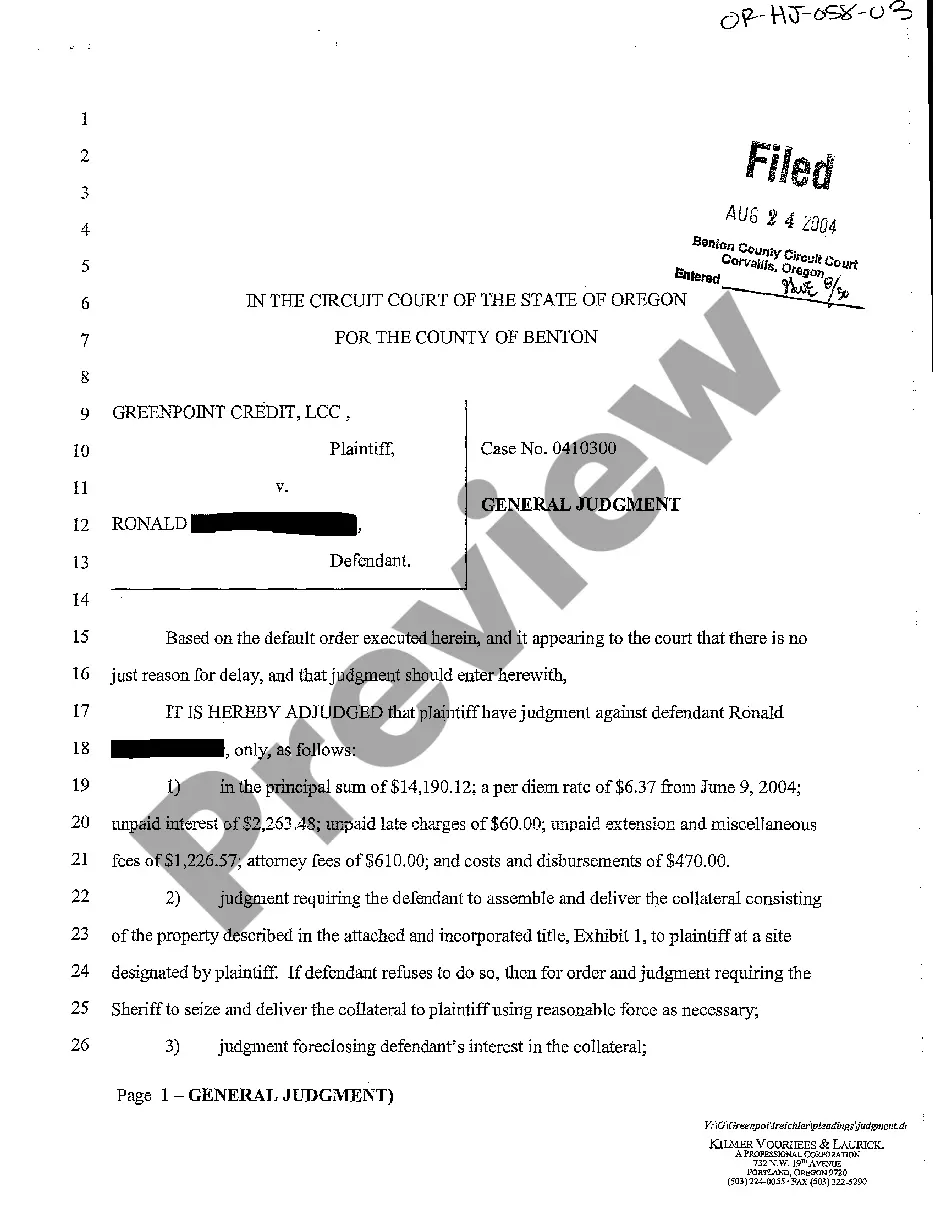

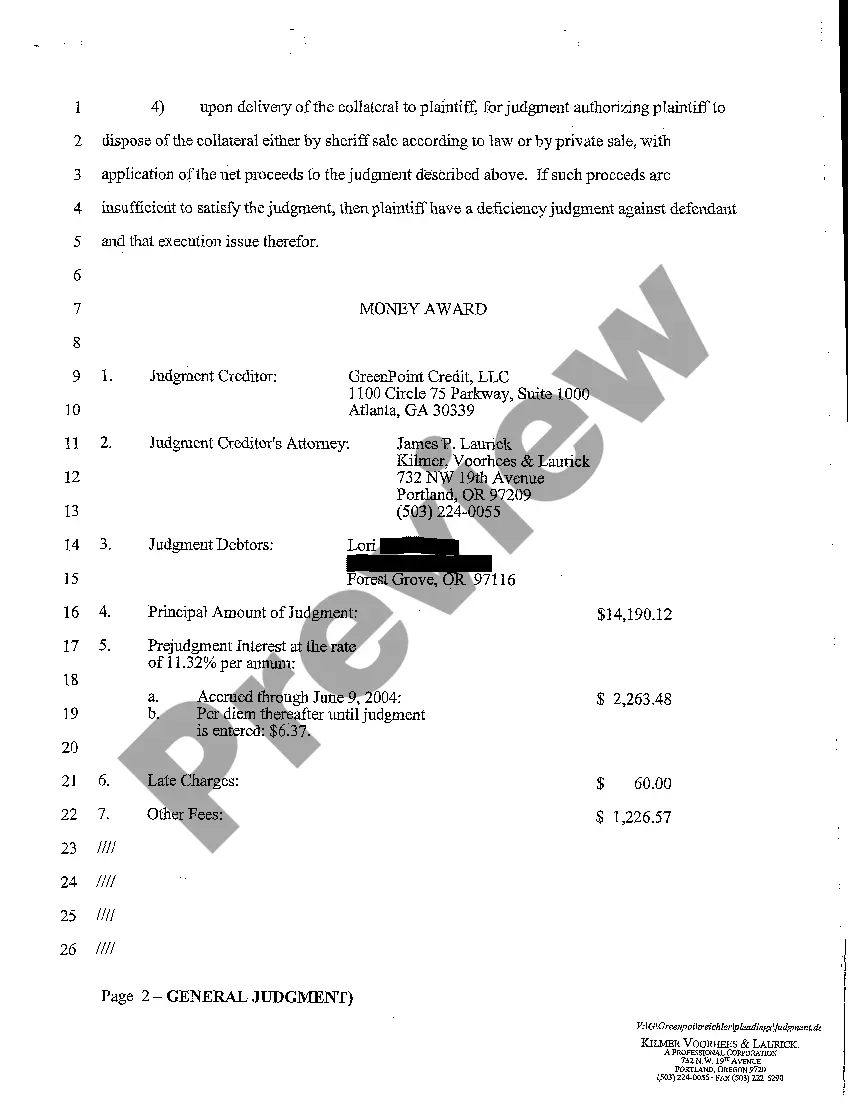

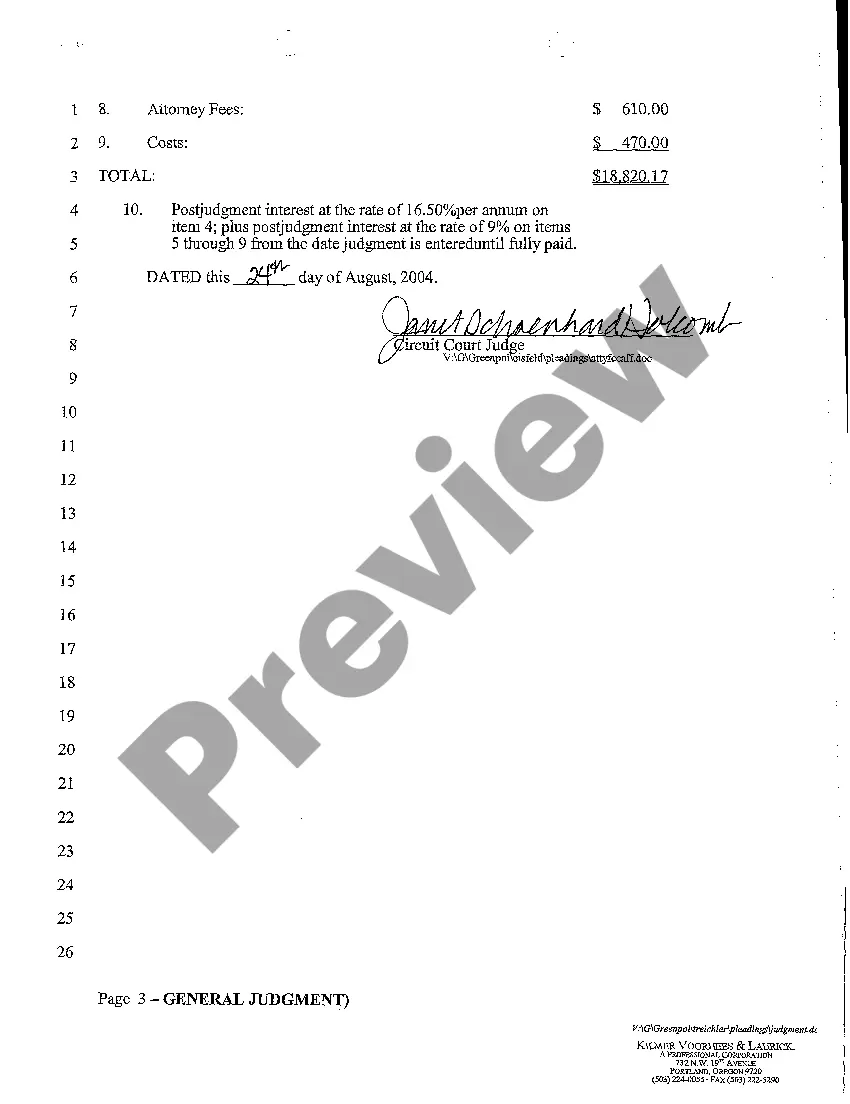

Oregon General Judgment Against Defendant Ordering Him to Repay Debt and Foreclosing Property

Description

How to fill out Oregon General Judgment Against Defendant Ordering Him To Repay Debt And Foreclosing Property?

In terms of submitting Oregon General Judgment Against Defendant Ordering Him to Repay Debt and Foreclosing Property, you probably think about a long process that consists of choosing a appropriate form among a huge selection of similar ones and after that having to pay out legal counsel to fill it out for you. Generally speaking, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific template within clicks.

For those who have a subscription, just log in and then click Download to have the Oregon General Judgment Against Defendant Ordering Him to Repay Debt and Foreclosing Property sample.

In the event you don’t have an account yet but want one, follow the point-by-point guideline listed below:

- Be sure the file you’re downloading applies in your state (or the state it’s needed in).

- Do this by looking at the form’s description and also by clicking on the Preview option (if accessible) to see the form’s information.

