Oregon Business Credit Application

What this document covers

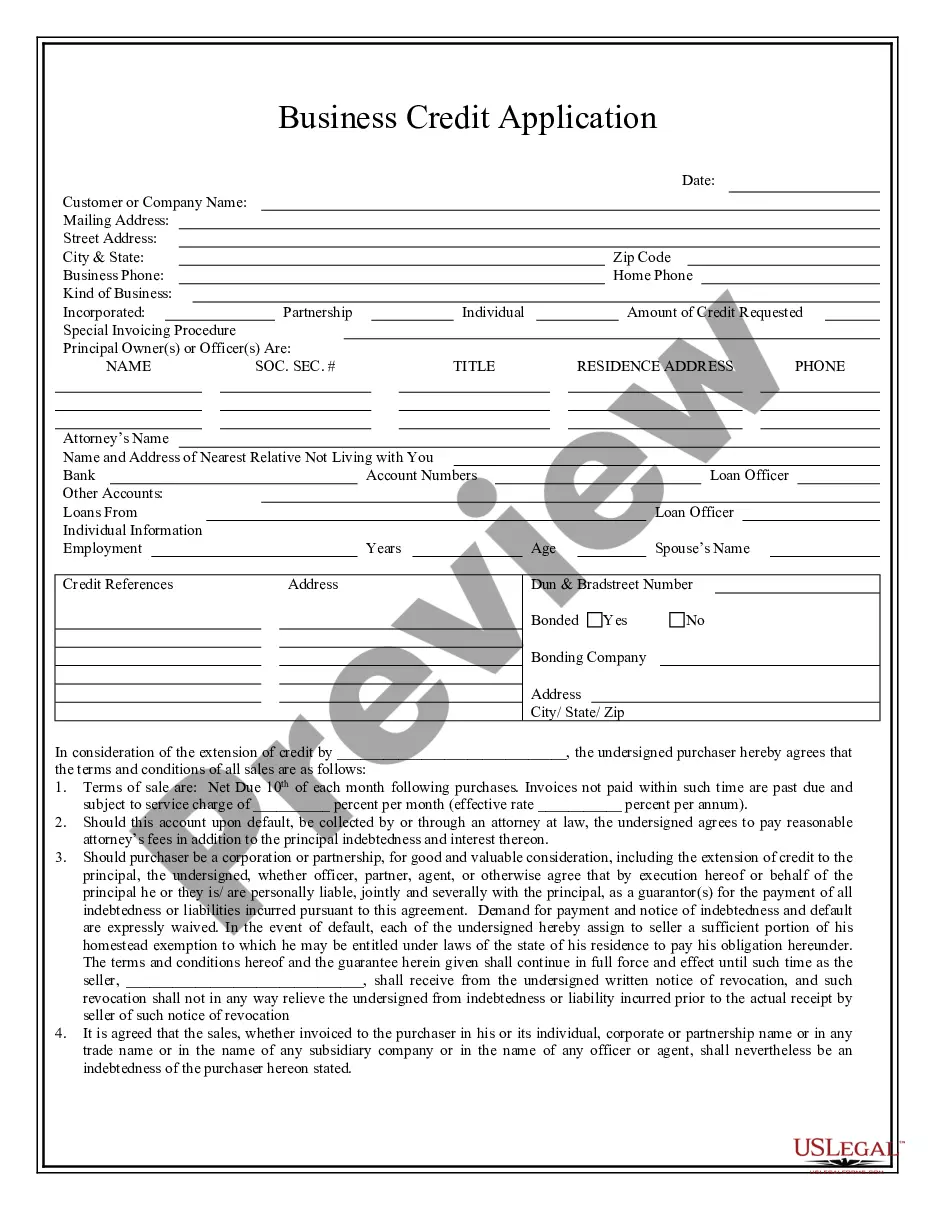

The Business Credit Application is a legal document used by individuals or businesses to request credit from a seller for future purchases. This form outlines the repayment terms, interest rates, and responsibilities of both the purchaser and seller. Unlike other credit applications, this document includes specific provisions for personal guarantees from corporate officers or partners, making it essential for financial dealings involving credit purchases.

