South Carolina Bylaws for Corporation

What is this form?

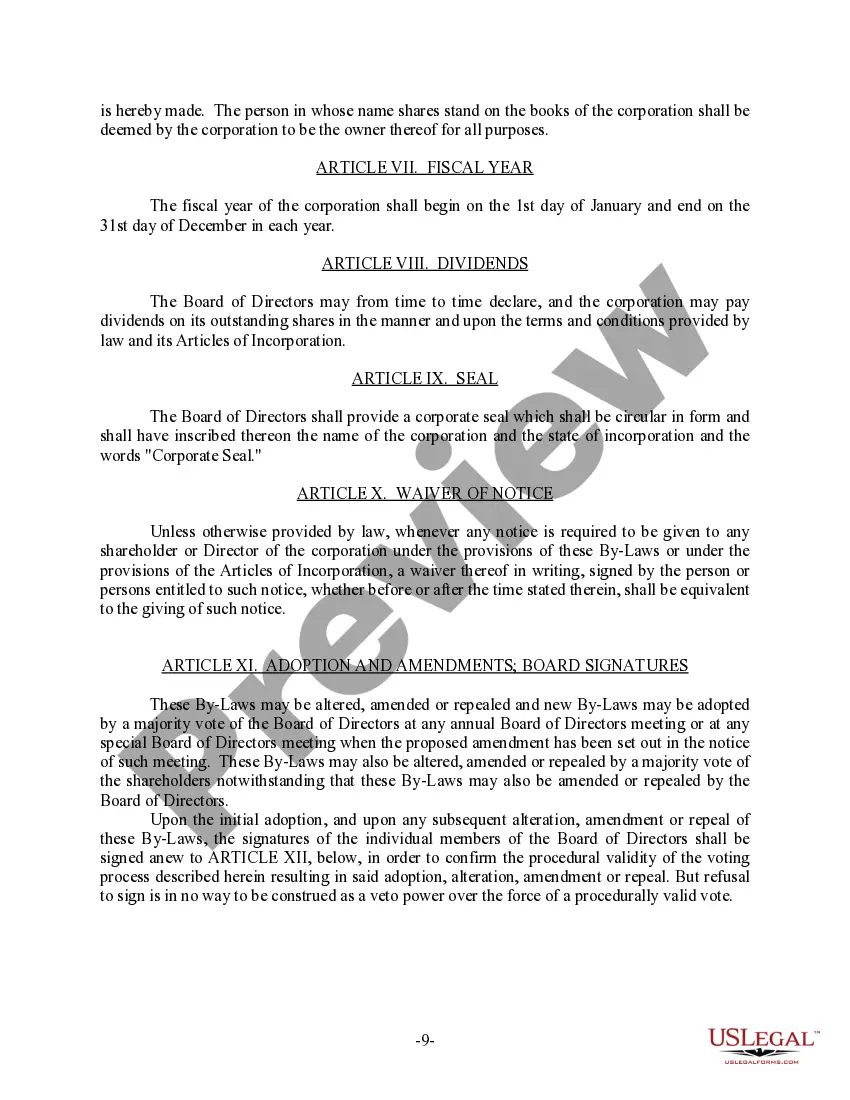

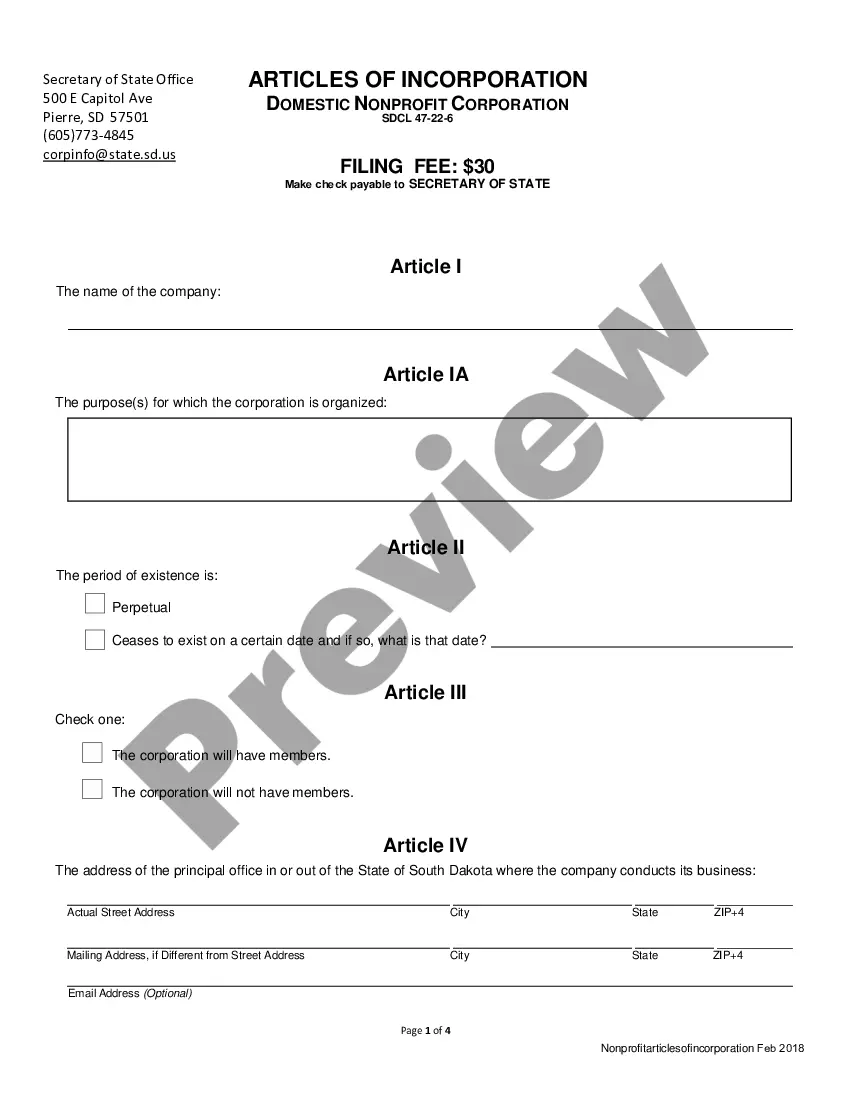

This form is the South Carolina Bylaws for Corporation. It outlines the internal governance structure of the corporation, including rules for shareholder meetings, officer appointments, and voting procedures. Unlike other corporate forms, these bylaws specifically cater to the legal requirements and operational needs of businesses incorporated in South Carolina.

