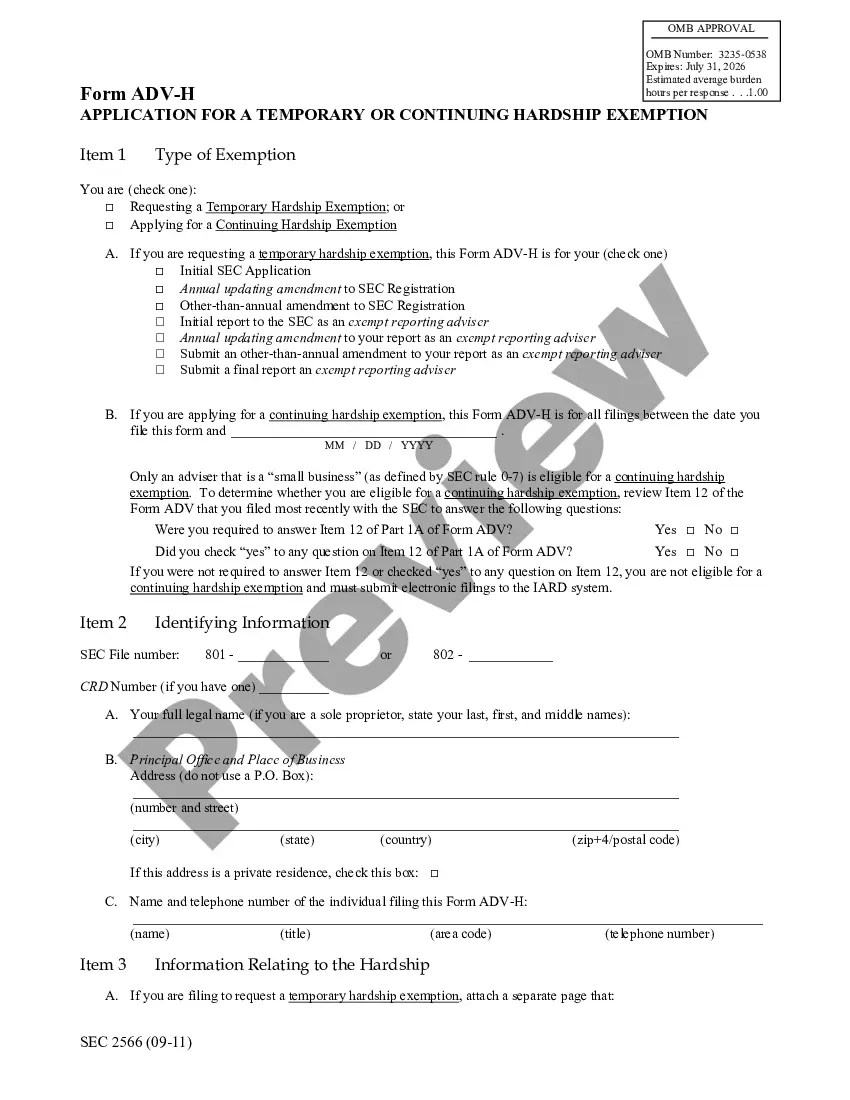

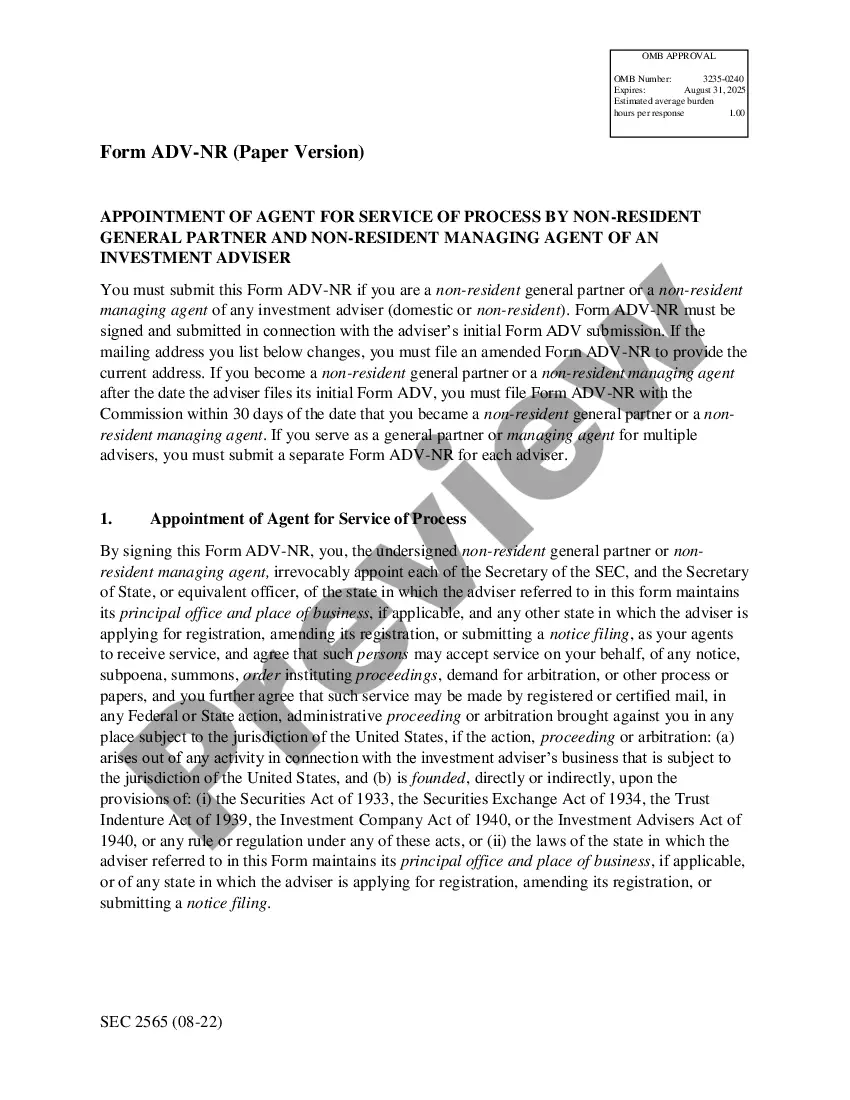

Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

Oklahoma Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description

How to fill out Oklahoma Eastern District Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

In terms of completing Oklahoma Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13, you almost certainly imagine a long procedure that consists of getting a perfect form among a huge selection of very similar ones after which being forced to pay a lawyer to fill it out to suit your needs. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific template within just clicks.

If you have a subscription, just log in and click on Download button to have the Oklahoma Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 template.

If you don’t have an account yet but need one, follow the step-by-step guideline below:

- Be sure the file you’re saving is valid in your state (or the state it’s required in).

- Do so by looking at the form’s description and also by visiting the Preview option (if readily available) to find out the form’s information.

- Click on Buy Now button.

- Select the proper plan for your budget.

- Join an account and choose how you want to pay out: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Get the document on your device or in your My Forms folder.

Skilled lawyers draw up our samples so that after downloading, you don't have to worry about editing content material outside of your personal info or your business’s info. Sign up for US Legal Forms and receive your Oklahoma Eastern District Bankruptcy Guide and Forms Package for Chapters 7 or 13 example now.

Form popularity

FAQ

Bankruptcies: 7 years for completed Chapter 13 bankruptcies and 10 years for Chapter 7 bankruptcies. Foreclosures: 7 years. Collections: Generally, about 7 years, depending on the age of the debt being collected. Public Record: 7 years.