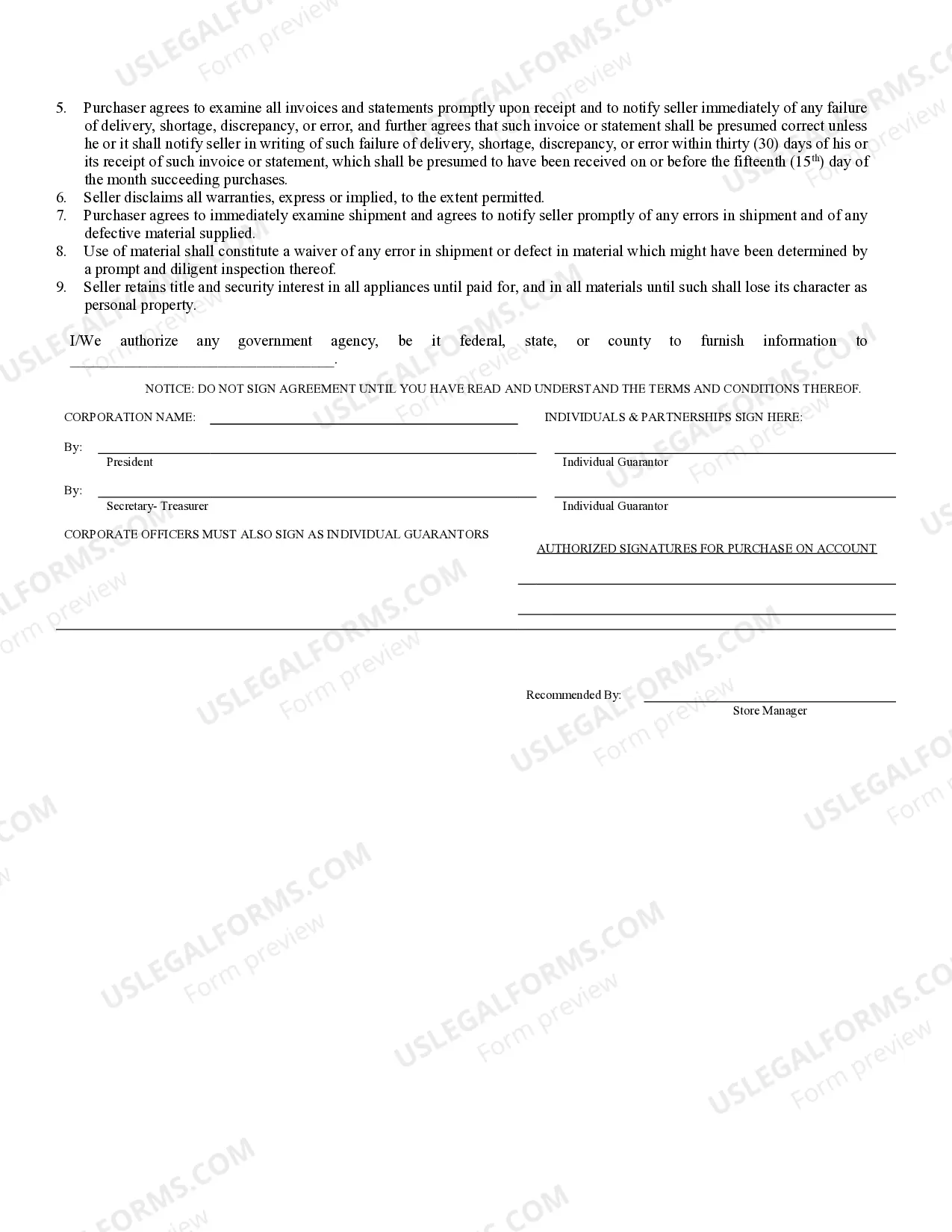

Main sections of this form

- Credit Extension Agreement: A provision stating the sellerâs agreement to extend credit based on conditions outlined in the application.