Form components explained

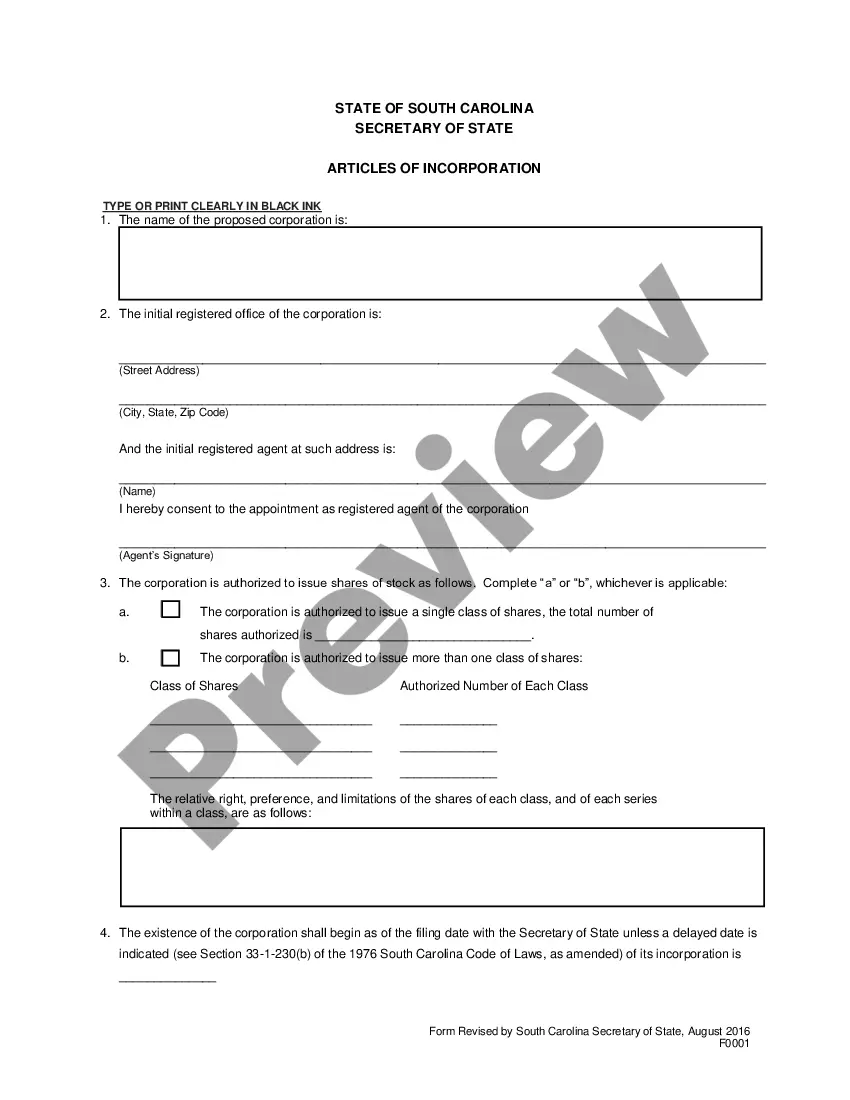

- Name and Location: Specifies the corporation's name and the address of its principal and registered offices.

- Annual Meeting: Details the scheduling and procedure for the annual shareholder meeting.

- Board of Directors: Provides the structure, number, and qualifications for the board members.

- Officers: Identifies the required officers and their roles within the corporation.

- Voting Rights: Outlines the voting procedures for shareholders, including proxies and quorum requirements.

When to use this form

Use this form when forming a corporation in South Carolina to establish clear operational guidelines. It is essential for structuring governance, managing shareholder meetings, and defining the roles of corporate officers. These bylaws serve as an internal manual for the corporation's management and must be adopted following the incorporation process.

Who this form is for

Individuals and groups looking to form a corporation in South Carolina should use this form, including:

- Entrepreneurs starting a new business.

- Business partners forming a partnership corporation.

- Corporations seeking to formalize their governance structure.