Case Information Online Public Access to Court Electronic Records (PACER) is a web-based system that allows users with an internet connection and a PACER account to view or print case documents online. A fee is charged for each page viewed. To sign up for a PACER account, register at http://www.pacer.gov .

The filing fee for a Chapter 7 case is $335. The filing fee for a Chapter 11 case is $1,717. The filing fee for a Chapter 12 is $275. The filing fee for a Chapter 13 is $310.

Disadvantages of Filing for Chapter 13 Bankruptcy Be aware that it can take up 5 five years for you to repay your debts under a Chapter 13 plan, and debts must be paid out of your disposable income.A Chapter 13 bankruptcy can remain on your credit report for up to 10 years, and you will lose all your credit cards.

Unless sealed, all documents filed in a bankruptcy case are available for public viewing. Information contained in bankruptcy case documents is a matter of public record. Documents may be accessed in the Clerk's Office during regular business hours, or 24 hours a day via internet access to PACER.

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

If you have a PACER account, you can search using the PACER Case Locator. You can visit the courthouse and use a public terminal. If you know the social security number, you can use the VCIS system. It's a toll free call to 1-866-222-8029. See VCIS instructions here.

In many cases, Chapter 7 bankruptcy is a better fit than Chapter 13 bankruptcy. For instance, Chapter 7 is quicker, many filers can keep all or most of their property, and filers don't pay creditors through a three- to five-year Chapter 13 repayment plan.

The truth: Bankruptcies are considered public records, which is how they're reported on your credit. The public record associated with a Chapter 7 bankruptcy will remain on your credit report for as long as 10 years. That time period starts on the date you file the bankruptcy petition.