- Terms of Sale: Specifies payment terms, including deadlines and potential service charges for late payments.

- Personal Guarantee Clause: Obligates individuals signing on behalf of businesses to be personally liable for debts incurred.

- Warranties Disclaimer: Clarifies that the seller disclaims all warranties concerning the goods sold.

- Default Provisions: Outlines actions to be taken in case of default, including attorney fees and assignments of homestead exemption.

When to use this document

Who can use this document

- Businesses seeking to establish credit accounts with suppliers.

- Individuals acting as guarantors for a business credit application.

- Partners in a business who wish to formalize credit arrangements.

- Corporate officers that need to secure credit for their company's purchases.

Steps to complete this form

- Identify the seller by filling in their name at the beginning of the form.

- Enter the purchaser's details, including the business name and address.

- Specify payment terms, including due dates and any late fees as applicable.

- Obtain signatures from all necessary parties, including individual guarantors if applicable.

- Review the completed form for accuracy before submission.

Notarization guidance

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to read the terms and conditions carefully before signing.

- Omitting necessary signatures, particularly from corporate officers or partners.

- Not specifying or incorrectly calculating late payment fees.

- Neglecting to notify the seller of any discrepancies in invoices within the required timeframe.

Why complete this form online

- Convenient access to downloadable templates that save time.

- Editable forms allow customization to meet specific requirements.

- Reliable documentation that follows standard legal practices.

Legal use & context

- This form is legally binding upon signature by all parties involved.

- Repayment terms outlined must be adhered to prevent legal action.

- The form serves as a formal agreement for credit and may be used in court to enforce obligations.

Looking for another form?

Form popularity

FAQ

General Business Licenses. In Oregon, your new business must obtain a general business license from each city or county for unincorporated areas where you operate your business. You may want to contact your local city or county administrative offices or check their websites for licensing information and forms.

The state of Oregon doesn't have a general business license. However, many occupations and business activities require special licenses, permits or certifications from state agencies or boards.

Choose a Business Idea. Decide on a Legal Structure. Choose a Name. Create Your Business Entity. Apply for Licenses and Permits. Pick a Business Location and Check Zoning. Report Taxes. Obtain Insurance.

Determine how much funding you'll need. Fund your business yourself with self-funding. Get venture capital from investors. Use crowdfunding to fund your business. Get a small business loan. Use Lender Match to find lenders who offer SBA-guaranteed loans. Small Business Administration investment programs.

Yes, all businesses in Oregon must be registered, including those businesses operating as DBAs, assumed names, sole proprietorship, LLC, corporation, or limited partnership. The form can be filed on the Oregon Secretary of State website or mailed to the State's Corporation Division. The filing fee is $50.

Yes, all businesses in Oregon must be registered, including those businesses operating as DBAs, assumed names, sole proprietorship, LLC, corporation, or limited partnership. The form can be filed on the Oregon Secretary of State website or mailed to the State's Corporation Division. The filing fee is $50.

Step 1: Choose the Right Business Idea. Step 2: Plan Your Oregon Business. Step 3: Get Funding. Step 4: Choose a Business Structure. Step 5: Register Your Oregon Business. Step 6: Set up Business Banking, Credit Cards, and Accounting. Step 7: Get Insured. Step 8: Obtain Permits and Licenses.

Step 1: Choose your name and structure. Before you can register your business you'll need to choose a business name. Step 2: Register your business. Step 3: Get your tax numbers. Step 4: Insurance Requirements. Step 5: Permits & Licensing. Step 6: Employer Obligations.

Reserving a business name in Oregon requires a $100 filing fee. Once filed, your business name will be reserved in Oregon for 120 days.