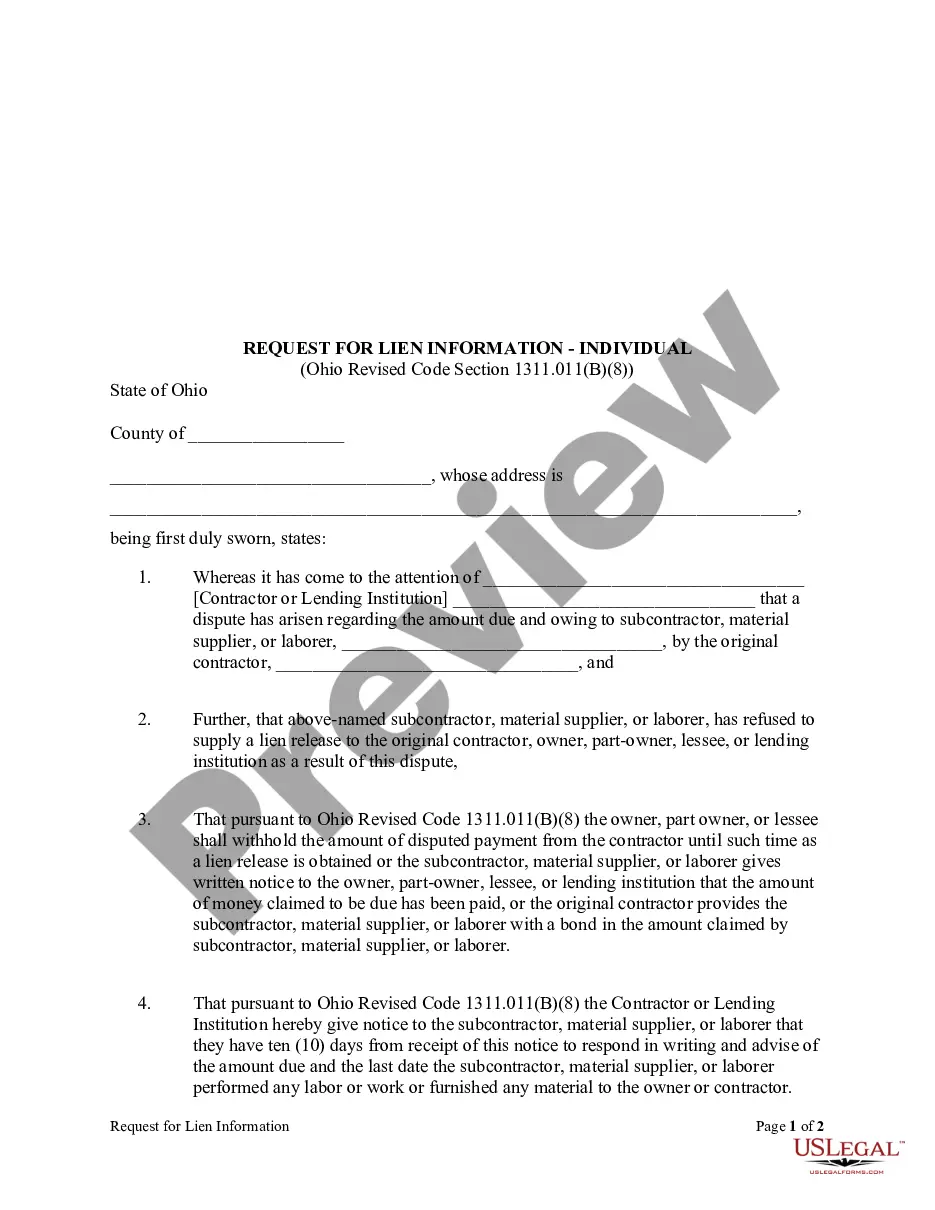

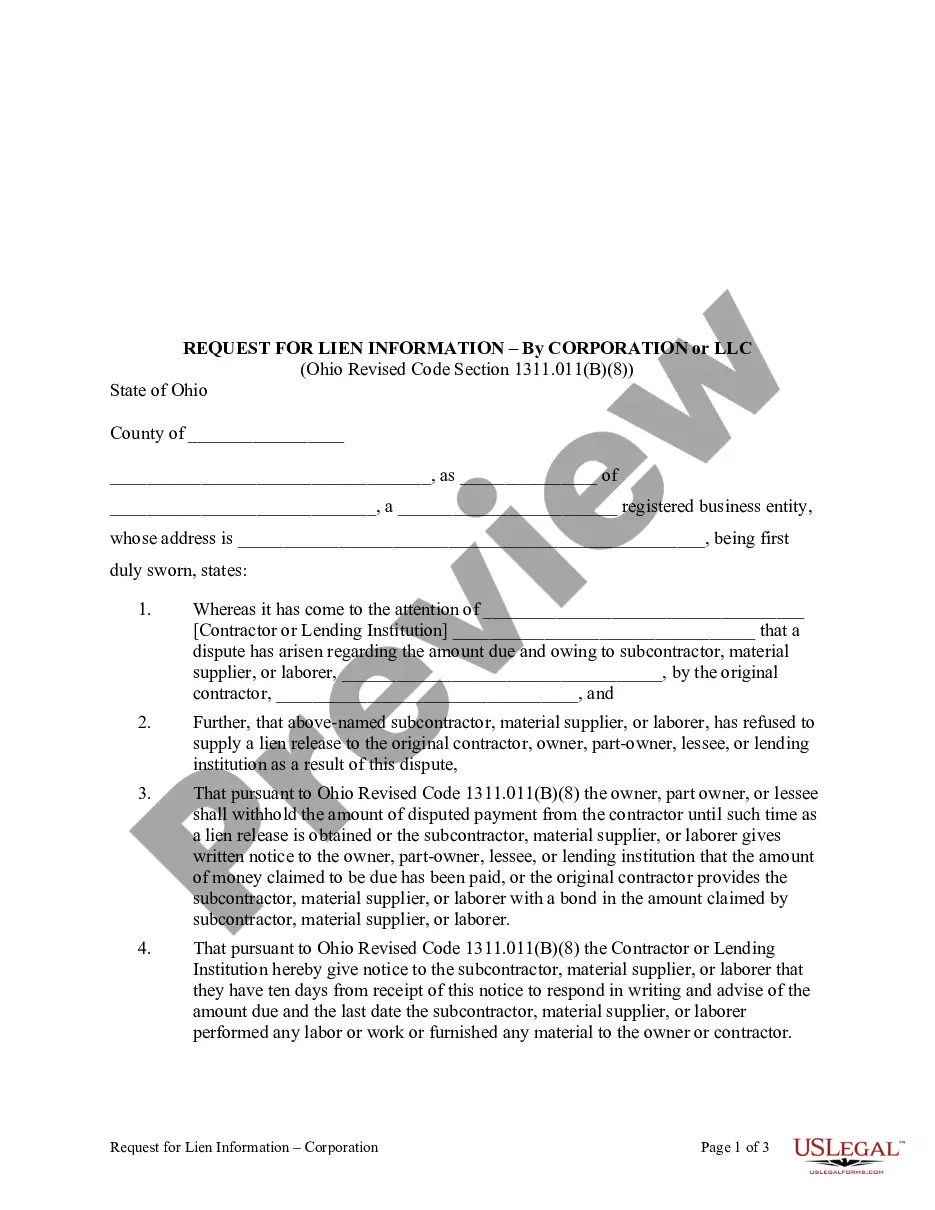

When a dispute arises over payment from the contractor to subcontractor, materialman, or laborer, and the subcontractor, materialman, or laborer refuses to release his lien as a result, the owner and/or lending institution may withhold payment from the contractor in the amount disputed. The amount to be withheld must be supplied by the subcontractor, materialman, or laborer, to the contractor within ten days of receipt of a request to supply this information. Failure of the subcontractor, materialman, or laborer to supply this information within ten days will result in the contractor submitting the amount to be withheld to the owner and/or lending institution.

Ohio Request for Lien Information - Individual

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Ohio Request For Lien Information - Individual?

In terms of completing Ohio Request for Lien Information - Individual, you almost certainly visualize an extensive procedure that requires finding a suitable sample among countless similar ones and after that being forced to pay a lawyer to fill it out for you. In general, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific form in just clicks.

If you have a subscription, just log in and click on Download button to get the Ohio Request for Lien Information - Individual template.

If you don’t have an account yet but want one, follow the step-by-step guide listed below:

- Make sure the file you’re saving is valid in your state (or the state it’s required in).

- Do it by looking at the form’s description and also by clicking on the Preview option (if accessible) to find out the form’s content.

- Simply click Buy Now.

- Find the appropriate plan for your budget.

- Join an account and select how you would like to pay: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Professional legal professionals work on drawing up our templates so that after downloading, you don't need to worry about editing content material outside of your personal information or your business’s information. Be a part of US Legal Forms and receive your Ohio Request for Lien Information - Individual document now.

Form popularity

FAQ

