Demand Letter - Repayment of Promissory Note

Description

How to fill out Demand Letter - Repayment Of Promissory Note?

Use US Legal Forms to get a printable Demand Letter - Repayment of Promissory Note. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms library on the internet and provides reasonably priced and accurate samples for customers and attorneys, and SMBs. The templates are categorized into state-based categories and a number of them might be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For those who don’t have a subscription, follow the tips below to easily find and download Demand Letter - Repayment of Promissory Note:

- Check out to ensure that you get the correct form with regards to the state it’s needed in.

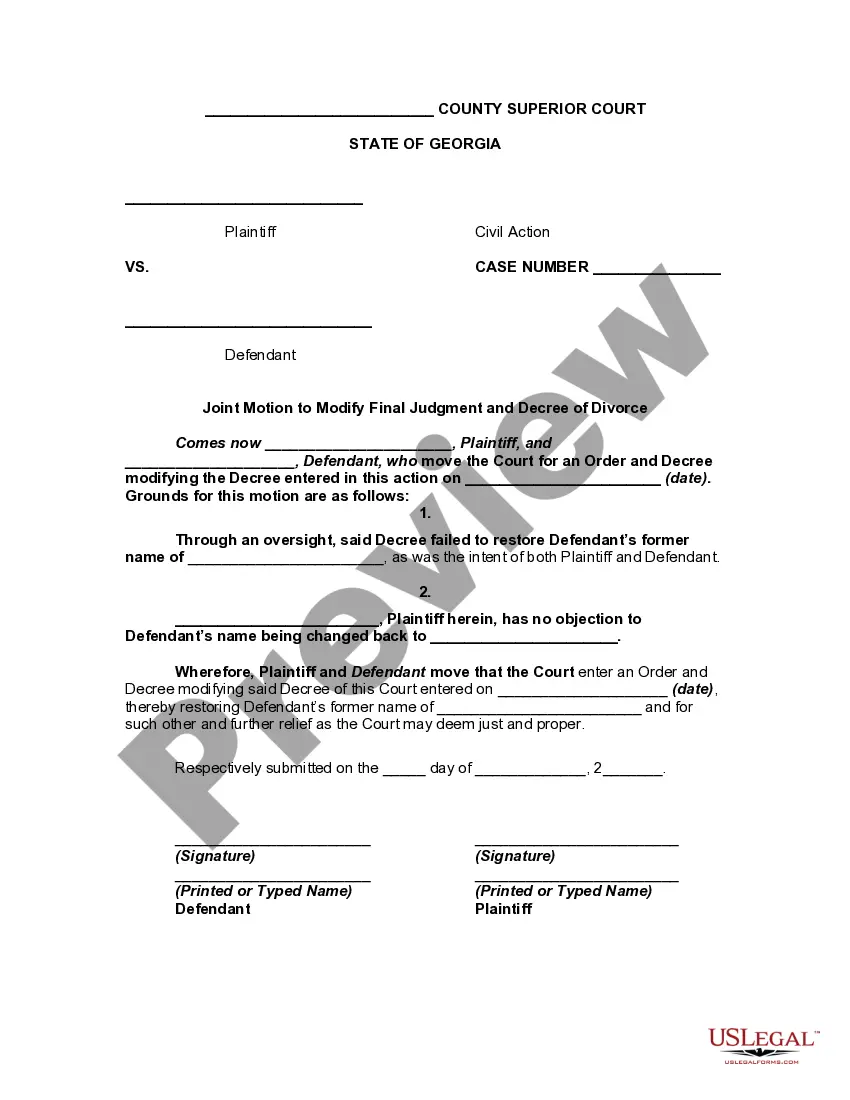

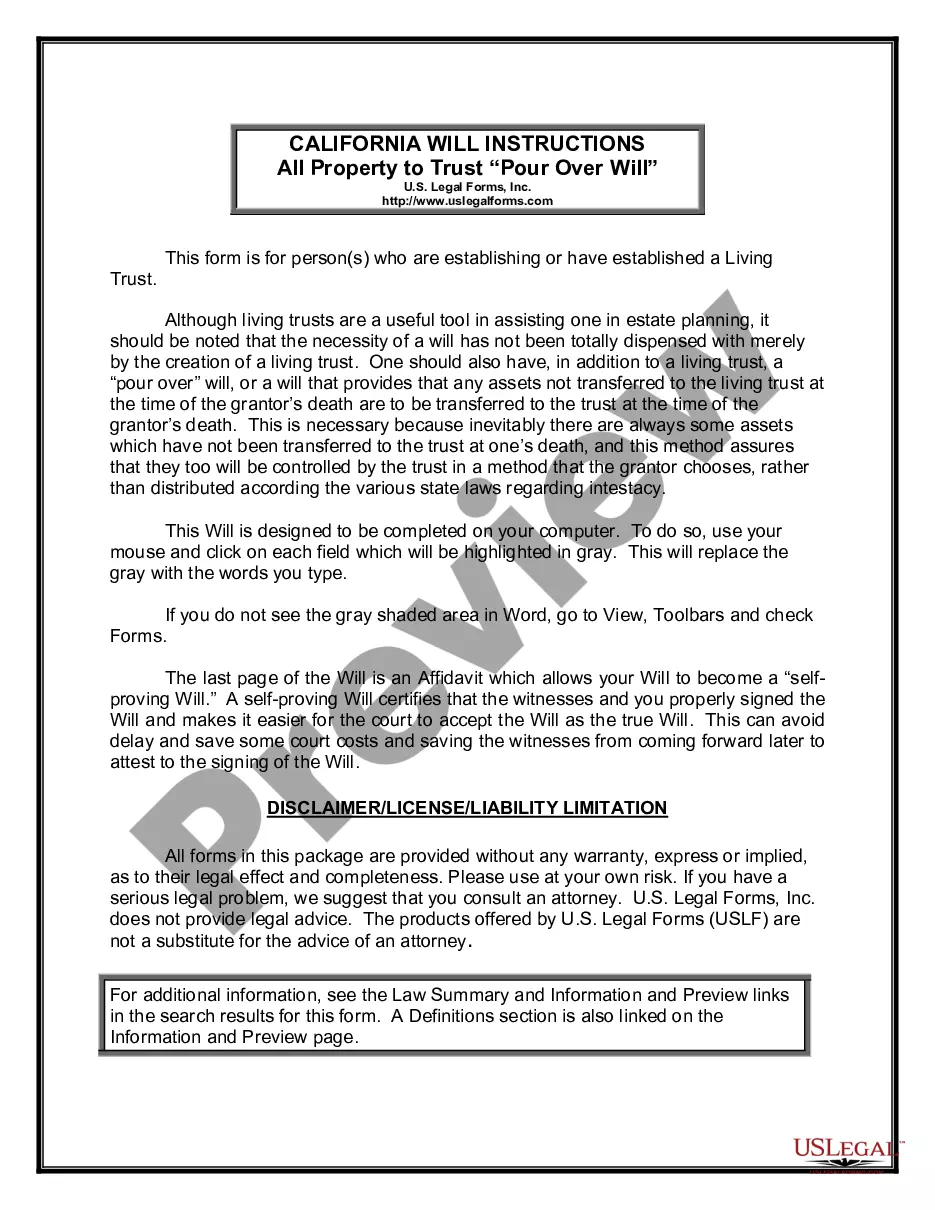

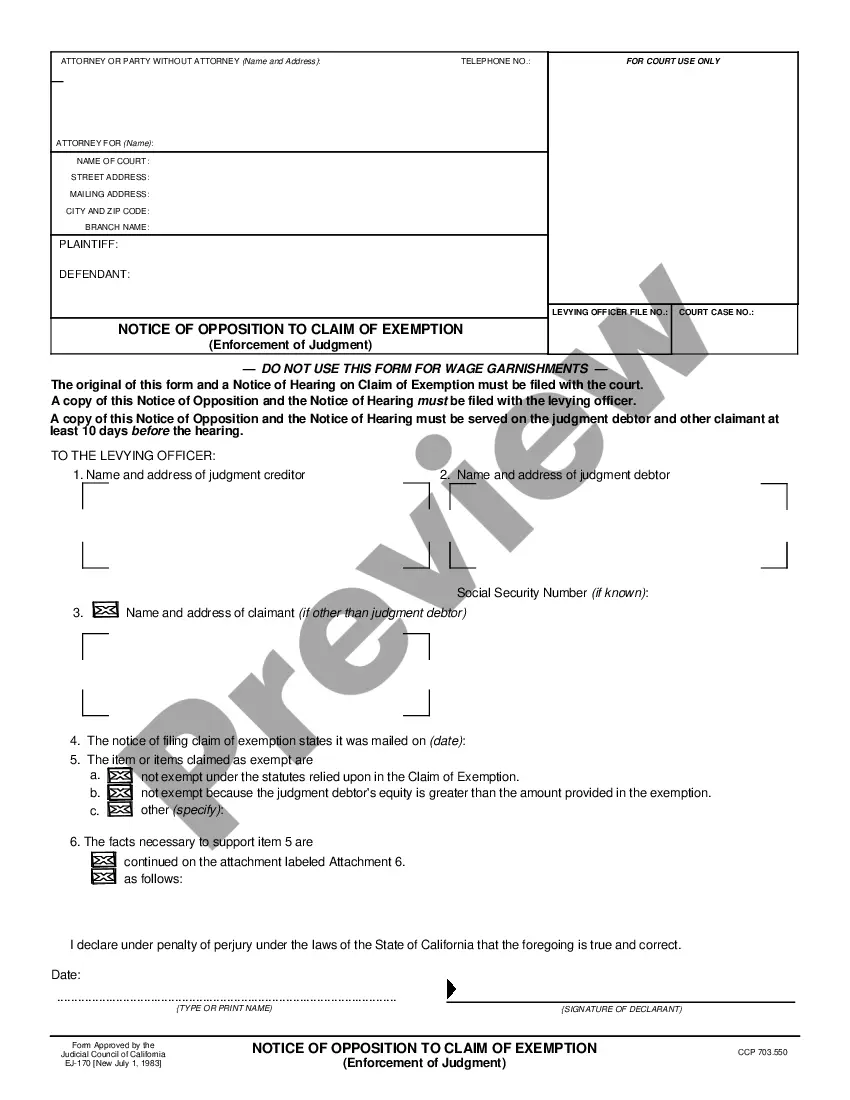

