South Carolina General Warranty Deed for Husband and Wife from Joint Tenants to Tenants in Common

What this document covers

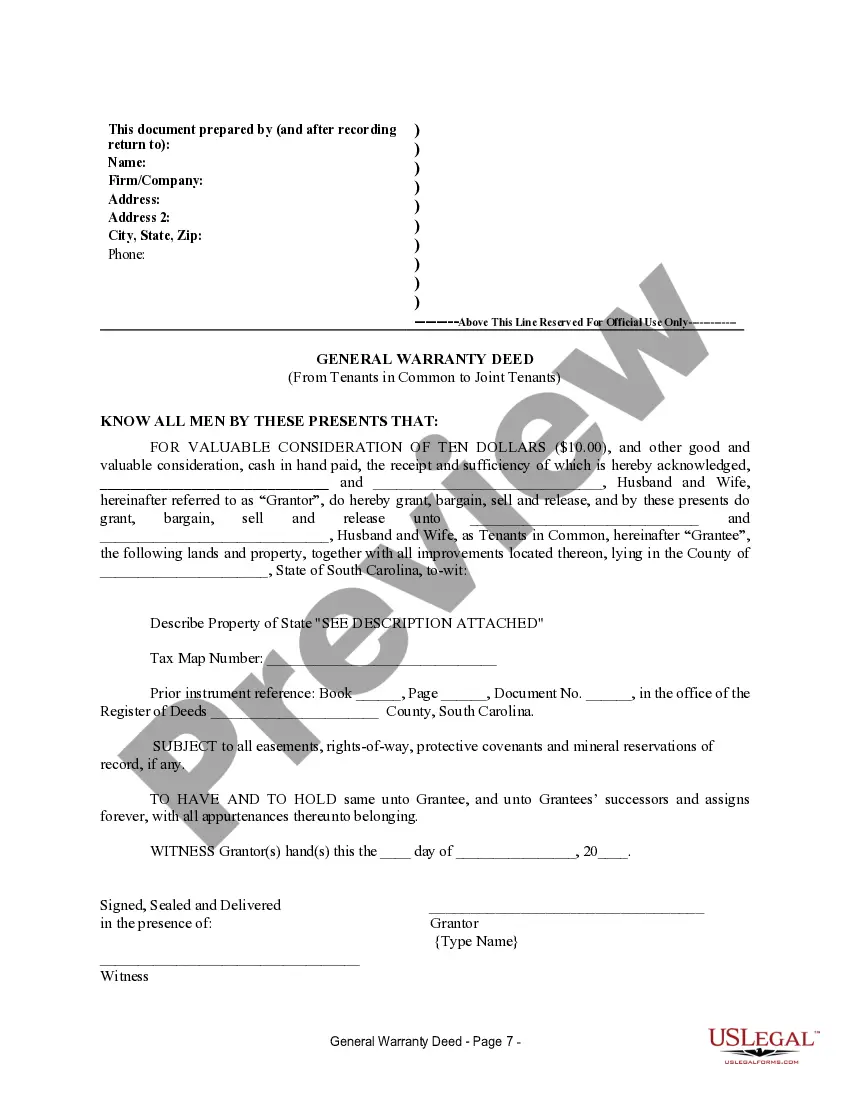

The General Warranty Deed for Husband and Wife from Joint Tenants to Tenants in Common is a legal document used to transfer property ownership between spouses. This form specifically facilitates the conversion of property held as joint tenants, where both spouses have equal shares and rights, to tenants in common, where each spouse can have different shares and can independently transfer their interest in the property. This form is crucial for couples who wish to alter how their property is owned, ensuring clear terms for future transfers or inheritance scenarios.

Form components explained

- Identifying details of the property being transferred.

- Names and addresses of the grantor (spouses) and grantee.

- Original signatures of both spouses and necessary witnesses.

- Acknowledgment by a notary public to validate the signatures.