Electronic Titling Options. Ohio has a number of electronic titling options for entities who submit title transactions to Clerks of Courts on a regular basis. Each option carries with it a need to register with the Department of Public Safety (DPS) by completing the appropriate Participant Agreement for that option.

The state of Ohio allows county treasurers to pursue the delinquent property taxes directly, or the county treasurer may sell a tax lien certificate to the public.However, tax lien certificates are assignable and can be sold to investors to collect upon at a later time.

You can check the status of your Ohio refund online at the Ohio Department of Taxation website. by calling the Ohio Refund Hot Line at 1-800-282-1784. A taxpayer and/or spouse, if filing a joint return, who owes money for overpayment of public assistance.

In Ohio you can find out if your property has a lien on it by simply checking the records of the local county recorder and the local clerk of courts.

Congratulations on owning your vehicle free and clear. Now that your loan is paid off, you should receive a "letter of lien release" from the bank or financial institution that financed your vehicle.You cannot transfer ownership of a vehicle until the lien is cleared from the title.

If the title was lost after ownership was transferred, you can apply for a duplicate title. The State of Ohio requires that duplicate titles must be applied for by the owner of record at a county title office. The process requires a valid photo ID of the applicant and documentation of the vehicle identification number.

Go to the Ohio Bureau of Motor Vehicles website. Download and print out form BMV 3774, which is titled as an Application for Certificate of Title to a Motor Vehicle (see Resources). Fill out form 3774 with the information about the lien and lien holder included.

To obtain more information about the lien, contact the Attorney General's Office. For business taxes call 1-888-246-0488, for individual taxes call 1-888-301-8885.

According to Ohio law, the State can wait 7 years to hit you with a tax lien. And it can stay there for up to 40 years, unless of course you pay up. Jenkins only found out when the kept his tax refund. That's despite, he says, getting refunds for the past 15 years.