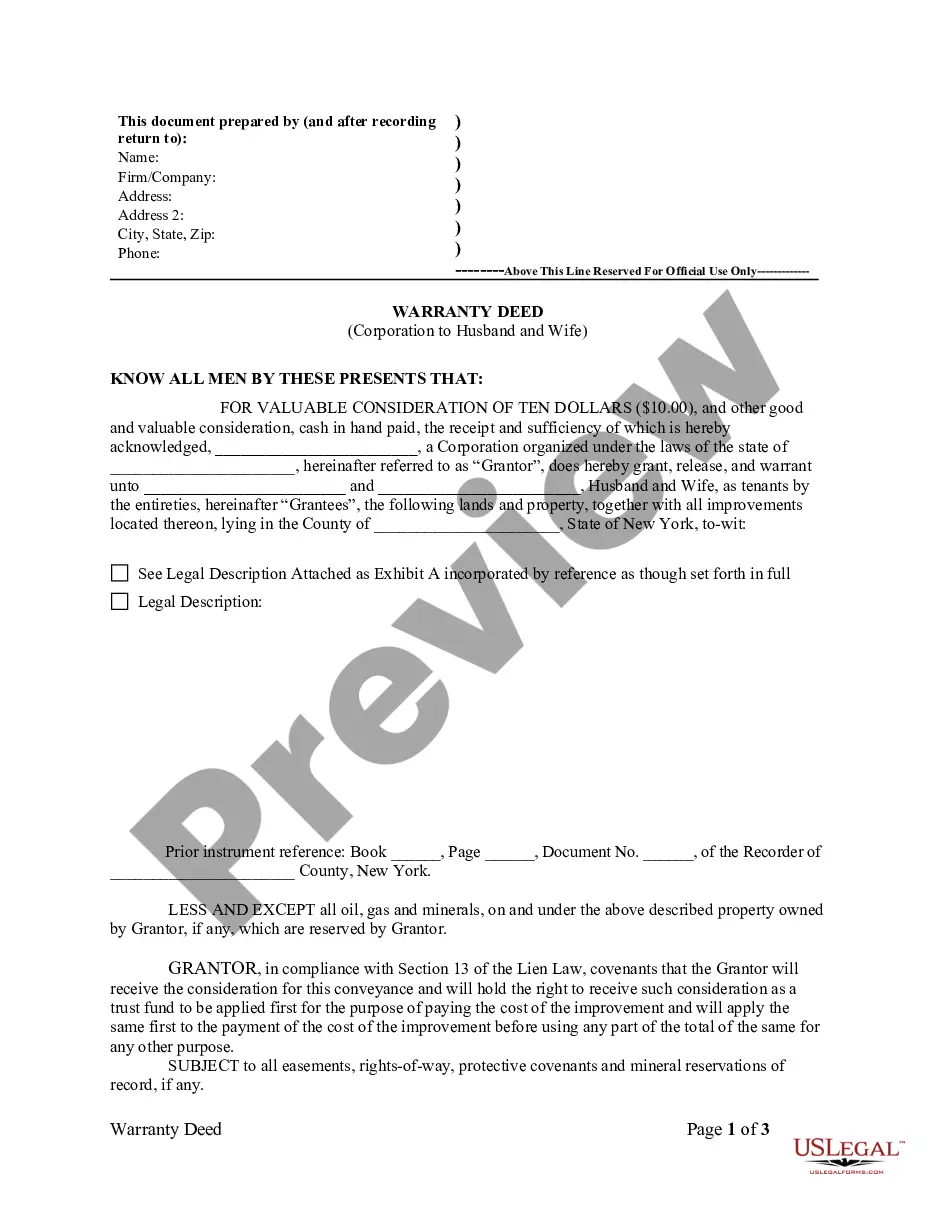

New York Warranty Deed from Corporation to Husband and Wife

Description

How to fill out New York Warranty Deed From Corporation To Husband And Wife?

US Legal Forms is actually a special platform to find any legal or tax template for filling out, such as New York Warranty Deed from Corporation to Husband and Wife. If you’re tired of wasting time seeking ideal examples and paying money on document preparation/legal professional service fees, then US Legal Forms is precisely what you’re seeking.

To experience all the service’s advantages, you don't have to install any application but simply pick a subscription plan and create an account. If you have one, just log in and find an appropriate template, save it, and fill it out. Saved files are all saved in the My Forms folder.

If you don't have a subscription but need to have New York Warranty Deed from Corporation to Husband and Wife, check out the recommendations listed below:

- make sure that the form you’re considering applies in the state you want it in.

- Preview the form and look at its description.

- Simply click Buy Now to get to the sign up webpage.

- Select a pricing plan and carry on registering by providing some information.

- Decide on a payment method to finish the sign up.

- Save the file by choosing your preferred file format (.docx or .pdf)

Now, complete the document online or print it. If you are unsure concerning your New York Warranty Deed from Corporation to Husband and Wife form, speak to a lawyer to check it before you send out or file it. Begin hassle-free!

Form popularity

FAQ

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

Although it's possible to change the names on title deeds yourself, we recommend that you seek professional help from a solicitor. The value of property is sufficiently high to make it worthwhile getting the transfer right.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Under New York law, a person who wishes to update her name on a deed must execute a new deed and record it with the county clerk where the property is located. Obtain or purchase a New York warranty deed form.