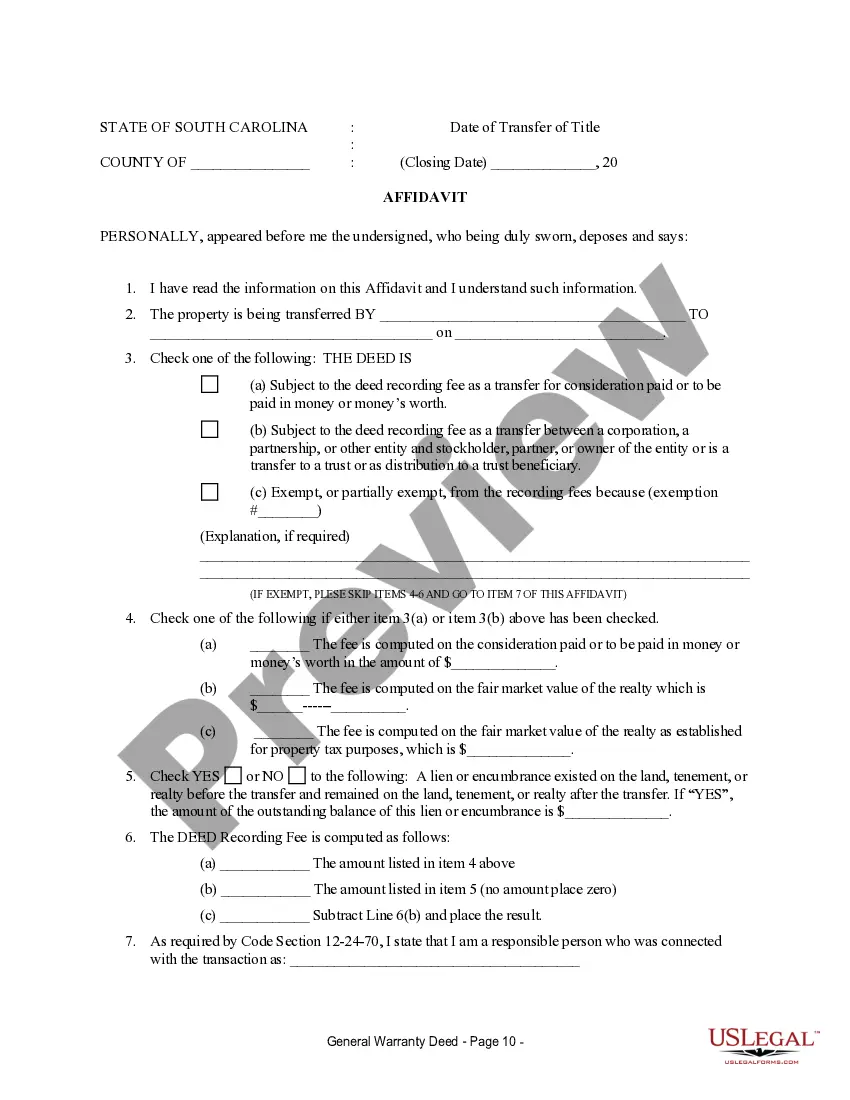

- Affidavit detailing the true consideration for the transfer to meet local record-keeping requirements.

When to use this form

This General Warranty Deed should be used when a married couple wants to change their property ownership status. Common scenarios include when one spouse wants their ownership interest in the property to be independently transferrable, or when they are making arrangements for estate planning purposes.

Who needs this form

- Married couples who own property together and wish to adjust their ownership structure.

- Individuals involved in an estate planning process where changing property titles is necessary.

- Couples considering divorce and need to clarify property ownership moving forward.

Instructions for completing this form

- Enter the names and addresses of both spouses as grantors and the intended grantee.

- Provide a legal description of the property being transferred.

- Indicate the date of the execution, ensuring that original signatures are included.

- Complete the notarization section, ensuring a licensed notary public witnesses the signatures.

- Confirm that the affidavit reflecting the true consideration for the property is filled out if applicable.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include original signatures from both spouses.

- Not providing a complete legal description of the property.

- Missing notarization or acknowledgments from witnesses.

- Not filling out the affidavit for true consideration when required.

Why complete this form online

- Convenience of filling out the form from home at your own pace.

- Editability allows users to make corrections without starting over.

- Access to reliable templates drafted by licensed professionals ensures accuracy.

Summary of main points

- This General Warranty Deed allows married couples to transition from joint tenancy to tenants in common.

- Proper completion includes notarization and accurate property description.

- Avoid common mistakes by ensuring all signatures and sections are properly filled out before submission.

Looking for another form?

Form popularity

FAQ

South Carolina Fillable Forms is a FREE product and is only for filing your South Carolina return. South Carolina Fillable Forms provides the option to fill out your return online and mail it to the SCDOR OR to submit your return the SCDOR electronically.

If you qualify for a paper copy of a tax form based on these criteria, you can email your paper form request to forms@dor.sc.gov or call 1-844-898-8542 to speak to a representative. You will need to provide your name, address, and the form you are requesting.

Employee instructions Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

File SC1040, including all federal taxable income, and attach SC1040TC to claim a credit for taxes paid to another state.