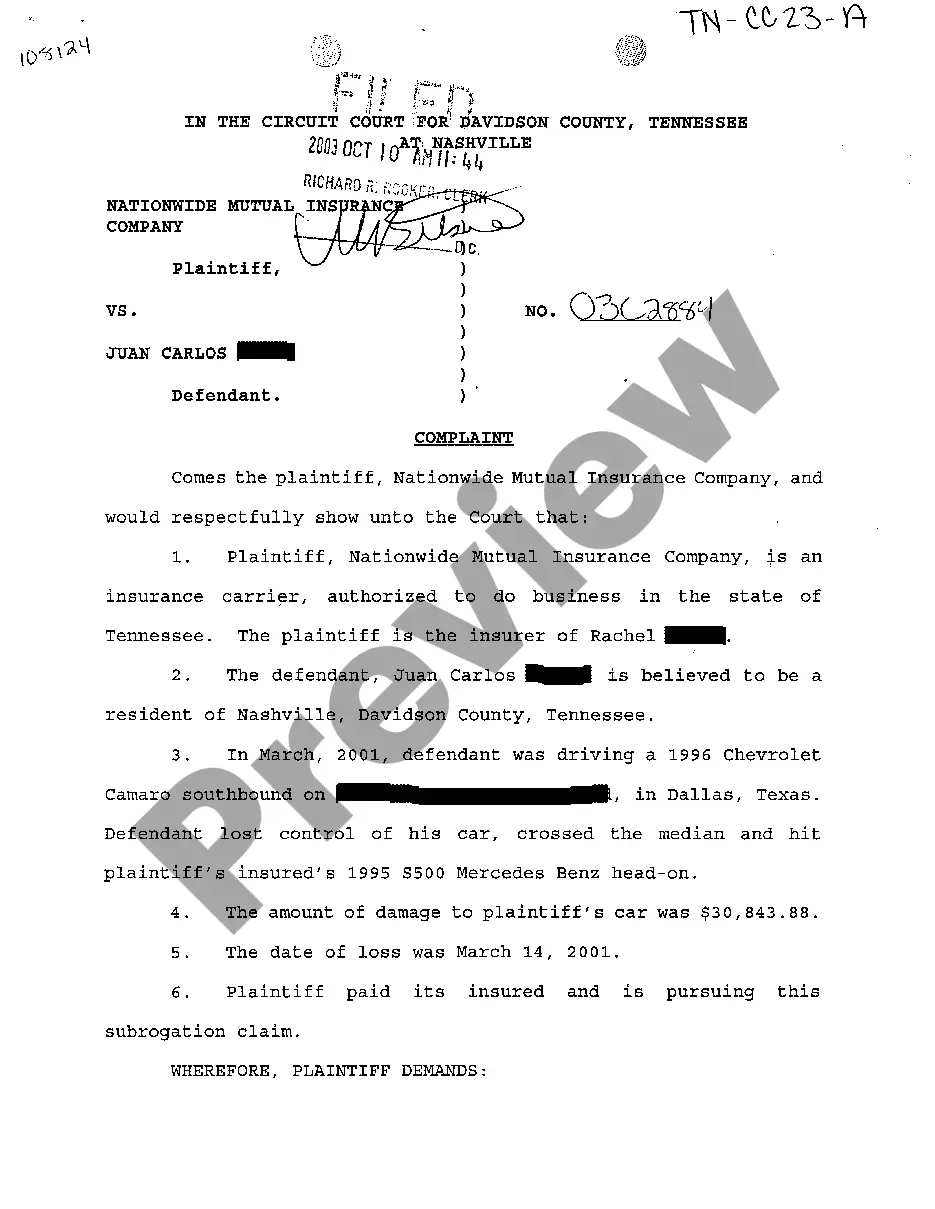

Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle

Description

How to fill out Tennessee Complaint By Insurance Company To Recover Cost Of Property Damage To Vehicle?

Get access to high quality Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle templates online with US Legal Forms. Avoid days of wasted time seeking the internet and lost money on files that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get around 85,000 state-specific authorized and tax samples that you could download and complete in clicks in the Forms library.

To find the example, log in to your account and click on Download button. The file will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Check if the Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle you’re looking at is appropriate for your state.

- See the form using the Preview option and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay by card or PayPal to complete making an account.

- Choose a favored file format to download the document (.pdf or .docx).

Now you can open the Tennessee Complaint by Insurance Company to recover cost of property damage to vehicle example and fill it out online or print it out and do it by hand. Think about sending the document to your legal counsel to make sure things are completed properly. If you make a mistake, print and complete sample once again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and get access to far more samples.

Form popularity

FAQ

Property damage liability coverage is part of a car insurance policy.It typically helps cover the cost of repairs if you are at fault for a car accident that damages another vehicle or property such as a fence or building front. Property damage liability coverage usually does not cover damage to your own vehicle.

Many car accident cases in Tennessee will settle within nine months. Most will be resolved within two years from the date of the wreck.

If the property can be repaired, the amount of damages can be set at the amount it costs to repair the property, plus the loss of its use by the owner.In addition to the cost to repair or replace, plus loss of use, interest and loss of profits may also be considered when determining the total value of property damage.

Your insurer fulfilled their responsibility to you by paying out the claim, and, as long as your policy and your state's laws allow it, you can keep the money for other uses. If the damage to your car was just cosmetic and you'd rather spend the money for repairs on something else, you might choose to do this.

A property damage claim is a request for financial compensation from an insurance company when a person's property has been damaged by a collision or other covered cause. The most common property damage claim is when a not-at-fault driver files a claim with the at-fault driver's insurer after a car accident.

No, property damage liability insurance does not have a deductible. Property damage liability car insurance pays for other people's property damage after accidents that the policyholder causes, up to the limits of the policy, and it does not require the policyholder to pay anything out of pocket.

Take a note of the offending vehicle's registration number as well as make, model and colour. Take images of the incident scene. Report the incident to the Police. Report the matter to your property/home insurer for information purposes only initially but advise them that you will revert should you need to.

An insurance adjuster works for the insurance company. After the adjuster submits a report on your claim, your insurance company may issue a settlement, which is the money they agree to give you to fix or replace your damaged property, for example, fix a hole in your roof, repair your car, or replace your belongings.

How Do Home Insurance Claims Work?Your coverage will help with the cost to replace these items, subject to your policy limits (home replacement cost vs actual cash value). After damage or loss due to theft, fire, water damage, or weather events, homeowners will file to recover the personal property.