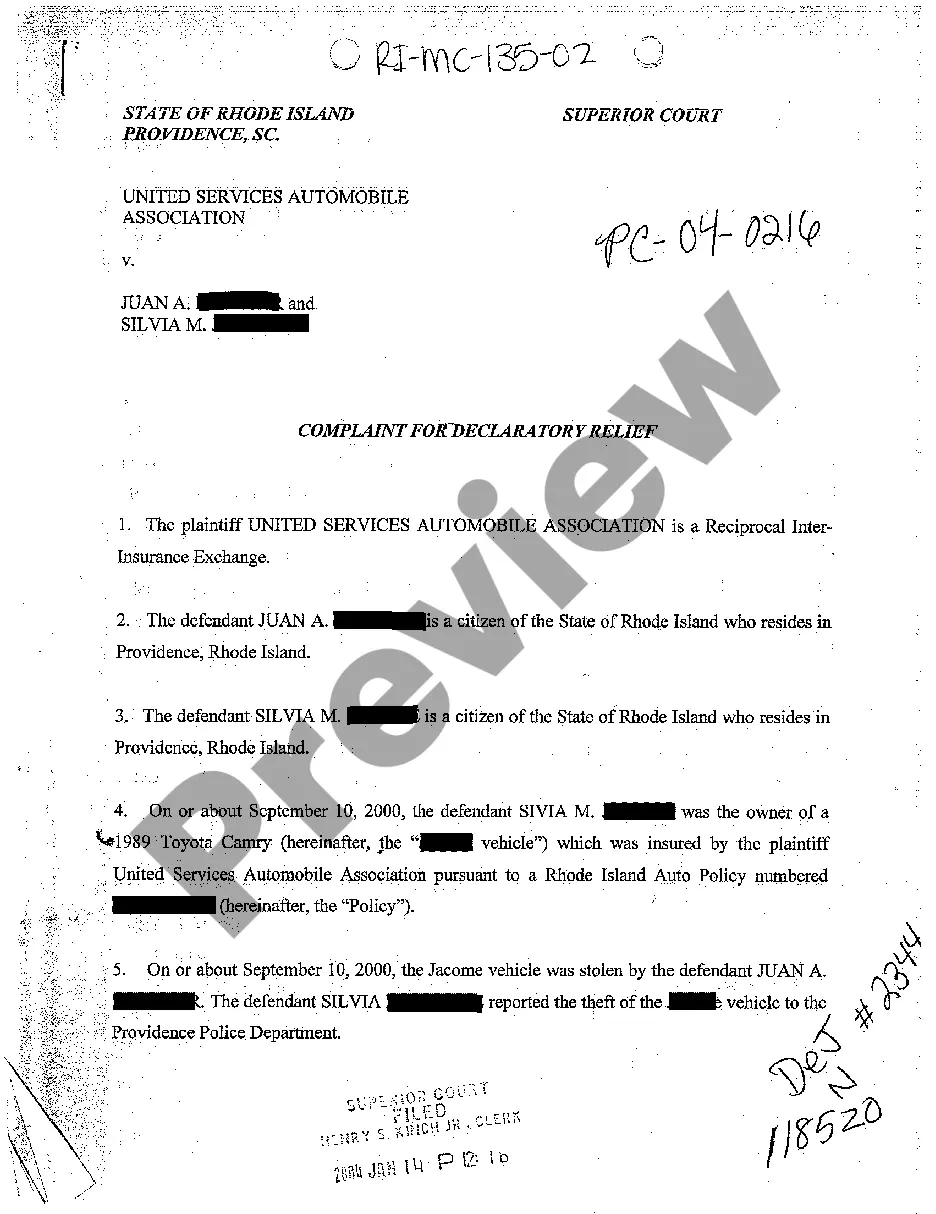

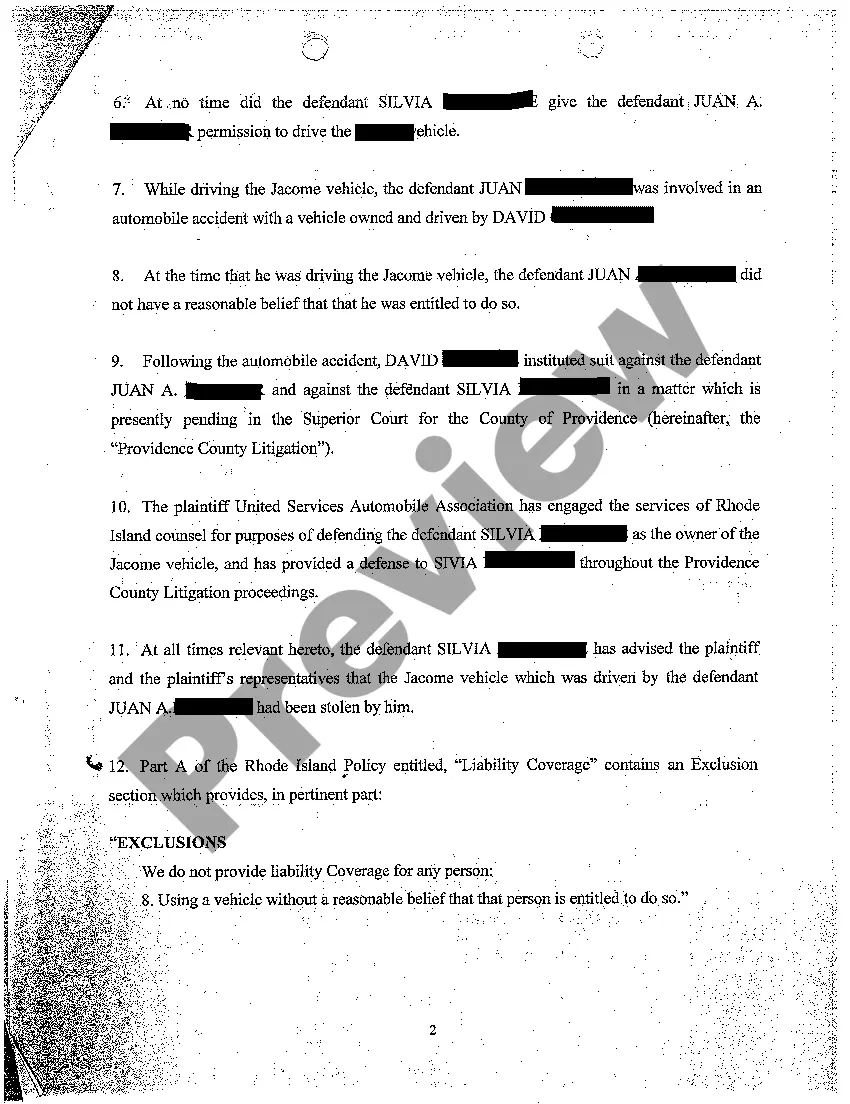

Rhode Island Complaint for Declaratory Relief That Insurance Company Has No Duty to Defend or Indemnify Thief Who Stole Car From Insured and Then Wrecked It

Description

How to fill out Rhode Island Complaint For Declaratory Relief That Insurance Company Has No Duty To Defend Or Indemnify Thief Who Stole Car From Insured And Then Wrecked It?

Among numerous free and paid samples that you’re able to find on the net, you can't be sure about their accuracy. For example, who made them or if they are qualified enough to deal with what you need these people to. Keep calm and use US Legal Forms! Get Rhode Island Complaint for Declaratory Relief That Insurance Company Has No Duty to Defend or Indemnify Thief Who Stole Car From Insured and Then Wrecked It samples made by skilled attorneys and avoid the expensive and time-consuming procedure of looking for an lawyer and after that having to pay them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the form you’re looking for. You'll also be able to access all of your earlier saved templates in the My Forms menu.

If you are making use of our website the very first time, follow the guidelines below to get your Rhode Island Complaint for Declaratory Relief That Insurance Company Has No Duty to Defend or Indemnify Thief Who Stole Car From Insured and Then Wrecked It easily:

- Ensure that the file you find applies in your state.