- Click Buy Now.

- Select the proper plan for your budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Skilled attorneys work on creating our samples so that after downloading, you don't have to bother about editing content outside of your personal details or your business’s information. Sign up for US Legal Forms and receive your Oregon General Judgment Against Defendant Ordering Him to Repay Debt and Foreclosing Property sample now.

Form popularity

FAQ

In order to get a judgment, the creditor must go to court. Either the original creditor or a collection agency may sue you to collect a debt. If this happens, you will be served with a summons and complaint. If you want to dispute the existence or the amount of the debt, you must file a timely response with the court.

Do not use illegal ways to collect your money. The debtor may be protected from abusive or unfair ways to collect the debt. Encourage the debtor to pay you voluntarily. Be organized. Ask a lawyer or collection agency for help. Make sure you renew your judgment. Ask the court for help.

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.

Keep in mind that if you do NOT pay the judgment: The amount you owe will increase daily, since the judgment accumulates interest at the rate of 10% per year. The creditor can get an order telling you to reimburse him or her for any reasonable and necessary costs of collection.

Plan Your Strategy. Perfect Your Lien Rights as Soon as Possible. Ask for Your Money. Educate Yourself. Find the Debtor's Assets. Start With Easy-to-Reach Assets. Consider Hiring a Collection Expert. Renew Your Judgment.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

Charging Order. A Charging Order is a means of securing the debt against property owned by either the individual or the company in debt to you. Attachment of Earnings Order. Winding Up Proceedings. Bankruptcy Petition. Warrant of Execution.

Even after you win a lawsuit, you still have to collect the money awarded in the judgmentthe court won't do it for you. Financially sound individuals or businesses will routinely pay a judgment entered against them. However, not everyone will be as willing. If necessary, legal ways to force payment exist.

The third and easiest way to collect is wage garnishment. If the debtor has a job, you can collect up to 25% of his or her wages until the judgment is paid. Give your sheriff or other local official (known as a levying officer) information about the judgment and where the debtor works.