue. Provide a short but detailed description without having to add unnecessary terms and phrases. Provide an explanation of the steps you've taken to rectify the error or to complete the missing information.

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank-you in advance for your understanding of my situation.

Adjusting Entry for Debt Forgiveness When a debt is cancelled or forgiven, an adjusting entry must be made on the company books to reflect the cancellation as income. It is usually done by debiting (reducing) debts payable on the balance sheet and crediting (increasing) an income entry on the profit and loss statement.

Due to these reasons, I respectfully request that you forgive my alleged debt as my financial status doesn't support the debt repayment. I have attached my medical bills and proof of accident as evidence to my claims. Please respond to my letter through my Address at your earliest convenience.

Your letter should start with an introduction of who you are and what kind of loan you are applying for. Lead into your story with something like "We want to explain our foreclosure from six years ago." Then, launch right into the details that led you to lose your home. This is not the time to be shy or modest.