- Review the form by looking through the description and by using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you want to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Demand Letter - Repayment of Promissory Note. Above three million users have utilized our platform successfully. Select your subscription plan and get high-quality documents within a few clicks.

Form popularity

FAQ

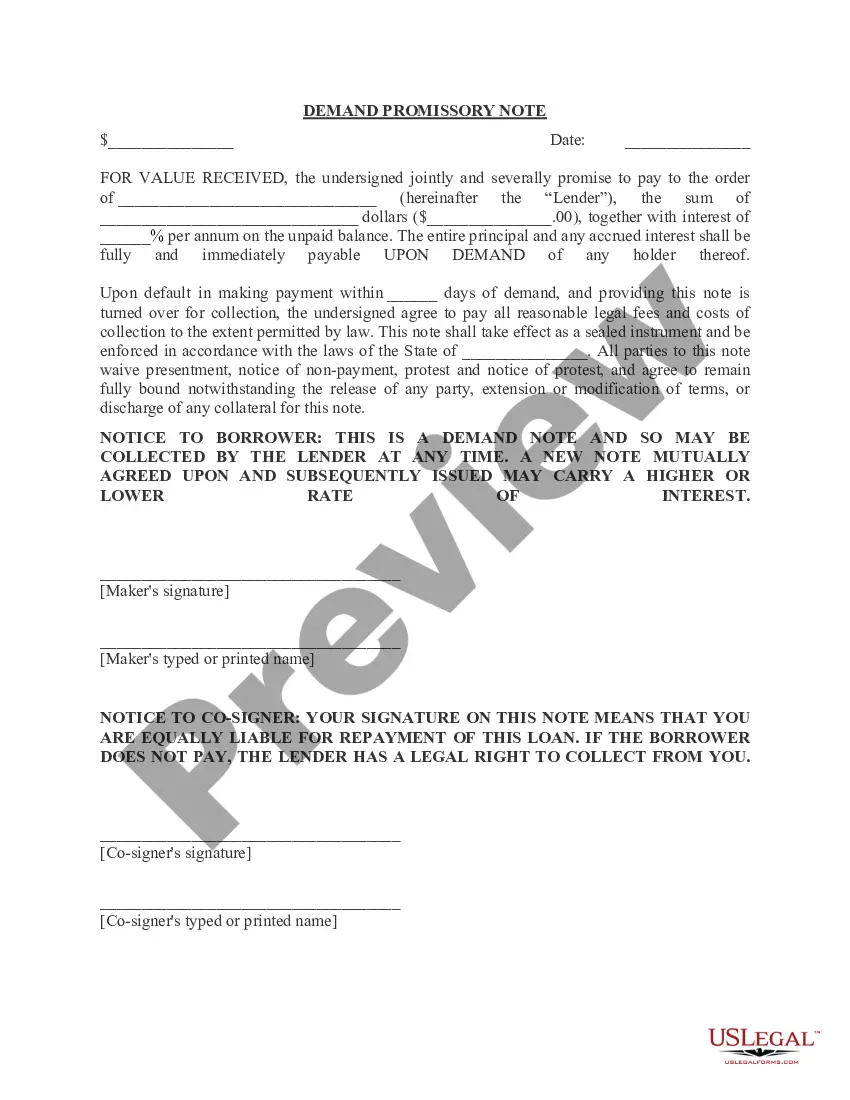

Place a signature beside the paid in full notation. The lender must sign and date the front of the promissory note beside the paid in full notation. The date the lender includes on the promissory note should be the date on which the borrower made the final payment on the loan.

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.

Promissory Notes In addition to the amount and the signature, any interest charged for the amount may also be stipulated in the note, as well as the name of the payee. If a promissory note has a date on it and the date has passed, that note can also be considered to be payable on demand.

Although an attorney often writes the demand letter, you can also do it yourself in several cases:If you have a fairly simple legal issue and you want to go through the process yourself, without an attorney. If you want to clarify your thoughts on what happened and what you want.

Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand of the lender. Usually the lender will only give the borrower a few days' notice before the payment is due.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

Full names of parties (borrower and lender) Repayment amount (principal and interest) Payment plan. Consequences of non-payment (default and collection) Notarization (if necessary) Other common details.