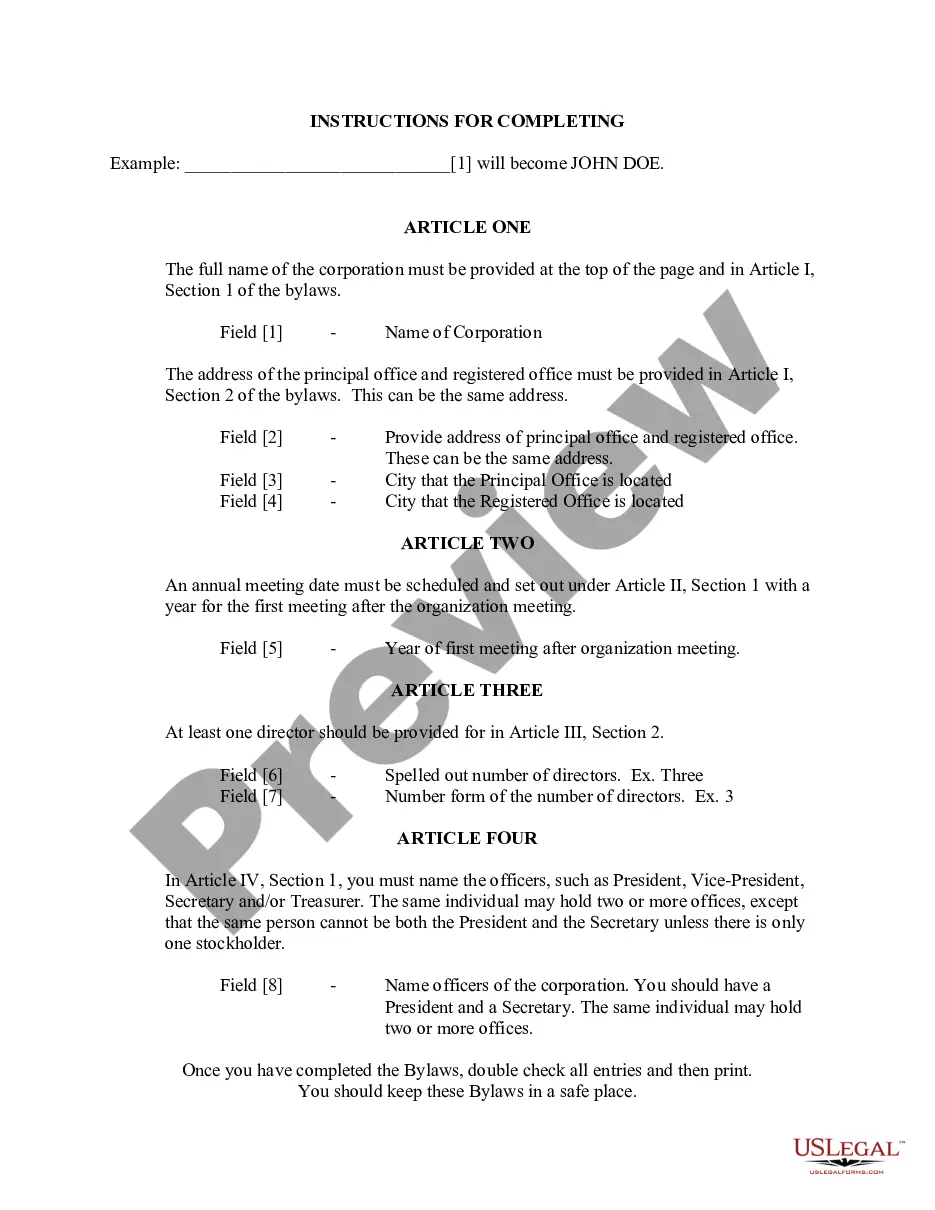

How to complete this form

- Enter the full name of the corporation in the designated fields.

- Provide the address for both the principal office and registered office.

- Specify the year for the first annual meeting after incorporation.