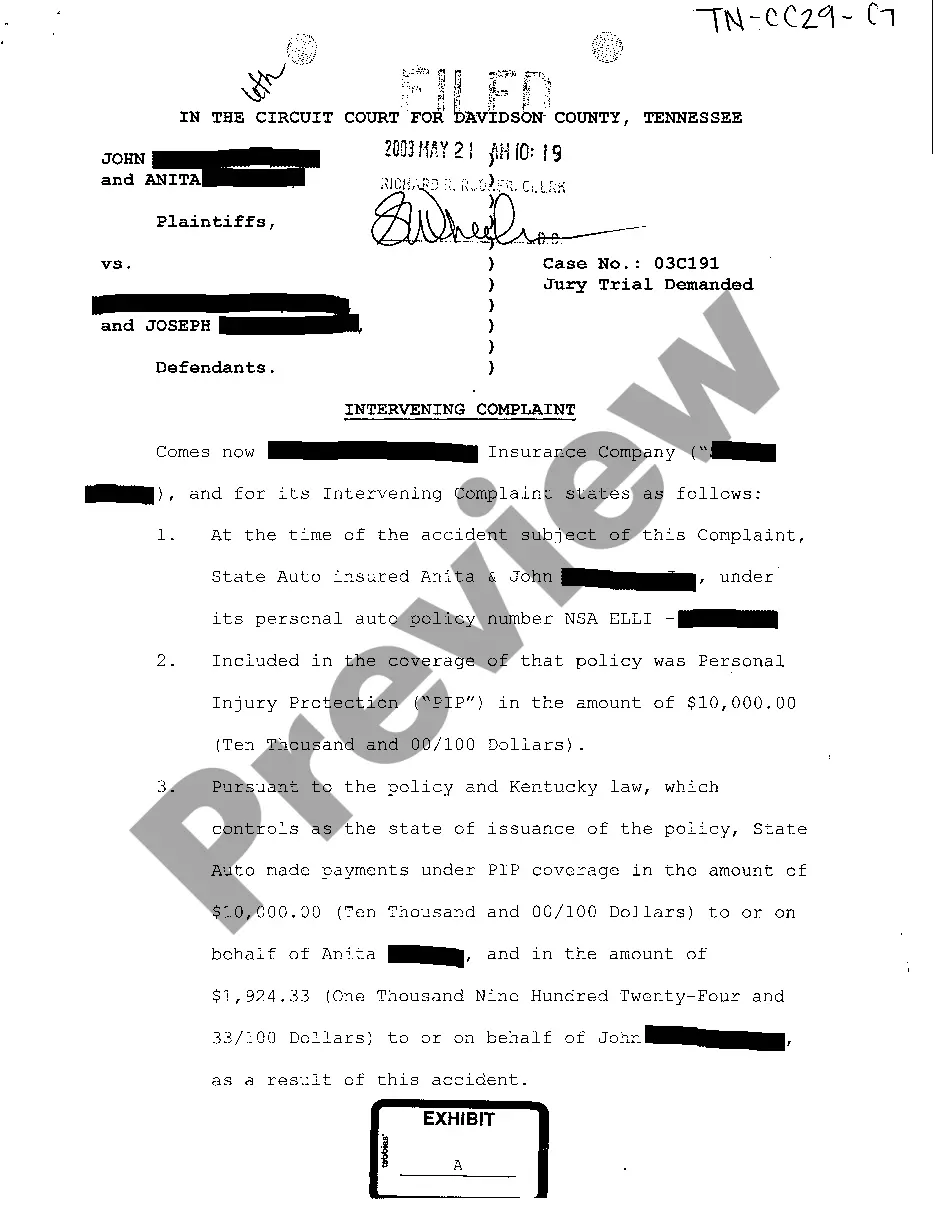

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another example utilizing the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and paid for your subscription, you can use your Rhode Island Complaint for Declaratory Relief That Insurance Company Has No Duty to Defend or Indemnify Thief Who Stole Car From Insured and Then Wrecked It as many times as you need or for as long as it stays valid in your state. Change it in your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

The term duty-to-defend essentially means that in the event a claim is made against an insured for an alleged wrongful act, the insurance carrier has the right and duty-to-defend the claimeven if the claim is groundless, false, or fraudulent.

The main difference in this case is that hold harmless may require a party to protect against actual losses as well as potential losses while indemnification protects against actual losses only.There, the court categorized the obligations to indemnify and hold harmless as offensive and defensive rights.

The duty to defend is a distinct contractual obligation to an insured that is to be abided by from the outset of a legal proceeding. If triggered, the insurer has a duty to defend an insured in the entirety of an action and not just against claims that are covered within the insurance policy.

Defense-Only Coverage liability insurance covering defense costs but not settlements or indemnity payments. Defense-only policies are best suited to insureds having effective loss control programs and a willingness to defend, rather than settle, claims made against them.

Courts typically determine an insurer's duty to defend its insured under a liability policy in one of two ways.An insurer has a duty to defend if the face of the complaint alleges something covered and does not allege an exclusion to coverage.

The duty to defend is a term that describes an insurer's obligation to provide an insured with a defense to claims made under an insurance policy. The duty to indemnify describes an insurer's obligation to pay a claim for loss or damage against an insured. Both are typically included in a policy's insuring agreement.