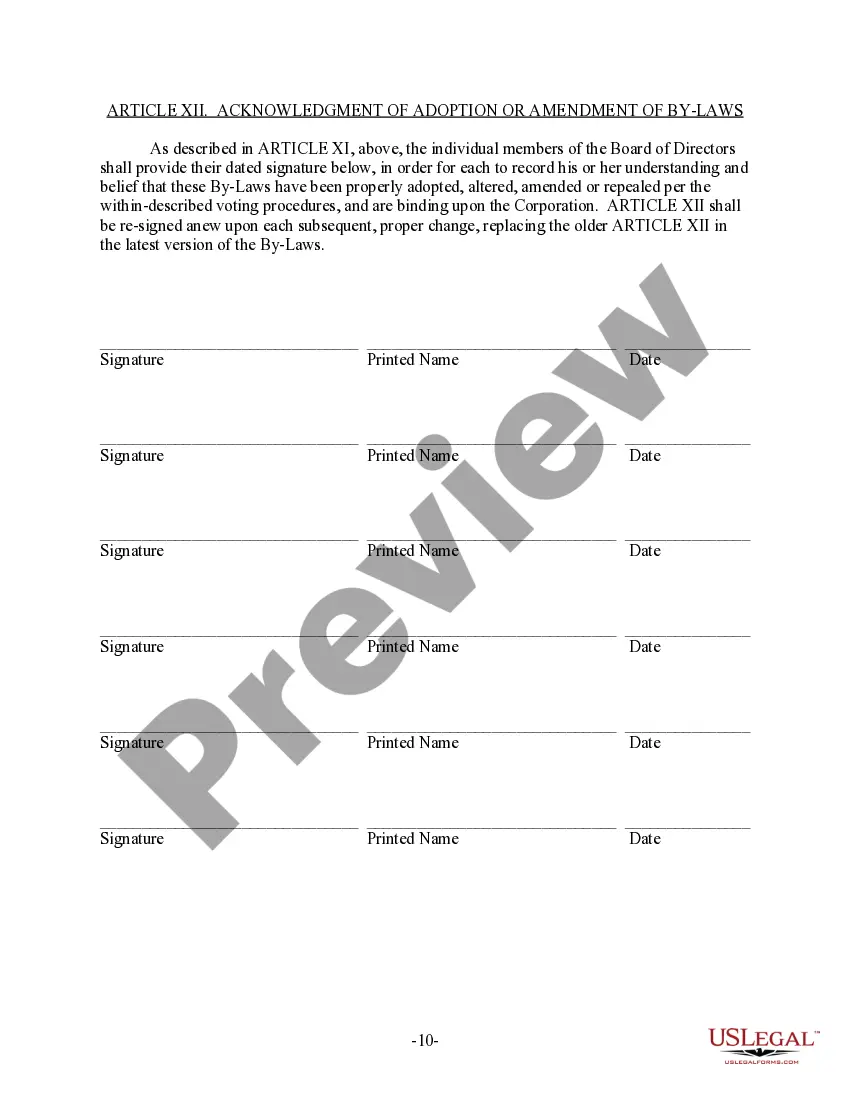

- Indicate the number of directors and list their names.

- Name the officers of the corporation, ensuring at least a President and Secretary are included.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include the required officers or appointing the same individual for conflicting roles.

- Neglecting to specify the date and location of the annual meeting.

- Not updating the bylaws with any changes in the corporation's structure or leadership.

Why use this form online

- Convenience of downloading the form instantly and editing it as needed.

- Access to templates drafted by licensed attorneys for accuracy and compliance.

- Ability to store and manage the documents electronically.

Looking for another form?

Form popularity

FAQ

The bylaws are the corporation's operating manual; they describe how the corporation is organized and runs its affairs. You do not file the bylaws with the state, but you need to explain the roles of the corporation's participants, and technology can play a role in carrying out the bylaws.

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation. Any corporation whose articles of incorporation do not specify the number of directors must adopt bylaws before the first meeting of the board of directors specifying the number of directors.

Bylaws generally define things like the group's official name, purpose, requirements for membership, officers' titles and responsibilities, how offices are to be assigned, how meetings should be conducted, and how often meetings will be held.

Corporate bylaws commonly include information that specifies, for example, the number of directors the corporation has, how they will be elected, their qualification, and the length of their terms. It can also specify when, where, and how your board of directors can call and conduct meetings, and voting requirements.

For a corporation, it's the articles of incorporation. The second concerns the internal operating procedures of the company. For corporations, these are bylaws, and for LLCs, this is an operating agreement. Corporate bylaws give a clear structure to a business, helping it run smoothly.

Most states require you to memorialize your bylaws and, even in the states where there is no such requirement, having bylaws is a great idea. After all, corporate bylaws define your business' structure, roles, and specifies how your company will conduct its affairs.

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation.Aside from number of directors, all the matters typically covered in the bylaws are otherwise covered by California statute, which would apply in the absence of any contrary lawful bylaw provision.

Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping. Board meetings. Meeting minutes. State registration. Licensing.